Legal Will Not Withhold Taxes

Description

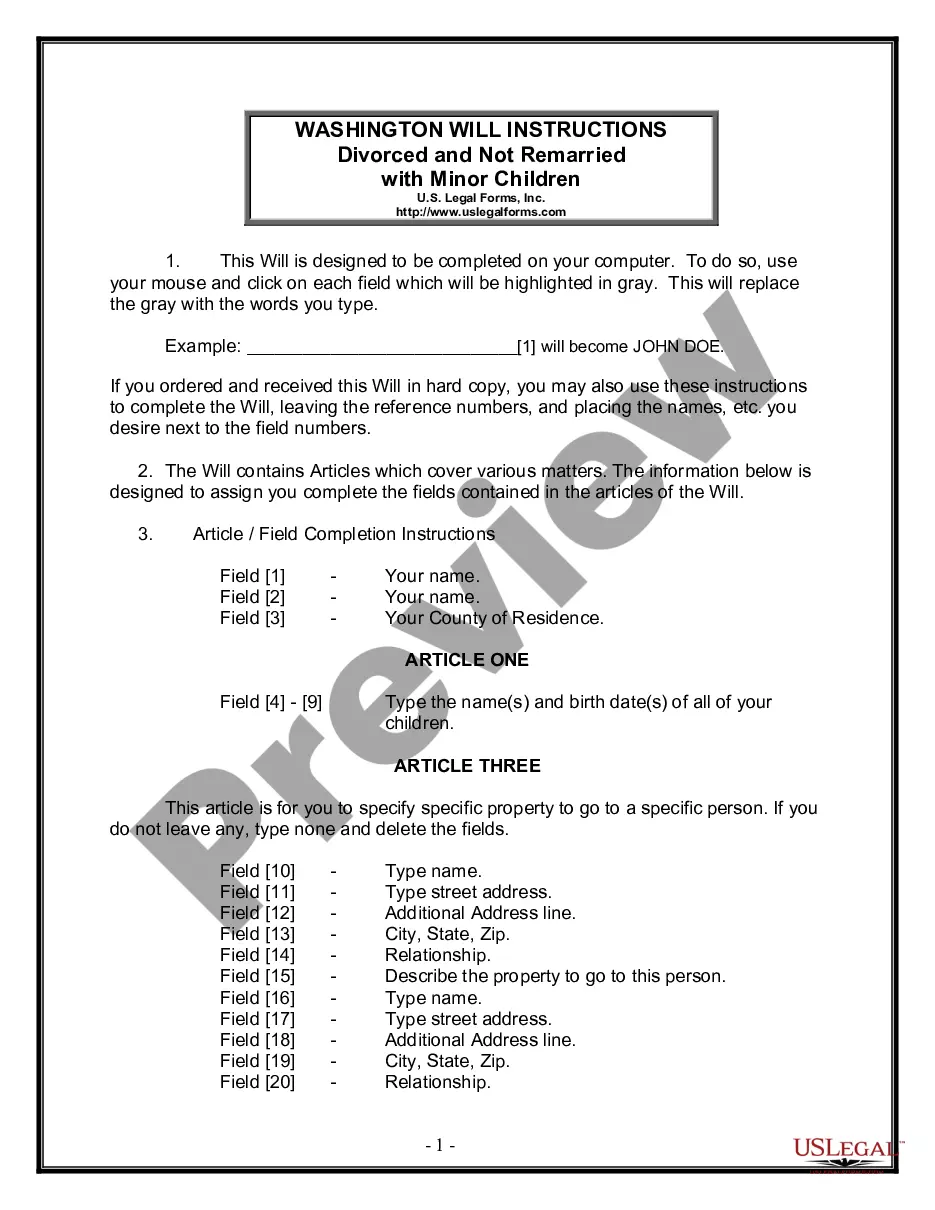

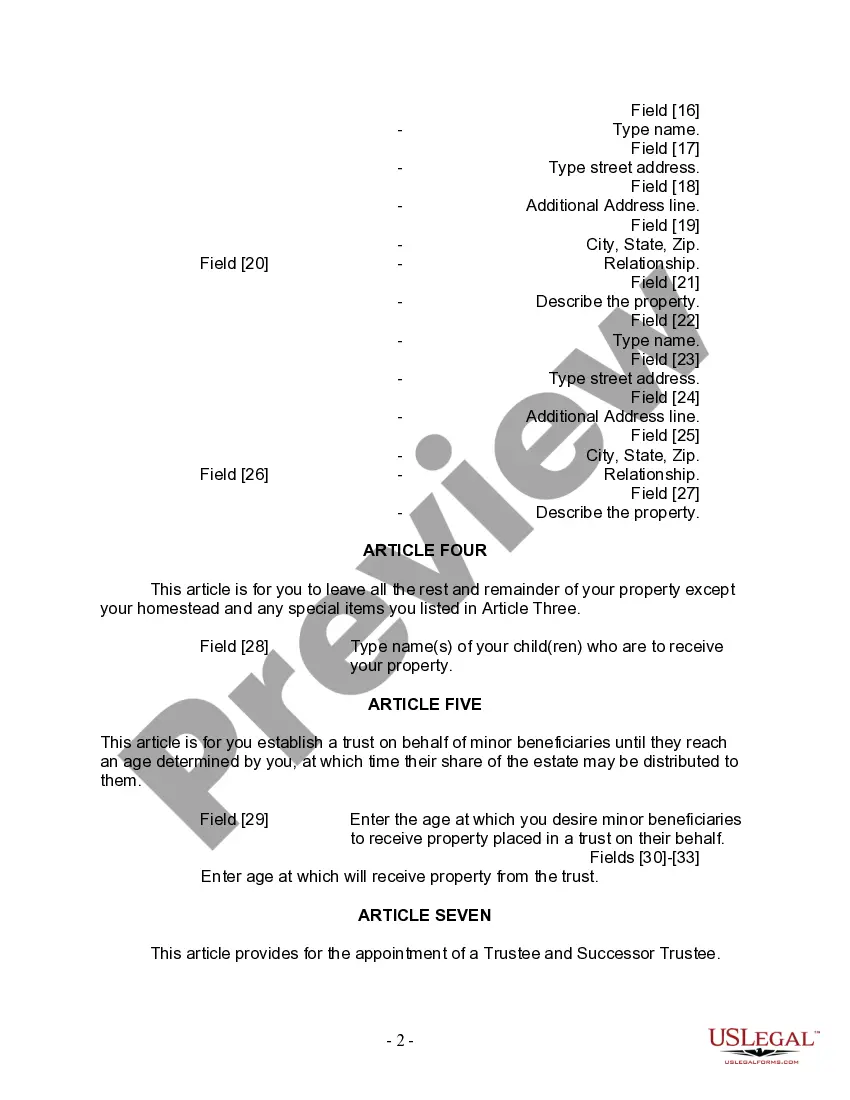

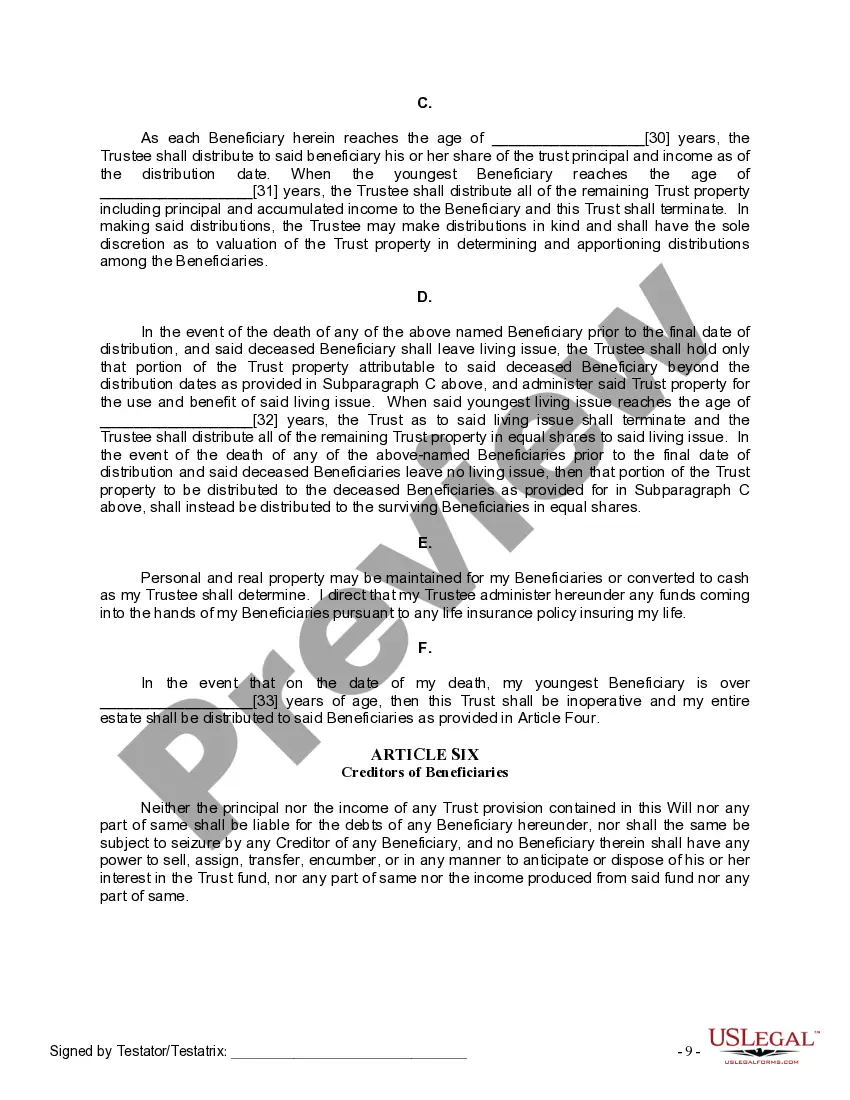

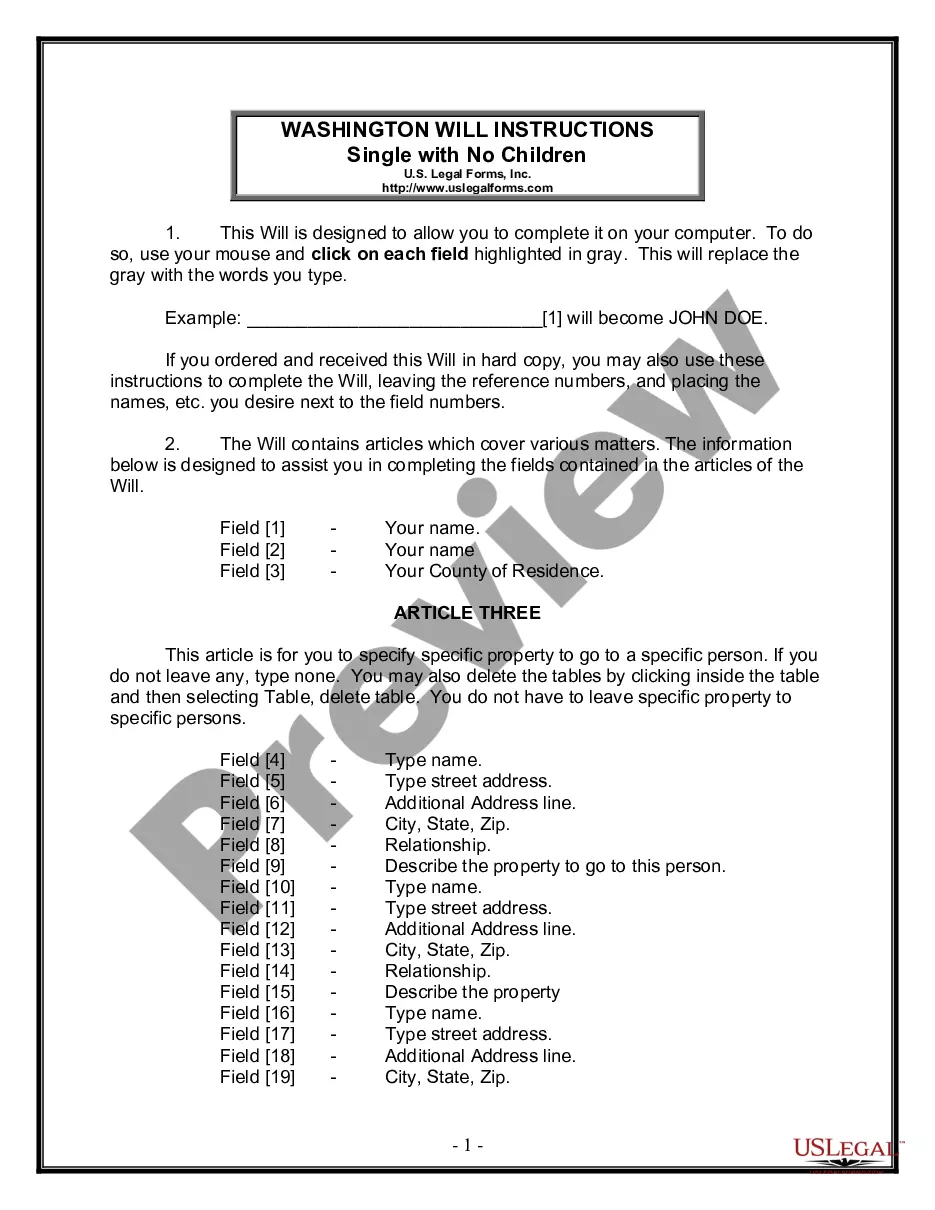

How to fill out Washington Last Will And Testament For Divorced Person Not Remarried With Minor Children?

The Legal Will Not Withhold Taxes that you observe on this page is a repeatable legal template created by qualified attorneys in adherence to federal and state legislation.

For over 25 years, US Legal Forms has supplied individuals, entities, and legal practitioners with more than 85,000 authenticated, state-specific forms for any commercial and personal scenario. It’s the fastest, simplest, and most reliable method to acquire the documents you require, as the service assures the utmost level of data security and anti-malware safeguards.

Register for US Legal Forms to have verified legal templates for all of life’s circumstances readily available.

- Search for the document you require and examine it.

- Browse through the sample you found and preview it or review the form description to confirm it meets your requirements. If it doesn't, use the search feature to locate the right one. Click Buy Now when you have identified the template you need.

- Register and sign in.

- Select the pricing plan that fits your needs and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to move forward.

- Acquire the fillable template.

- Pick the format you desire for your Legal Will Not Withhold Taxes (PDF, DOCX, RTF) and download the sample to your device.

- Complete and sign the documents.

- Print out the template to fill it out by hand. Alternatively, use an online multifunctional PDF editor to swiftly and accurately complete and sign your form with an electronic signature.

- Download your documents again.

- Utilize the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously saved forms.

Form popularity

FAQ

Employers are required by law to withhold employment taxes from their employees. Employment taxes include federal income tax withholding and Social Security and Medicare Taxes.

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.

To change your tax withholding you should: Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.

You can reduce the amount of taxes taken out of your paycheck by increasing your dependents, reducing the amount of ?non-job? income or untaxed income that you are accounting for in your withholding in lines 4(a) or 4(c), or increasing the figure for itemized deductions in line 4(b).

The Bottom Line. If your employer doesn't withhold payroll taxes, you will have to pay these taxes yourself. This typically applies to independent contractors who need to make quarterly estimates of their taxes to the IRS.