Wisconsin Transfer Deed With Trust

Description

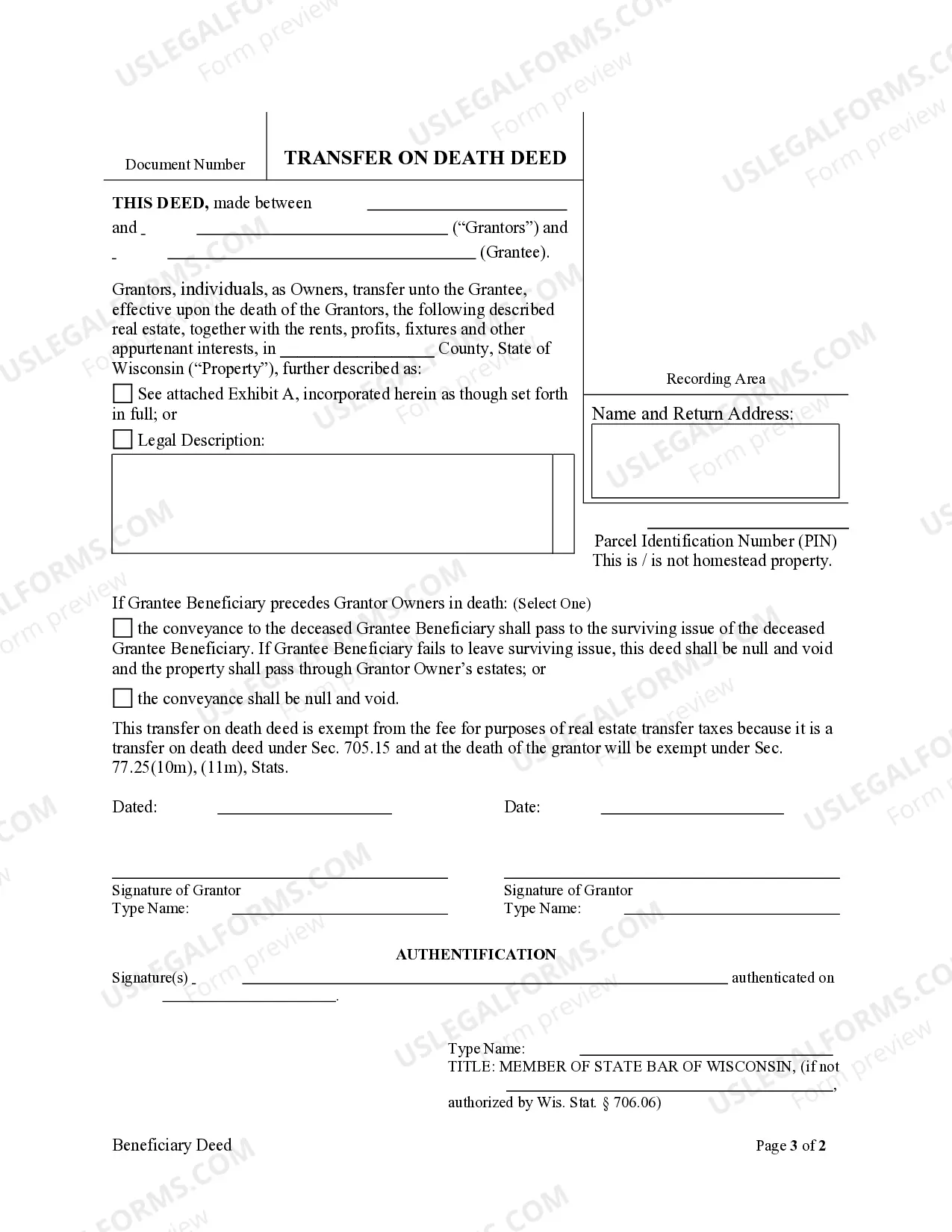

How to fill out Wisconsin Transfer On Death Deed Or TOD - Beneficiary Deed From Two Individuals To An Individual?

Drafting legal paperwork from scratch can sometimes be daunting. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a a more straightforward and more affordable way of preparing Wisconsin Transfer Deed With Trust or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual catalog of over 85,000 up-to-date legal forms covers virtually every element of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-compliant forms carefully prepared for you by our legal specialists.

Use our website whenever you need a trustworthy and reliable services through which you can quickly find and download the Wisconsin Transfer Deed With Trust. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and explore the catalog. But before jumping straight to downloading Wisconsin Transfer Deed With Trust, follow these tips:

- Check the form preview and descriptions to ensure that you are on the the form you are looking for.

- Check if template you select conforms with the requirements of your state and county.

- Choose the right subscription option to get the Wisconsin Transfer Deed With Trust.

- Download the form. Then complete, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us today and turn form completion into something simple and streamlined!

Form popularity

FAQ

4 Steps to Securely Transfer Real Estate into a Trust | Wisconsin Estate Planning Law Getting the Deed Ready for Transfer. To begin, your attorney will obtain a deed form. ... Making a Record of the Deed Before Transferring. ... Paying Taxes on Deed Transfers. ... Reporting Changes to Real Estate for Insurance Coverage.

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

Draw up the trust document: You can use an online program to do it yourself or get the help of an attorney. Get the trust document notarized: Sign the trust document before a notary public. Put your property into the trust: You can also do this yourself, but it does take some paperwork, so a lawyer may be helpful.

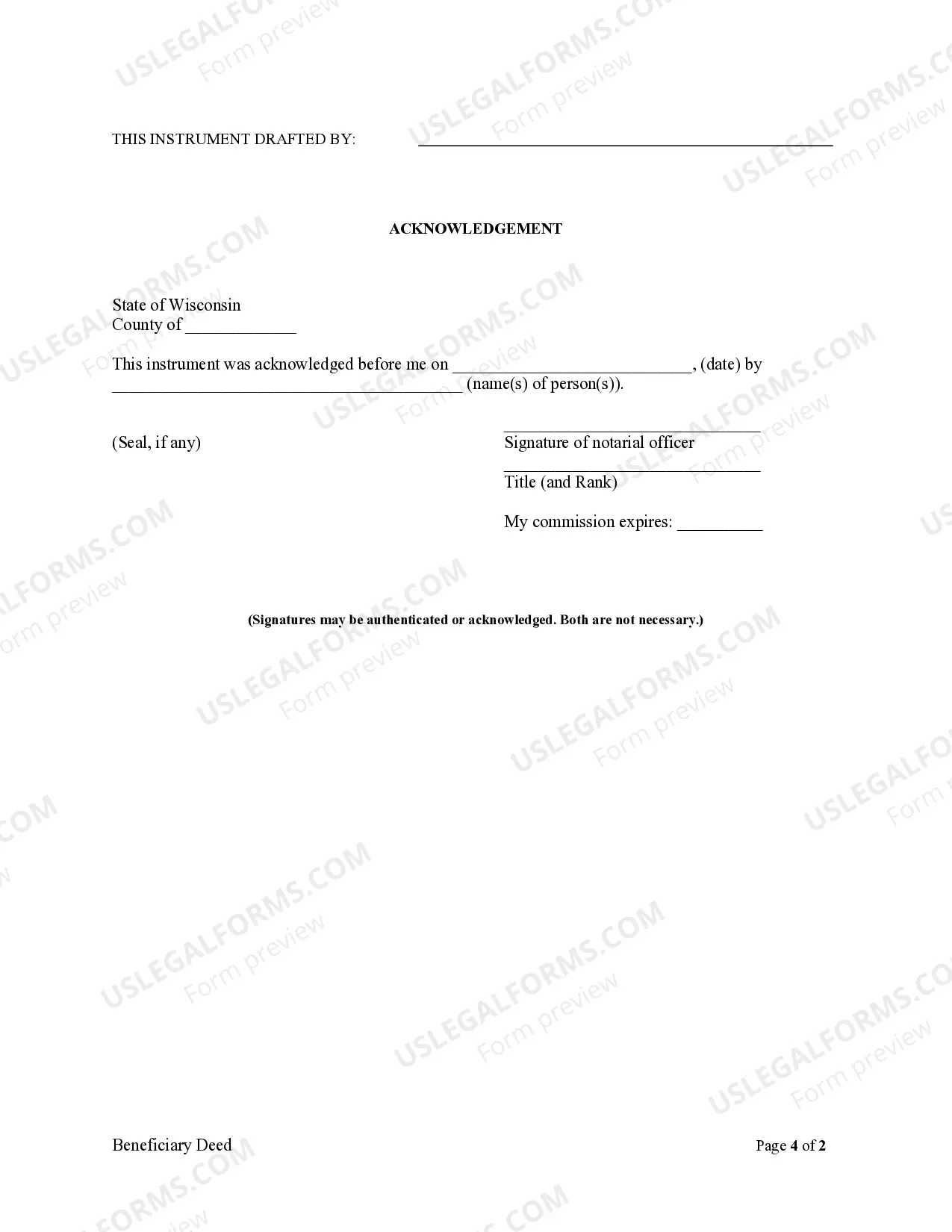

The Grantors (current owners) must sign the deed before a notary public. 2. Go to the Wisconsin Department of Revenue's E-Return website at and complete an E-Return (eRETR). Most of the information you need for the eRETR comes from your property tax statement and the new deed.