Leased

Description

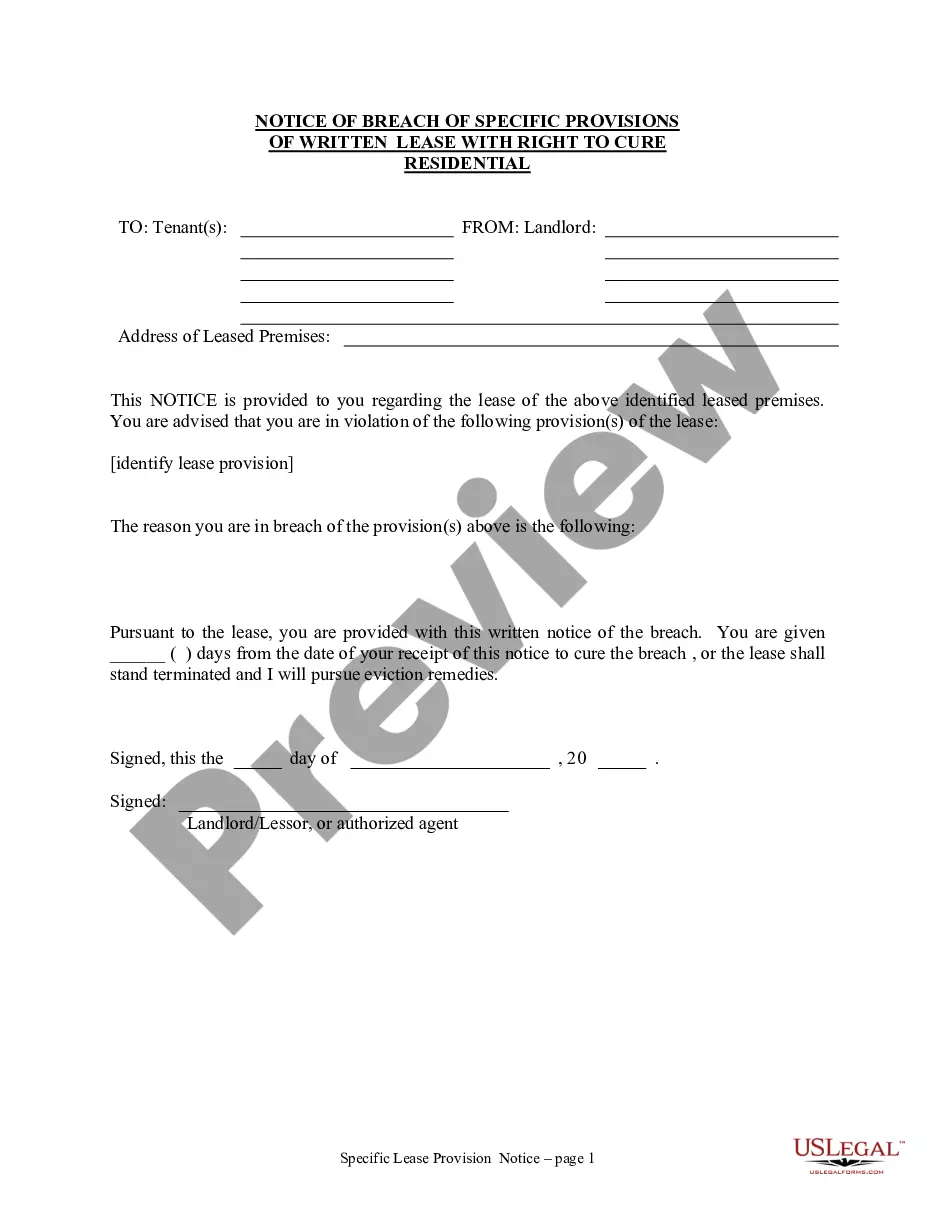

How to fill out Washington Notice Of Breach Of Written Lease For Violating Specific Provisions Of Lease With Right To Cure For Nonresidential Property From Landlord To Tenant?

- If you're a returning user, log into your account and select the lease form you need. Check your subscription status; if expired, renew based on your payment plan.

- For first-time visitors, begin by previewing legal forms. Examine the descriptions to verify that they meet your specifications and comply with local laws.

- If needed, utilize the Search tab to find alternative templates that better suit your requirements before proceeding.

- Purchase the selected document. Click the Buy Now button and choose your desired subscription plan. An account registration is necessary to access the extensive library.

- Complete your payment using credit card information or your PayPal account to finalize the subscription.

- Download the leased document and save it on your device for completion. You can also retrieve it anytime from the My Forms section of your profile.

By following these steps, you can efficiently acquire the legal forms you need, backed by the robust collection and expert support of US Legal Forms.

Explore the extensive library today and empower yourself with legally sound documentation. Start your journey with US Legal Forms now!

Form popularity

FAQ

To write off a leased vehicle, you must track your expenses related to the lease. Typically, you can deduct a portion of your lease payments based on business use. Ensure to keep accurate records of your mileage and expenses, as these will be necessary for tax reporting. Consulting with a tax professional or using resources like USLegalForms can provide clarity on the tax write-off process.

Filling a lease agreement requires attention to detail and understanding the terms involved. Start by providing your personal information, including your name and address, followed by the vehicle's information you wish to lease. Ensure to review payment terms, mileage limits, and any additional fees. If needed, use the resources available through USLegalForms to guide you through the process, making it simpler.

Several factors can disqualify you from leasing a car. A poor credit score, typically below 680, may hinder your leasing opportunities. Additionally, having a high debt-to-income ratio or a history of missed payments can raise red flags for lenders. Using USLegalForms can help you understand the leasing process better, ensuring you're prepared to meet the necessary qualifications.

You must report all rental income earned from your leased properties, regardless of the amount. There is no minimum threshold below which income is ignored. Accurate reports ensure compliance with tax regulations and help avoid potential penalties.

Typically, lenders look for a stable income that is about three times the monthly lease payment. This ensures that you can manage the financial commitment associated with leasing. Be prepared to provide proof of income when negotiating a lease contract.

To claim a leased vehicle on your taxes, make sure to calculate the business use of the vehicle accurately. You can deduct expenses related to that use, such as lease payments and maintenance costs. Keep detailed records to support your claims, as this documentation is crucial for tax reporting.

To report rental income to the IRS, you need to complete Schedule E and attach it to your Form 1040. Your rental income from leased properties should be clearly indicated. It's essential to maintain thorough records of both income and expenses related to your rental activities.

You report rental income on your tax return using Schedule E, which is part of Form 1040. This form allows you to detail the income from your leased properties and any associated expenses. By organizing this information, you can present a clear picture of your rental situation to the IRS.

You can report rental income even without a 1099 by including it on Schedule E of your Form 1040. Simply list the total rental income you earned from your leased properties. Make sure to keep accurate records of all your income to support your claims.

The IRS receives various reports from financial institutions and third-party service providers. If you lease property and generate rental income, your tenants may receive forms that report their payments. This information can trigger an IRS review if you fail to report this income.