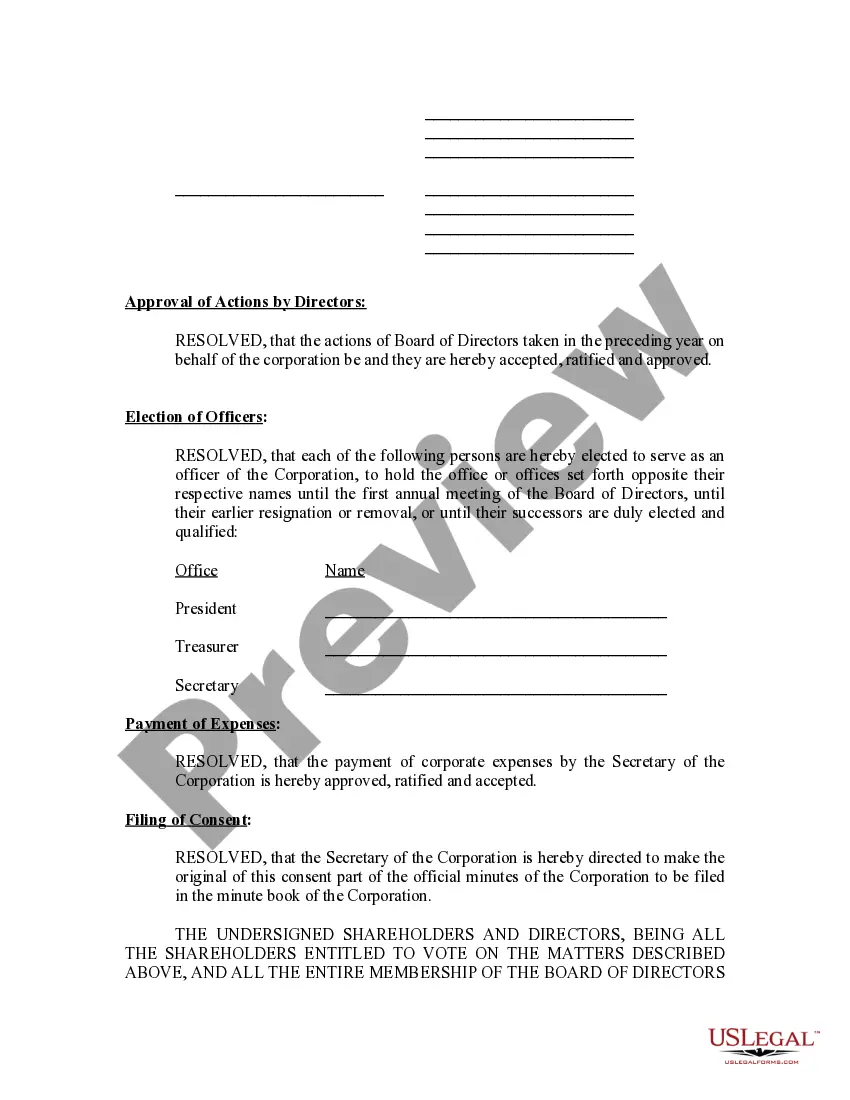

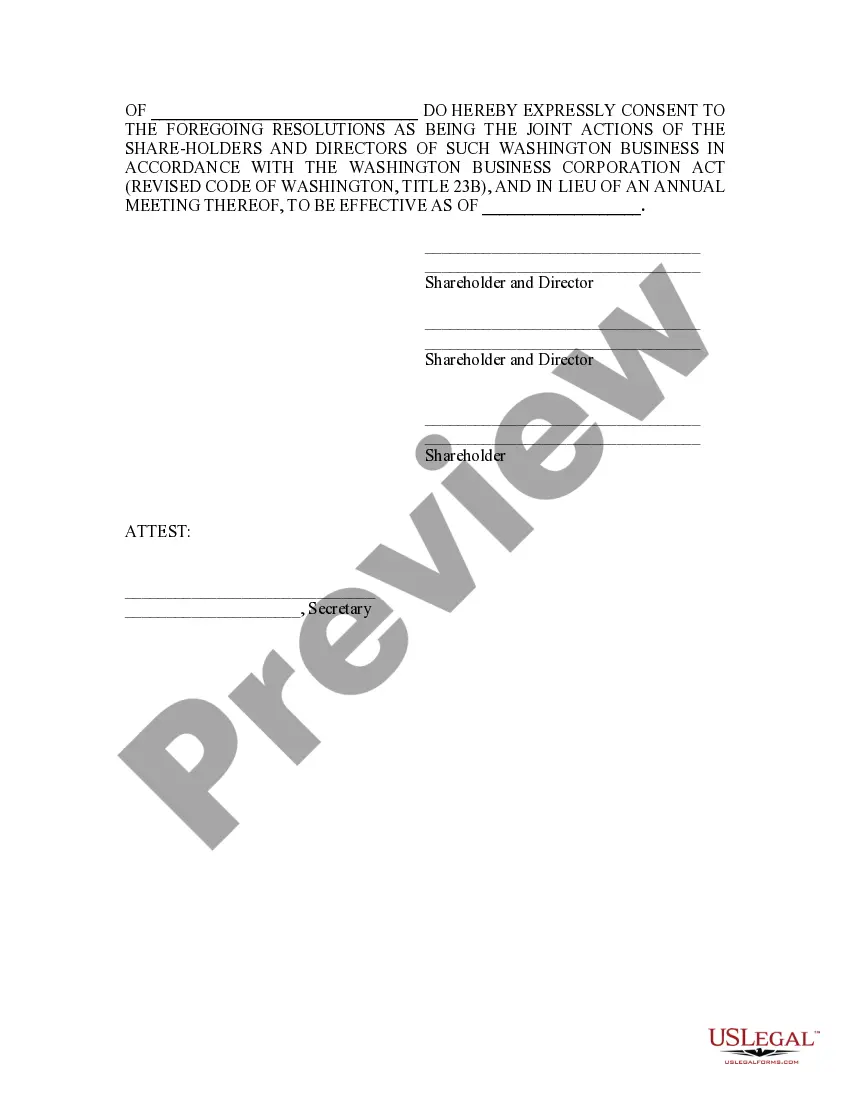

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Washington Annual File For Nonprofit

Description

How to fill out Washington Annual Minutes?

Accessing legal templates that meet the federal and regional laws is a matter of necessity, and the internet offers numerous options to pick from. But what’s the point in wasting time looking for the appropriate Washington Annual File For Nonprofit sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by attorneys for any business and personal situation. They are easy to browse with all documents grouped by state and purpose of use. Our professionals stay up with legislative changes, so you can always be sure your paperwork is up to date and compliant when acquiring a Washington Annual File For Nonprofit from our website.

Getting a Washington Annual File For Nonprofit is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, follow the guidelines below:

- Take a look at the template using the Preview feature or through the text description to make certain it meets your requirements.

- Locate a different sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the right form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Washington Annual File For Nonprofit and download it.

All templates you find through US Legal Forms are reusable. To re-download and complete earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Starting a Washington Nonprofit Guide: Choose your WA nonprofit filing option. File the WA nonprofit articles of incorporation. Get a Federal EIN from the IRS. Adopt your nonprofit's bylaws. Apply for federal and/or state tax exemptions. Apply for required state licenses. Open a bank account for your WA nonprofit.

What Is a Nonprofit Annual Report? Emphasize your organization's mission statement. Express gratitude for your supporters and partners. Showcase your organization's most successful initiatives. Deliver financial transparency with detailed reports. Demonstrate a clear impact. Look ahead to the coming year.

An Annual Report may be filed within 180 days before the expiration date. Visit our Corporations and Charities Filing System landing page and log in to your account. Once logged in, select ?Business Maintenance Filings? from the navigation bar on the left side, then select ?Annual Report?.

Every year, foreign and domestic businesses are required to file an annual report to keep their UBI active and remain in good standing. The Annual Report is due by the last day of the month in which the business was originally formed.

Contents of a Nonprofit Annual Report Financial data. Accomplishments. Impact stories. Mission statements. Donor spotlights (e.g. major donors, recurring donors, etc.)