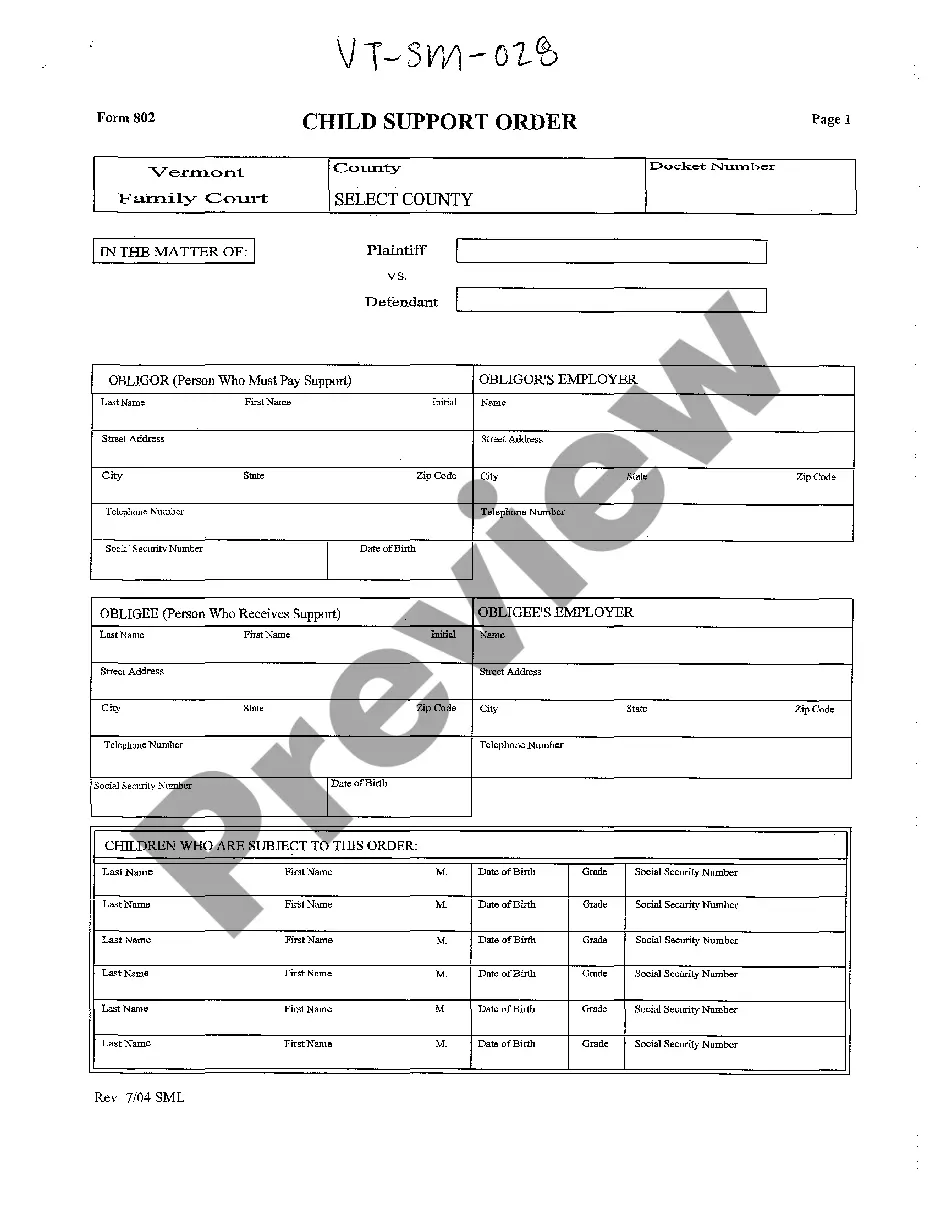

Child Support Vermont For Self Employed

Description

How to fill out Child Support Vermont For Self Employed?

Maneuvering through the red tape of official documents and templates can be challenging, particularly if one does not engage in that field professionally.

Even locating the appropriate template for Child Support Vermont For Self Employed will consume a lot of time, as it needs to be accurate and correct to the last digit.

Nevertheless, you will have to spend significantly less time selecting a suitable template if it is sourced from a reliable resource.

Acquiring the right form is just a few simple steps away: Enter the document title in the search field. Select the appropriate Child Support Vermont For Self Employed from the results. Review the description of the sample or open its preview. If the template suits your needs, click Buy Now. Proceed to choose your subscription option. Enter your email and create a secure password to register an account at US Legal Forms. Select a credit card or PayPal payment method. Download the template file in your preferred format. US Legal Forms saves you the hassle of determining whether the form seen online is appropriate for your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of locating the right forms online.

- US Legal Forms serves as a single location to access the most current samples of forms, confirm their applicability, and download these samples to complete them.

- It is a compilation of over 85K forms that pertain to various fields of employment.

- When searching for Child Support Vermont For Self Employed, you can trust its authenticity as all forms are verified.

- Having an account at US Legal Forms will ensure you have all necessary samples at your fingertips.

- You can store them in your history or add them to the My documents catalog.

- Access your saved forms from any device by clicking Log In at the library website.

- If you do not have an account yet, you can always search for the template you need.

Form popularity

FAQ

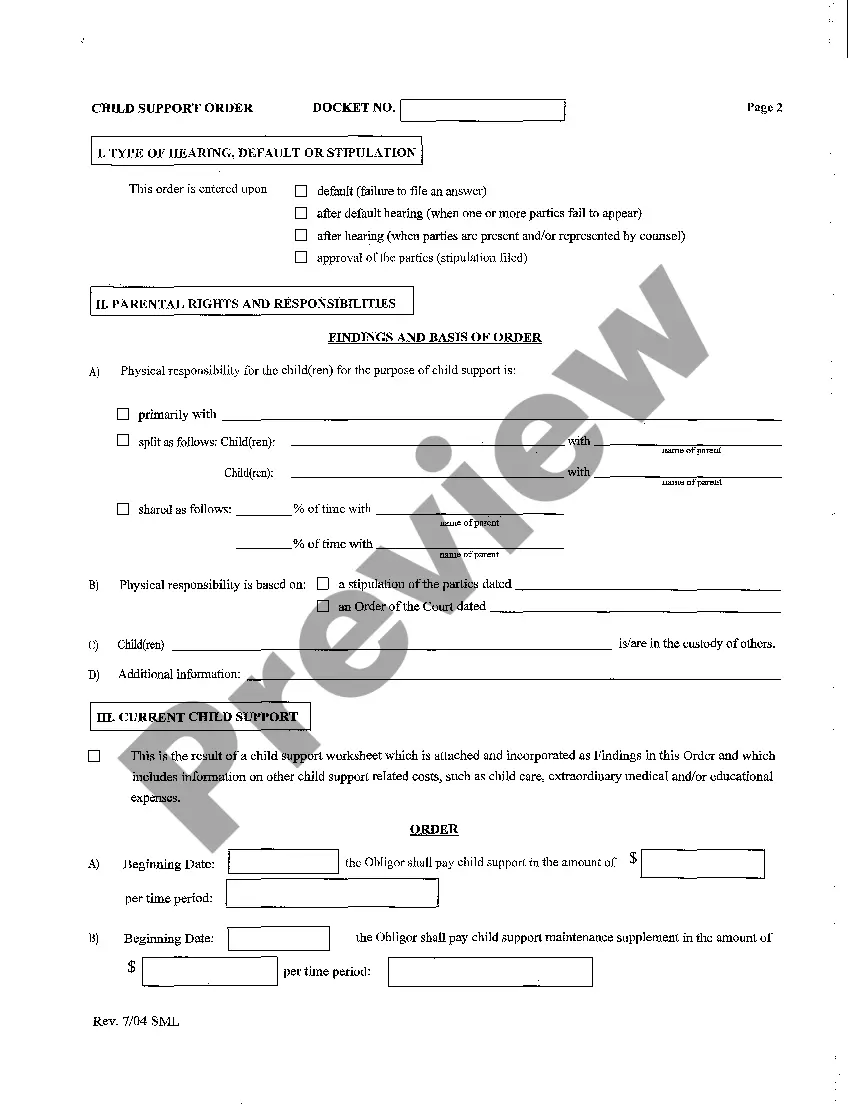

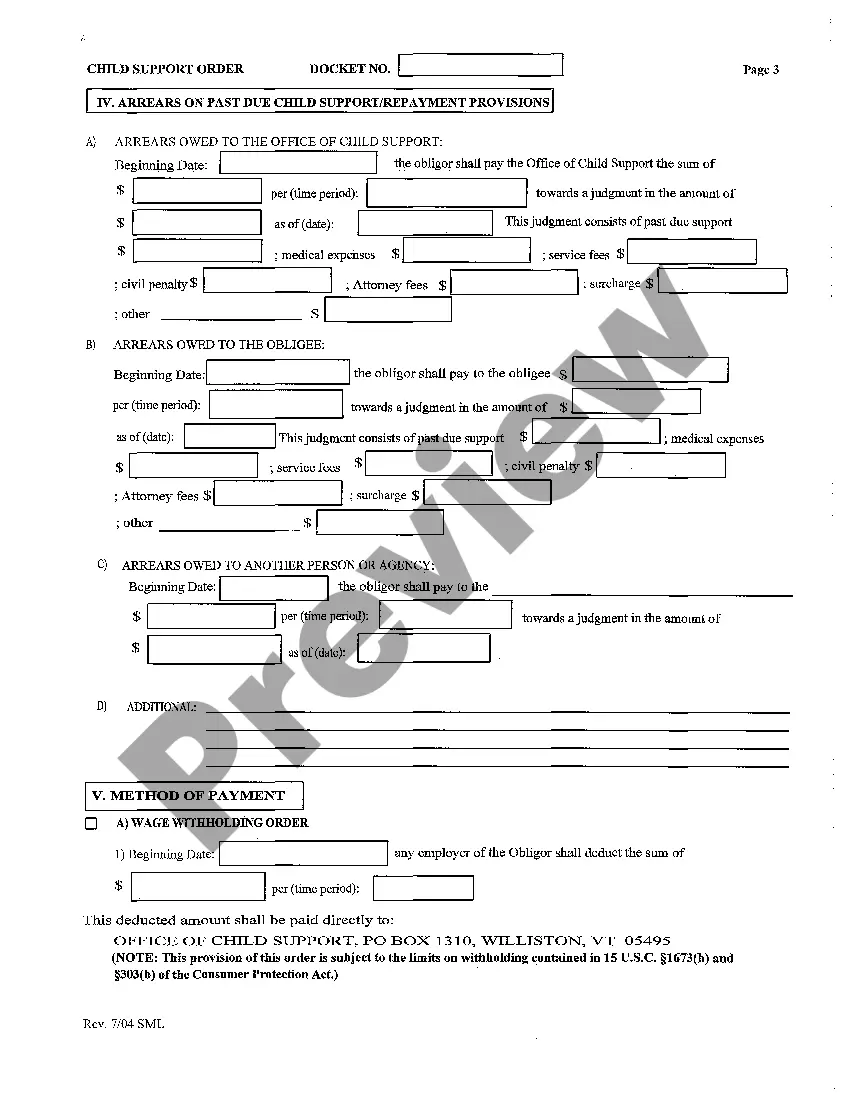

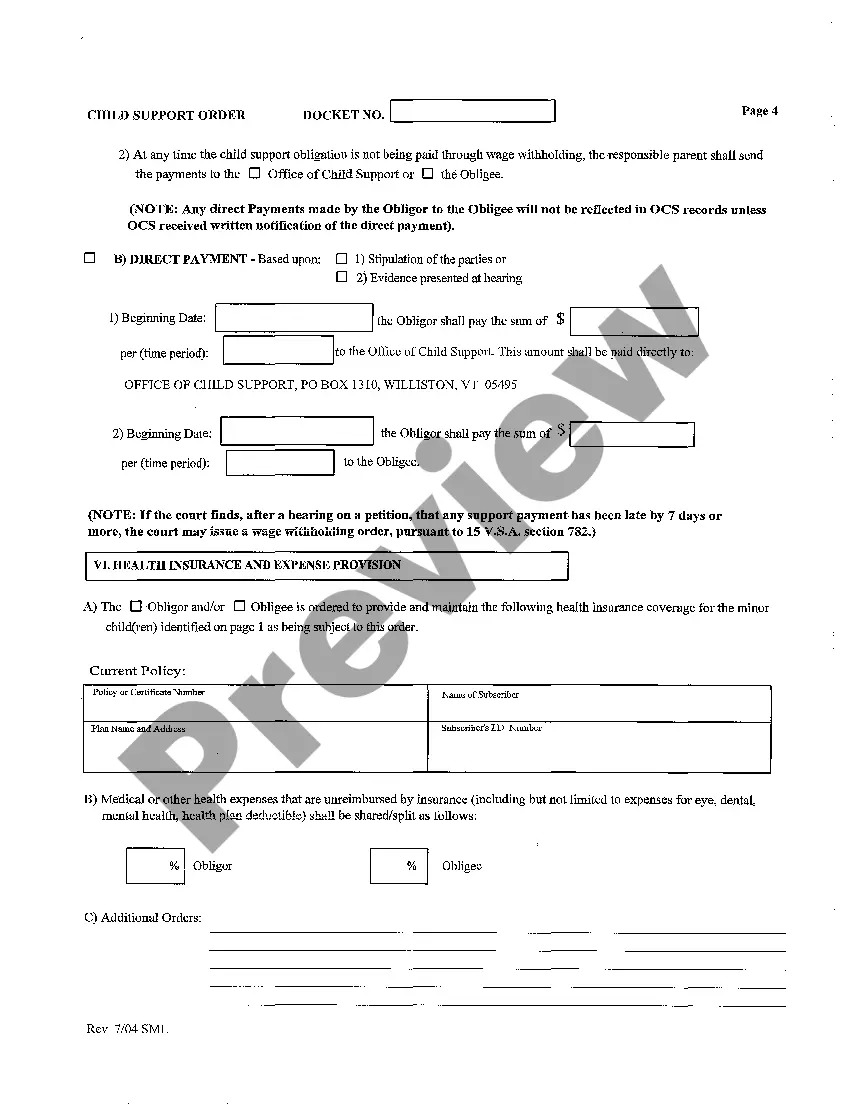

Child support Vermont for self employed individuals bases calculations on the net income you earn from your business. The state examines tax returns and other financial documents to determine an equitable support amount. As a self-employed person, it is crucial to maintain diligent records to ensure clarity in your income, facilitating a fair assessment of your obligation.

To prove your income as a self-employed individual, you will need to provide documentation such as tax returns, profit and loss statements, and bank statements. These documents demonstrate your actual earnings and business expenses to accurately reflect your financial situation. Utilizing tools like US Legal Forms can streamline the preparation of these essential documents.

Child support Vermont for self employed individuals who own an LLC is determined based on your business income. When calculating your support obligations, Vermont considers the net income from your LLC after deducting legitimate business expenses. It's essential to maintain accurate financial records to establish your income clearly, as these will be reviewed during the child support determination process.

If you lie about your income in child support matters in Vermont, you risk facing legal consequences. Courts take false declarations seriously, which may result in penalties, changes to support obligations, or even contempt charges. Maintaining honesty is crucial for a fair process, as any discrepancies could harm your reputation and credibility. Utilizing US Legal Forms can assist you in staying organized and truthful in your documentation.

You can prove your ex is lying about income by compiling significant documentation, such as invoices, bank statements, or witness testimonies. Comparing their claimed income with lifestyle choices or expenditures can also provide insights. Gathering this evidence helps in negotiations or court proceedings regarding child support in Vermont. US Legal Forms can help you access the necessary legal documents for your case.

Yes, you can take legal action if you suspect false child support claims in Vermont. If you have evidence that shows a discrepancy in declared income or financial resources, this can be a basis for your case. Courts prioritize the child's best interests, so presenting strong evidence may lead to a reevaluation of child support amounts. Consulting resources offered by US Legal Forms can guide you through the process.

You can file for child support in Vermont even if you are currently unemployed. The court will consider all sources of income, including any potential earnings for self-employed individuals. Documenting efforts to secure employment can strengthen your case. It's essential to be truthful about your situation to ensure a fair evaluation.

Ordering child support in Vermont requires you to initiate a legal process through the family court system. You will need to provide proof of your financial situation, particularly as a self-employed individual. The court reviews this information to determine the amount owed, so providing comprehensive documentation is key. Platforms like USLegalForms help you navigate this process with clarity, offering you the tools needed to submit your order effectively.

The best way to file for child support involves gathering all necessary financial documentation, such as income statements and tax returns. For self-employed individuals in Vermont, accurately reporting your income is crucial. You can begin the process online, or by visiting your local court to obtain the necessary forms. Utilizing resources like USLegalForms can simplify this process and ensure you don’t miss any important steps.

Yes, LLC income plays a significant role in child support calculations in Vermont. The courts evaluate the net income from your LLC, as this affects your capacity to make payments. Accurate documentation and reporting of your business income can help ensure that your child support obligations are fair and reflective of your actual earnings. Utilizing platforms like USLegalForms can provide insights and resources to navigate these complexities.