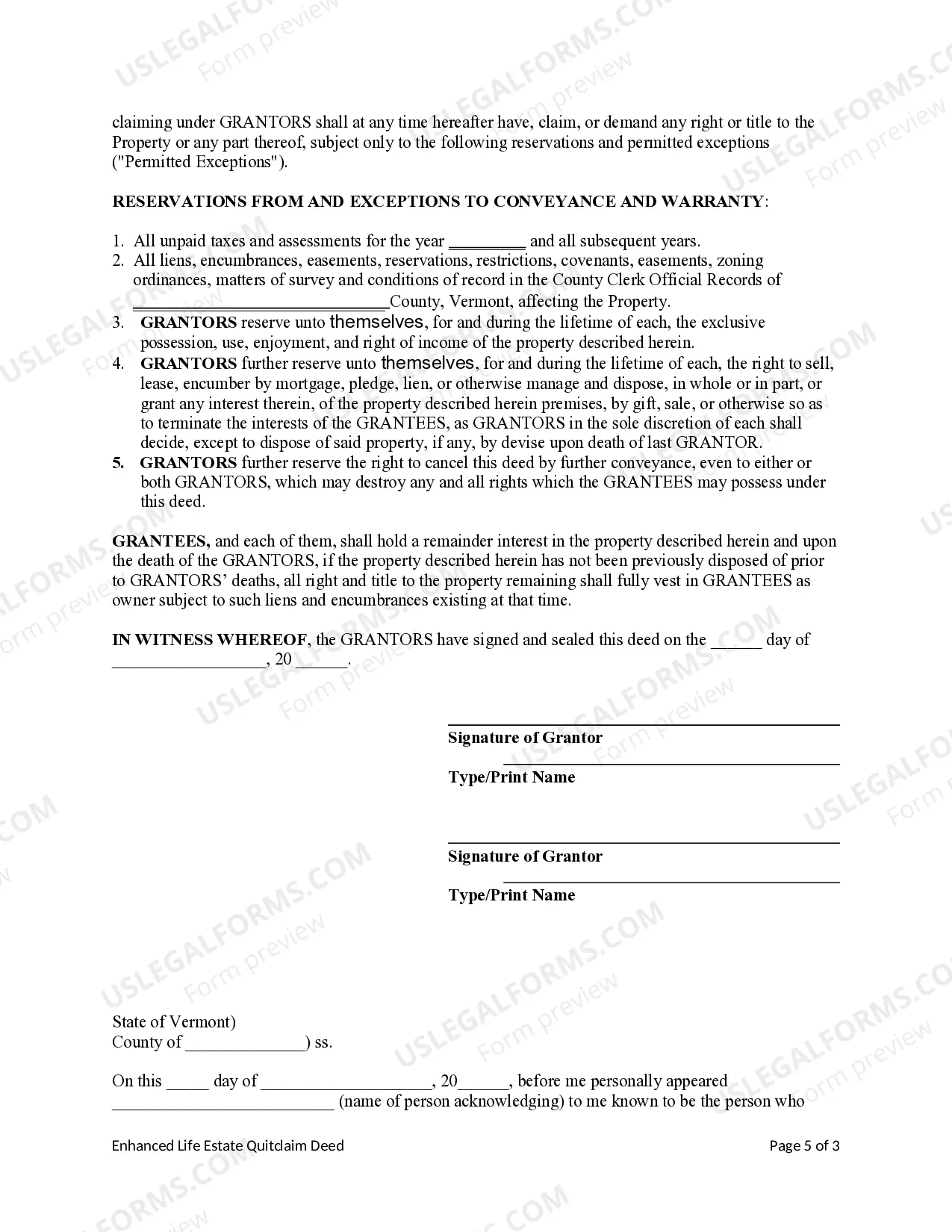

This form is a Transfer on Death Deed where the Grantors are two individuals, or husband and wife, and the Grantees are two individuals or husband and wife. This transfer is revocable by Grantors until death and effective only upon the death of the last Grantor. This deed complies with all state statutory laws.

Ladybird Deed Vermont Withholding

Description

How to fill out Vermont Enhanced Life Estate Deed (a.k.a. Lady Bird Deed) From Two Individuals / Husband And Wife To Two Individuals / Husband And Wife.?

Whether for business purposes or for personal matters, everyone has to handle legal situations sooner or later in their life. Filling out legal papers demands careful attention, starting with picking the correct form sample. For example, when you select a wrong version of a Ladybird Deed Vermont Withholding, it will be rejected once you send it. It is therefore crucial to have a trustworthy source of legal files like US Legal Forms.

If you need to obtain a Ladybird Deed Vermont Withholding sample, stick to these easy steps:

- Get the template you need by using the search field or catalog navigation.

- Examine the form’s description to make sure it matches your situation, state, and region.

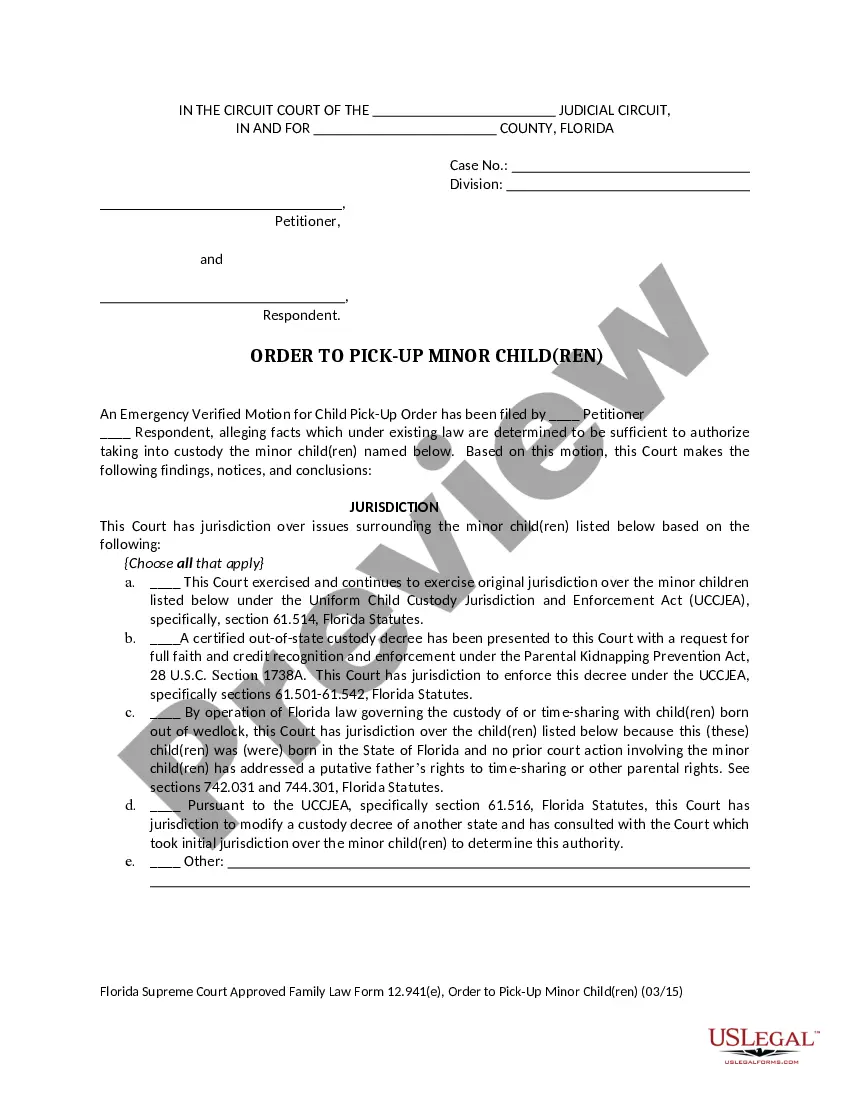

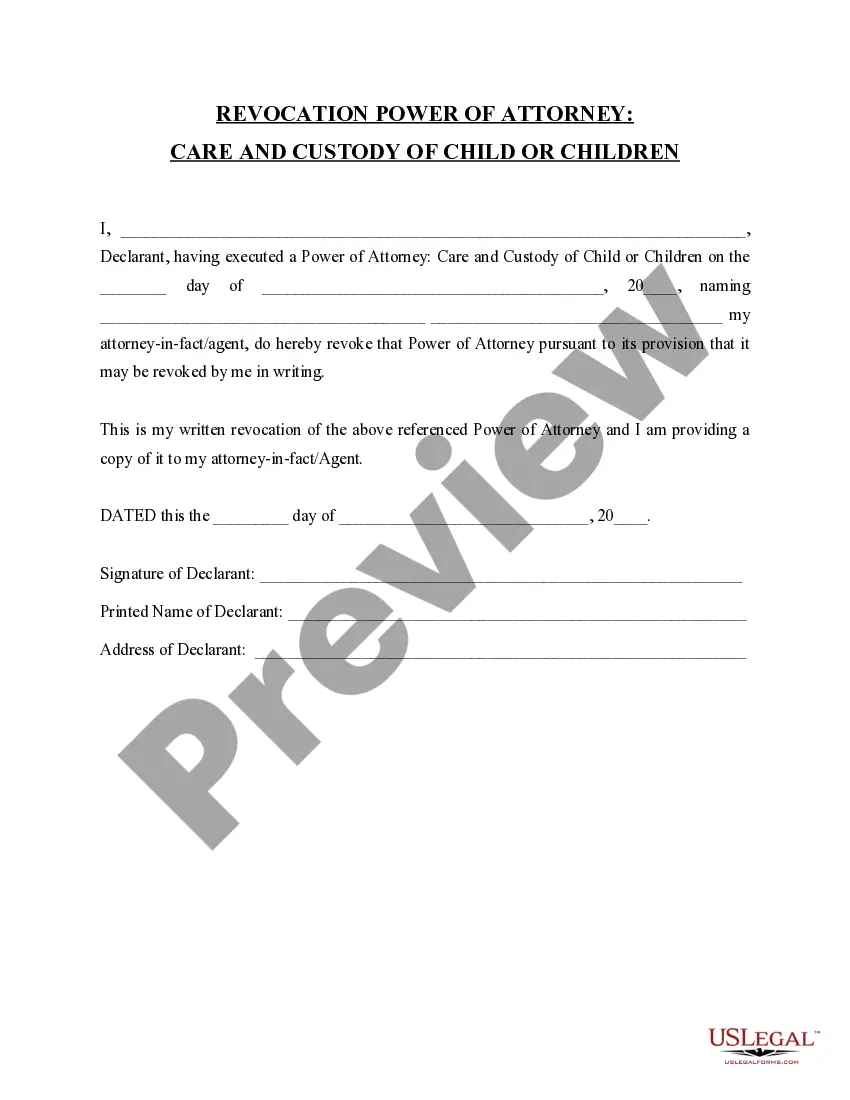

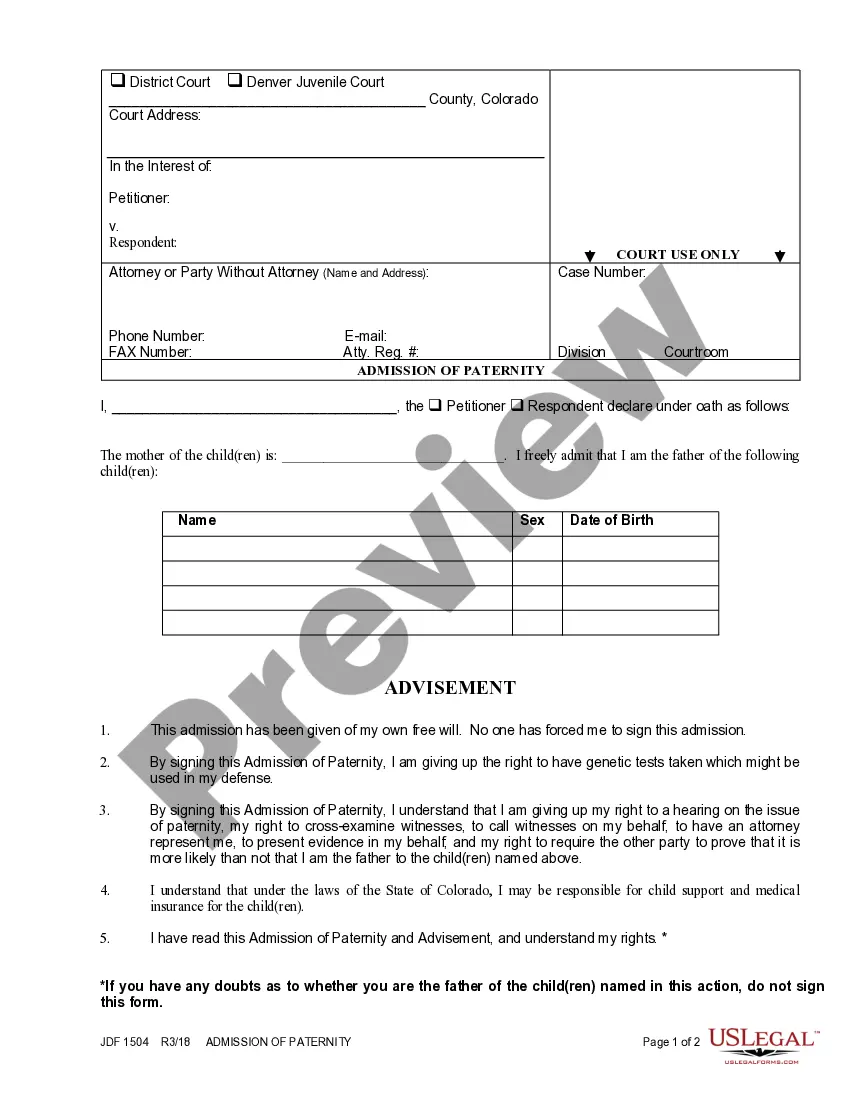

- Click on the form’s preview to see it.

- If it is the wrong form, go back to the search function to find the Ladybird Deed Vermont Withholding sample you require.

- Download the template if it matches your requirements.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved files in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Select the correct pricing option.

- Complete the profile registration form.

- Select your payment method: use a bank card or PayPal account.

- Select the file format you want and download the Ladybird Deed Vermont Withholding.

- After it is downloaded, you can fill out the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time searching for the appropriate template across the web. Use the library’s straightforward navigation to find the correct form for any occasion.

Form popularity

FAQ

One disadvantage of using a Lady Bird deed alone is that it's not the most flexible solution. The document may need additional work if you wish to leave your assets to multiple beneficiaries. New circumstances may make you change your mind about your initially chosen beneficiary or the transfer.

Disadvantages. The downside is that property transferred via a lady bird deed will be subject to a new tax assessment that could (and often does) result in higher property taxes generally.

When a transfer is made by deed, the buyer or transferee is liable for the transfer tax.

Although there are variations of the Lady Bird Deed that exist in other states, Vermont has been just one of six states that recognize an Enhanced Life Estate Deed. (The 5 other states include Texas, Florida, Michigan, North Carolina, and West Virginia.)

When real estate is sold in Vermont, state income tax is due on the gain from the sale, whether the seller is a resident, part-year resident, or nonresident. If the seller is a nonresident, the buyer is required to withhold 2.5% of the sale price and remit it to the Vermont Department of Taxes.