Va Closing Transaction With Debit Card

Description

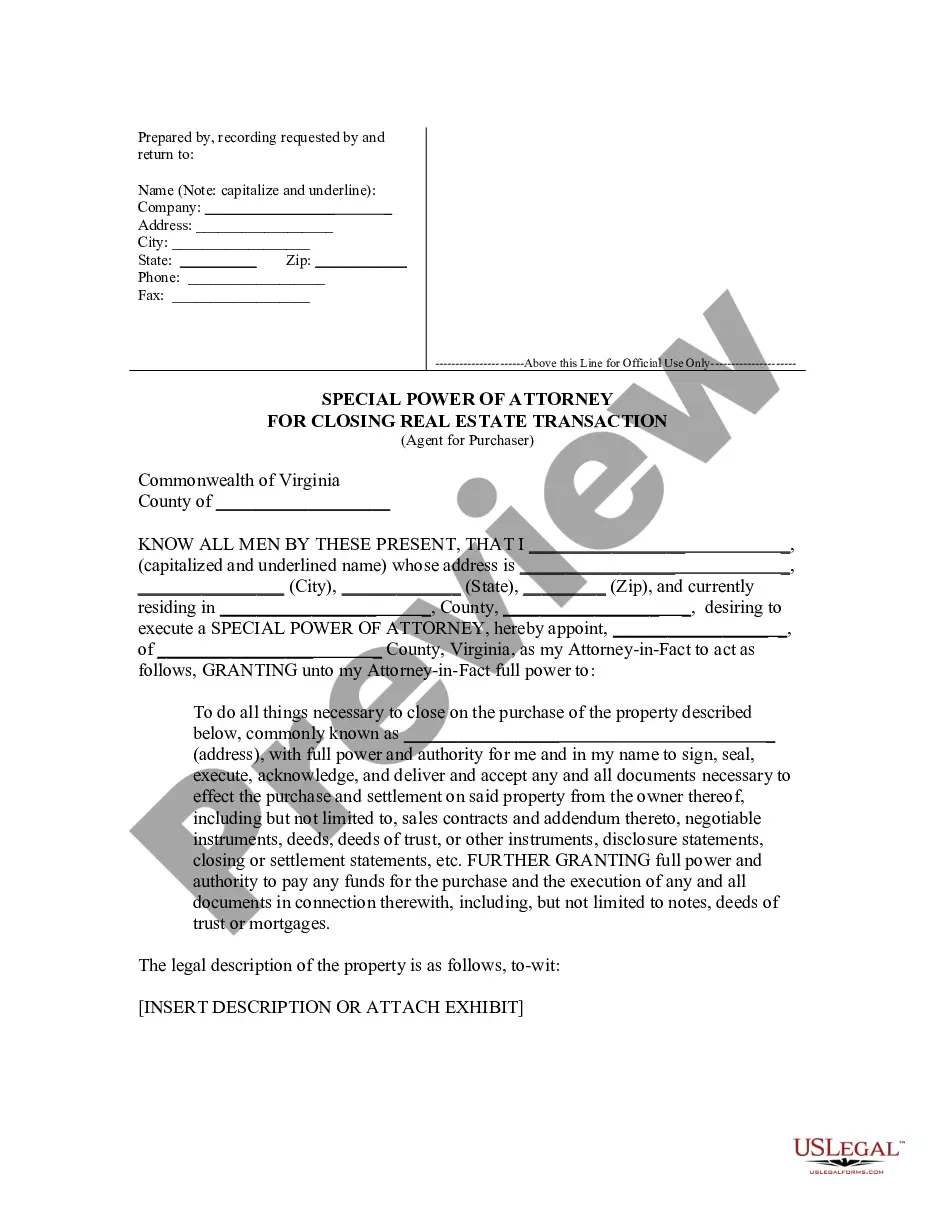

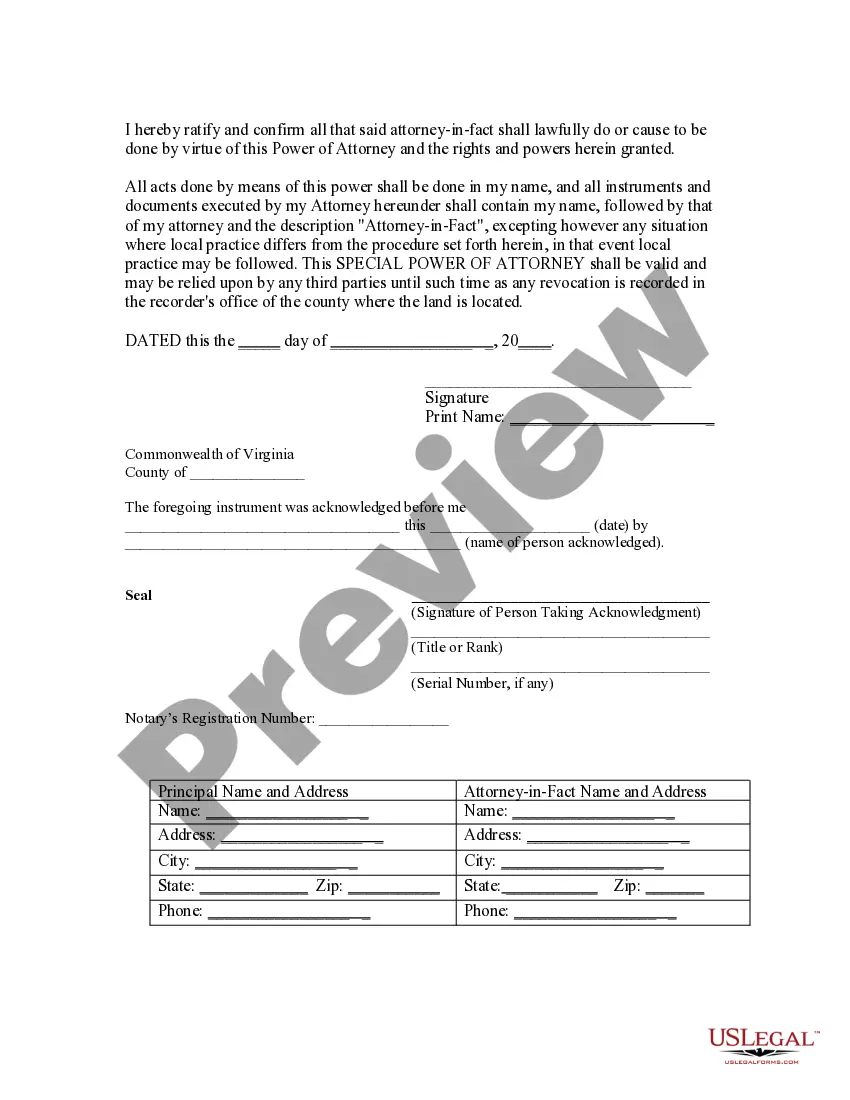

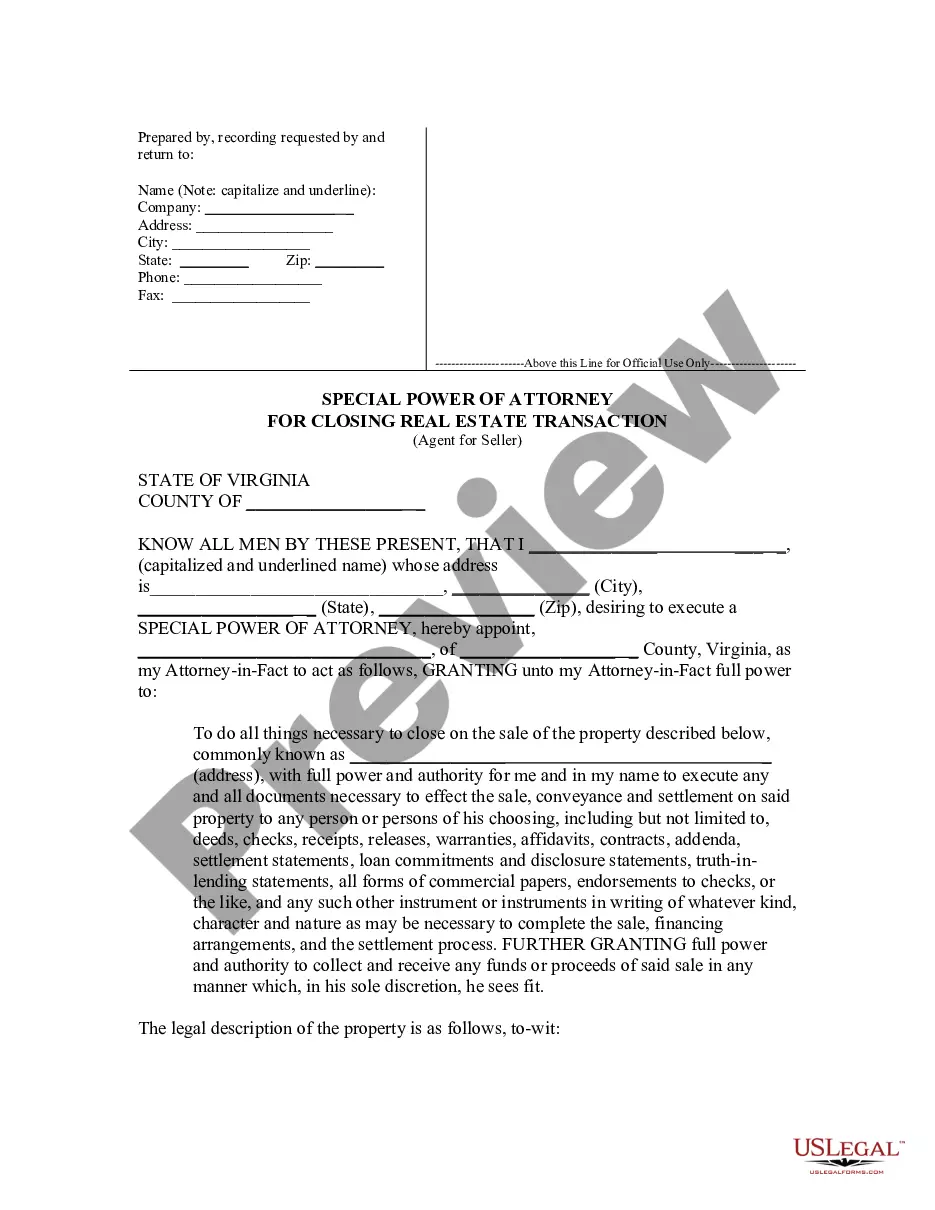

How to fill out Virginia Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Finding a reliable source for the most up-to-date and suitable legal templates is a significant part of navigating bureaucracy.

Identifying the correct legal documentation necessitates precision and thoroughness, which is why it is essential to obtain samples of Va Closing Transaction With Debit Card exclusively from trustworthy providers, such as US Legal Forms. An incorrect template will squander your time and delay your current situation. With US Legal Forms, you have minimal worries. You can access and verify all the specifics concerning the document's usage and applicability for your situation and in your state or region.

Eliminate the hassle associated with your legal paperwork. Browse the extensive US Legal Forms library to discover legal templates, verify their suitability for your situation, and download them instantly.

- Utilize the catalog navigation or search bar to find your template.

- Examine the form's description to confirm it meets the criteria of your state and locality.

- Check the form preview, if available, to ensure the template is indeed the one you need.

- Return to the search and seek the appropriate document if the Va Closing Transaction With Debit Card does not fulfill your requirements.

- If you are confident about the form's applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Choose the pricing option that aligns with your preferences.

- Proceed to the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Va Closing Transaction With Debit Card.

- Once you have the form on your device, you can edit it with the editor or print it and fill it out by hand.

Form popularity

FAQ

Transfer Cash and Close the Account Once all pending direct deposits and payments clear, transfer the remaining funds in your old account to your new one and move forward with the account cancellation. You may be able to withdraw the balance of your account using a check or an electronic transfer.

Some banks may let you close your account online with options such as a live chat with customer service. But if closing your account online isn't an option at your bank, you may be able to do it over the phone, by mail or fax or in person.

The procedure of how to block Debit Card by Phone Banking is: Call up the bank and authenticate yourself. Authenticate and confirm the Debit Card details. The Phone Banking customer executive may ask you for some security questions. ... Once confirmed, the customer executive will block your Debit Card.

Your debit card will work online. But debit cards are not a good way to pay when you shop online. Credit cards are safer to use when you buy things online: You might have a problem with something you buy online.

Usually, it is the responsibility of the buyer to pay the closing cost at the end of a real estate deal.