Legal Will Not Withhold Federal Taxes

Description

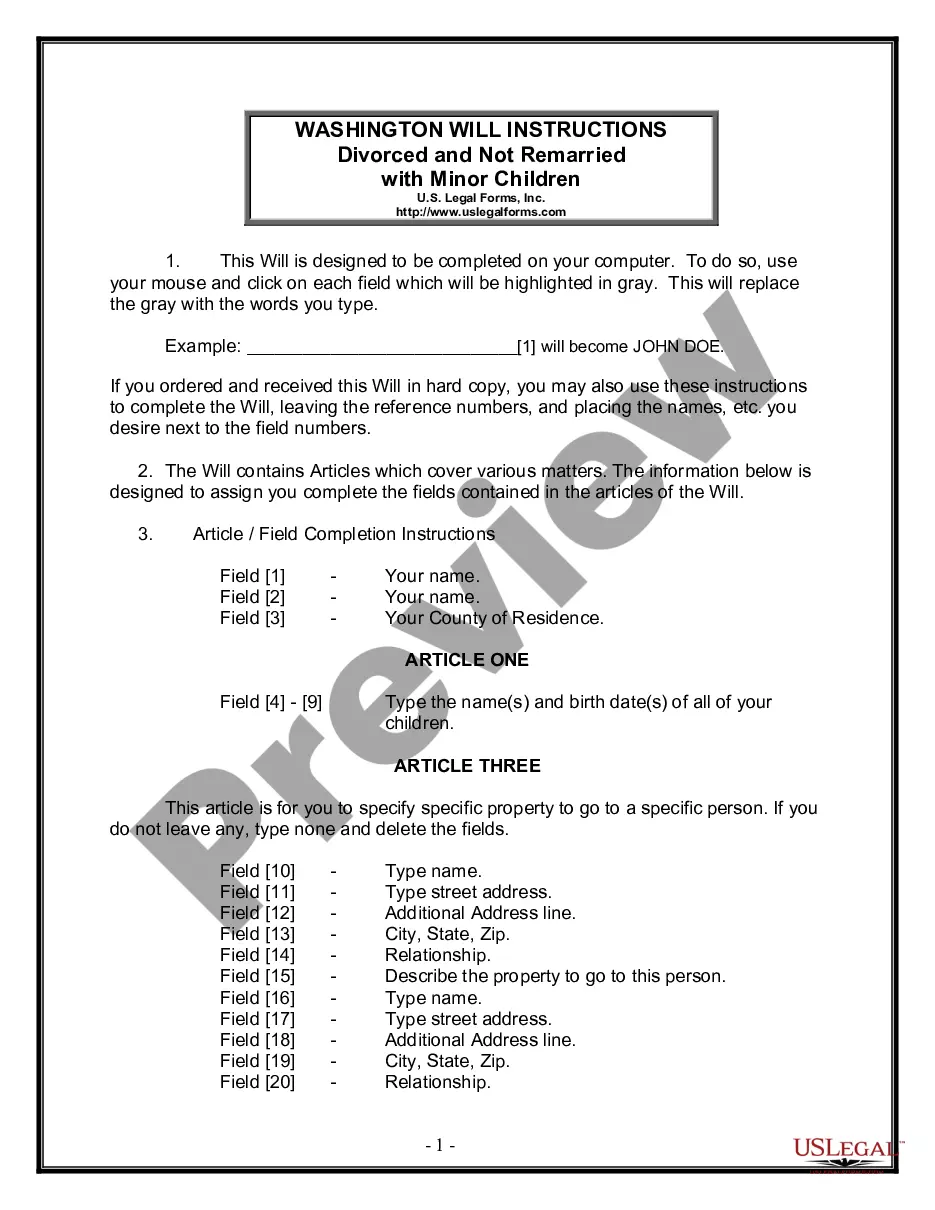

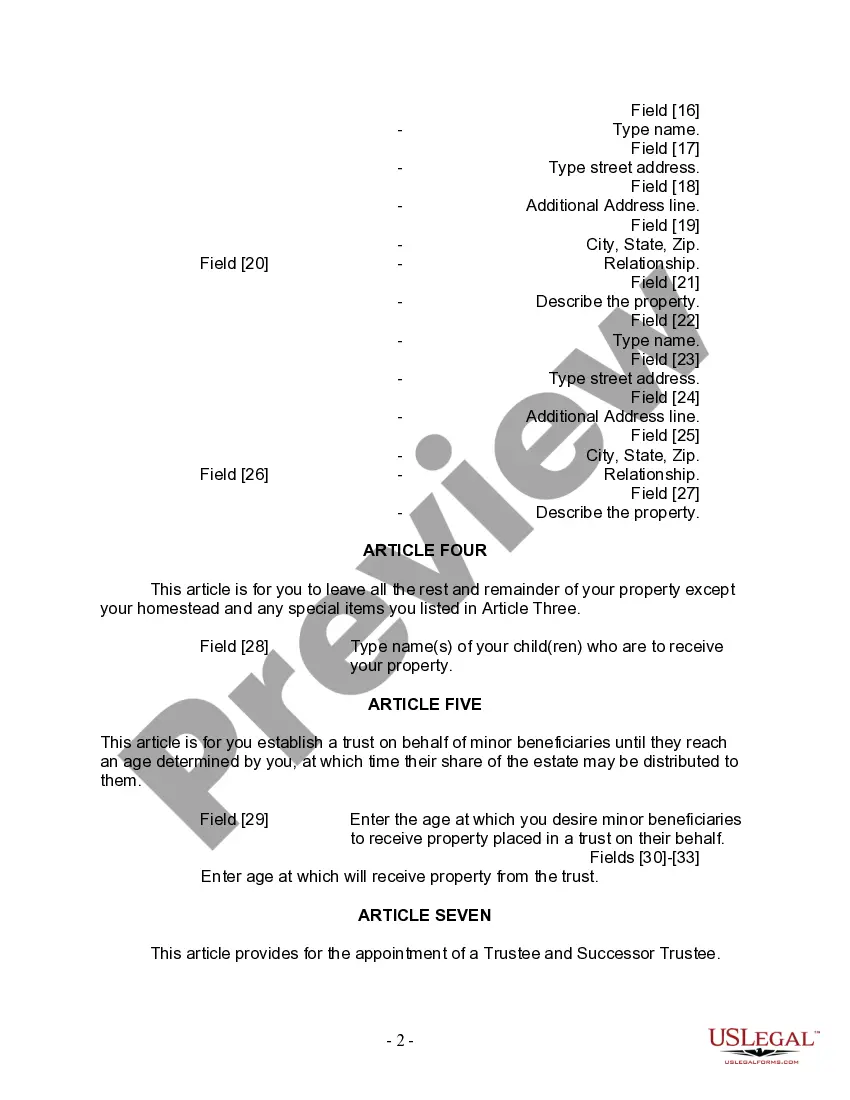

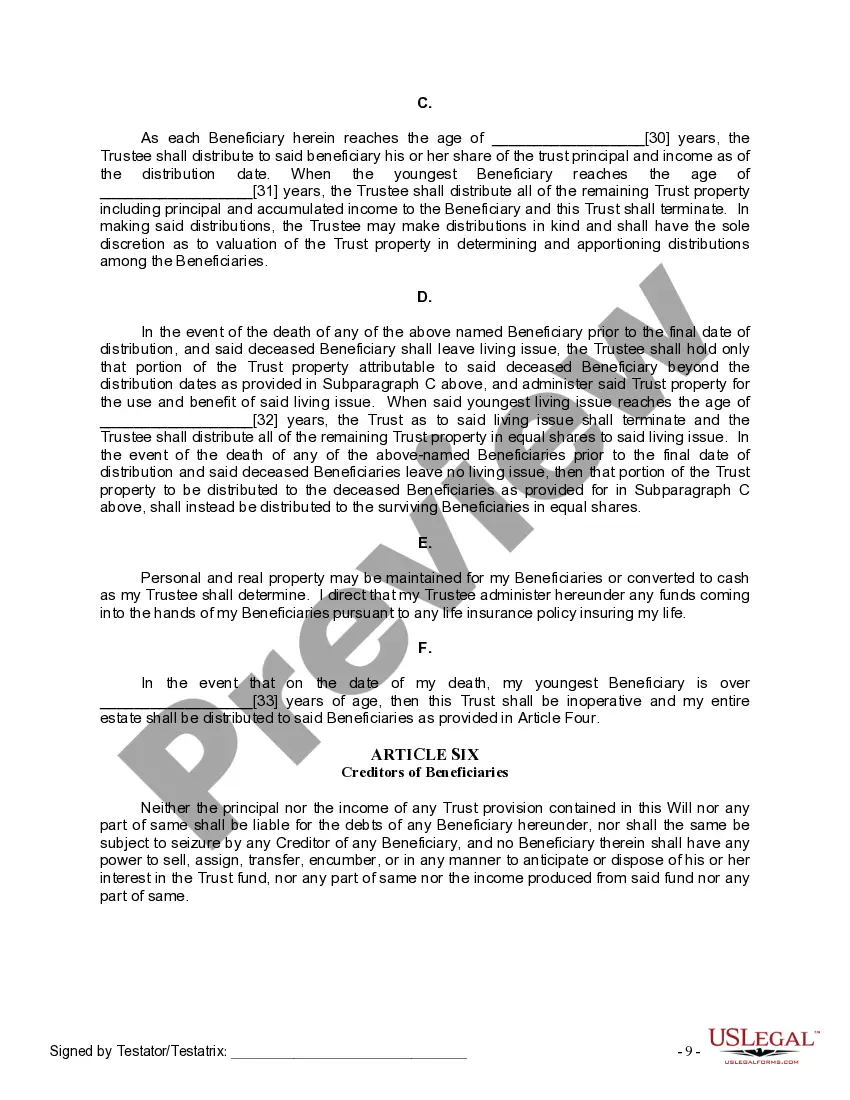

How to fill out Washington Last Will And Testament For Divorced Person Not Remarried With Minor Children?

Creating legal documents from the ground up can frequently be overwhelming.

Certain situations may require extensive research and significant financial investment.

If you're seeking an easier and cost-effective method to generate Legal Will Not Withhold Federal Taxes or any other paperwork without the hassle of red tape, US Legal Forms is readily accessible.

Our online repository of more than 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal matters.

Before proceeding to download Legal Will Not Withhold Federal Taxes, consider these guidelines: Review the document preview and descriptions to confirm you're selecting the correct document, ensure the form meets your state and county's requirements, choose the most suitable subscription plan to acquire the Legal Will Not Withhold Federal Taxes, and then download the document. Complete it, certify it, and print it out. US Legal Forms has a commendable reputation and brings over 25 years of expertise. Join us today to make document completion a straightforward and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously prepared for you by our legal professionals.

- Utilize our website whenever you require a dependable and trustworthy service to quickly locate and download the Legal Will Not Withhold Federal Taxes.

- If you’re a returning user and have previously registered with us, just Log In to your account, find the template, and download it or access it later in the My documents section.

- Didn’t register yet? No problem. It takes just a few moments to sign up and explore the library.

Form popularity

FAQ

Tax withholding refers to the income tax an employer removes from an employee's paycheck and sends to the Internal Revenue Service (IRS) on the employee's behalf. Withholding allows the payer to manage their tax bill gradually, rather than owe one large bill come tax season.

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

With every paycheck, your employer withholds some of your earnings for taxes. If too much is withheld, it's true that you will receive a refund, but when you really think about it, by waiting until tax season to claim that money back, you've essentially provided the IRS with an interest-free loan during the year.

When your employer drafts your paycheque, they automatically withhold your Employment Insurance (EI) premiums, Canada Pension Plan (CPP) contributions, and income tax, and they remit those payments to the Canada Revenue Agency (CRA).

Withholding taxes are a reality for all working Canadians. Withholding tax is the amount of tax taken off each paycheque and remitted to the Canada Revenue Agency (CRA) on your behalf. Just because you retire does not mean you can get away from withholding tax.