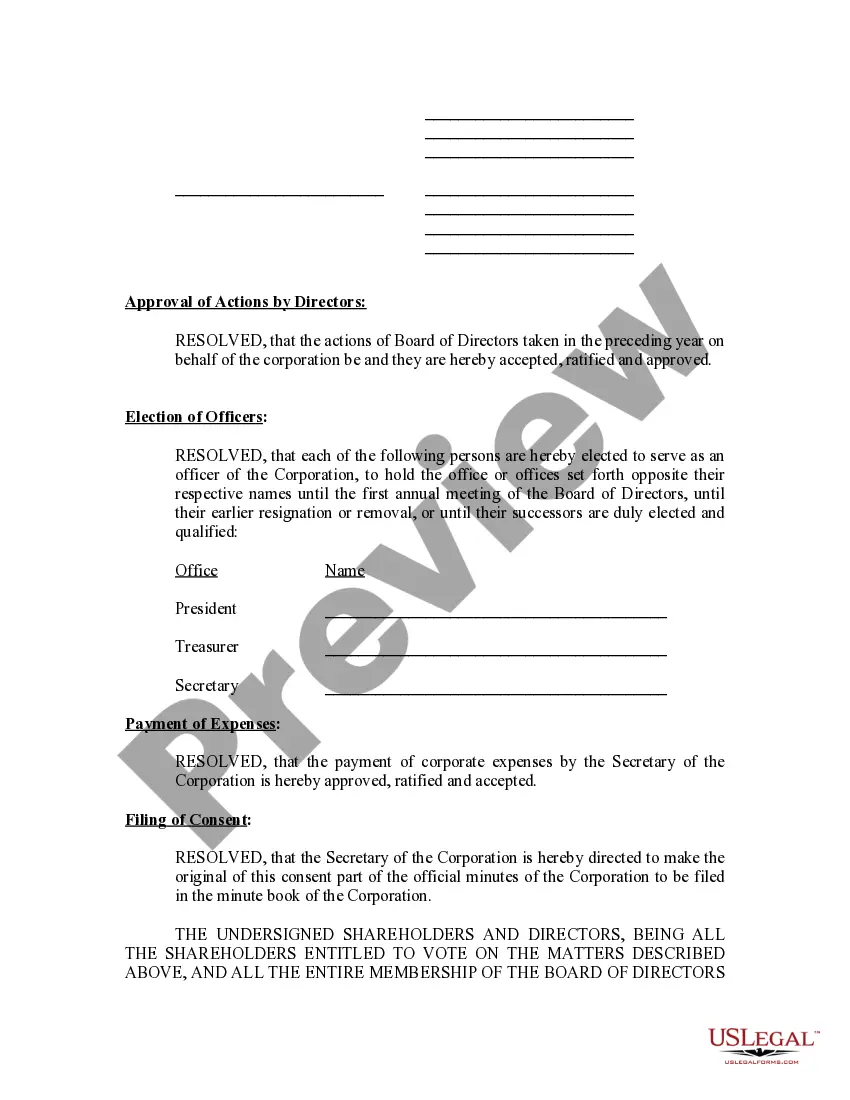

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Filing annual meeting minutes in Washington state is a crucial step for businesses to comply with state regulations and maintain proper corporate records. Annual meeting minutes serve as a documented record of discussions, decisions, and actions taken during a company's annual meeting. Adhering to this requirement ensures transparency, accountability, and legal compliance. Generally, Washington state law mandates corporations, limited liability companies (LCS), and other business entities to keep accurate and up-to-date records of their annual meetings. To meet these requirements, business entities in Washington must file their annual meeting minutes with the Secretary of State's office. Here are some relevant keywords related to filing annual meeting minutes in Washington state: 1. Washington state annual meeting minutes filing: This phrase highlights the specific location and action required within the state of Washington. 2. Business entity compliance: Refers to the overall adherence to state regulations and legal frameworks that businesses must follow. 3. Corporate record-keeping: Emphasizes the importance of maintaining accurate records that serve as a historical reference for a company's activities. 4. Annual meeting minutes documentation: Describes the process of creating detailed records of annual meeting discussions, decisions, and actions. 5. Secretary of State filing: Refers to the entity responsible for receiving and processing required documents, including annual meeting minutes, for record-keeping purposes. 6. Washington state legal compliance: Highlights the importance of meeting state-specific legal requirements to ensure businesses operate ethically and within the law. Different types of filing annual meeting minutes in Washington state may include variations based on the business entity type. For instance, corporations, LCS, partnerships, and nonprofit organizations all have specific guidelines and requirements for filing annual meeting minutes. Each entity type may have different reporting deadlines, templates, and formatting guidelines. It is essential to consult the specific regulations and instructions provided by the Washington Secretary of State's office or seek legal advice to ensure compliance with the appropriate guidelines for each business type.