Va Attorney Real Foreclosure

Description

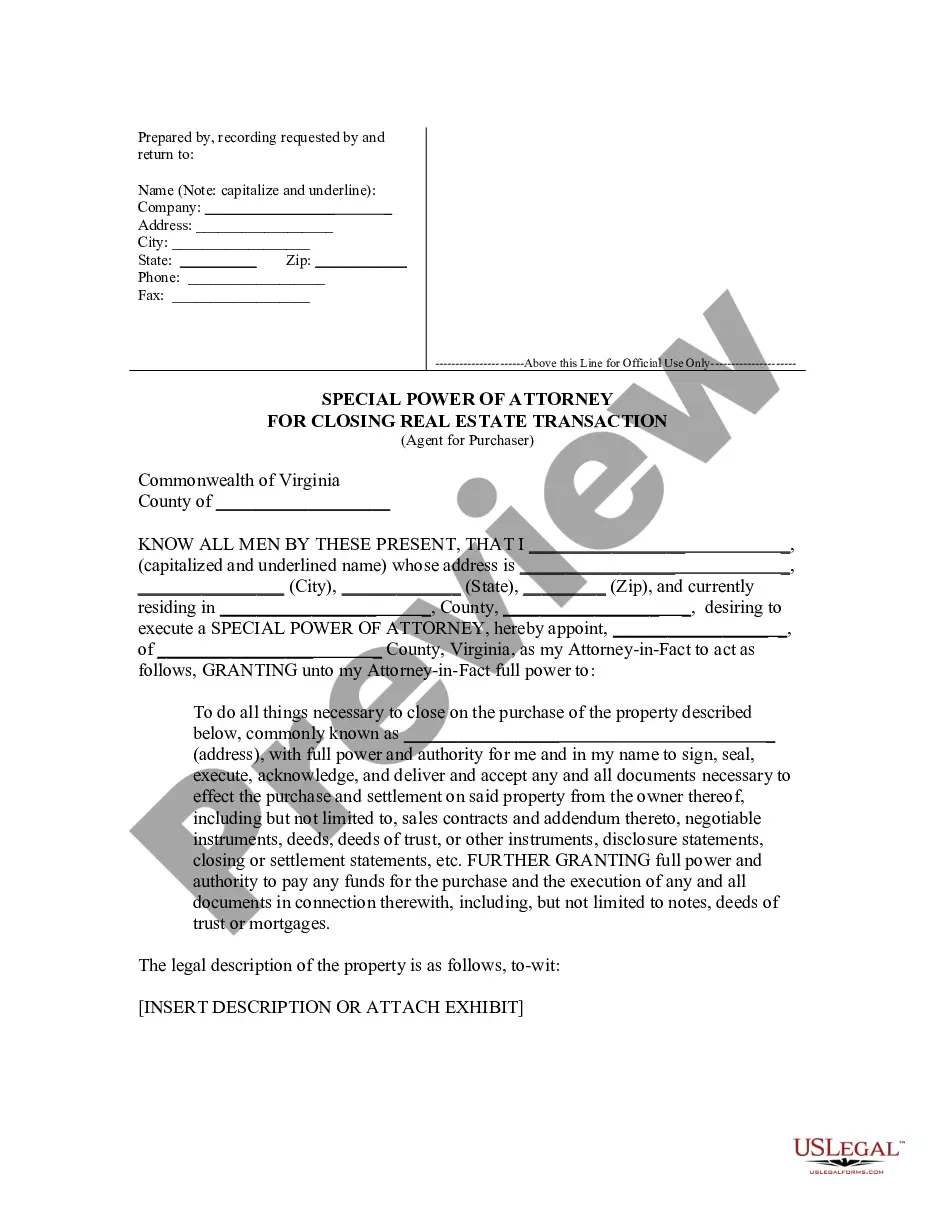

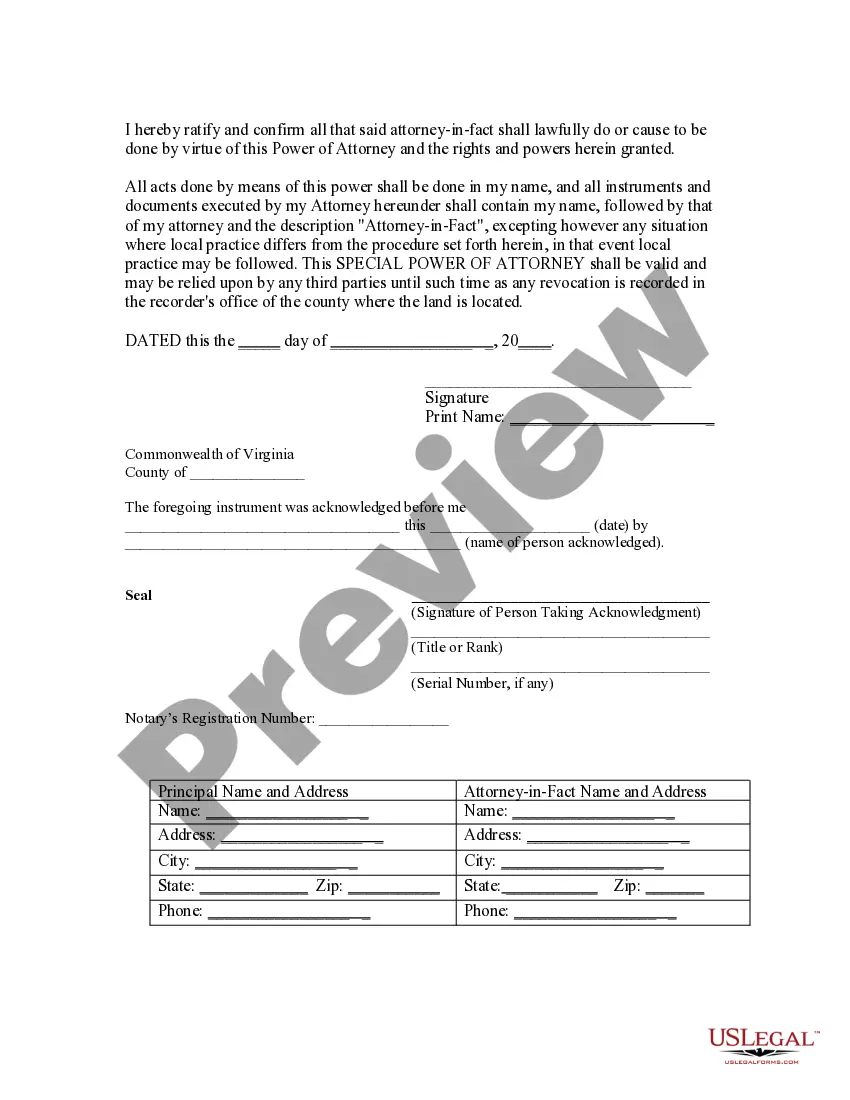

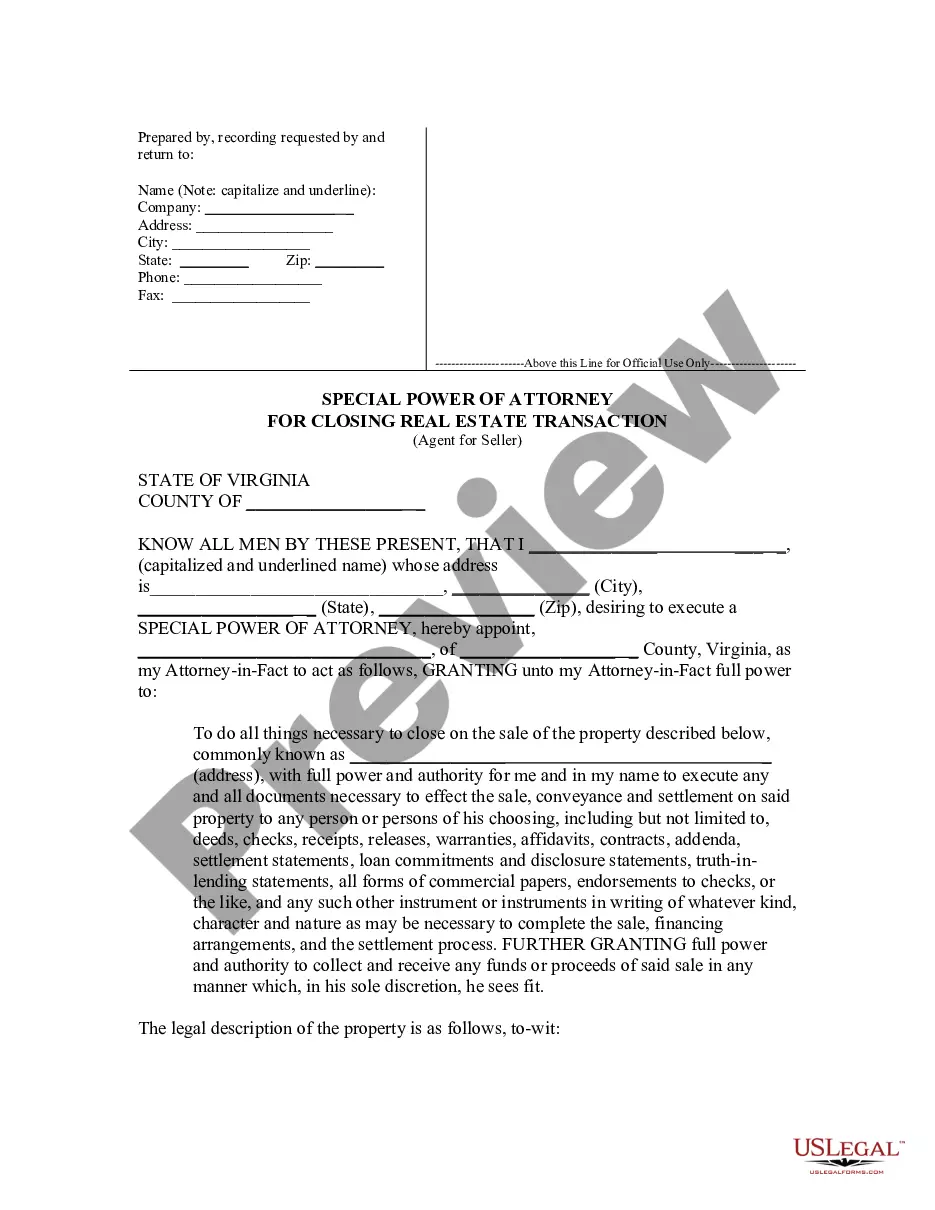

How to fill out Virginia Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

The Virginia Attorney Real Foreclosure you see on this site is a versatile legal document crafted by experienced attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 certified, state-specific documents for any professional and personal situation.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations readily available.

- Find the document you require and review it.

- Browse the example you searched and view it or examine the form details to ensure it meets your requirements. If it doesn’t, utilize the search feature to find the correct one. Click Buy Now once you have located the template you need.

- Create an account and Log In.

- Select the subscription plan that fits you and set up an account. Use PayPal or a credit card to make an immediate payment. If you already have an account, Log In and check your membership to proceed.

- Download the editable document.

- Choose the format you prefer for your Virginia Attorney Real Foreclosure (PDF, Word, RTF) and save the document on your device.

- Complete and sign the document.

- Print the template to finish it by hand. Alternatively, use an online multifunctional PDF editor to swiftly and accurately fill out and sign your form with an eSignature.

- Re-download your documents as needed.

- Access the same document again whenever necessary. Navigate to the My documents tab in your profile to re-download any previously obtained documents.

Form popularity

FAQ

For a VA mortgage assumption to take place, the following conditions must be met: The existing loan must be current. ... The buyer must qualify based on VA credit and income standards. The buyer must assume all mortgage obligations, including repayment to the VA if the loan goes into default.

VA foreclosure works similarly to any mortgage foreclosure process. There are limited cases in which you could be foreclosed upon much more quickly (for example, triggering due-on sale provisions).

VA loan entitlement cannot be regained after foreclosure without repaying the VA in full. The good news is that many borrowers are able to purchase again using their second-tier entitlement.

VA loan entitlement cannot be regained after foreclosure without repaying the VA in full. The good news is that many borrowers are able to purchase again using their second-tier entitlement.

A: If foreclosure unavoidable, it may directly affect your VA loan entitlement. If the government suffers any loss as a result of your delinquency, the amount of entitlement that was used for the VA loan cannot be restored until the loss is paid back.