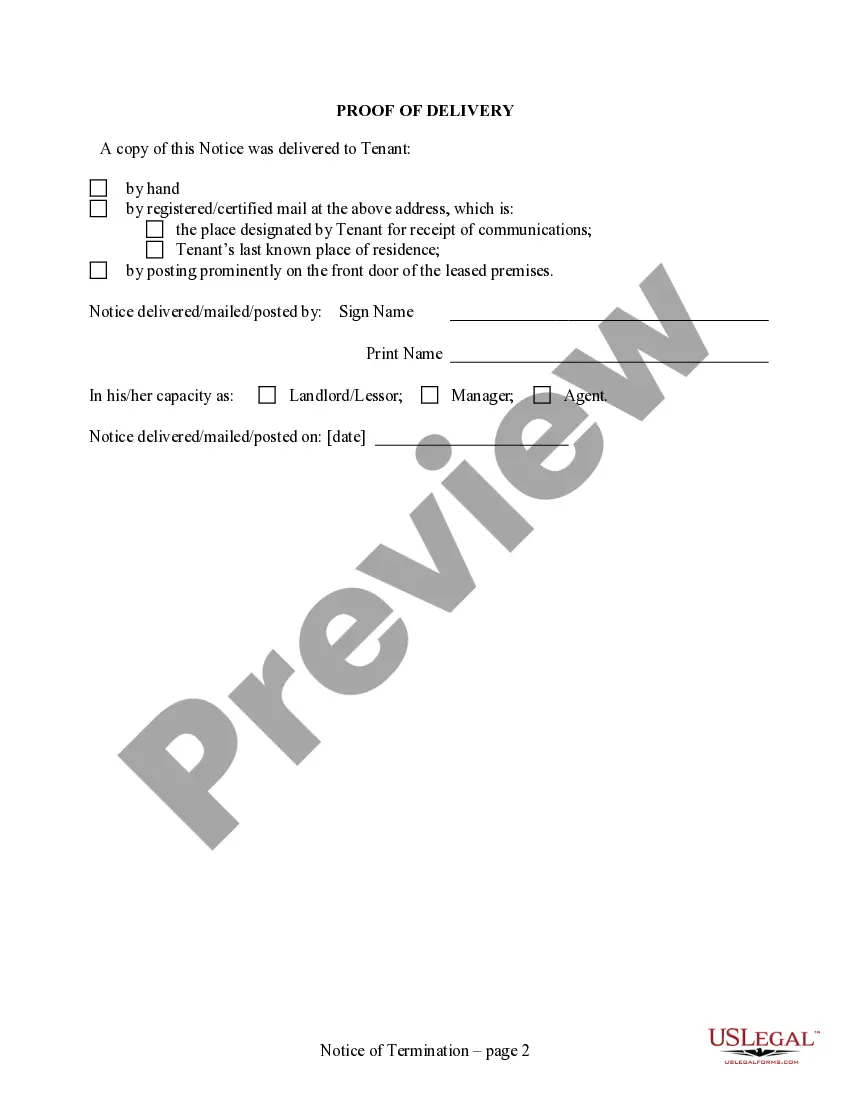

This 28 Day Notice to Terminate Month to Month Lease - No Right to Cure form is for use by a Landlord to terminate a month-to-month residential lease. "Residential" includes a house, apartment or condo. Unless a written agreement provides otherwise, the Landlord does not have to have a reason for terminating the Lease in this manner, other than a desire to end the lease. A month-to-month lease is one which continues from month-to-month unless either party chooses to terminate. Unless a written agreement provides for a longer notice, 28 days notice is required prior to termination in this state. The notice must be given to the Tenant within at least 28 days prior to the termination date. The form indicates that the Landlord has chosen to terminate the lease, and states the deadline date by which the Tenant must vacate the premises. For additional information, see the Law Summary link.

Wisconsin 28 Day Form With Decimals

Description

How to fill out Wisconsin 28 Day Notice To Terminate Month To Month Lease - No Right To Cure - Residential?

Whether for business purposes or for personal matters, everyone has to handle legal situations sooner or later in their life. Filling out legal paperwork needs careful attention, beginning from selecting the correct form sample. For instance, if you select a wrong edition of the Wisconsin 28 Day Form With Decimals, it will be declined once you send it. It is therefore important to have a reliable source of legal documents like US Legal Forms.

If you have to get a Wisconsin 28 Day Form With Decimals sample, follow these simple steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Check out the form’s description to make sure it suits your case, state, and county.

- Click on the form’s preview to examine it.

- If it is the wrong form, go back to the search function to find the Wisconsin 28 Day Form With Decimals sample you need.

- Download the file when it meets your needs.

- If you already have a US Legal Forms account, simply click Log in to access previously saved templates in My Forms.

- In the event you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Complete the account registration form.

- Select your transaction method: use a bank card or PayPal account.

- Choose the file format you want and download the Wisconsin 28 Day Form With Decimals.

- After it is saved, you are able to fill out the form by using editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you do not need to spend time looking for the right template across the internet. Utilize the library’s simple navigation to get the correct template for any occasion.

Form popularity

FAQ

Wisconsin offers taxpayers the opportunity to take a standard deduction. Standard deduction amounts are based on your taxable income and filing status.

1 adjustments: reconciliation of book and taxable income (income and deductions.) Differences exist because of the difference in GAAP and tax law. Deferred tax assets and deferred tax liabilities: book assets or book liabilities involving deferred tax amounts.

Schedule M is used to report differences between federal and Wisconsin income. These differences are called modifications and may affect the amount you report on lines 15 and 28 of Form 1NPR.

For the latest information about developments related to Schedule I and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form1041.

As shown in Table 1, for 2022, a single tax- payer with Wisconsin AGI less than $16,990 has a standard deduction of $11,790; for single tax- payers with AGI in excess of $115,240, no standard deduction is provided.