Transfer Affidavit Valued Form L4260

Description

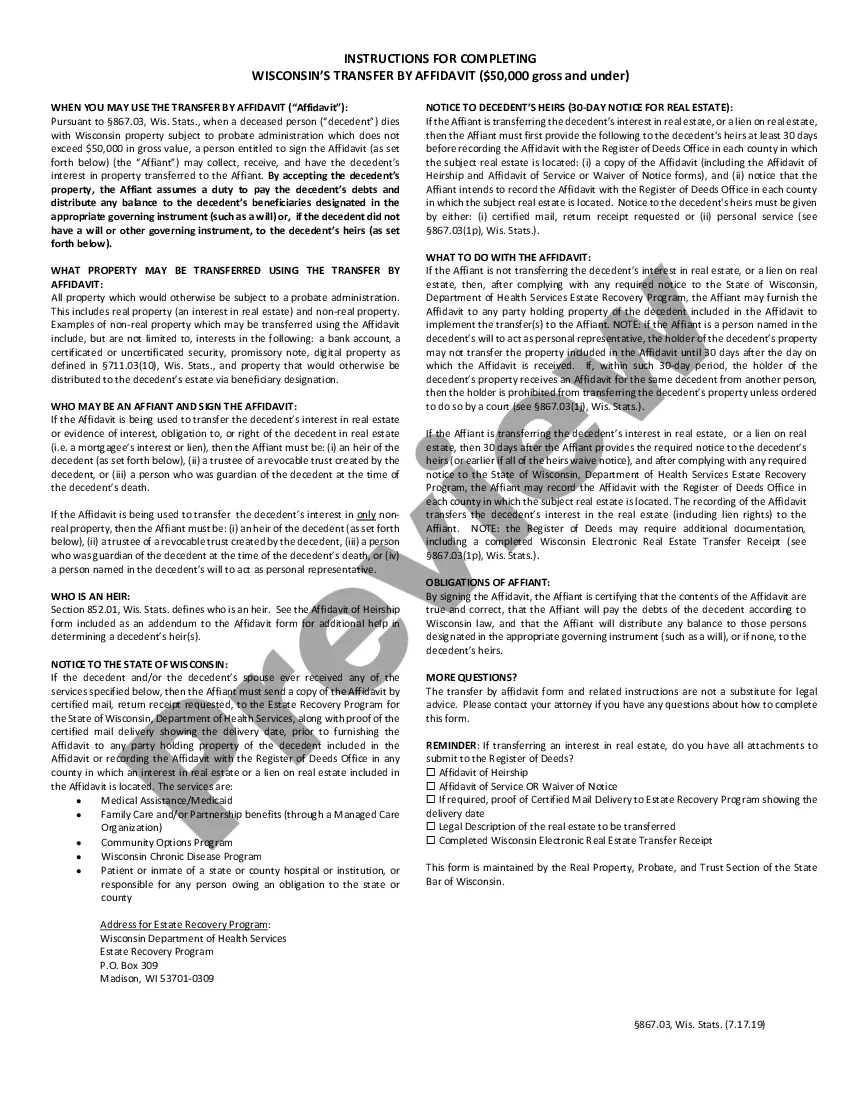

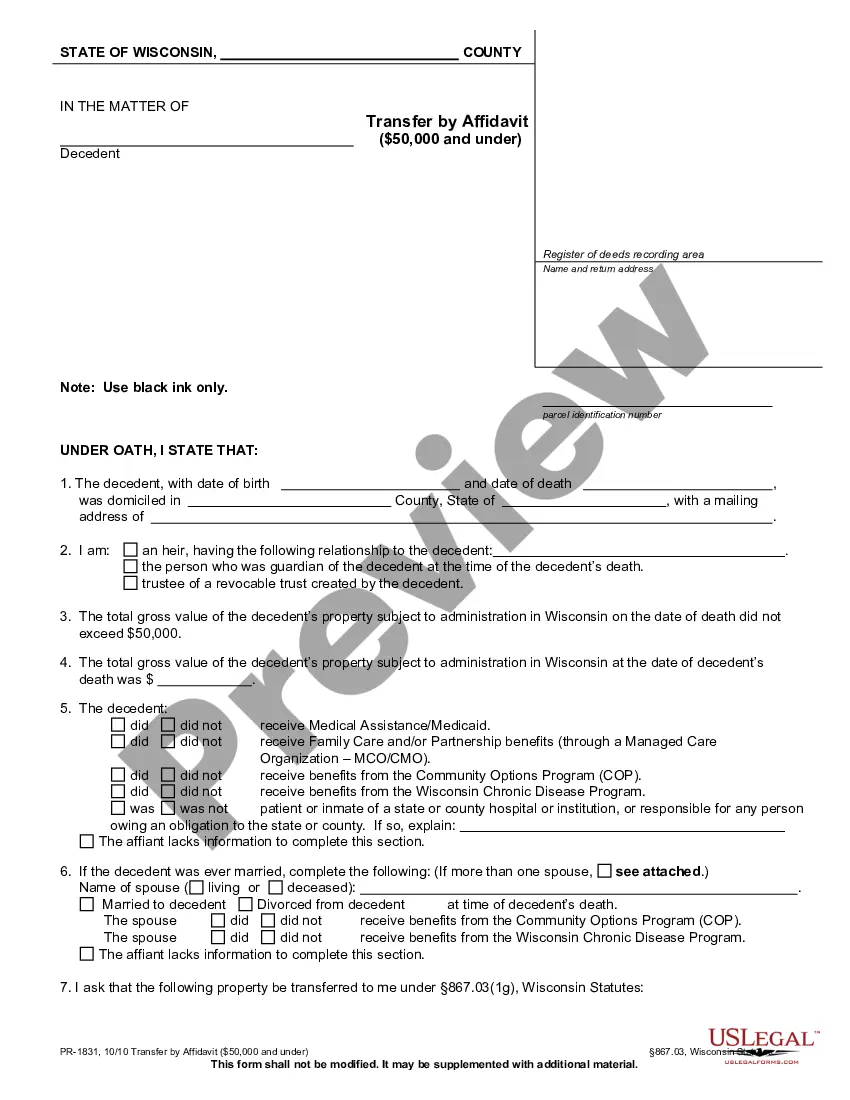

How to fill out Wisconsin Transfer By Affidavit For Estates Valued Under $50,000?

Legal management can be overpowering, even for the most experienced experts. When you are looking for a Transfer Affidavit Valued Form L4260 and don’t have the time to commit in search of the appropriate and up-to-date version, the procedures might be nerve-racking. A strong web form library might be a gamechanger for everyone who wants to handle these situations efficiently. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms covers any demands you might have, from individual to enterprise documents, all-in-one place.

- Employ innovative resources to accomplish and control your Transfer Affidavit Valued Form L4260

- Gain access to a useful resource base of articles, guides and handbooks and materials connected to your situation and needs

Save time and effort in search of the documents you need, and employ US Legal Forms’ advanced search and Preview feature to locate Transfer Affidavit Valued Form L4260 and download it. In case you have a subscription, log in to your US Legal Forms profile, search for the form, and download it. Review your My Forms tab to view the documents you previously saved as well as to control your folders as you can see fit.

If it is your first time with US Legal Forms, register an account and obtain limitless use of all advantages of the library. Here are the steps to take after accessing the form you need:

- Verify this is the correct form by previewing it and looking at its description.

- Be sure that the sample is accepted in your state or county.

- Select Buy Now when you are all set.

- Select a monthly subscription plan.

- Pick the format you need, and Download, complete, eSign, print out and deliver your papers.

Benefit from the US Legal Forms web library, supported with 25 years of expertise and trustworthiness. Change your everyday papers managing in a smooth and intuitive process right now.

Form popularity

FAQ

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.

Sign and date the quitclaim deed in a notary's presence, then file it with the County Register of Deeds Office in the property's county, not the county where you live. Once the deed is filed and recorded, the transfer is deemed legal.

The home seller typically pays the real estate transfer taxes. The state tax is calculated at $3.75 for every $500 of value transferred and the county tax is calculated at $0.55 for every $500 of value transferred.

State Law requires a Property Transfer Affidavit to be filed whenever real estate is transferred (even if you are not recording a deed).