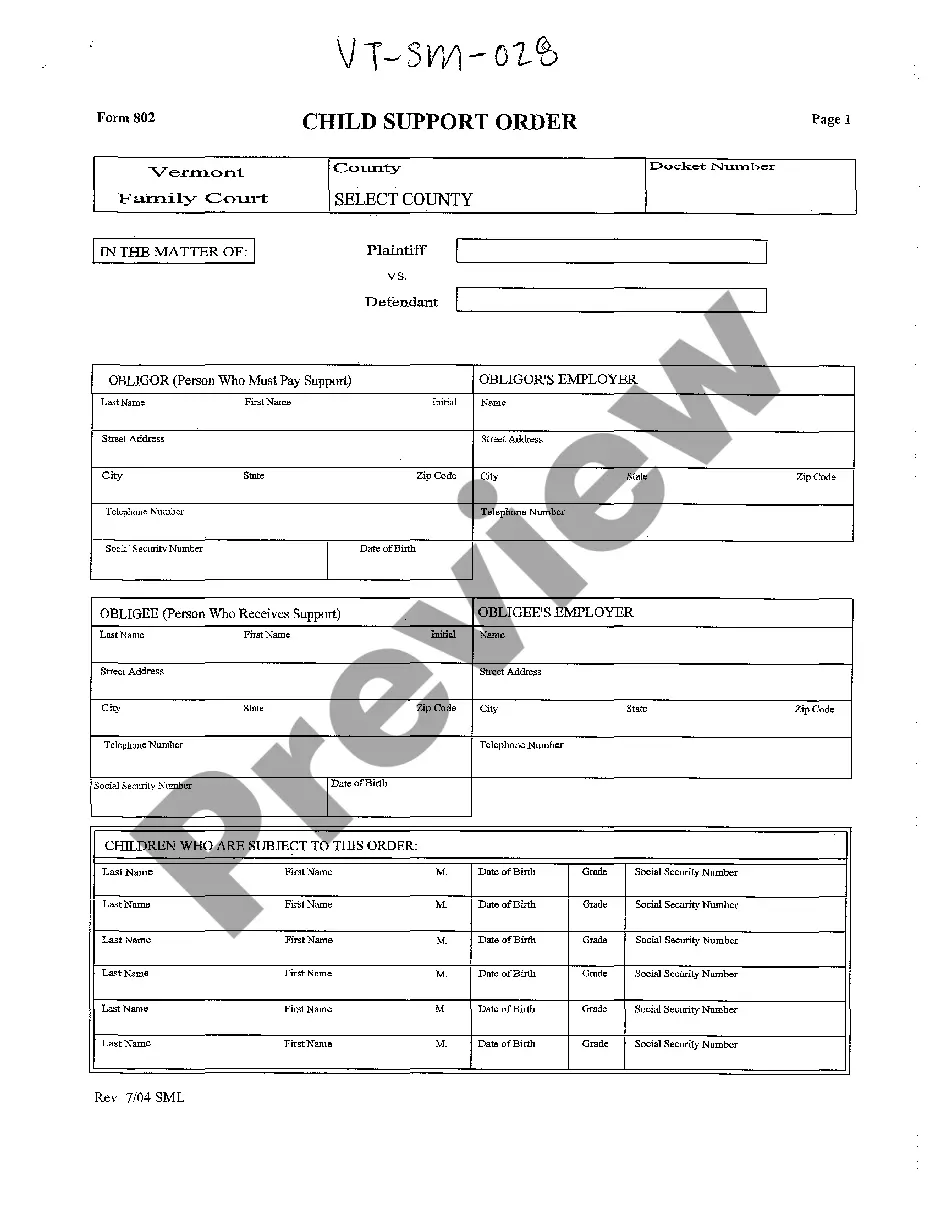

This is a Child Support Order to be used in the State of Vermont. This document is used by the Court to detail the specific findings regarding the amount of child support to be paid and the terms of the award.

Child Support In Vermont Formula

Description

How to fill out Vermont Child Support Order?

When you are required to finalize Child Support In Vermont Formula that adheres to the regulations of your local state, there can be numerous options to choose from.

There is no necessity to verify each form to ensure it fulfills all the legal requirements if you are a US Legal Forms subscriber.

It is a reliable service that can assist you in obtaining a reusable and up-to-date template on any topic.

Utilizing professionally crafted formal documents becomes simple with US Legal Forms. In addition, Premium users can also benefit from powerful integrated tools for online document editing and signing. Try it today!

- US Legal Forms is the most extensive online archive with a assortment of over 85k ready-to-use documents for business and personal legal matters.

- All templates are reviewed to comply with each state's regulations.

- Thus, when downloading Child Support In Vermont Formula from our website, you can be assured that you possess a valid and current document.

- Retrieving the necessary sample from our platform is exceptionally simple.

- If you already possess an account, just Log In to the system, verify your subscription to be valid, and save the selected file.

- Later, you can access the My documents tab in your profile and maintain access to the Child Support In Vermont Formula at any time.

- If it is your first experience with our website, please follow the guide below.

- Review the suggested page and verify it for alignment with your criteria.

Form popularity

FAQ

To file for child support in Vermont, start by obtaining the appropriate forms from your local family court or online through platforms like US Legal Forms. Carefully fill out the forms with accurate information regarding your finances and your child's needs, as the child support in Vermont formula will apply. After completing the paperwork, submit it in person or by mail to the family court. It’s wise to keep copies for your records.

The best way to file for child support is to gather necessary documents, including income statements and information about your child’s needs, and then complete the required forms. You can also utilize resources like US Legal Forms to access the correct forms tailored to Vermont law. Once your forms are ready, submit them to your local family court to initiate the process. This ensures that you follow the child support in Vermont formula correctly.

Whether to file for child support or custody first depends largely on your personal situation. Filing for custody first may establish where the child will live, which can influence child support calculations that follow the child support in Vermont formula. However, if financial support is urgent, seeking child support first could be more beneficial. Consulting with a family law attorney can help you make this decision.

The average child support payment in Vermont is determined by the child support in Vermont formula, which considers both parents' incomes and the needs of the child. Typically, payments aim to cover essential expenses such as food, housing, and education. However, actual amounts can vary significantly depending on individual circumstances. It is vital to consult with a legal professional to calculate the specific obligations in your case.

To calculate adjusted gross income for child support, gather all income sources and subtract allowed deductions. This includes earnings from work, investments, and certain tax benefits. Knowing how to accurately calculate your AGI is vital to ensuring that the child support in Vermont formula is applied properly and reflects your financial situation.

To calculate the parents' adjusted gross income, combine both parents' total income sources and apply any applicable deductions. This includes wages, investments, and any tax deductions. Understanding this combined AGI is essential when applying the child support in Vermont formula, as it affects how support amounts are determined.

When filling out a check for child support, start by writing the date at the top. Next, write the name of the person receiving the payment or the agency handling the payments. Finally, clearly write the amount in both numerical and written form, and include a note in the memo section indicating it is for child support. This ensures transparency and helps avoid any confusion regarding payments.

To gross up your child support income, you will need to account for any taxes that are withheld from your earnings. Start by determining your net income and then calculate the amount you would need to earn before taxes to arrive at that net figure. This approach ensures that the child support in Vermont formula reflects your true financial capacity to meet your obligations.

Texas does not have a strict maximum for child support, as amounts depend on the child support in Vermont formula and the paying parent's income. However, there are guidelines that cap the percentage of income allocated for child support to provide a reasonable limit. Understanding your financial obligations within the context of state law is essential. Resources from USLegalForms can offer guidance on navigating these requirements effectively.

In Vermont, the child support in Vermont formula determines the amount parents receive based on several factors including income, expenses, and the number of children involved. Typically, most parents can expect a fair assessment that reflects their financial situation and needs of the child. It's crucial to calculate this amount accurately to ensure that your child receives necessary support. Using reliable tools like USLegalForms can help simplify this process.