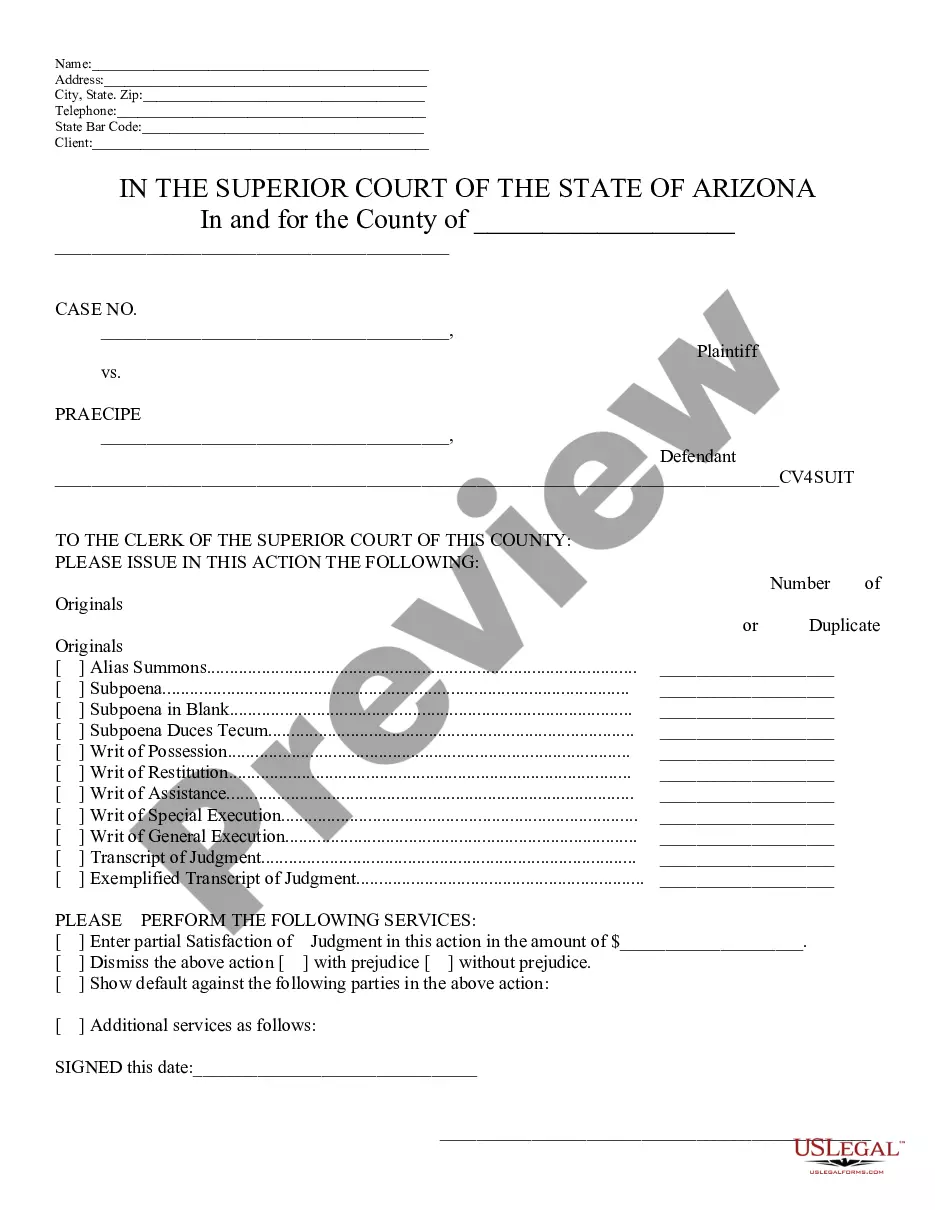

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Articles Of Incorporation Washington State Formation

Description

How to fill out Washington Articles Of Incorporation For Domestic For-Profit Corporation?

Creating legal documents from the ground up can occasionally be somewhat daunting. Some situations may entail extensive research and significant expenses.

If you’re searching for a more straightforward and budget-friendly option for preparing Articles Of Incorporation in Washington State or any other documentation without unnecessary complications, US Legal Forms is always at your service.

Our online library of over 85,000 current legal forms covers nearly every area of your financial, legal, and personal matters. With just a few clicks, you can swiftly access state- and county-specific forms meticulously crafted for you by our legal professionals.

Utilize our website whenever you require dependable and trustworthy services to effortlessly find and download the Articles Of Incorporation for Washington State. If you’re an existing user and have previously established an account with us, simply Log In to your account, choose the template, and download it immediately or retrieve it later in the My documents tab.

US Legal Forms holds an excellent reputation backed by over 25 years of experience. Join us today and simplify the process of document execution!

- Examine the document preview and details to confirm you’ve located the form you need.

- Verify that the form you select adheres to the regulations of your state and county.

- Choose the most appropriate subscription plan to purchase the Articles Of Incorporation for Washington State.

- Download the document. Then complete, sign, and print it out.

Form popularity

FAQ

You received an identity verification letter because an Ohio income tax return was filed OR an OH|TAX eServices account was created using your SSN. You should check with your spouse or tax preparer to ensure an Ohio return was not legitimately filed or an OH|TAX eServices account was not created on your behalf.

Section 6015(b) Innocent Spouse Relief: Provides relief from additional tax you owe if you can prove that you did not know, or could not have known, that your spouse or former spouse failed to report income, reported income improperly, or claimed improper deductions or credits.

Section 4513.17 | Limit on number of lights. (C)(1) Flashing lights are prohibited on motor vehicles, except as a means for indicating a right or a left turn, or in the presence of a vehicular traffic hazard requiring unusual care in approaching, or overtaking or passing.

There is hereby established within the department of administrative services a state records program, which shall be under the control and supervision of the director of administrative services or the director's appointed deputy.

Common exemptions from Ohio sales and use tax: Groceries and food sold for off premises consumption. Prescription medicines. Housing related utilities, such as gas, electric, water and steam.

Section 149.34 | Records management procedures. The head also shall submit to the state records program applications for disposal of records in the head's custody that are not needed in the transaction of current business and are not otherwise scheduled for retention or destruction.

The dissolution, termination, or bankruptcy of a corporation, limited liability company, or business trust shall not discharge a responsible officer's, member's, manager's, employee's, or trustee's liability for a failure of the corporation, limited liability company, or business trust to file returns or remit tax due.

Even though the company's owners may not personally be on the hook for having to pay corporate taxes, if they are employed by the company, then they will have to pay personal taxes on that income.