Wi Life Estate With Mortgage

Description

How to fill out Wisconsin Release Deed - Life Estate - Individual To Nine Individuals?

Whether for business purposes or for personal affairs, everybody has to handle legal situations at some point in their life. Completing legal documents demands careful attention, starting with picking the right form template. For instance, when you pick a wrong edition of a Wi Life Estate With Mortgage, it will be turned down when you submit it. It is therefore essential to get a reliable source of legal documents like US Legal Forms.

If you need to get a Wi Life Estate With Mortgage template, stick to these easy steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Examine the form’s information to ensure it suits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect document, go back to the search function to locate the Wi Life Estate With Mortgage sample you require.

- Get the file if it meets your requirements.

- If you already have a US Legal Forms account, just click Log in to access previously saved documents in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Pick the appropriate pricing option.

- Finish the account registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Pick the file format you want and download the Wi Life Estate With Mortgage.

- After it is saved, you are able to fill out the form by using editing software or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you do not need to spend time searching for the appropriate template across the internet. Make use of the library’s easy navigation to find the right template for any occasion.

Form popularity

FAQ

The FMV of the life estate is determined using the age of the life estate holder on the date that the life estate was created and the property's FMV on that date. Multiply the FMV by the life estate multiplier on the Life Estate and Remainder Interest Table (see Section 39.1 Life Estate and Remainder Interest).

To determine the value of a life estate, multiply the real value by 6%, then multiply this product by the annuity dollar at the nearest birthday of the owner of the life estate (see table below).

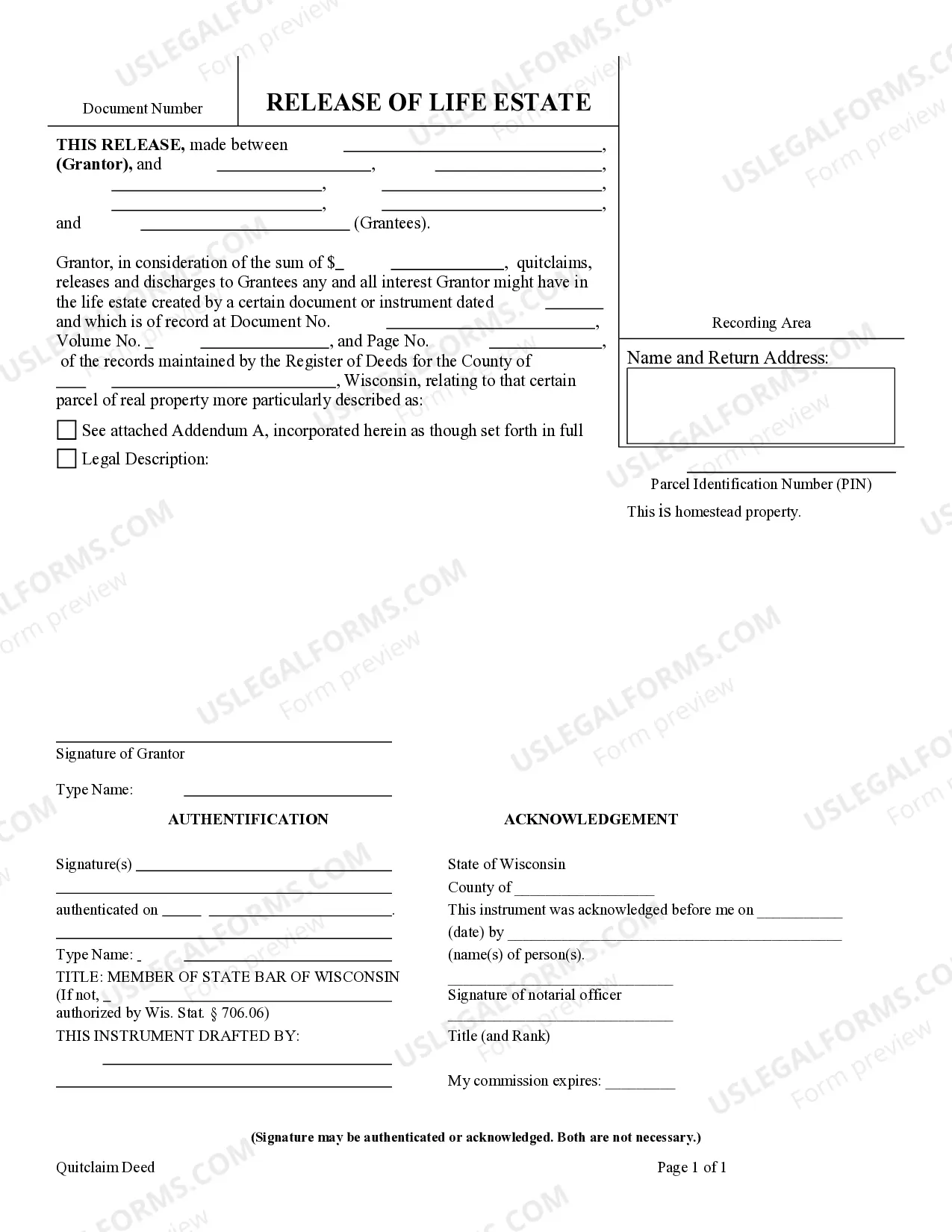

A life estate is created when a property holder transfers ownership of the property to someone else and retains the right to live on the property and the income from it. The new owner of the property is referred to as the remainder person.

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

In addition, life estates allow the owner to control the property in all respects, except that they cannot sell or mortgage the property without the consent of their heirs. If created in a timely manner, a life estate can even help its creator qualify for Medicaid assistance.