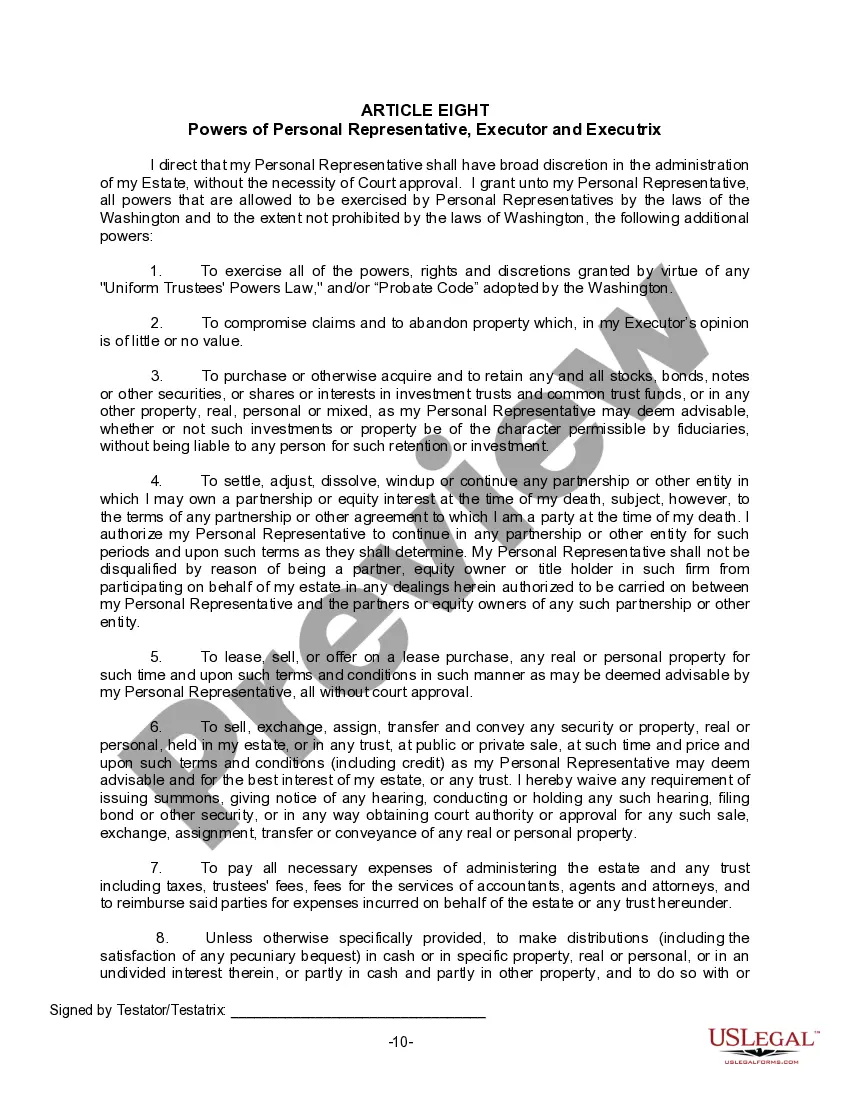

Last Will for a Widow or Widower with no Children

Note: This law summary is not intended to be all-inclusive of the Washington law of Will, but does include basic and other

provisions.

Who may make a will. Any person of sound

mind who has attained the age of eighteen years may, by last will, devise

all his or her estate, both real and personal.

RCW 11.12.010

Requisites of wills. (1) Every will shall

be in writing signed by the testator, and shall be attested by two

or more competent witnesses, by subscribing their names to the will, or

by signing an affidavit that complies with law (2), while in the presence

of the testator and at the testator's direction. RCW 11.12.020

Foreign Will. A last will and testament,

executed in the mode prescribed by the law of the place where executed

or of the testator's domicile, either at the time of the will's execution

or at the time of the testator's death, shall be deemed to be legally executed,

and shall be of the same force and effect as if executed in the mode prescribed

by the laws of this state.

RCW 11.12.020

Revocation of will -- How effected -- Effect on codicils.

(1) A will, or any part thereof, can be revoked:

(a) By a subsequent will that revokes,

or partially revokes, the prior will expressly or by inconsistency; or

(b) By being burnt, torn, canceled, obliterated,

or destroyed, with the intent and for the purpose of revoking the same,

by the testator or by another person in the presence and by the direction

of the testator. If such act is done by any

person other than the testator, the direction of the testator and the facts

of such injury or destruction must be proved by two witnesses.

(2) Revocation of a will in its entirety

revokes its codicils, unless revocation of a codicil would be contrary

to the testator's intent. RCW 11.12.040

Affidavits of attesting witnesses. Any or all

of the attesting witnesses to a will may, at the request of the testator

or, after his decease, at the request of the executor or any person interested

under it, make an affidavit before any person authorized to administer

oaths, stating such facts as they would be required to testify to in court

to prove such will, which affidavit may be written on the will or may be

attached to the will or to a photographic copy of the will. The sworn statement

of any witness so taken shall be accepted by the court as if it had been

taken before the court. RCW 11.20.020

Interested witness -- Effect on will. (1)

An interested witness to a will is one who would receive a gift under the

will. (2) A will or any of its provisions is not invalid because it is

signed by an interested witness, however, there is a presumption that the

gift was a result of fraud unless there are two other witnesses. RCW 11.12.160

Incorporation by reference. A will may

incorporate by reference any writing in existence when the will is executed

if the will itself manifests the testator's intent to incorporate the writing

and describes the writing sufficiently to permit its identification. In

the case of any inconsistency between the writing and the will, the will controls. RCW 11.12.255

Dissolution or invalidation of marriage.

If, after making a will, the testator's marriage is dissolved or invalidated,

all provisions in the will in favor of or granting any interest or power

to the testator's former spouse are revoked, unless the will expressly

provides otherwise. Provisions affected by this section must be interpreted,

and property affected passes, as if the former spouse failed

to survive the testator, having died at the time of entry of the decree

of dissolution or declaration of invalidity. Provisions

revoked by this section are revived by the testator's remarriage to the

former spouse. RCW 11.12.051

Separate writing may direct disposition of tangible personal

property --

Requirements:

(1) A will may refer to

a writing that directs disposition of tangible personal property not otherwise

specifically disposed of by the will other than property used primarily

in trade or business. Such a writing shall not be effective unless:

(a)

An unrevoked will refers to the writing,

(b) the writing is either in the

handwriting of, or signed by, the testator, and

(c) the writing describes

the items and the recipients of the property with reasonable certainty.

(2) The writing may be written or signed before or after the execution

of the will and need not have significance apart from its effect upon the

dispositions of property made by the will. A writing that meets the requirements

of this section shall be given effect as if it were actually contained

in the will itself, except that if any person designated to receive property

in the writing dies before the testator, the property shall pass as further

directed in the writing and in the absence of any further directions, the

disposition shall lapse and RCW 11.12.110 shall not apply to such lapse.

(3) The testator may make subsequent handwritten

or signed changes to any writing. If there is an inconsistent disposition

of tangible personal property as between writings, the most recent writing

controls.

(4) As used in this section "tangible personal

property" means articles

of personal or household use or ornament, for example, furniture,

furnishings, automobiles, boats, airplanes, and jewelry, as well as precious

metals in any tangible form, for example, bullion or coins. The term

includes articles even if held for investment purposes and encompasses

tangible property that is not real property. The term does not include

mobile homes or intangible property, for example, money that is normal

currency or normal legal tender, evidences of indebtedness, bank accounts

or other monetary deposits, documents of title, or securities. RCW 11.12.260