Bank Account Holder

Description

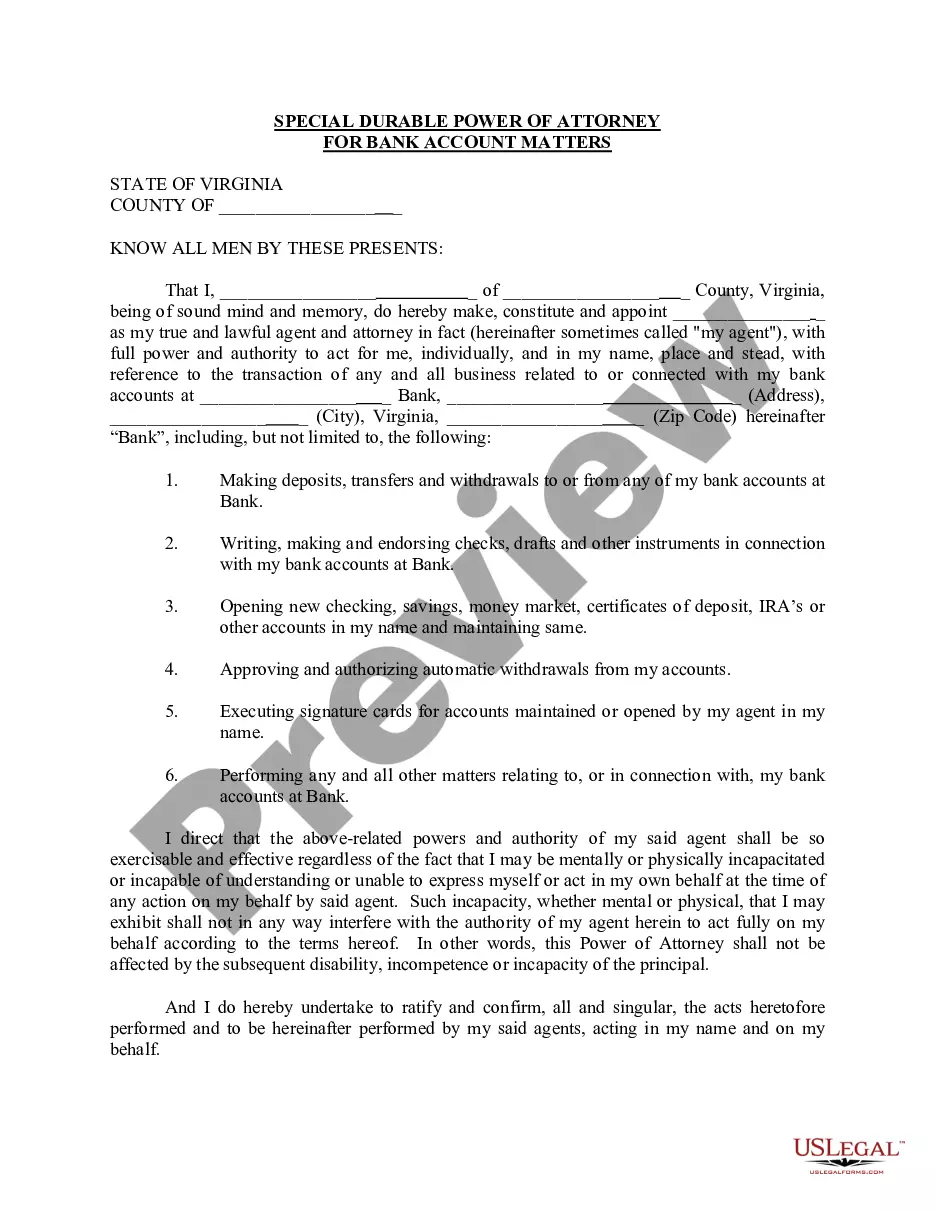

How to fill out Virginia Special Durable Power Of Attorney For Bank Account Matters?

- Log into your account. If you're a returning user, access your account and confirm that your subscription is active; renew it if necessary.

- Preview the form. Examine the form description and ensure it aligns with your requirements and local jurisdiction.

- Search for other forms. If the form doesn't meet your needs, use the search feature to find alternatives that fit your criteria.

- Purchase the document. Click on the 'Buy Now' button and select your preferred subscription plan, ensuring you register for access.

- Complete your payment. Enter your credit card information or choose PayPal to finalize your purchase.

- Download your forms. Save the document to your device, and find it later in the 'My Forms' section of your profile.

By following these simple steps, bank account holders can swiftly obtain and manage their legal documents, taking advantage of the robust selection that US Legal Forms offers.

Ready to simplify your legal process? Visit US Legal Forms today and discover how easy it can be to access the documents you need.

Form popularity

FAQ

A 'bank holder' is an individual or entity that possesses a bank account and has legal ownership rights associated with that account. This designation allows the holder to engage in various banking activities, such as deposits, withdrawals, and more. Understanding the implications of being a bank holder is essential for managing your financial affairs effectively. If you want to know more about your rights as a bank account holder, uslegalforms can provide helpful information.

The term 'holder' refers to any individual or legal entity that owns a financial account. In the context of banking, this includes anyone whose name appears on the account documents. Being recognized as the holder allows you to conduct banking transactions and manage the account independently. If you have uncertainties about your status as a holder, consider using resources from uslegalforms for clarity.

A bank account holder is a person or business entity that possesses an account with a financial institution. This role comes with various powers, such as making deposits, requesting withdrawals, and understanding account features. Knowledge of your status as a bank account holder is crucial for effective account management. If you have questions about your rights or responsibilities, uslegalforms can help clarify your position.

The term 'holder' in banking signifies the account owner who has the authority to perform transactions and make decisions regarding the account. This can include individuals or organizations, depending on the type of account. Recognizing your status as a holder enables you to maximize your banking experience. If you need assistance navigating these terms, tools like uslegalforms can offer valuable insights.

In banking, a holder refers to a person or entity that legally owns a bank account. This individual has the right to deposit, withdraw, and manage funds in the account. Understanding the role of the holder is vital, as it outlines your rights and responsibilities concerning the account. For comprehensive guidance, consider using a platform like uslegalforms to clarify your role as a bank account holder.

An account holder name typically includes the legal name of the individual or business that owns the bank account. For individuals, it might be 'John Smith', while for businesses, it could be 'Smith Enterprises LLC'. This name must match official identification for verification purposes. Being aware of how your account holder name appears can prevent issues during transactions.

A bank holder title refers to the official designation assigned to an individual or entity that owns a bank account. This title establishes the legal relationship between the account holder and the financial institution. It's essential for access to account features, rights, and responsibilities. Understanding your bank holder title is crucial for effective account management and compliance.

The account holder of your bank account is you or anyone else whose name appears on the account paperwork. If it is a joint account, both parties share ownership and responsibilities. It's important to verify this information, especially when managing finances, applying for loans, or making changes through platforms like uslegalforms.

The account holder of a checking account is the person designated as the owner and operator of that account. This individual holds authority over transactions and balances and is recognized by the bank as the primary contact. If you have a checking account, you are typically the bank account holder responsible for its activities.

While the account holder refers to the individual or entity owning the account, the account name is the title often displayed on bank statements. This name represents the account holder in transactions and communications with the bank. Understanding this distinction ensures clarity in your banking experience.