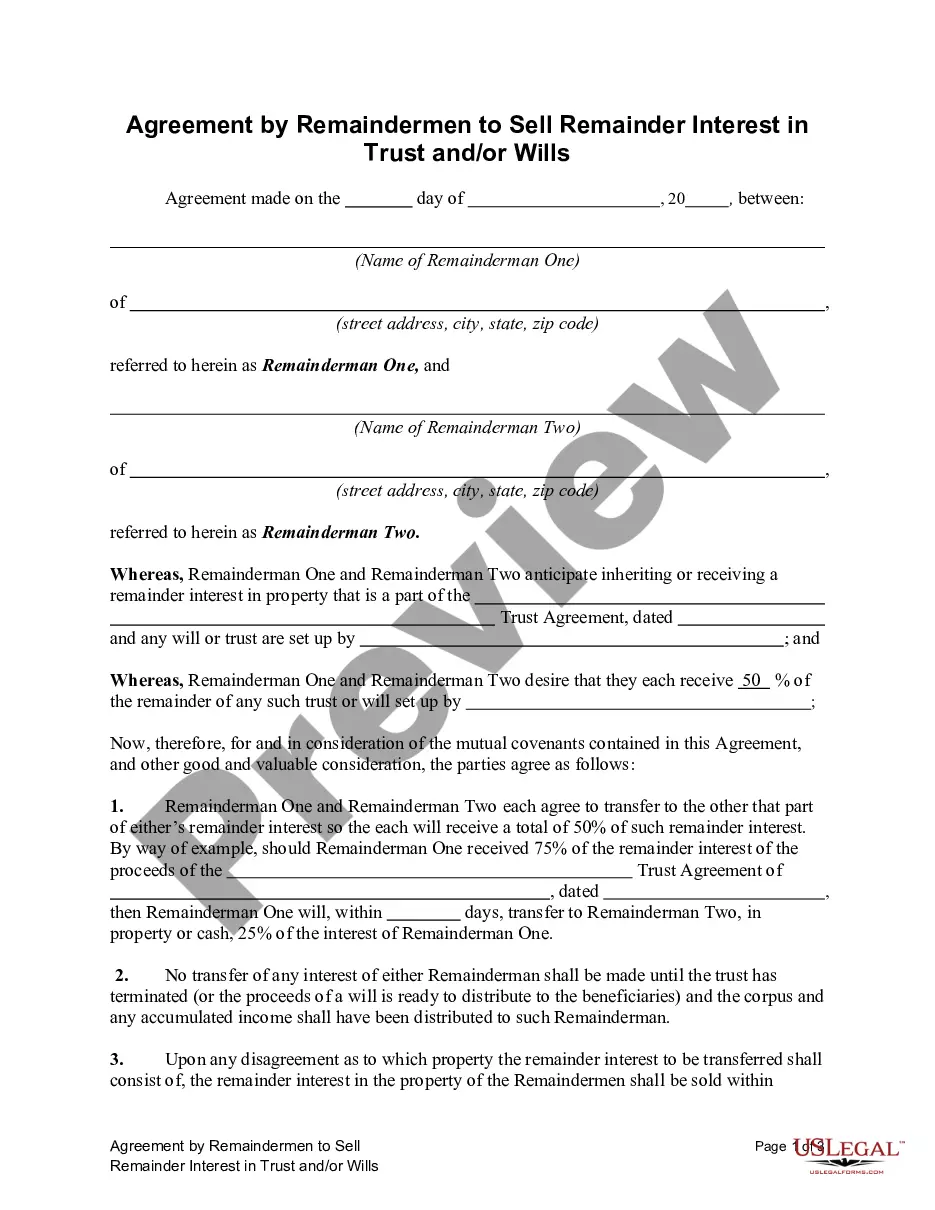

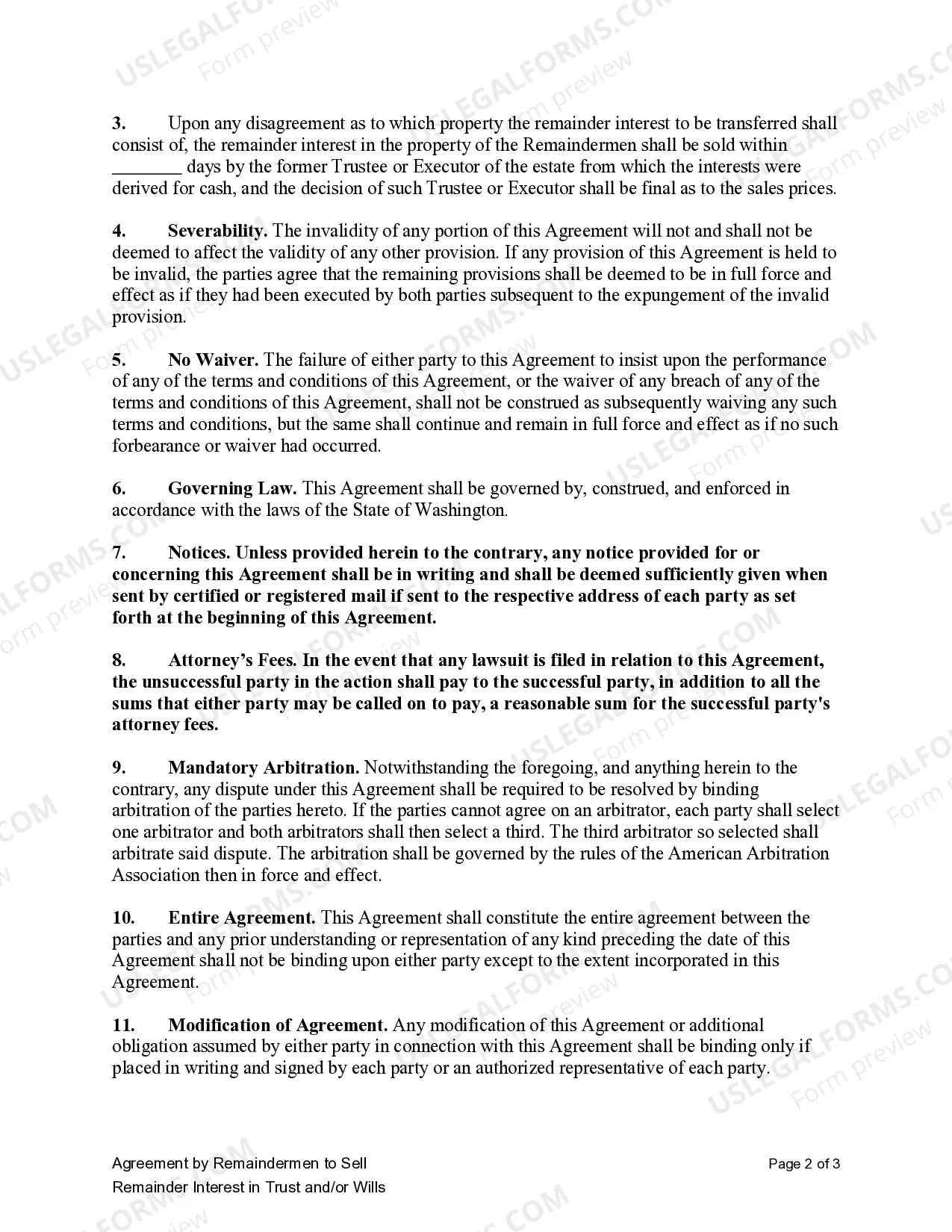

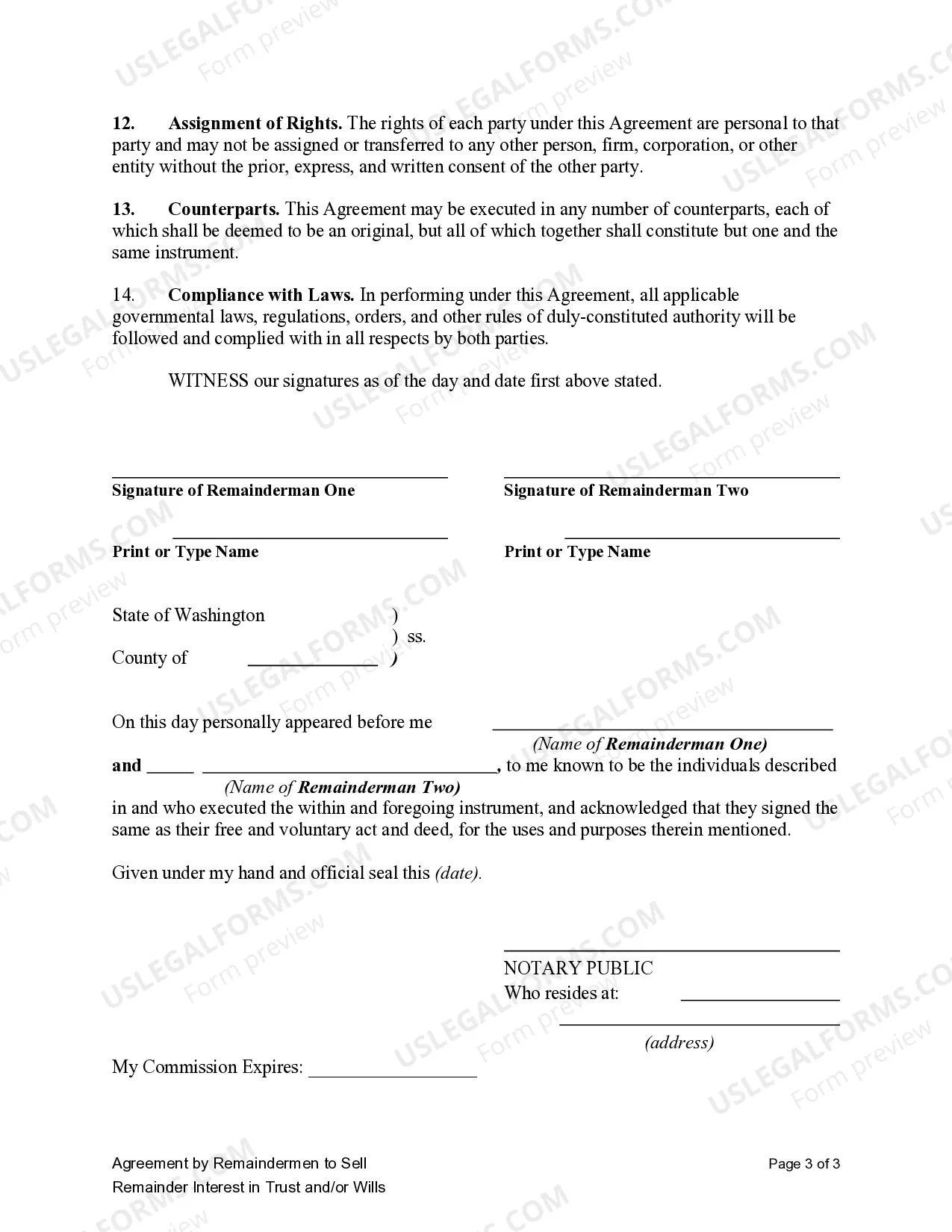

This form is an agreement between individuals who hold the status of remainderman in a trust and/or will to sell to each an amount of their interest in the asset so as to establish an agreed percentage of interest by each party.

Remainder Interest Trust With Real Estate

Description

Form popularity

FAQ

The term 'in rem' refers to a legal action directed toward a property rather than against a person. In the context of a remainder interest trust with real estate, this means that legal rights and claims pertain directly to the property itself. Understanding these legal nuances can significantly improve your strategy in managing such properties.

The abbreviation 'le' on a property description typically refers to a life estate. A life estate is an arrangement where an individual holds property for the duration of their lifetime. In the case of a remainder interest trust with real estate, this concept is crucial for determining what happens to the property after the life tenant passes away.

Lerem is an abbreviation often associated with legal terminology in real estate. It may refer to aspects of property interests or valuation. If you're navigating a remainder interest trust with real estate, understanding these terms is essential for successful legal compliance and effective estate planning.

REM typically stands for 'real estate management' in property contexts. This term relates to various processes involved in managing real estate investments effectively. In a remainder interest trust with real estate, proper property management becomes vital to maximize the benefits for future beneficiaries.

Le rem is short for 'le rem' which is a term describing a specific type of legal property interest, particularly in estate contexts. When discussing a remainder interest trust with real estate, it's crucial to recognize the implications of such terms as they can affect ownership transfer and rights. Therefore, clarity on these definitions enhances your property transactions.

A remainder interest in real estate refers to the right to receive property or benefit from it after a specified condition is met, often following a life estate. In the context of a remainder interest trust with real estate, the property is designated to pass to another party after the current owner's interest ends. Understanding this concept can help you structure your estate planning more effectively.

The 10 percent rule for charitable remainder unitrusts (CRUT) requires that at least 10 percent of the initial fair market value of the assets must go to charity upon the trust's termination. This ensures that a significant portion of the trust's assets supports charitable causes. Understanding this rule is important when designing your remainder interest trust with real estate.

To establish a charitable remainder unitrust (CRUT), you need to work through several steps. Start by selecting the assets, such as real estate, that you want to transfer. Then, partner with a financial advisor or attorney to create the trust document, which outlines the structure and terms of the CRUT. Services from US Legal Forms can help guide you in this establishment process.

The two main types of charitable remainder unitrusts (CRUT) are the standard CRUT and the net-income CRUT. A standard CRUT pays a fixed percentage of its value to beneficiaries each year, while a net-income CRUT pays the lesser of that percentage or the actual income generated. Both types can be effective choices depending on your financial goals and assets, such as real estate.

Setting up a charitable remainder unitrust (CRUT) involves several key steps. First, identify the assets, such as real estate, that you wish to place in the trust. Next, consult with legal and financial professionals to draft the trust document and outline the terms, including distribution percentages and beneficiaries. Platforms like US Legal Forms offer resources and templates to simplify this process.