Washington Security Deposit For Rent

Description

Form popularity

FAQ

Recently, Washington has implemented new rental laws that include stricter regulations on security deposits, such as limiting the amount that can be charged and enhancing tenant rights regarding refunds. These changes aim to protect renters and ensure more transparency in rental agreements. Staying informed about the latest updates on the Washington security deposit for rent will help both tenants and landlords navigate these legal requirements.

Security deposits are generally not split evenly; they are meant to cover specific costs associated with damages or unpaid rent. However, if multiple tenants are on a lease, they might agree among themselves how to share the financial responsibility. Clear agreements about the Washington security deposit for rent can reduce misunderstandings at the end of a tenancy.

Landlords in Washington typically hold security deposits in a designated trust account, which can be a savings or checking account that is separate from their personal or business funds. This account must generate at least nominal interest, which may be payable to the tenant. Choosing the right type of account for the Washington security deposit for rent is crucial for compliance and peace of mind.

Yes, in Washington state, landlords are required to hold security deposits in a trust account, distinct from their operating funds. This ensures that the funds are protected and available for the tenant when the lease ends. Proper management of the Washington security deposit for rent can prevent disputes and foster a good landlord-tenant relationship.

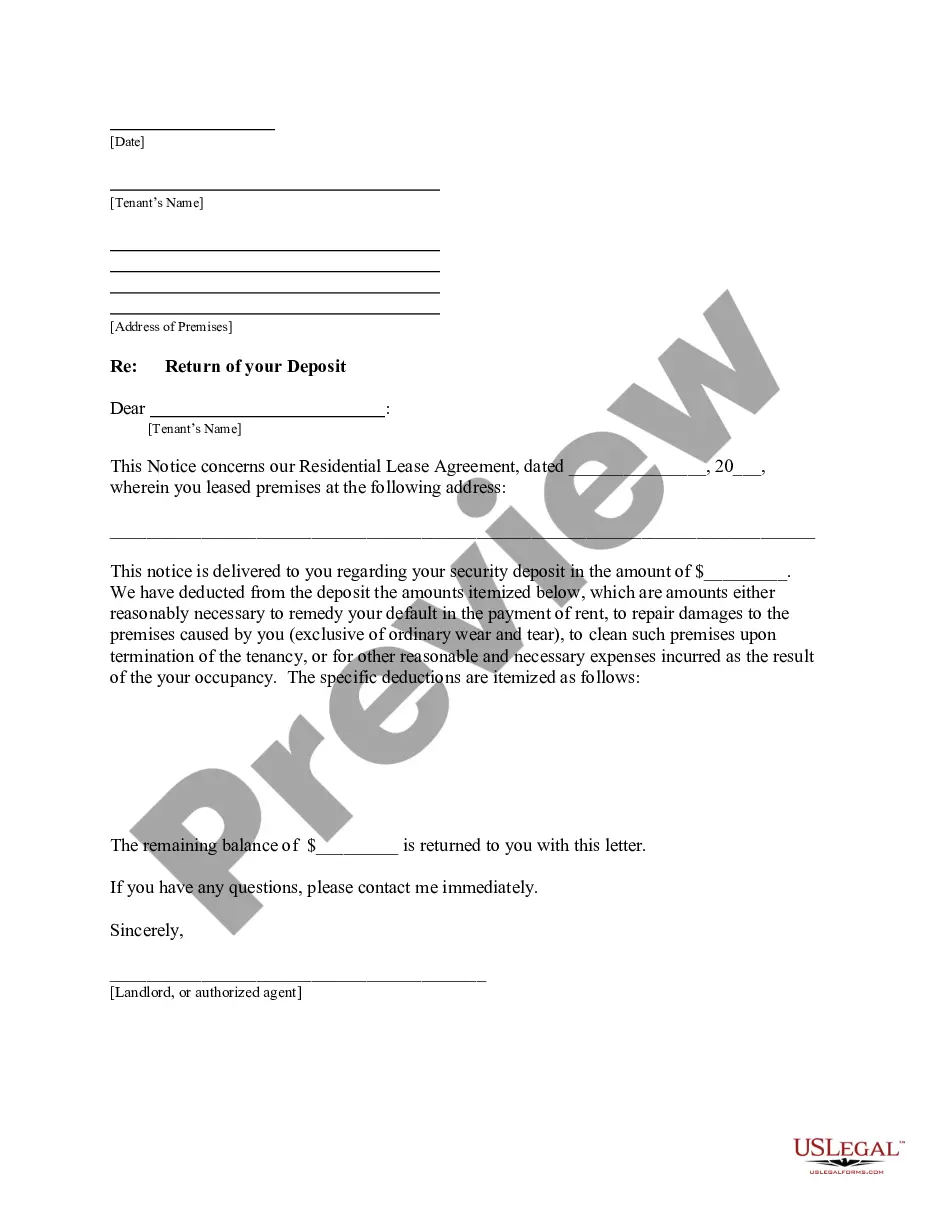

In Washington, a landlord can deduct expenses for unpaid rent, damages beyond normal wear and tear, and costs for cleaning the property if necessary. It's important for landlords to provide an itemized list of these deductions to tenants to ensure transparency. Understanding what can be deducted will help both parties navigate the Washington security deposit for rent effectively.

In Washington state, it is legal for landlords to collect a first month’s rent, last month’s rent, and a security deposit. However, the total amount of security that a landlord can request generally cannot exceed one month’s rent. Always inform yourself about the specifics of the Washington security deposit for rent laws to ensure compliance. Using resources like USLegalForms can help clarify these regulations.

To send a security deposit back to a tenant, ensure that you calculate any deductions and document them clearly. You can issue a check or initiate an electronic transfer, depending on what is most convenient for both parties. Ensure to provide the tenant with a detailed explanation accompanying the refund to keep everything transparent and in line with the Washington security deposit for rent regulations.

If a tenant leaves belongings behind in Washington state, landlords must follow specific legal procedures to dispose of or store those items. Typically, the landlord should notify the tenant and provide a defined period for them to reclaim their belongings. Properly handling abandoned property is crucial to avoiding legal complications and maintaining the condition of the rental unit, especially concerning your Washington security deposit for rent.

In Washington state, landlords are prohibited from unlawfully entering a tenant's property or retaliating against a tenant for asserting their rights. They also cannot discriminate based on race, gender, or other protected categories. This legal protection fosters a respectful landlord-tenant relationship, especially regarding the management of your Washington security deposit for rent.

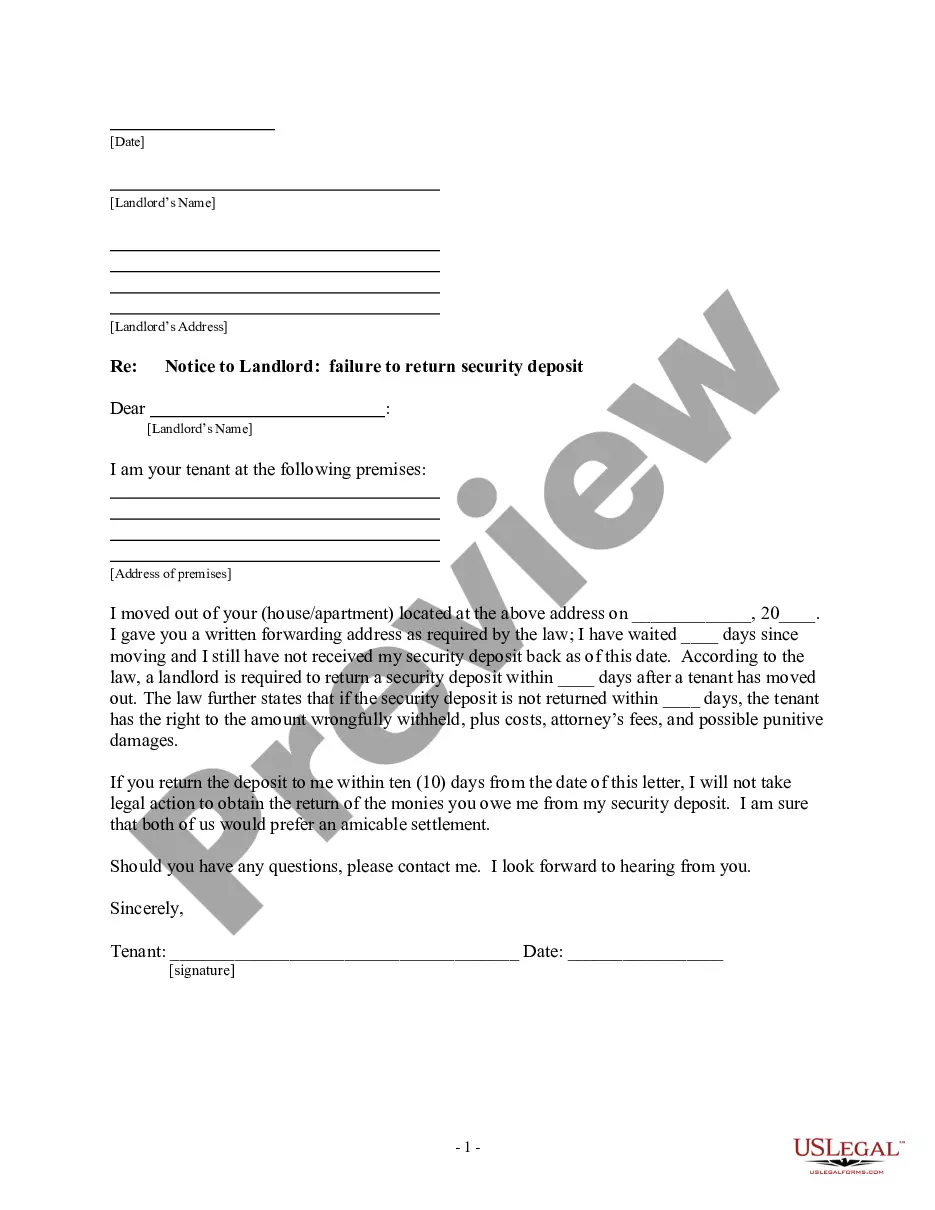

If a landlord fails to return the security deposit within 21 days in Washington state, they may lose their right to keep any portion of that deposit. This law encourages landlords to quickly resolve the security deposit issues and return what is due. As a tenant, you have the right to dispute the charges if you believe they are unjustified. Understanding your rights regarding the Washington security deposit for rent can help you navigate these situations more effectively.