Washington Mutual No Withdrawal Policy

Description

How to fill out Washington Mutual Wills Package For Married Couple With No Children?

Locating a reliable source for obtaining the latest and most suitable legal documents is a significant part of navigating bureaucracy. Acquiring the correct legal paperwork requires precision and careful consideration, which is why it is essential to obtain samples of the Washington Mutual No Withdrawal Policy exclusively from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and delay your current situation. With US Legal Forms, you have minimal concerns. You can view and review all details regarding the document’s application and significance for your circumstances and in your locality.

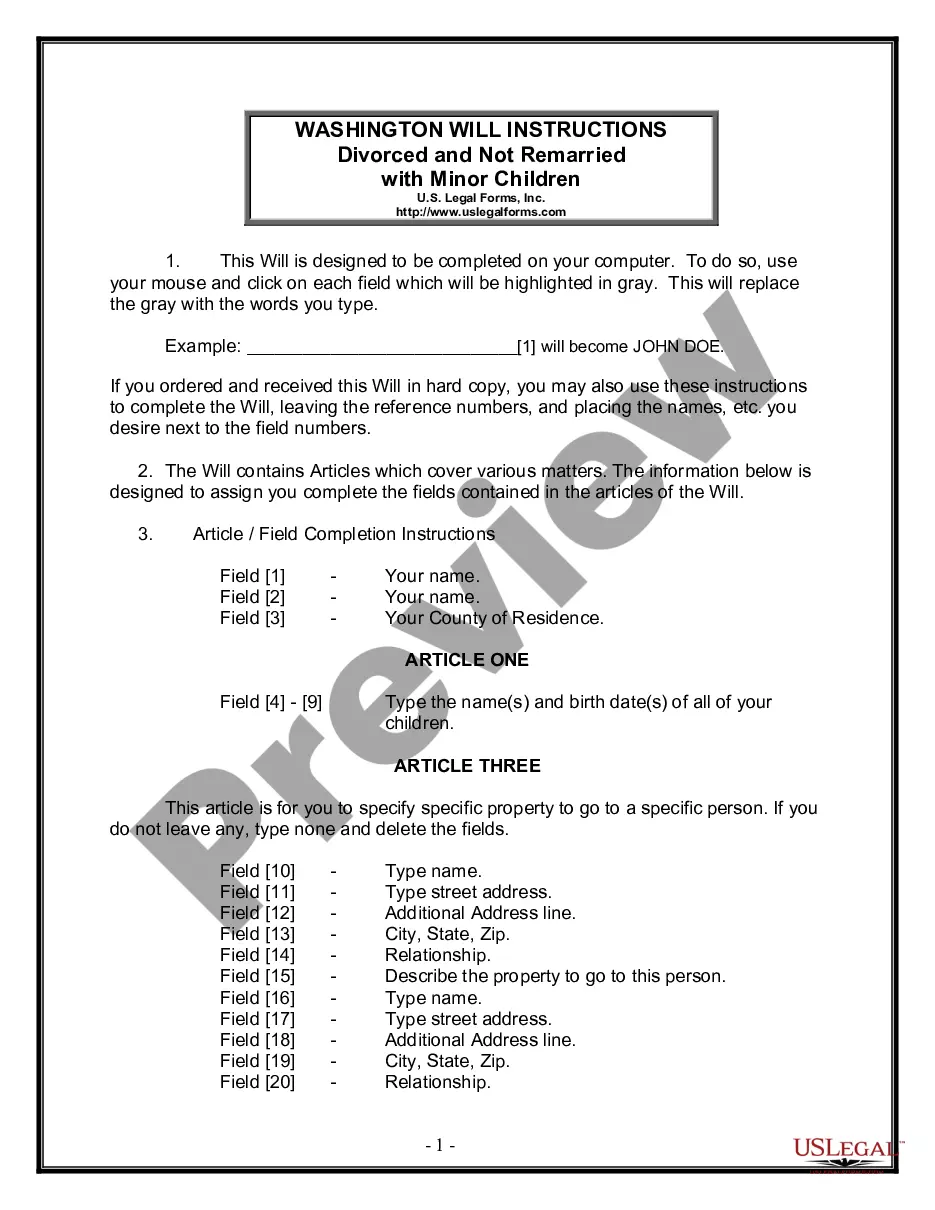

Review the following steps to finalize your Washington Mutual No Withdrawal Policy: Utilize the library navigation or search bar to locate your template. Access the form’s description to determine if it meets your state and regional criteria. Preview the form, if accessible, to confirm it is what you require. Return to the search and seek the appropriate template if the Washington Mutual No Withdrawal Policy does not fulfill your needs. Once you are confident about the form’s applicability, download it. If you are a registered user, click Log in to verify and access your selected forms in My documents. If you do not possess an account yet, click Buy now to acquire the template. Select the pricing plan that fits your needs. Proceed to register to complete your transaction. Conclude your purchase by selecting a payment option (credit card or PayPal). Choose the file format for downloading the Washington Mutual No Withdrawal Policy. After obtaining the form on your device, you can modify it with the editor or print it and fill it out manually. Eliminate the stress that accompanies your legal documentation. Explore the extensive US Legal Forms collection to discover legal documents, evaluate their applicability to your situation, and download them instantly.

Explore the US Legal Forms catalog to find legal samples and download them immediately.

- Locate a reliable source for legal documents.

- Acquiring correct legal paperwork requires precision.

- Obtain samples from trustworthy providers.

- An incorrect template can waste time.

- US Legal Forms minimizes concerns.

- View details regarding document application.

- Use library navigation to find templates.

- Access form descriptions to meet criteria.

- Preview to confirm the right form.

- Return to search if needs are unmet.

- Download once confident about applicability.

- Log in for registered users.

Form popularity

FAQ

What about checks that I have written on my account with Washington Mutual Bank? Your checks will clear up to the balance in your account. You can continue to use the checks you have.

WaMu was placed into the federal receivership of the Federal Deposit Insurance Corp. (FDIC) on September 25, 2008. Fearing more widespread financial contagion if a buyer was not found, the Federal Reserve held a secret auction of WaMu, announcing the buyer, JPMorgan Chase, that same day.

All deposit accounts were transferred to JP Morgan Chase who acquired WaMu for $1.9 billion. No one lost any money that was deposited in Washington Mutual Bank & no deposit insurance was used.

It only wrote 20% of its mortgages at greater than 80%loan-to-value ratio. 6 But when housing prices fell, it no longer mattered. The second reason for WaMu's failure was that it expanded its branches too quickly. As a result, it was in poor locations in too many markets.