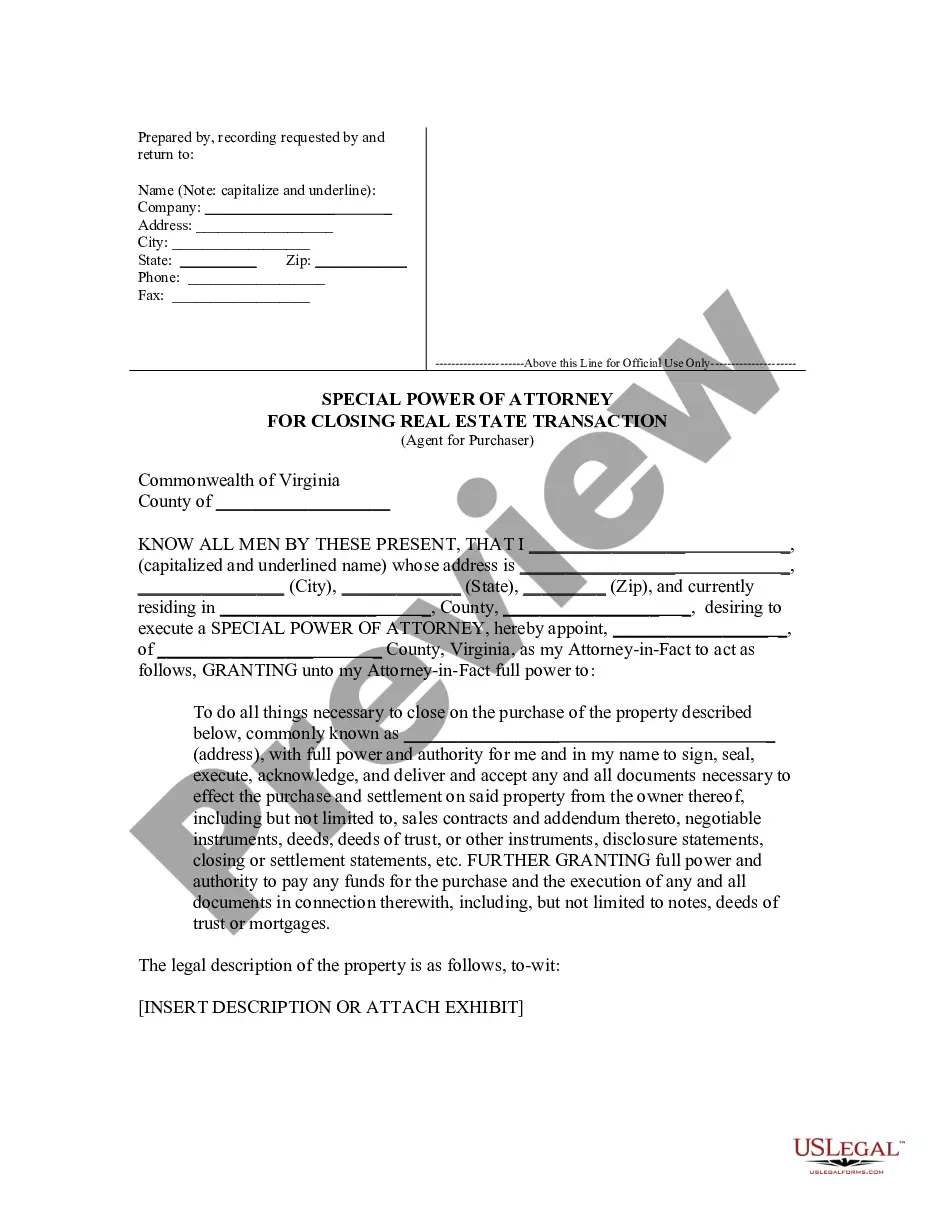

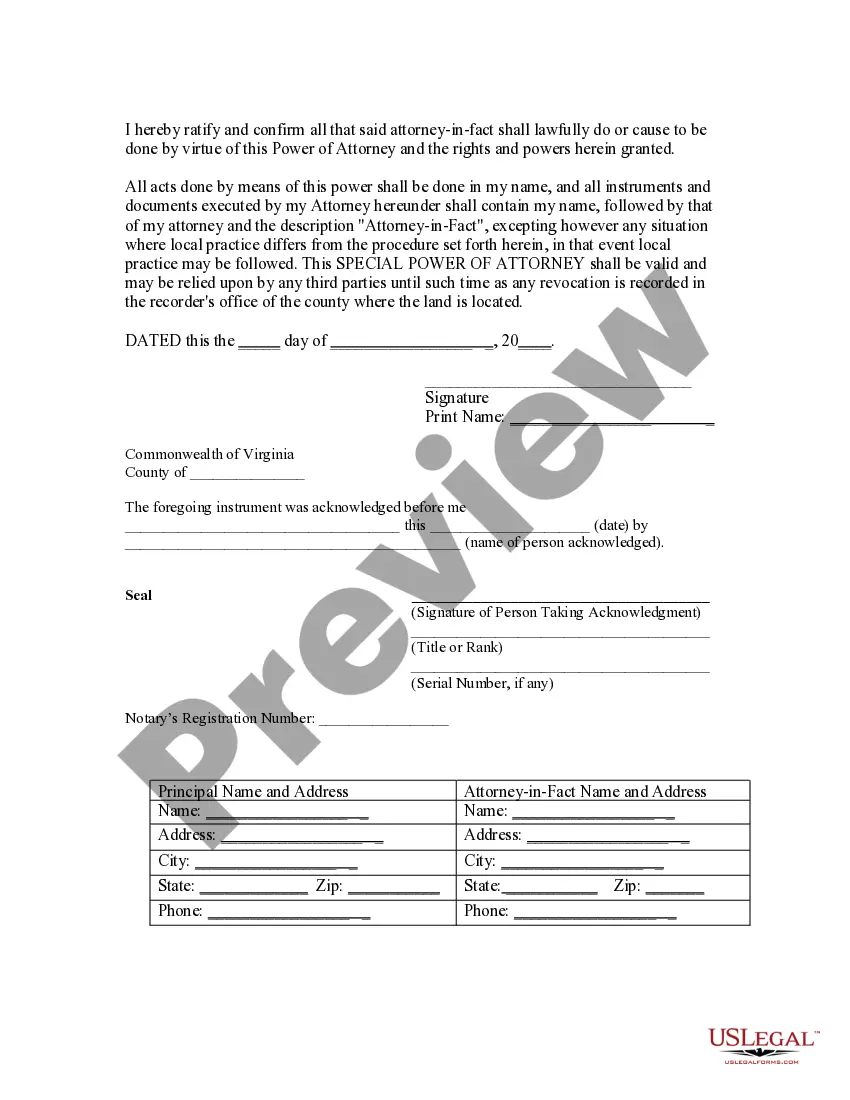

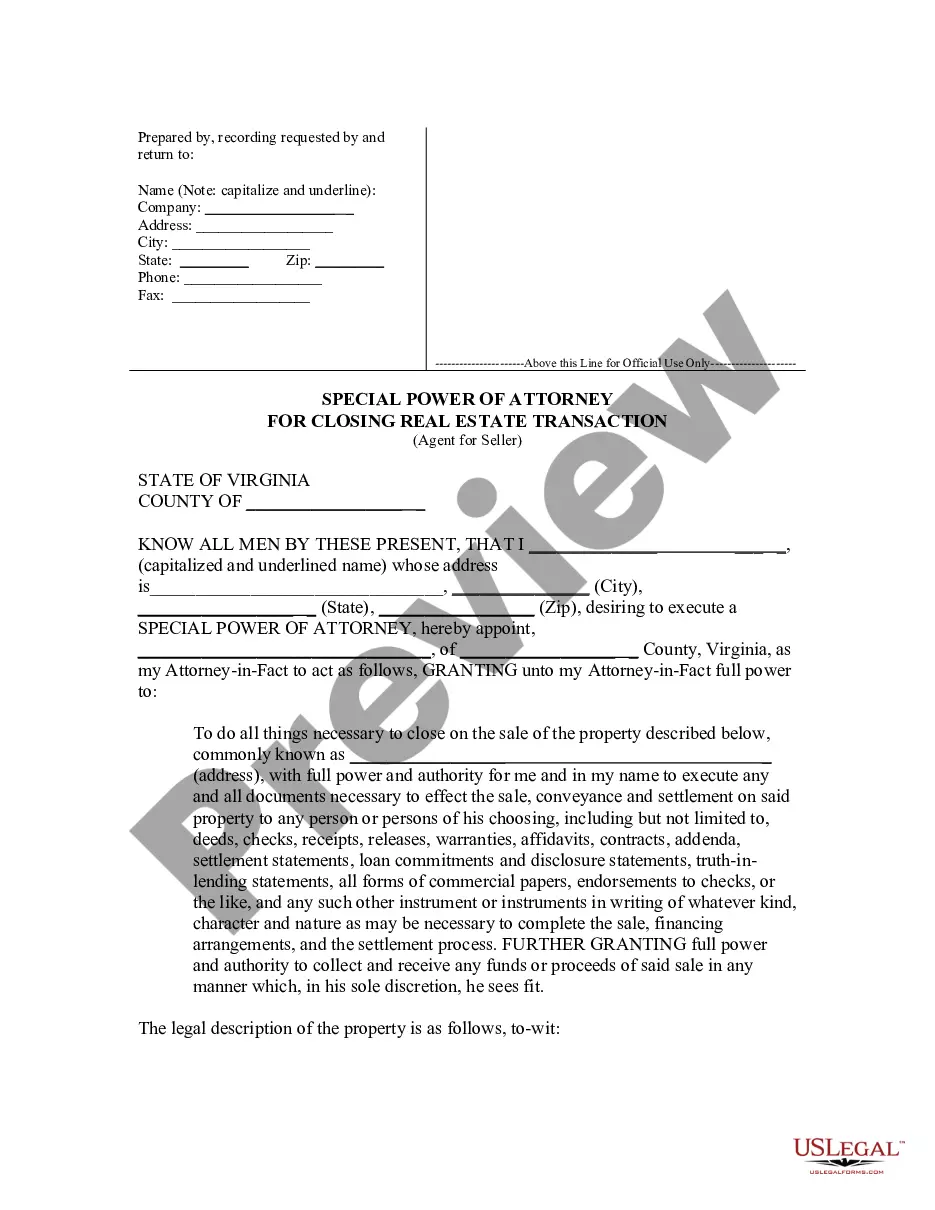

Va Closing Transaction Forward

Description

How to fill out Virginia Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Utilizing legal document examples that comply with federal and state regulations is essential, and the internet provides numerous alternatives to choose from.

However, what’s the purpose of spending time searching for the suitable Va Closing Transaction Forward sample online if the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable documents created by lawyers for any business and personal situation.

Review the template using the Preview option or via the text outline to ensure it meets your requirements.

- They are straightforward to navigate with all documents organized by state and intended use.

- Our specialists keep up with legal changes, so you can always be assured your form is current and compliant when obtaining a Va Closing Transaction Forward from our site.

- Acquiring a Va Closing Transaction Forward is quick and easy for both existing and new users.

- If you already have an account with a valid subscription, Log In and save the document sample you require in your preferred format.

- If you are new to our website, follow the guidelines below.

Form popularity

FAQ

The VA Escape Clause, also known as the "VA Amendment to Contract" or the "VA Amendatory Clause," is an appraisal contingency that protects homebuyers' earnest money if the VA appraisal determines the home is worth less than what they agreed to pay.

Simply state: ?I do not feel comfortable signing onto a loan before I have explored my options.? If the lender pushes you, stand your ground. Say: ?I am not going to sign this loan yet. While I appreciate the deal, I do not like being pressured into a loan.?

If you request proceeds to be wired to your bank account, it can take 24 ? 48 hours to process, but it's typically available by the next business day. Note: You will receive payment for the full purchase price of the property, minus fees, closing costs, taxes and real estate commissions.

Loan signing ? The date when all the loan documents are signed and notarized. Loan Funding ? When the lender releases funds to title/escrow. Recording ? This is the date ? the true 'closing of escrow' ? when the deed and any other associated recordable documents are recorded at the County Recorder's office.

Oftentimes recording can take place on the same day as your closing, but sometimes it can take several days, especially if your closing is late in the day on a Friday or just before a holiday. The process of recording typically takes only a few hours.