Transfer Affidavit Valued Without Probate Indiana

Description

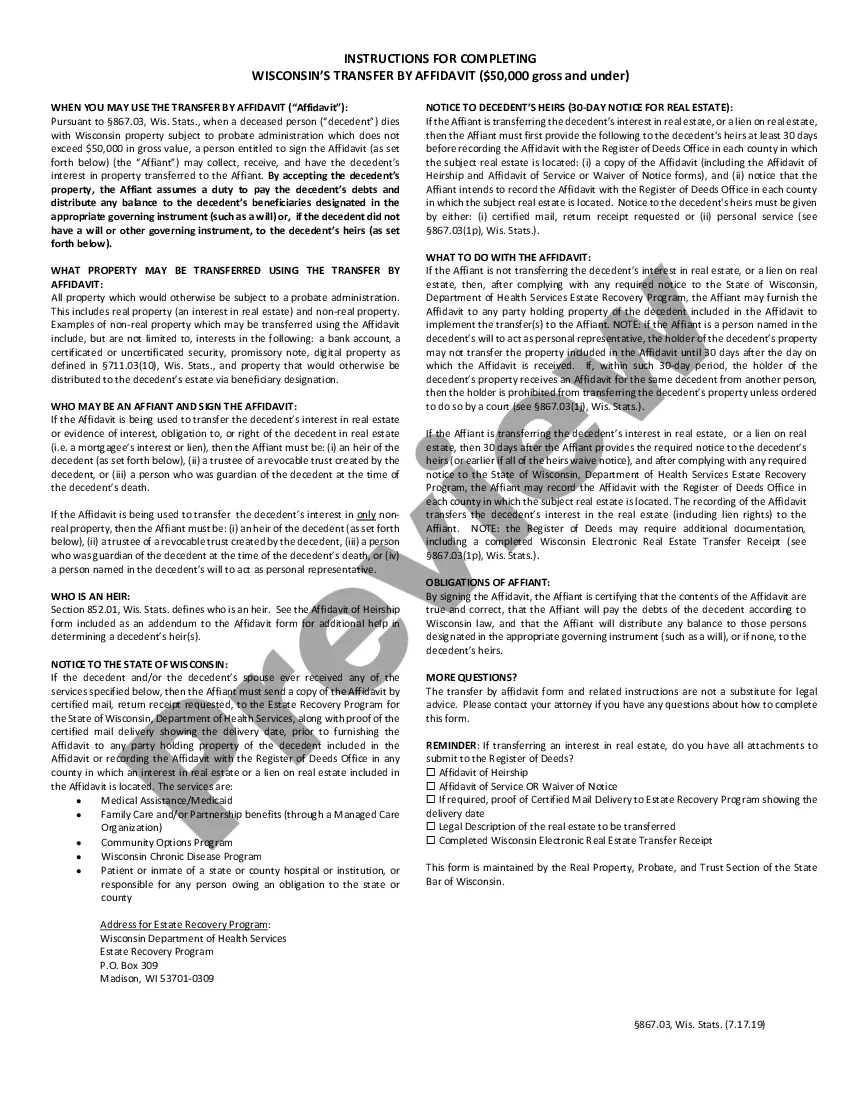

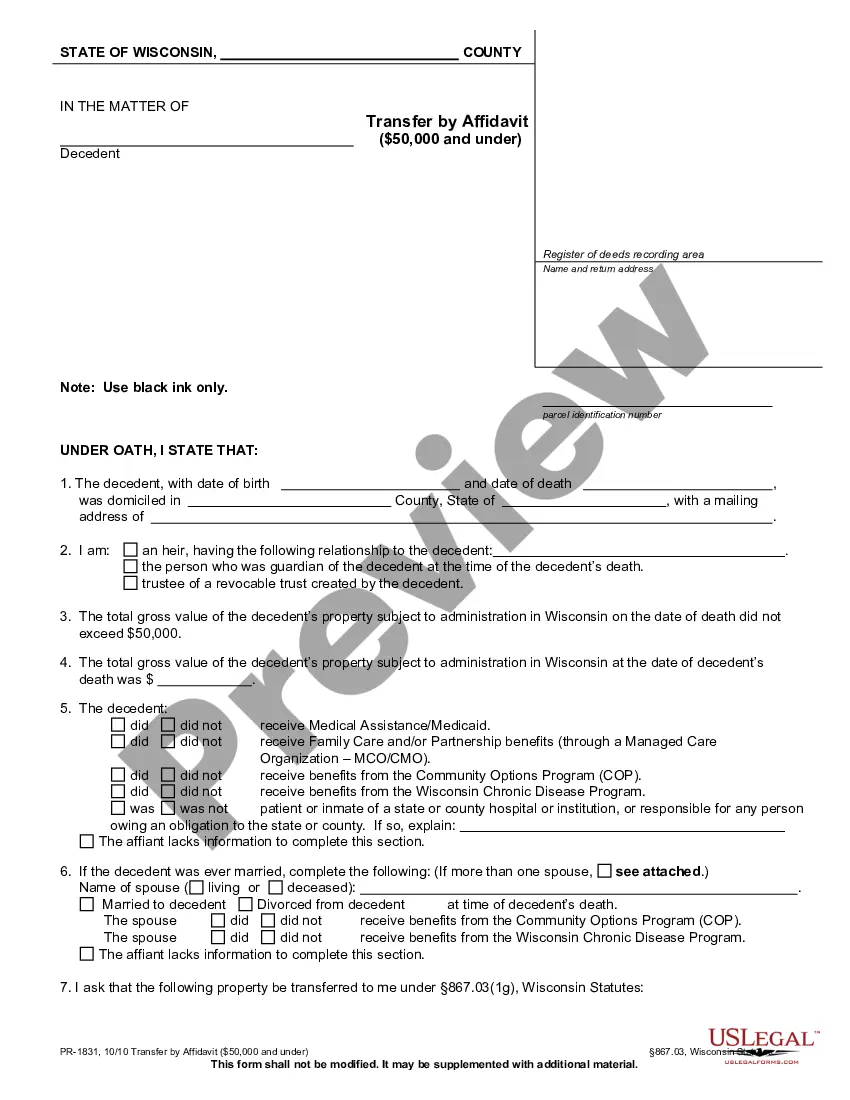

How to fill out Wisconsin Transfer By Affidavit For Estates Valued Under $50,000?

Using legal document samples that comply with federal and state regulations is essential, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the correctly drafted Transfer Affidavit Valued Without Probate Indiana sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by attorneys for any business and personal scenario. They are simple to browse with all files organized by state and purpose of use. Our experts stay up with legislative changes, so you can always be confident your paperwork is up to date and compliant when obtaining a Transfer Affidavit Valued Without Probate Indiana from our website.

Obtaining a Transfer Affidavit Valued Without Probate Indiana is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, follow the instructions below:

- Examine the template utilizing the Preview option or via the text description to make certain it meets your needs.

- Look for a different sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and select a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Transfer Affidavit Valued Without Probate Indiana and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out previously obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Is Probate Required in Indiana? Any estate worth more than $50,000 is subject to probate in Indiana. Estates worth less than $50,000 transfer ownership to heirs through the small estate administration with a written statement proving entitlement to the assets.

How to Fill Out Small Estate Affidavit | PDFRun - YouTube YouTube Start of suggested clip End of suggested clip For line two enter the section and state of the probate. Code that the affidavit is being filed.MoreFor line two enter the section and state of the probate. Code that the affidavit is being filed.

You understand that this form is not filed in court. After the form is completed, it is given to the entity (like the bank) that is holding the property.

In Indiana, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Access the Small Estate Affidavit Form (PDF). As of July 1, 2022, the value of the decedent's estate was increased to $100,000. This form is not required to be filed with the Court.