Wi Divorce Law For Alimony

Description

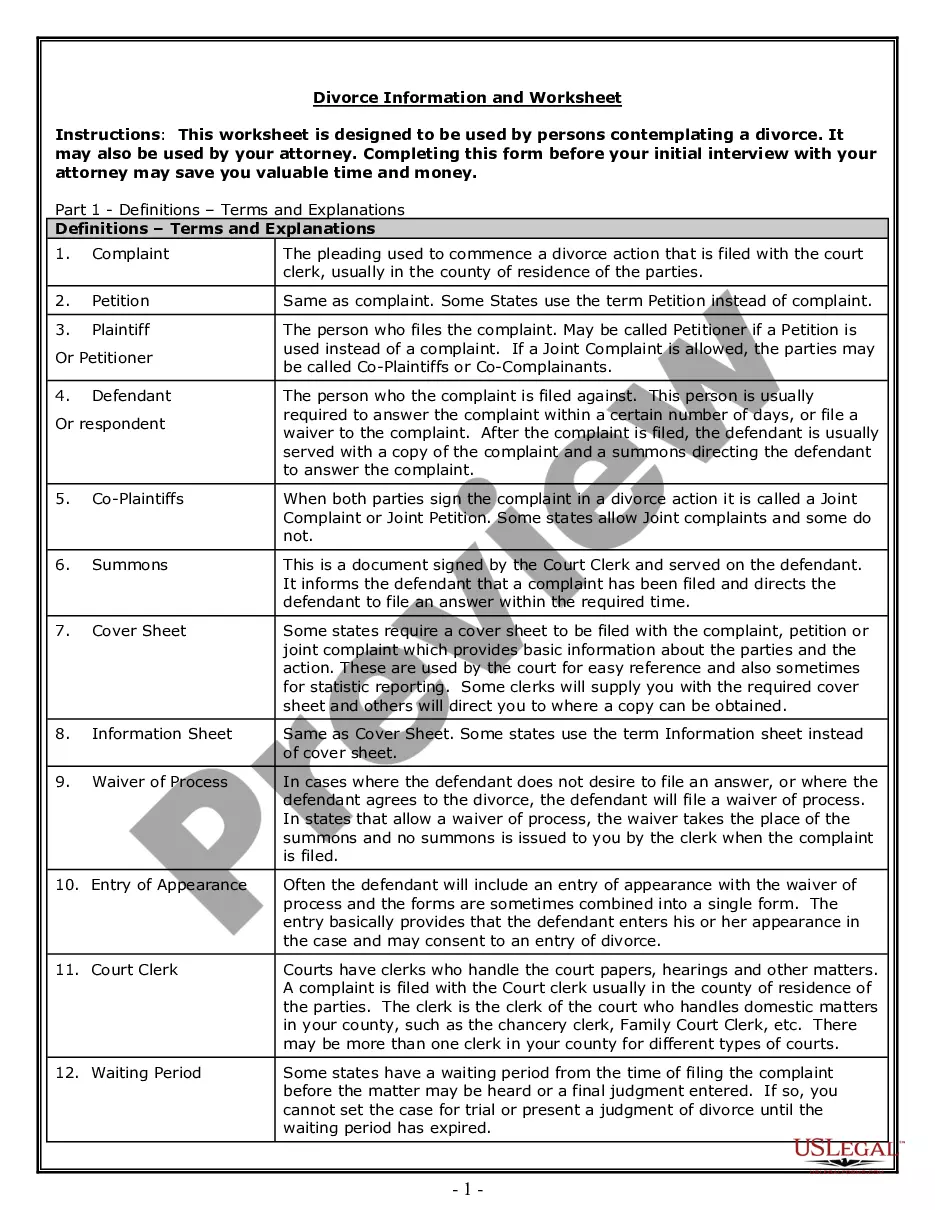

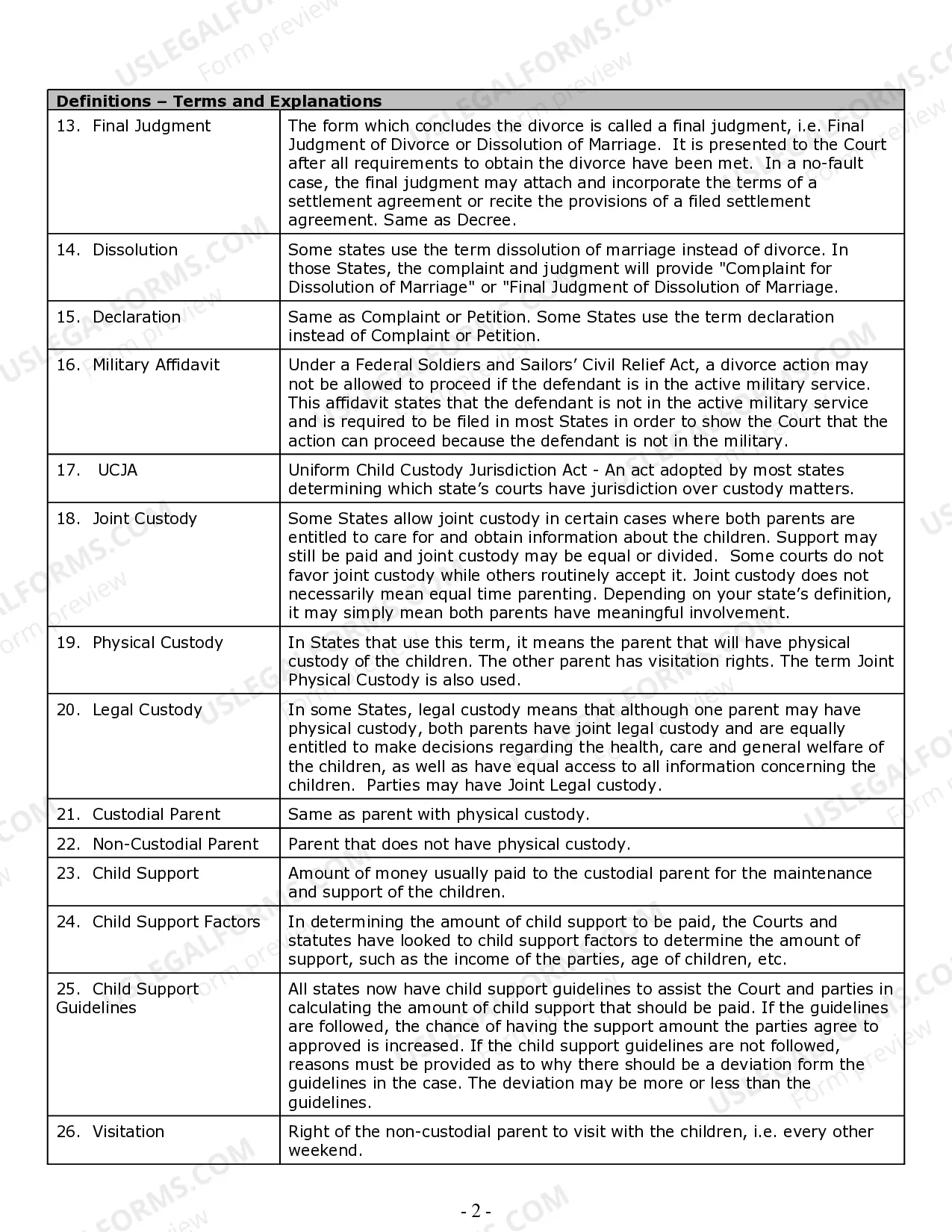

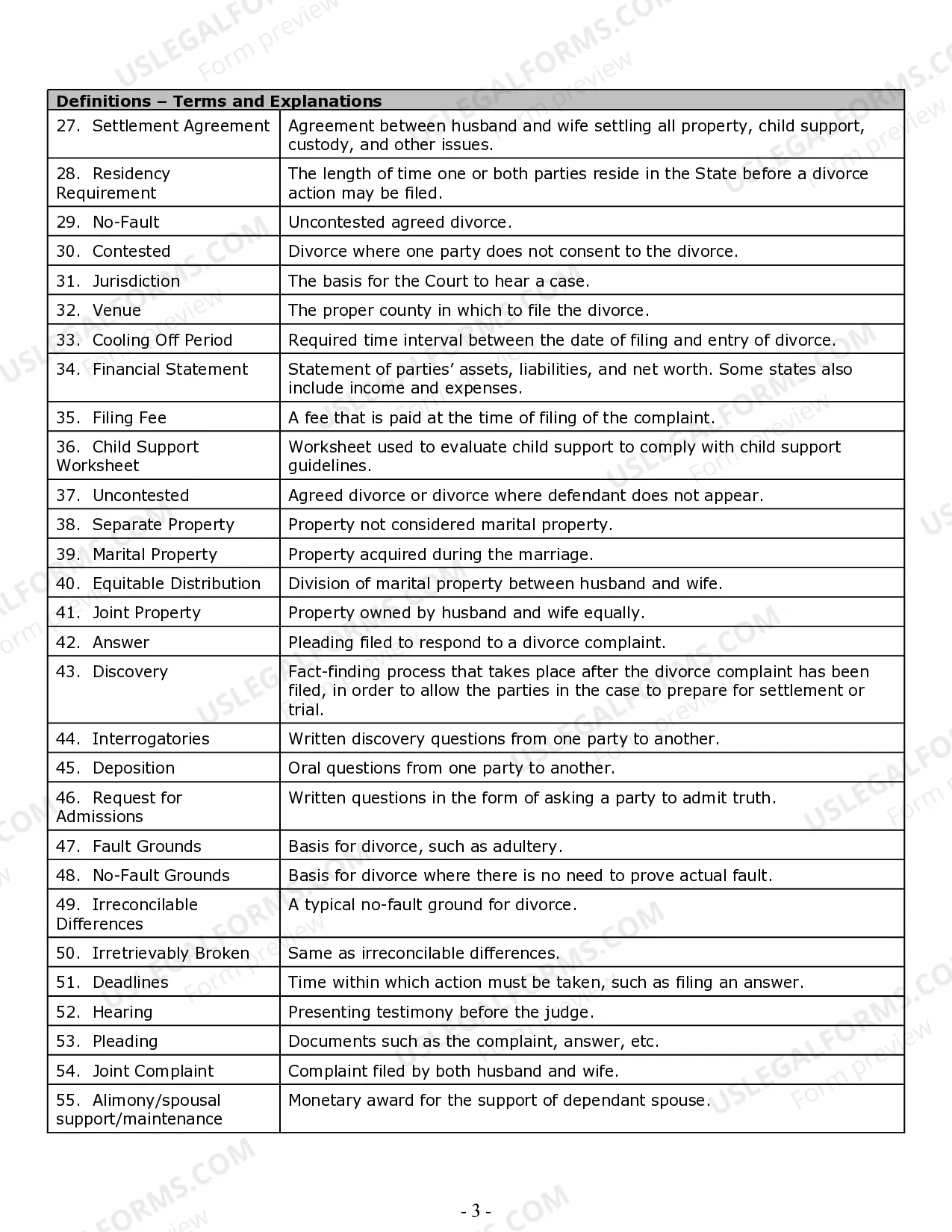

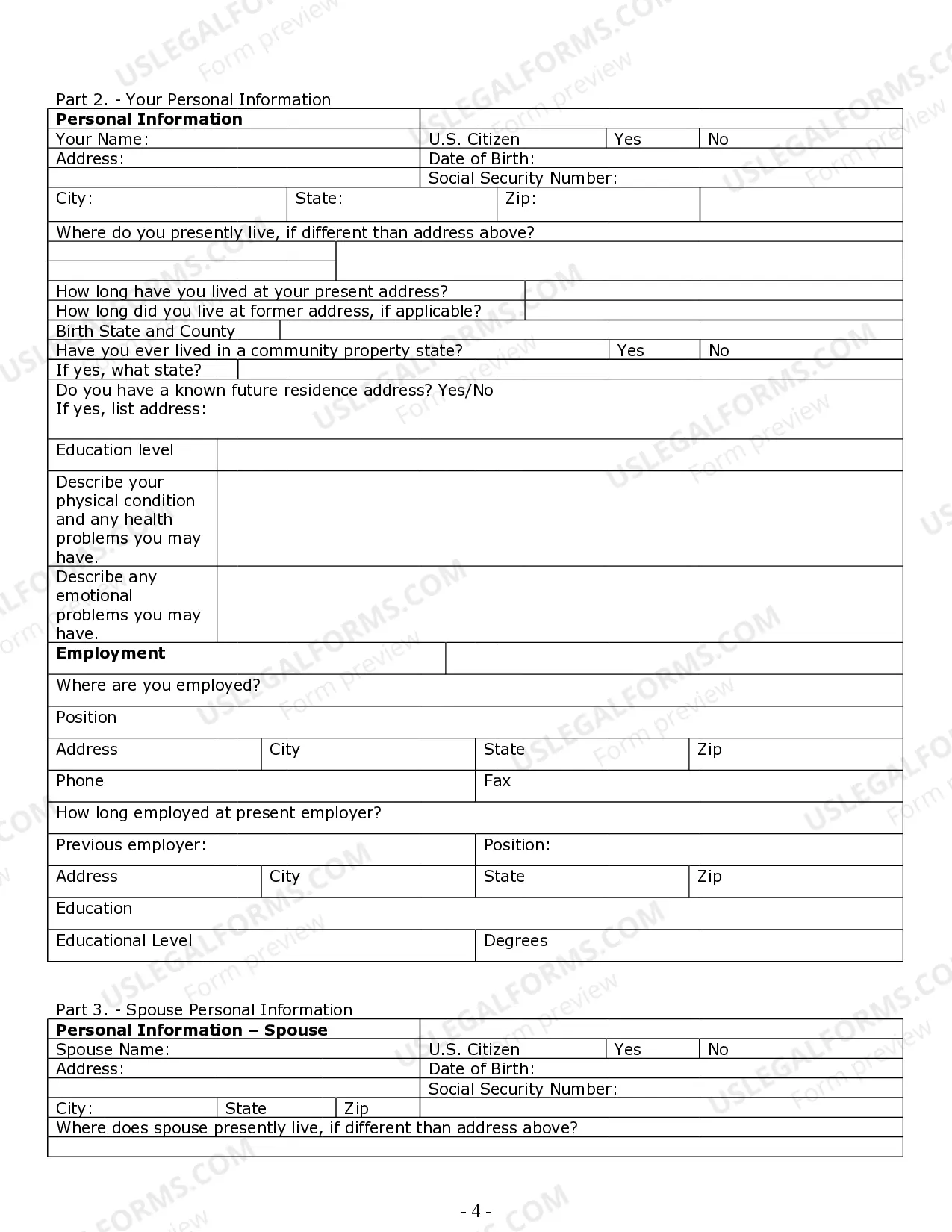

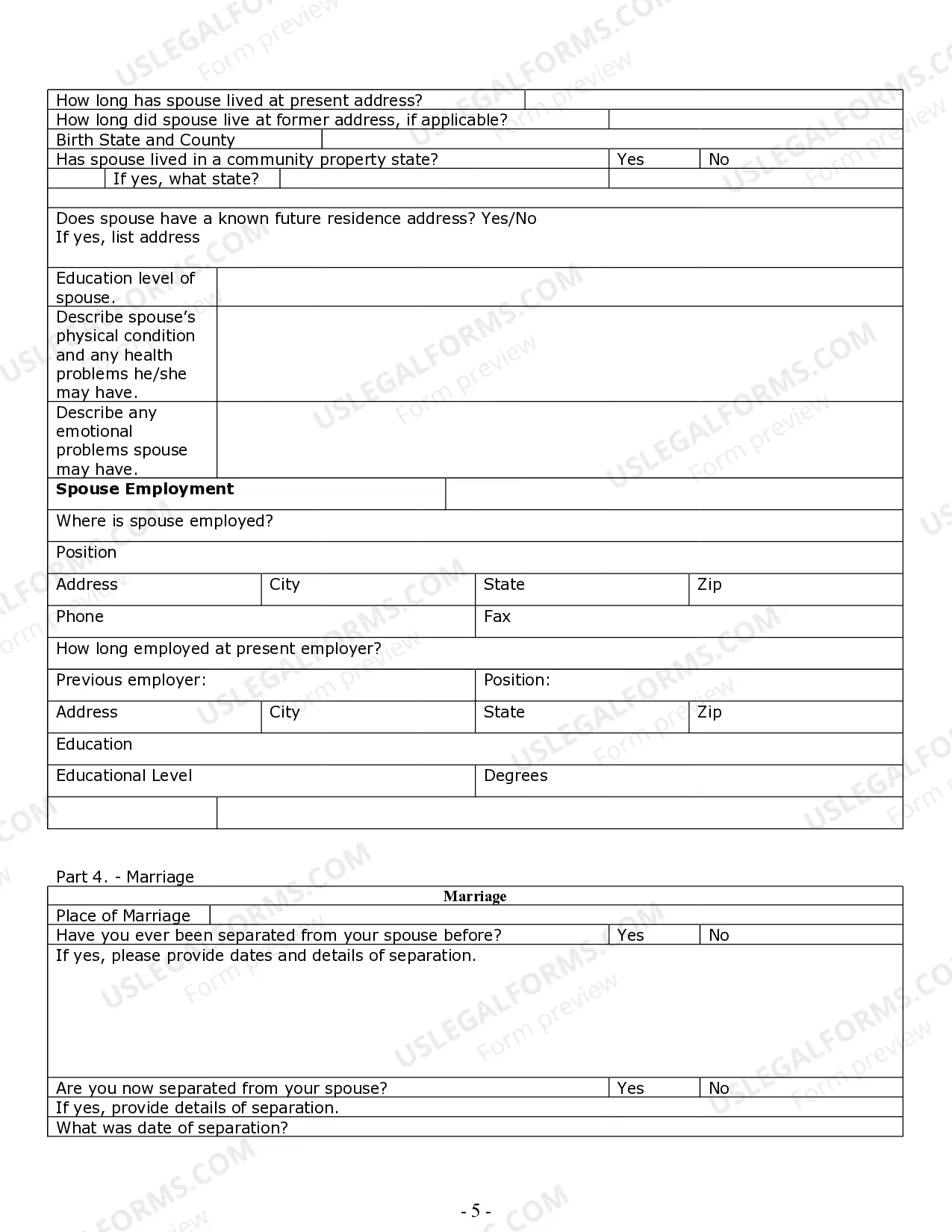

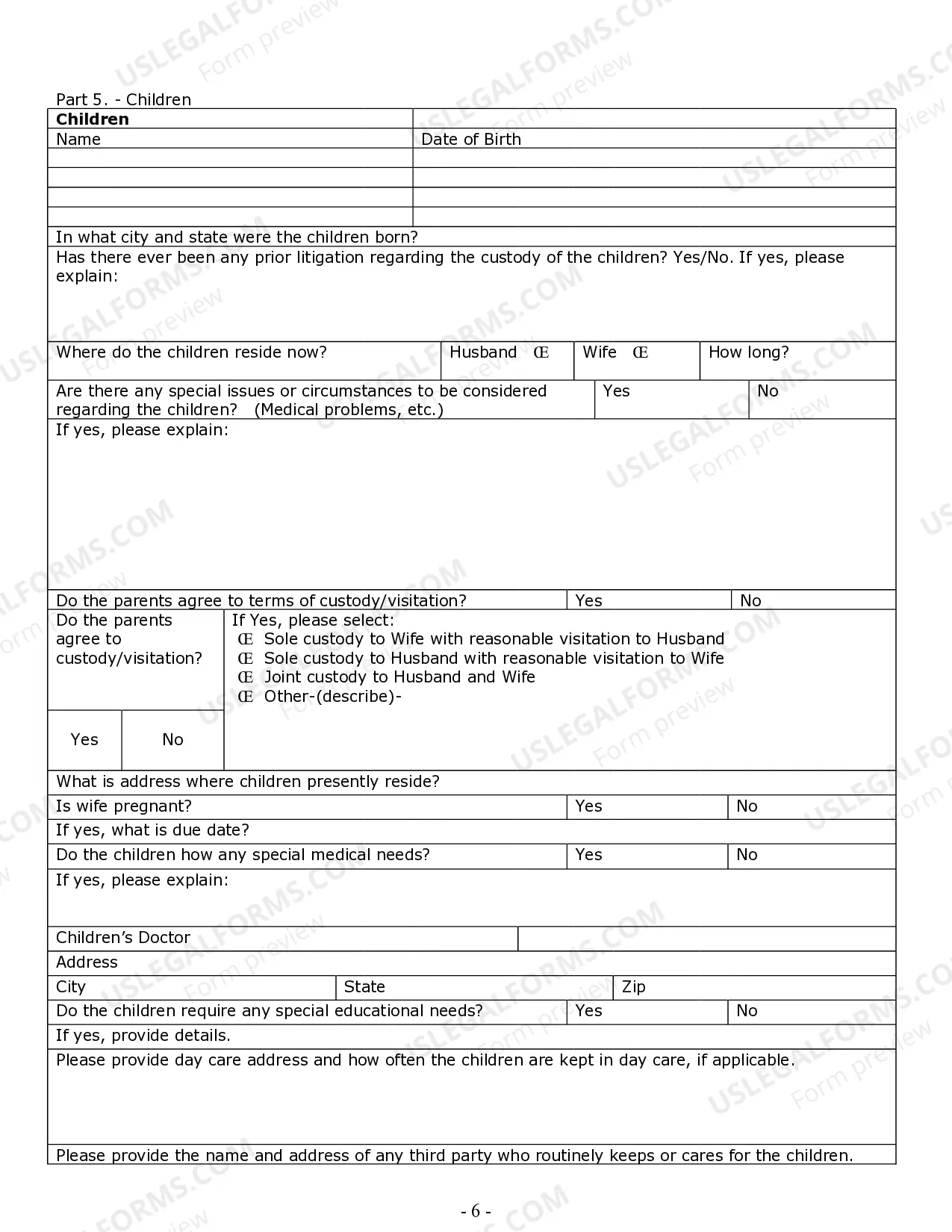

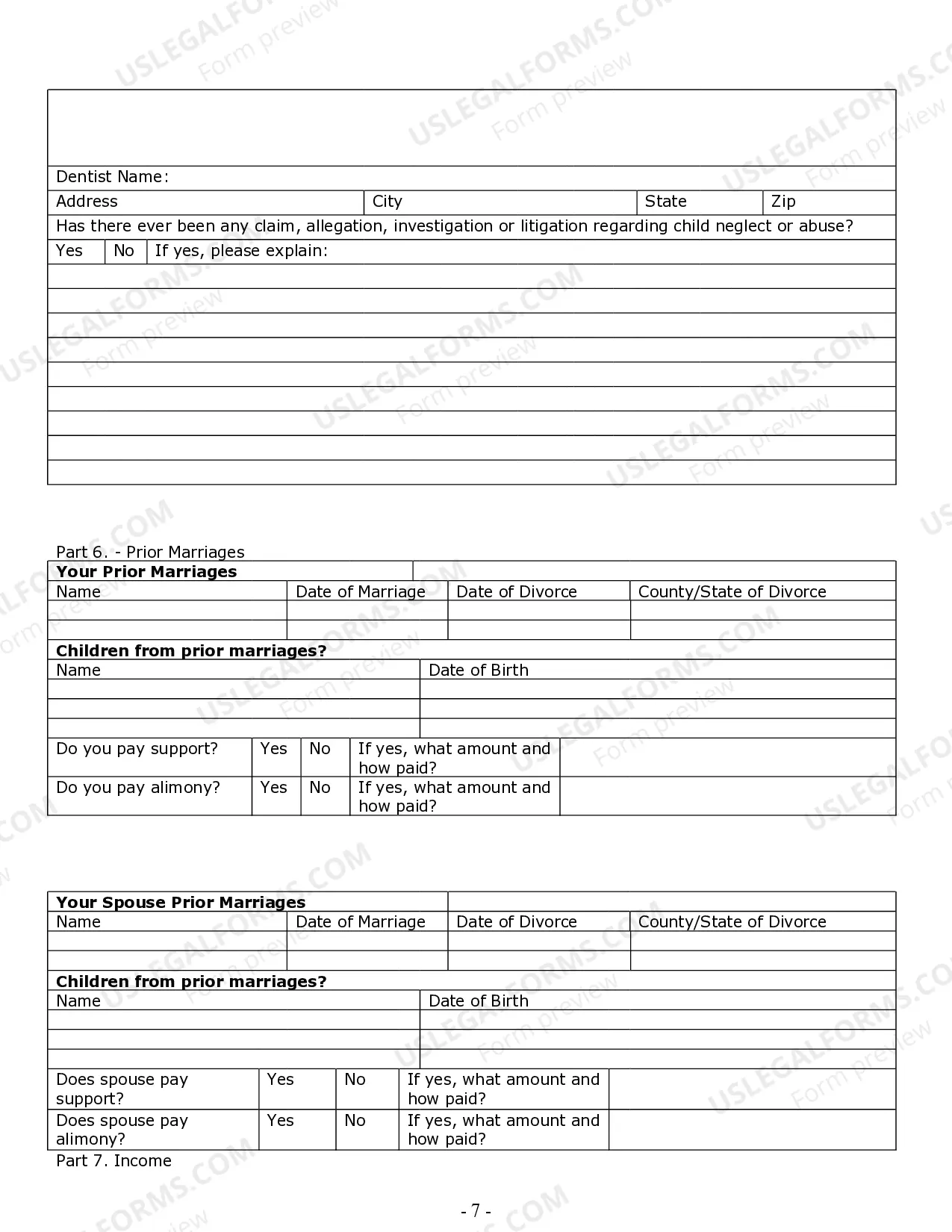

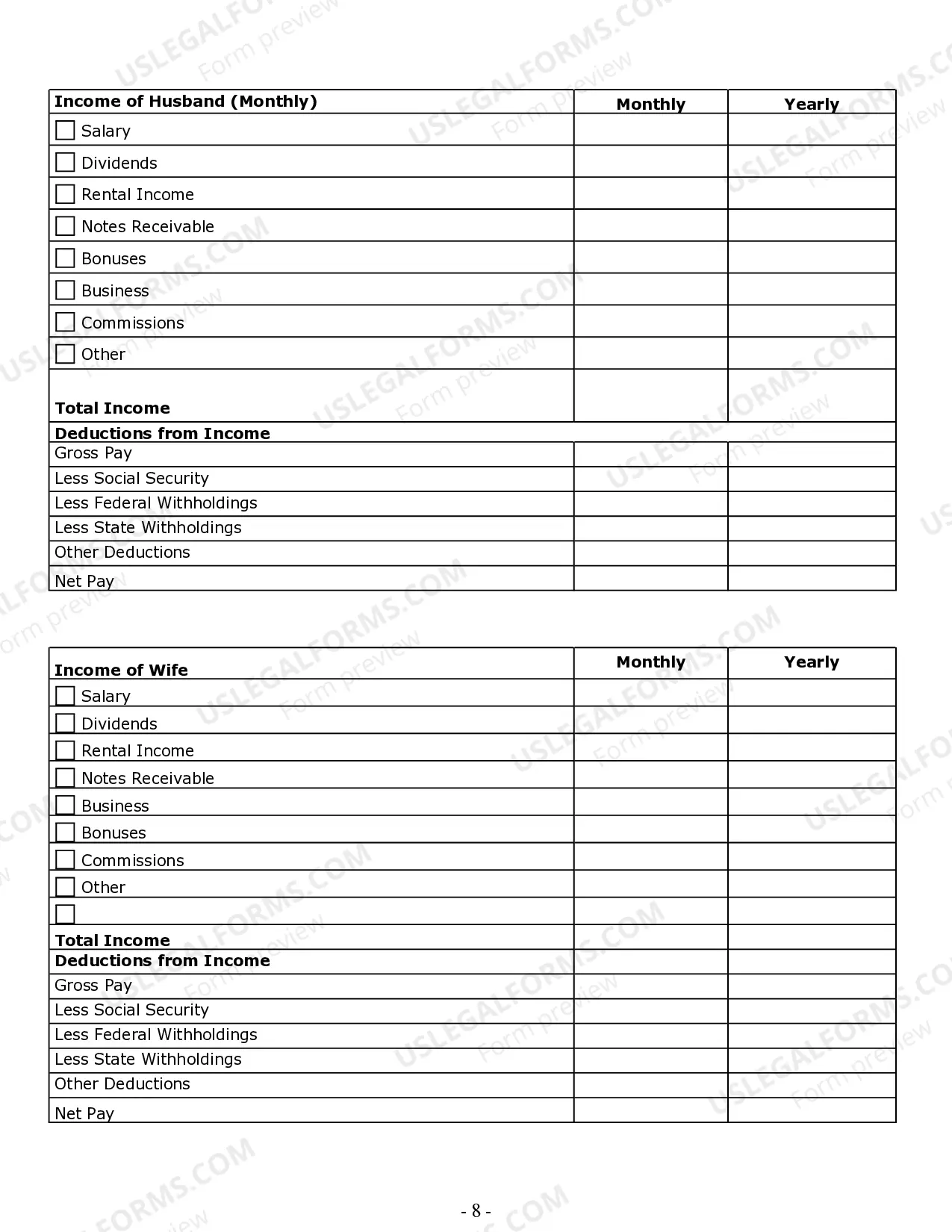

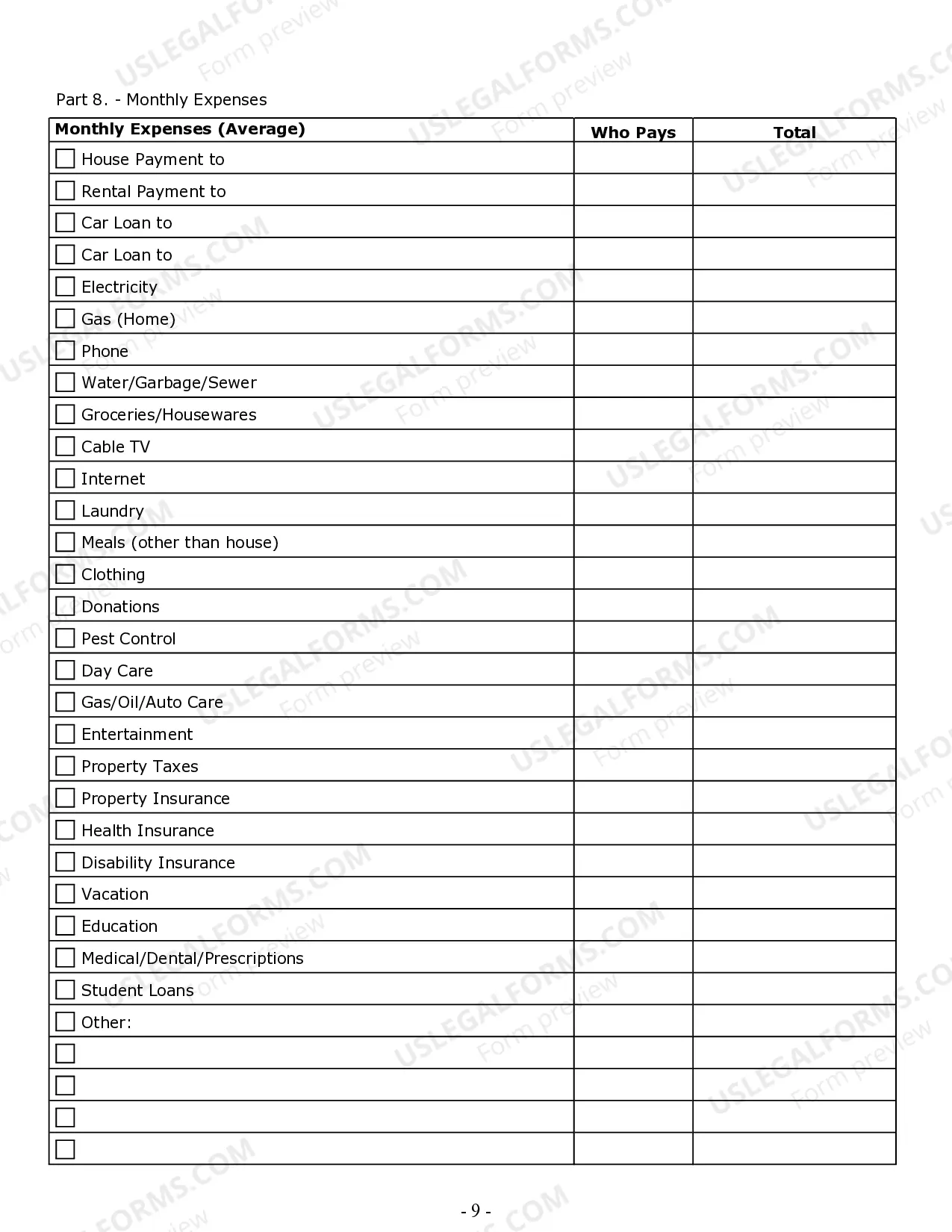

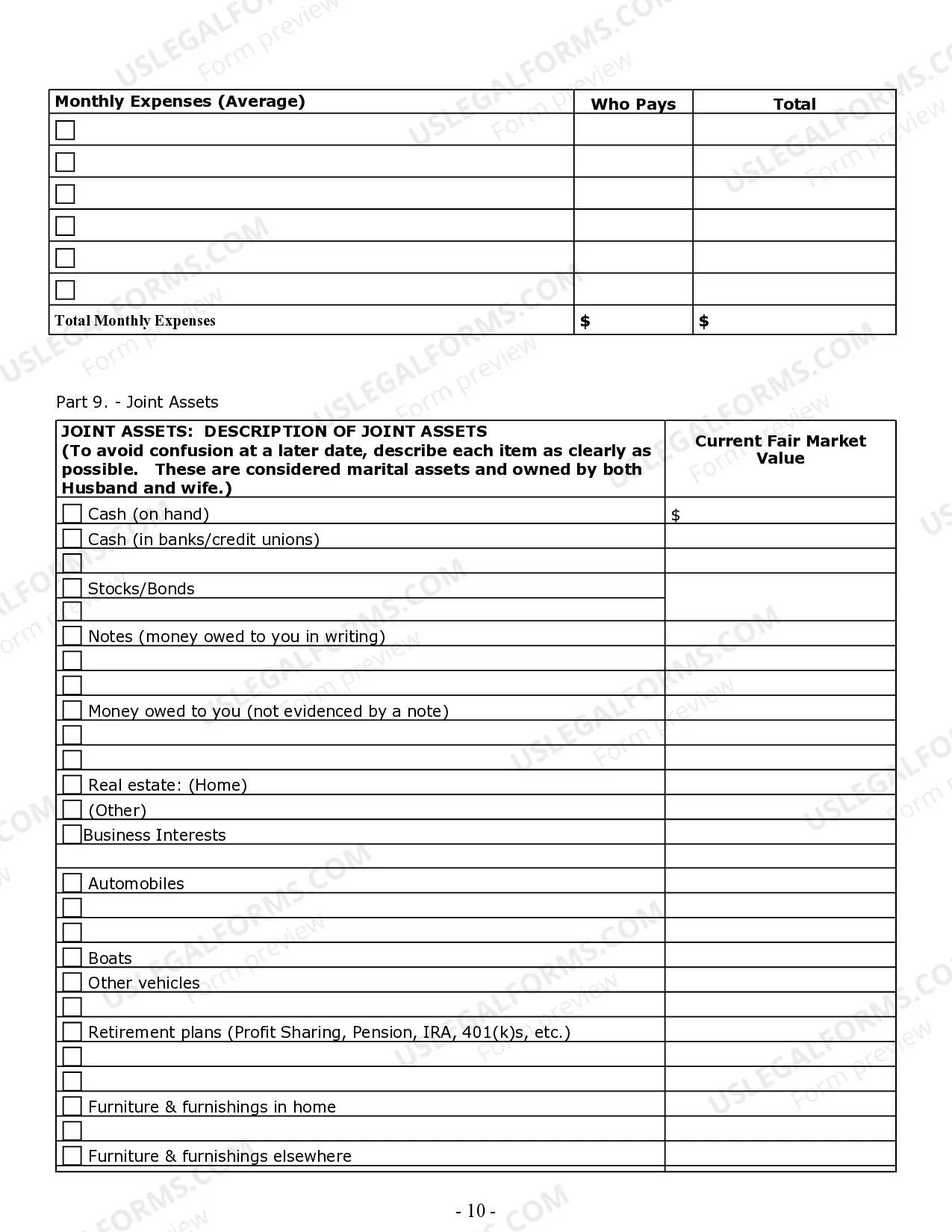

How to fill out Wisconsin Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Acquiring legal document samples that adhere to federal and state regulations is essential, and the internet provides numerous options to choose from.

However, what’s the benefit of squandering time looking for the appropriate Wi Divorce Law For Alimony sample online when the US Legal Forms digital repository already houses such templates conveniently in one location.

US Legal Forms stands as the largest online legal repository with more than 85,000 fillable templates crafted by attorneys for various professional and personal matters. They are simple to navigate, with all documents categorized by state and intended use. Our experts keep abreast of legislative developments, ensuring you can always trust that your form is current and compliant when obtaining a Wi Divorce Law For Alimony from our site.

- If you possess an account with an active subscription, Log In and save the document template you need in your preferred format.

- If you are unfamiliar with our site, adhere to the guidance below.

- Review the template using the Preview feature or by examining the text outline to verify it meets your requirements.

- If necessary, find another sample via the search tool located at the top of the page.

- Once you identify the correct form, click Buy Now and select a subscription option.

Form popularity

FAQ

Arizona Forms 5000 are used to claim Arizona TPT (sales tax) exemptions from vendors. Arizona Forms 5000A are used to claim Arizona TPT (sales tax) exemptions from vendors when making purchases for resale where tax will be collected on the retail sale to the end user.

Arizona Form 5000 is used to claim Arizona TPT (sales tax) exemptions from a vendor. The Certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the University in these cases, or for the vendor to refund the sales tax already billed to the University.

Arizona Forms 5000 are used to claim Arizona TPT (sales tax) exemptions from vendors. Arizona Forms 5000A are used to claim Arizona TPT (sales tax) exemptions from vendors when making purchases for resale where tax will be collected on the retail sale to the end user.

Arizona Form 5000 is used to claim Arizona TPT (sales tax) exemptions from a vendor. The Certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the University in these cases, or for the vendor to refund the sales tax already billed to the University.

However, there are certain purchases that are exempt from sales tax pursuant to ARS §42-5061. Common sales tax exemptions include: Professional or personal services where the sale of tangible personal property constitutes an inconsequential element.

Form 5005 Contractor Certificate. Prime Contractor. All Subcontractors under the control of the prime contractor. For a subcontractor's records to demonstrate they are not liable for the tax due on a modification or MRRA project. This certificate should not be provided to a materials vendor in order to purchase exempt.

To verify a license, select Individual or Business, enter search criteria and click Search to see the results.