Limited Liability For Llc

Description

How to fill out Wisconsin Limited Liability Company LLC Formation Package?

- If you are a returning user, log in to your account and select the desired form template for download. Verify that your subscription is active; if it isn’t, renew it based on your current payment plan.

- For first-time users, start by exploring the Preview mode and description of the available forms. This will help you ensure you're selecting the correct document that aligns with your local jurisdiction's requirements.

- Should you find discrepancies, use the Search tab to locate alternative templates that might better serve your needs. If you find the appropriate document, proceed to the next step.

- Click the Buy Now button associated with your chosen document and select your preferred subscription plan. You'll need to create an account to gain full access to the legal form library.

- Complete your purchase by entering your credit card information or opting for a PayPal transaction. This will finalize your subscription.

- Once your payment is processed, download your form. Save the document to your device, and remember that you can access it anytime from the My Forms section of your profile.

By following these steps, you can easily obtain the necessary legal forms to establish your LLC. US Legal Forms provides a robust selection of documents and access to expert assistance, making it a top choice for legal compliance.

Start your journey toward effective business formation today! Choose US Legal Forms for all your legal documentation needs.

Form popularity

FAQ

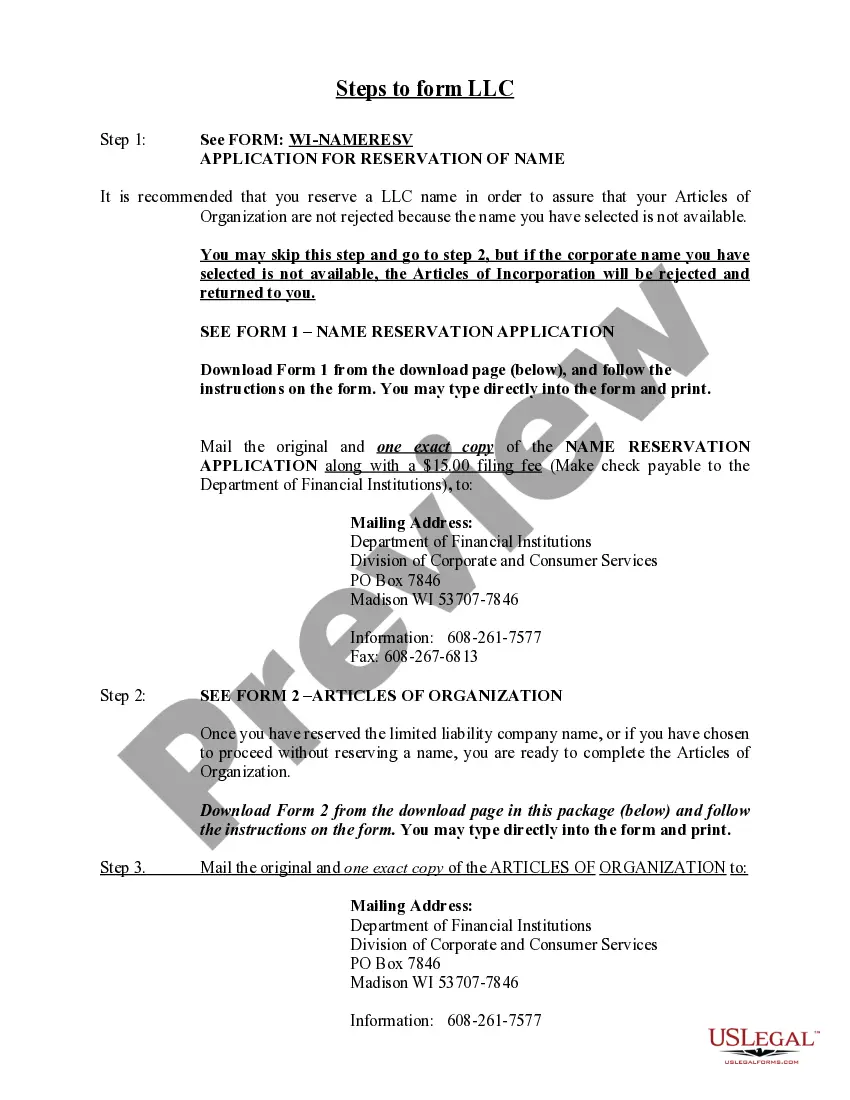

Filing for an LLC typically involves selecting a unique business name and submitting your formation documents to the appropriate state agency. It's crucial to include details like your business address and the names of the members. You can simplify this process by using platforms like uslegalforms, which provide user-friendly guidance and resources for completing the necessary steps effectively.

A common example of a limited liability company is a small business like a family-owned restaurant. This business structure allows the owners to protect their personal assets while benefiting from pass-through taxation. Many entrepreneurs prefer forming an LLC due to the advantages of limited liability for LLCs, as it helps them focus on growing their business without constant worry about personal risk.

Generally, the owner of an LLC enjoys limited liability protection, meaning they are not personally liable for the debts and obligations of the company. However, there are exceptions where personal liability may arise, such as personal guarantees or improper conduct. Thus, while limited liability for LLCs provides significant protection, staying compliant with legal requirements is essential to maintain that shield.

Yes, even with the protection offered by limited liability for LLCs, obtaining liability insurance remains essential. This type of insurance safeguards your business against potential lawsuits and claims, which may exceed the protection offered by your LLC status. It is a crucial step in risk management and can protect your business’s assets. By investing in liability insurance, you can operate your LLC with greater confidence and peace of mind.

While limited liability for LLCs offers protection to your personal assets, there are disadvantages to consider. Firstly, LLCs often face higher startup and ongoing costs compared to sole proprietorships or partnerships. Additionally, in some states, LLCs require more complex administrative tasks, such as annual reports or specific record-keeping. Lastly, some investors may prefer other business structures, potentially making it more challenging to raise capital.

To limit liability in an LLC, you should follow specific practices, such as keeping detailed financial records and separating personal and business expenses. Additionally, it is crucial to adhere to compliance requirements outlined by your state, including filing annual reports and maintaining a registered agent. For those seeking help, USLegalForms offers essential tools to ensure your LLC operates within legal standards, maximizing your limited liability protection.

The limited liabilities of an LLC primarily include protection from personal liability for business debts, lawsuits, and other financial obligations. Members are only at risk for the amount they invest in the business, which safeguards personal assets. Additionally, an LLC can often provide tax flexibility, allowing members to choose how they wish to be taxed, further enhancing financial security.

An LLC limits liability by creating a legal entity separate from its owners. This means that the company itself is responsible for its debts and obligations, not the individual members. By forming an LLC, you effectively reduce your risk of personal loss, impacting only your investment in the business, unless you engage in activities that compromise this protection.

An LLC, or limited liability company, provides significant protection against personal liability for its owners, known as members. Essentially, your personal assets, such as your home or savings, are generally shielded from business debts and legal claims. However, it's important to maintain proper business practices and not mix personal and business finances to ensure this protection remains intact.

To start an LLC in Nebraska, you need to choose a unique name, appoint a registered agent, and file the articles of organization with the Secretary of State. Additionally, create an operating agreement to outline the management structure and business practices. Using US Legal Forms can streamline this process, helping you fulfill all legal requirements and secure limited liability for LLC members effectively.