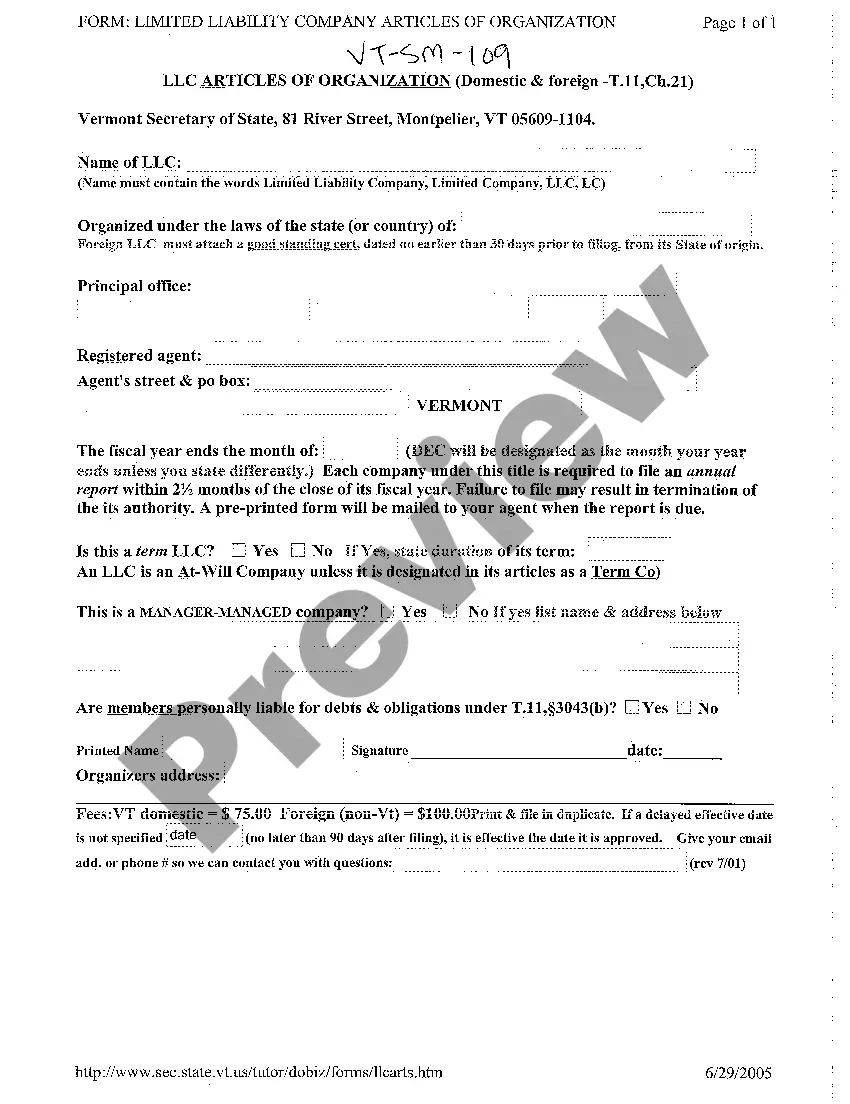

Vermont Llc Articles Of Organization With The Correct Label

Description

Form popularity

FAQ

LLCs in Vermont are typically treated as pass-through entities for tax purposes, meaning profits and losses pass directly to members without corporate income tax. However, LLCs can also elect to be taxed as a corporation if that is more advantageous for them. It's crucial to understand the implications of each tax classification and keep accurate financial records. You may find valuable resources on tax obligations for Vermont LLCs at USLegalForms.

Vermont does not legally require an operating agreement for an LLC. However, having one is highly recommended as it outlines the management structure and operating procedures of your business. An operating agreement can help prevent disputes among members and clarify each individual's roles within the LLC. You can create this agreement easily through resources available at USLegalForms, ensuring all members are on the same page.

Closing an LLC in Vermont involves a few key steps. First, hold a meeting to agree on the dissolution and document the decision. Then, file the Articles of Dissolution with the Vermont Secretary of State to formalize the closure. Additionally, settle all business debts and obligations, so you can fully wrap up your LLC’s affairs and move forward confidently.

To officially close an LLC, you must first hold a meeting with the members to vote on the dissolution. After reaching an agreement, file the Articles of Dissolution with the Vermont Secretary of State. Additionally, settle any outstanding debts and distribute remaining assets. This process ensures that your Vermont LLC is properly closed and recognized by the state.

Filing articles of organization in Illinois requires obtaining the appropriate form from the Secretary of State’s website. Complete the form with your LLC's information and submit it along with the necessary fees. Remember, if you plan to expand to other states like Vermont later on, understanding each state’s requirements for LLC articles of organization will be beneficial. Consider using USLegalForms for streamlined filing processes.

The best state to register a foreign LLC often depends on your business needs. Many entrepreneurs choose states like Delaware or Nevada for their favorable laws and business-friendly environments. However, if you plan to operate in Vermont, it is wise to register your LLC there as it can enhance your credibility and compliance. Remember, filing the proper Vermont LLC articles of organization is crucial in this process.

To register a foreign LLC in Vermont, you need to file the Certificate of Authority along with the Vermont LLC articles of organization. This filing allows your foreign entity to operate legally within the state. Ensure you provide all necessary documentation, including proof of good standing from your home state. For further assistance, consider using services like USLegalForms to simplify your filing.

To register a non-resident LLC in the USA, you must choose a state to file your articles of organization. Each state may have different requirements, so it's essential to research the specific regulations for that state. After selecting the state, complete the necessary forms and submit them, along with the required fees. If you need assistance, platforms like USLegalForms can help you navigate the process smoothly.