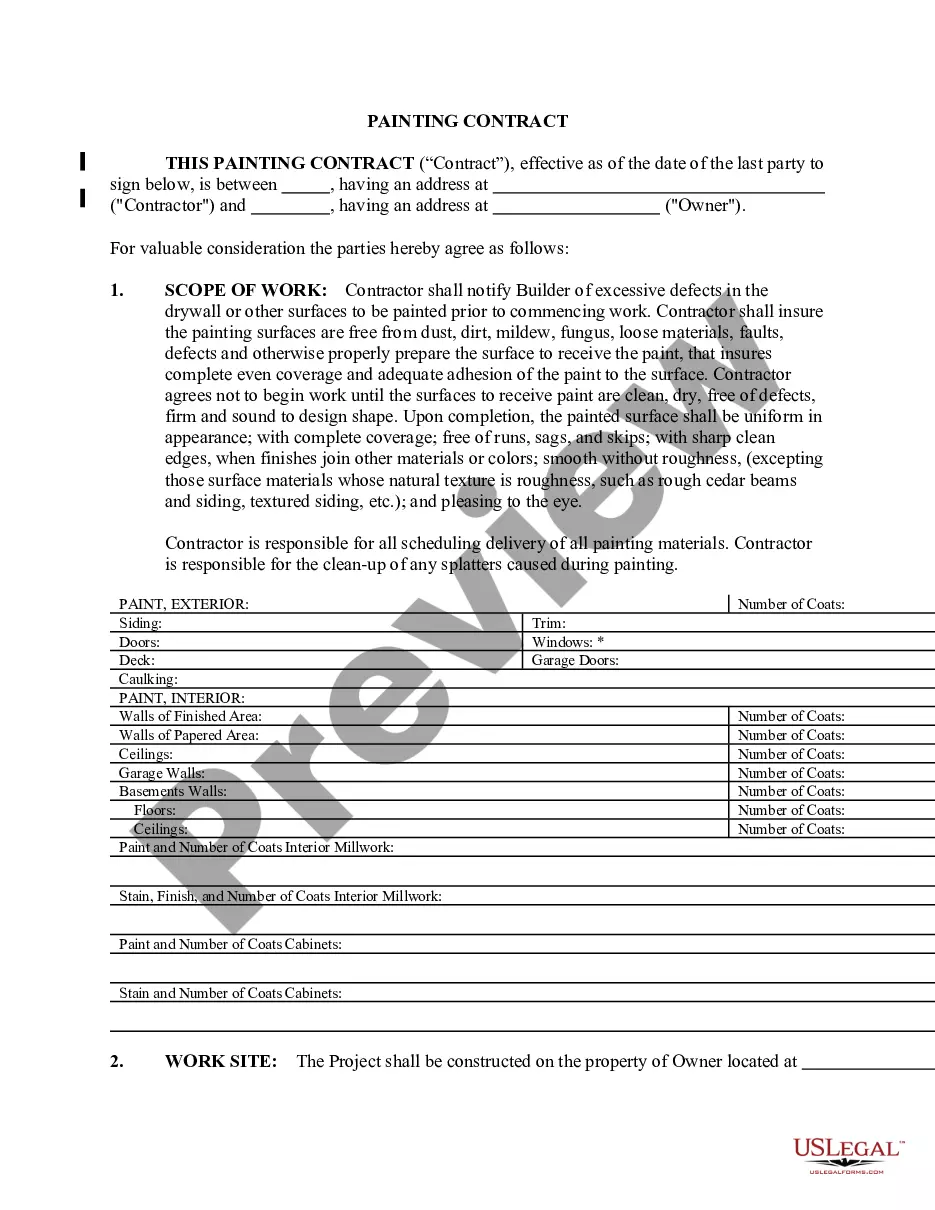

This form is By-Laws for a Business Corporation and contains provisons regarding how the corporation will be operated, as well as provisions governing shareholders meetings, officers, directors, voting of shares, stock records and more. Approximately 9 pages.

Wisconsin Corporation Withholding

Description

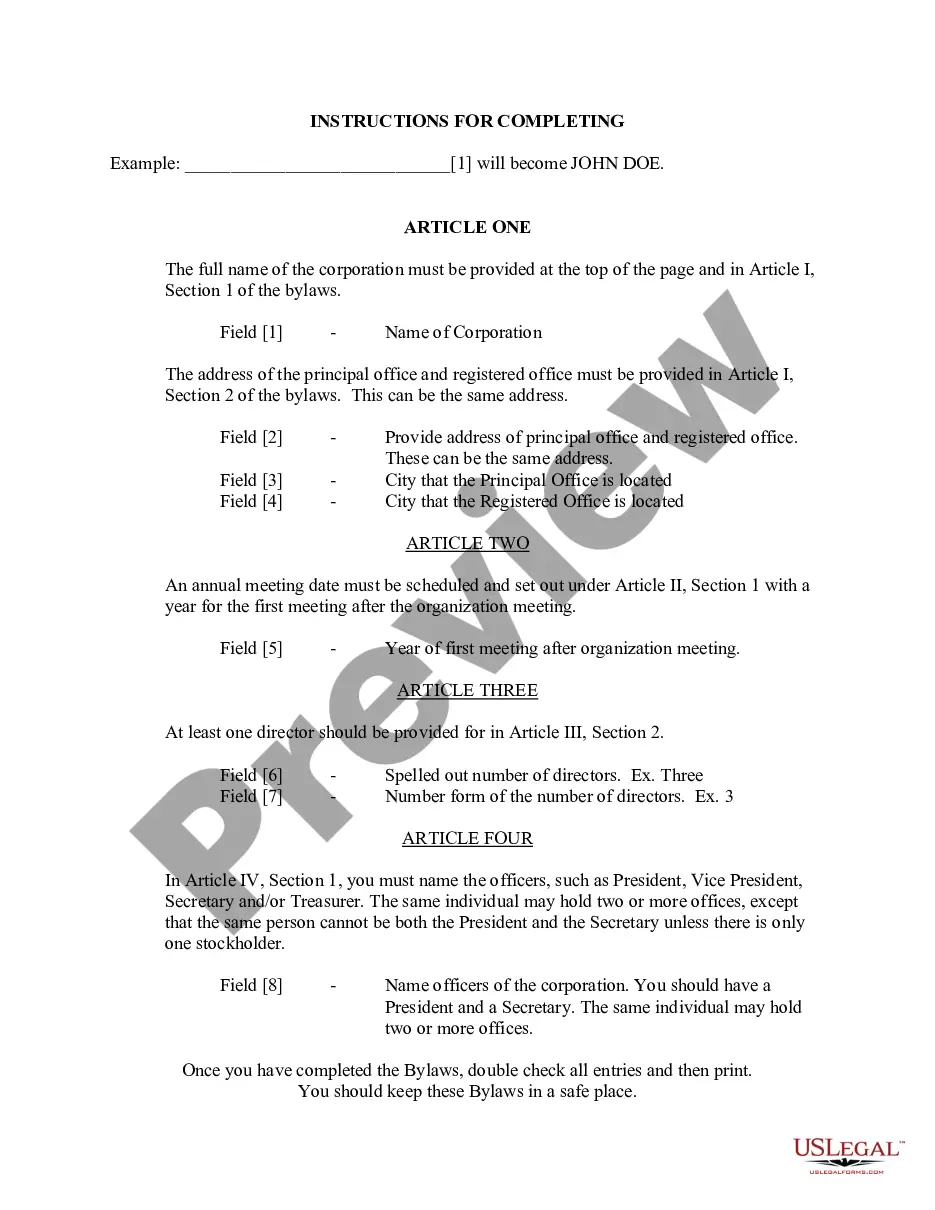

How to fill out Wisconsin Bylaws For Corporation?

Handling legal paperwork and operations could be a time-consuming addition to your entire day. Wisconsin Corporation Withholding and forms like it usually require that you search for them and navigate how you can complete them properly. Therefore, regardless if you are taking care of financial, legal, or individual matters, using a extensive and practical web library of forms close at hand will help a lot.

US Legal Forms is the best web platform of legal templates, boasting over 85,000 state-specific forms and numerous tools to assist you to complete your paperwork quickly. Check out the library of pertinent papers accessible to you with just one click.

US Legal Forms provides you with state- and county-specific forms offered at any time for downloading. Safeguard your document administration procedures using a high quality service that lets you put together any form within minutes with no additional or hidden fees. Just log in in your account, locate Wisconsin Corporation Withholding and download it immediately within the My Forms tab. You can also gain access to formerly saved forms.

Would it be your first time utilizing US Legal Forms? Sign up and set up up a free account in a few minutes and you’ll get access to the form library and Wisconsin Corporation Withholding. Then, stick to the steps below to complete your form:

- Be sure you have discovered the correct form using the Review feature and reading the form description.

- Pick Buy Now when ready, and choose the monthly subscription plan that is right for you.

- Press Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of expertise supporting consumers handle their legal paperwork. Find the form you require today and enhance any operation without having to break a sweat.

Form popularity

FAQ

Wisconsin WT-4 Instructions Complete the section labeled ?Figure your total withholding exemptions below?. Step 1 is a guideline for how many exemptions you would like to claim. If you know how many exemptions you would like to claim please list the number on Line 1 box d. Please sign and date the form and return.

Pass-through entities must also file Form PW-1 annually to report estimated withholding tax paid and pay any additional withholding tax due on behalf of their nonresident shareholders, partners, members, or beneficiaries. You must file Form PW-1 electronically.

Use your 15-digit Wisconsin withholding tax number, the period covered by your deposit and the amount of tax withheld for the period.

Quarterly, monthly, and semi-monthly filers with an active Wisconsin withholding account must file an electronic deposit report (Form WT-6) even if no tax is withheld during the period covered. Electronic filing options include: My Tax Account. Third-Party Software.

In most cases, the term ?tax ID? is just shorthand for your federal tax ID number. This 9-digit number is also called an employer identification number (EIN), and it's assigned to your business when you register with the federal government.