Washington Annual File Format

Description

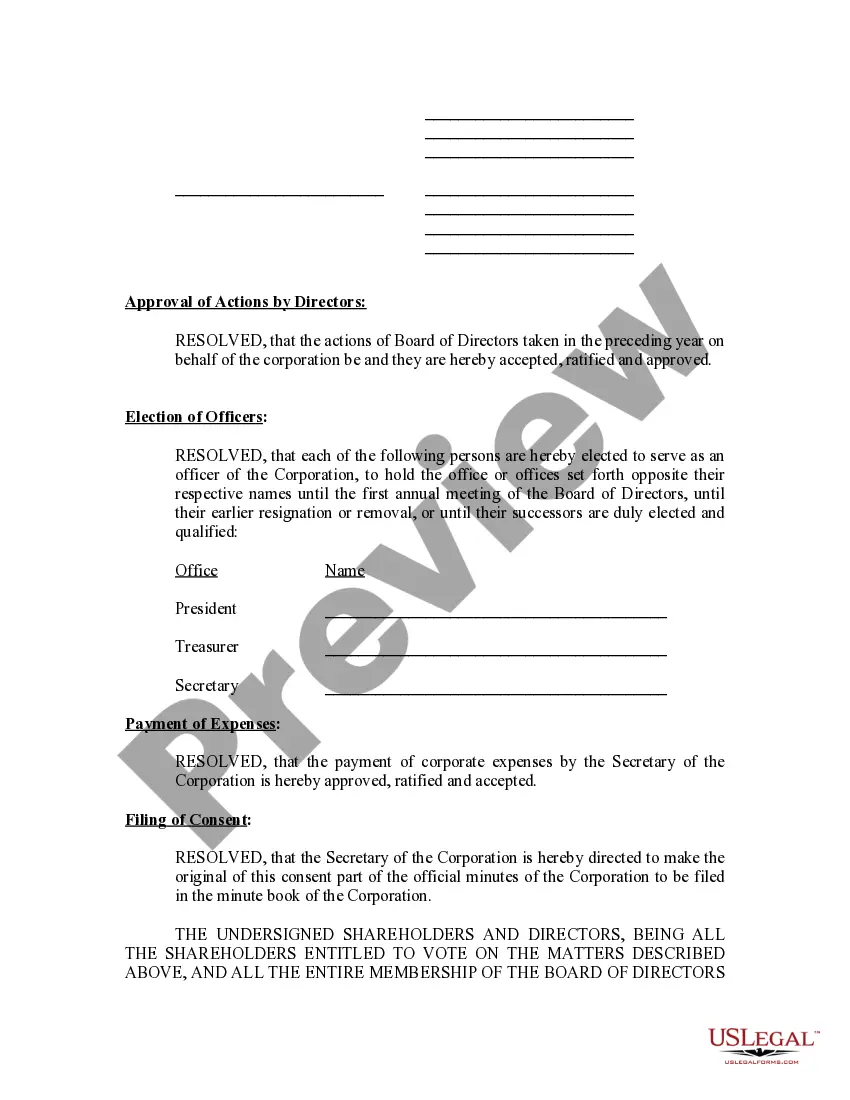

How to fill out Washington Annual Minutes?

Legal documentation management can be overwhelming, even for the most proficient professionals.

When you are in search of a Washington Annual File Format and lack the time to invest in hunting for the correct and current version, the process may be stressful.

Utilize a valuable resource hub of articles, guidance, manuals, and materials pertinent to your circumstances and requirements.

Conserve time and effort in locating the documents you require, and use US Legal Forms' advanced search and Review feature to locate the Washington Annual File Format and obtain it.

Leverage the US Legal Forms online catalog, supported by 25 years of expertise and reliability. Streamline your everyday document management into a seamless and user-friendly experience today.

- If you hold a subscription, Log In to your US Legal Forms account, search for the form, and acquire it.

- Examine your My documents section to access the documents you have previously saved and organize your folders as you wish.

- If it's your first time using US Legal Forms, create an account and gain unrestricted access to all the benefits of the collection.

- Here are the steps to follow after downloading the form you desire.

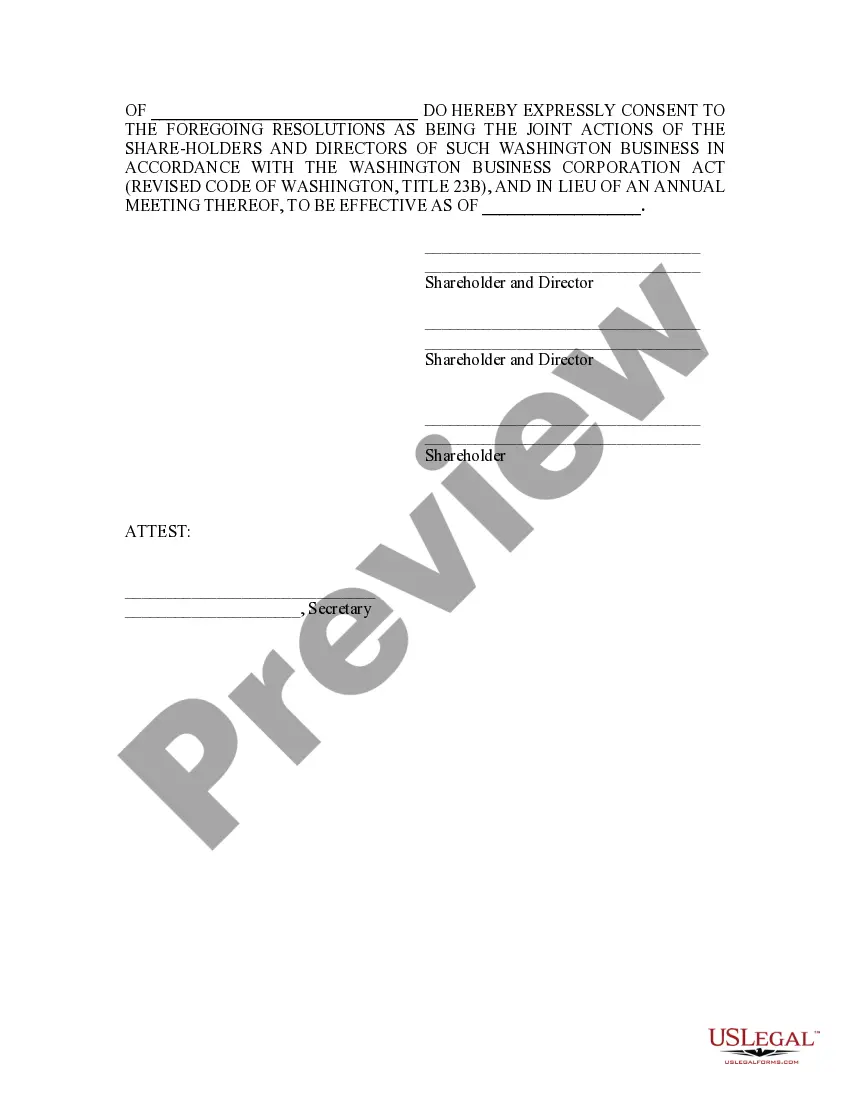

- Verify this is the correct document by previewing it and reviewing its description.

- Make sure that the template is valid in your state or county.

- Click Buy Now when you are prepared.

- Select a monthly subscription option.

- Choose your desired format, then Download, complete, eSign, print, and submit your document.

- Access regional or local legal and business documentation.

- US Legal Forms addresses any requests you might have, from personal to commercial documents, all in one location.

- Use state-of-the-art tools to complete and oversee your Washington Annual File Format.

Form popularity

FAQ

To file your Washington state annual report, you first need to gather the necessary information about your business, including your entity number and the business address. Then, visit the Washington Secretary of State's website to access the filing portal. You will follow the prompts to complete the process electronically, ensuring you select the correct Washington annual file format. Consider using US Legal Forms for step-by-step guidance and templates that simplify the filing process.

The format of an annual report typically includes a title page, a table of contents, and distinct sections highlighting your business’s achievements and financial data. It should present information clearly and logically, aligned with the Washington annual file format. Using platforms like US Legal Forms can help you access standard templates that ensure your report meets regulatory standards and effectively communicates your business story.

Structuring an annual report effectively can significantly enhance clarity and engagement. Begin with an executive summary, followed by sections detailing your business performance, financial statements, and future goals. Ensure each section adheres to the Washington annual file format for compliance and professionalism. Utilizing tools from US Legal Forms can help you create a well-organized and impactful annual report.

Filing a Washington state annual report is a straightforward process. First, gather all necessary information about your business, including your entity name and UBI number. You can then complete your report online through the Washington Secretary of State's website, ensuring you adhere to the Washington annual file format. If you need assistance, platforms like US Legal Forms offer resources and templates to streamline the filing process.

Filing your Washington annual report is a straightforward process that can be completed online. Start by visiting the Washington Secretary of State's website and locate the business services section. There, you can find guidance on how to complete the form based on the Washington annual file format. Utilizing platforms like US Legal Forms can simplify this process, as they offer templates and resources to help you file accurately and on time.

The Washington annual file format requires specific information to be included in your annual report. Generally, your report should have a clear layout with sections for your business name, address, registered agent, and a summary of financial performance. Consider using headings and bullet points to make it easy to read. Following the correct Washington annual file format helps ensure your report is accepted and processed smoothly.

An Annual Report may be filed within 180 days before the expiration date. Visit our Corporations and Charities Filing System landing page and log in to your account. Once logged in, select ?Business Maintenance Filings? from the navigation bar on the left side, then select ?Annual Report?.

Every year, foreign and domestic businesses are required to file an annual report to keep their UBI active and remain in good standing. The Annual Report is due by the last day of the month in which the business was originally formed.

How much does an LLC in Washington cost per year? All Washington LLCs need to pay $60 per year for the Annual Report fee. These state fees are paid to the Washington Secretary of State. And this is the only state-required annual fee.

If you have a Washington LLC or corporation, you are required to file a Washington Annual Renewal each year with the Business Licensing Service. Both LLCs and corporations must pay the same Annual Renewal fee of $71. You can file a Washington Annual Renewal online, which is the recommended approach.