Wa Tenant Without Lease

Description

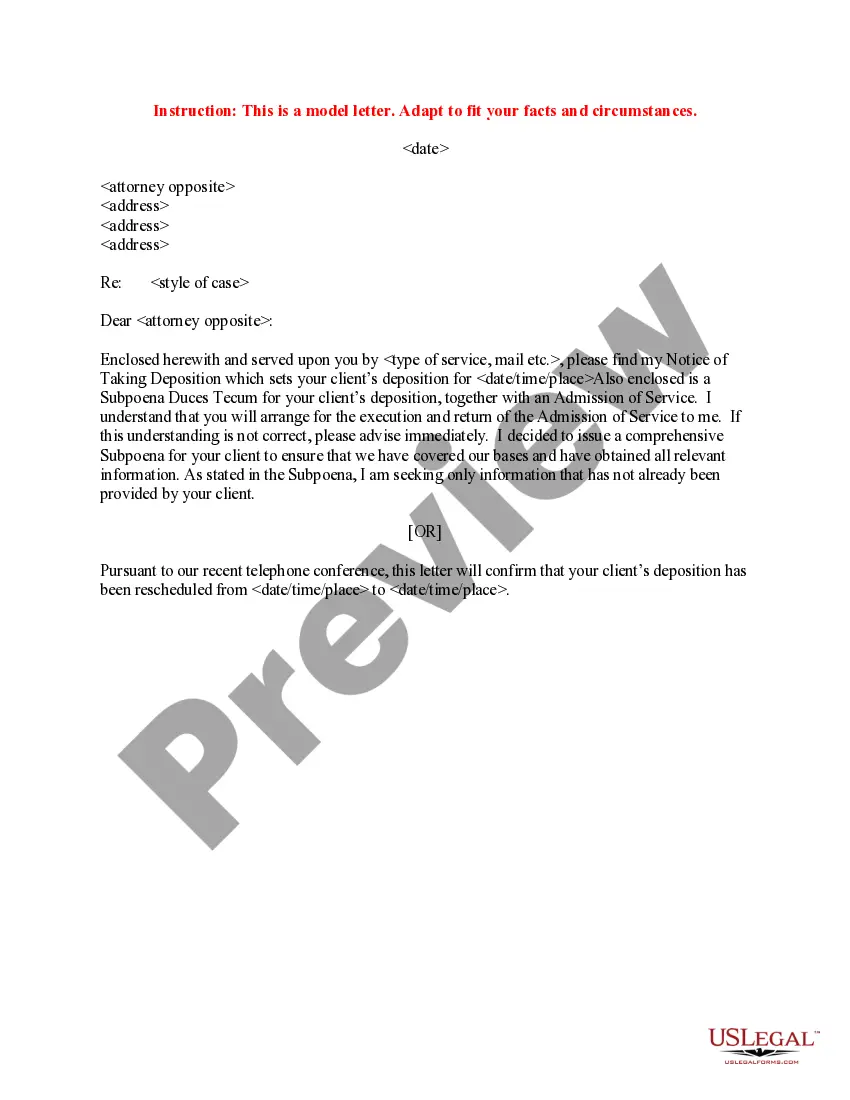

How to fill out Washington Residential Landlord Tenant Rental Lease Forms And Agreements Package?

The management of legal documents can be perplexing, even for the most adept professionals.

If you require a Wa Tenant Without Lease and lack the opportunity to find the suitable and current version, the processes can be stressful.

With US Legal Forms, you can.

Make use of advanced functionalities to fill out and manage your Wa Tenant Without Lease.

Here are the instructions to follow once you have obtained the form you require.

- Gain entry to a valuable library of articles, guides, and resources related to your requirements and circumstances.

- Conserve time and effort in locating the necessary documents, utilizing US Legal Forms’ enhanced search and Preview feature to find and download your Wa Tenant Without Lease.

- If you are a member, Log In to your US Legal Forms account, search for the template, and download it.

- Visit the My documents section to review the documents you've saved and manage your folders as needed.

- If it’s your initial experience with US Legal Forms, create a free account for unlimited access to all the features of the library.

- Utilize a comprehensive online form library that can significantly improve your ability to handle these matters efficiently.

- US Legal Forms stands out as a frontrunner in online legal forms, offering more than 85,000 state-specific legal documents available at your convenience.

- Gain access to localized legal and business documentation tailored to specific states or counties.

Form popularity

FAQ

A 20-day notice to terminate tenancy in Washington informs a tenant that they must vacate the property within 20 days. This notice applies to tenants without a lease or those on month-to-month agreements. It is a critical step in the process of ensuring compliance with state rental laws.

To revive or reinstate your Indiana LLC, you'll have to submit the following to the Indiana Secretary of State: an Indiana Certificate of Clearance. a completed Indiana Application for Reinstatement. a current Business Entity Report. a $30 Reinstatement Fee plus any fees for missed reports.

Register Your Business Entity Sole proprietorships: Business owners don't need to file organizational documents to operate as a sole proprietor in Indiana. In cases where the business's name differs from the owner's first and last name, a trade name filing is required.

If your business has been administratively dissolved or revoked, you cannot conduct business in Indiana. Don't panic. If you intend to continue doing business, you can reinstate the business if it has not been administratively dissolved or revoked for more than five (5) years.

In the case of a sole proprietorship, you declare your profit and loss on Schedule C of Form 1040. But, to file Schedule C, you'll have to qualify first. The conditions to qualify are: Your goal is to engage in business activity for income and profit.

You don't need to take any legal steps to form this type of business. If you are the only owner and begin conducting business, you automatically become a sole proprietorship. There is no need to formally file paperwork or submit anything at the federal, state, or local level to be recognized as such.

The filings fees consist of all fees owed for Business Entity Reports plus the Reinstatement Fee of $30.00.

How To Reinstate An Indiana Corporation Certificate of Tax Clearance from Indiana Department of Revenue. Form 4160, Application for Reinstatement. Form 48725, Business Entity Report (file one with current information) All business entity report fees owed. Reinstatement filing fee.

Obtaining a Certificate of Clearance Submit an Affidavit for Reinstatement (AD-19) and a Responsible Officer Information form (ROC-1) to the. Indiana Department of Revenue. ... Wait for the Certificate of Clearance to be mailed to you by the Department of Revenue. ... Process an Application for Reinstatement through INBiz.