Power Of Attorney For Va Home Loan

Description

How to fill out Virginia Springing Power Of Attorney?

Legal administration can be daunting, even for the most adept professionals.

When you are looking for a Power Of Attorney For Va Home Loan and cannot dedicate time to finding the correct and current version, the process can be stressful.

Access a repository of articles, guides, and handbooks connected to your circumstances and requirements.

Save time and effort searching for the documents you need, and use US Legal Forms’ advanced search and Preview feature to locate Power Of Attorney For Va Home Loan and obtain it.

Select Buy Now when you are prepared. Choose a subscription option. Download, complete, eSign, print, and send your document in the format you need. Take advantage of the US Legal Forms online library, backed by 25 years of expertise and trustworthiness. Streamline your daily document management into a straightforward and user-friendly process starting today.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check out My documents section to see the documents you have previously downloaded and to manage your folders as desired.

- If this is your first time using US Legal Forms, create an account and gain unrestricted access to all benefits of the library.

- Here are the steps to follow after acquiring the form you require.

- Ensure it is the correct form by previewing it and reviewing its details.

- Confirm that the sample is accepted in your state or county.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any requirements you might have, from personal to corporate paperwork, all in one place.

- Utilize state-of-the-art tools to complete and oversee your Power Of Attorney For Va Home Loan.

Form popularity

FAQ

Submitting documents to the VA typically involves mailing them or uploading them through the VA’s online portal, depending on the type of transaction. If you are using a power of attorney for VA home loan purposes, make sure to include it with your application or claims. Always check the specific submission guidelines for the documents you are providing to ensure proper handling. For ease and reliability, UsLegalForms helps you prepare all necessary documentation according to VA standards.

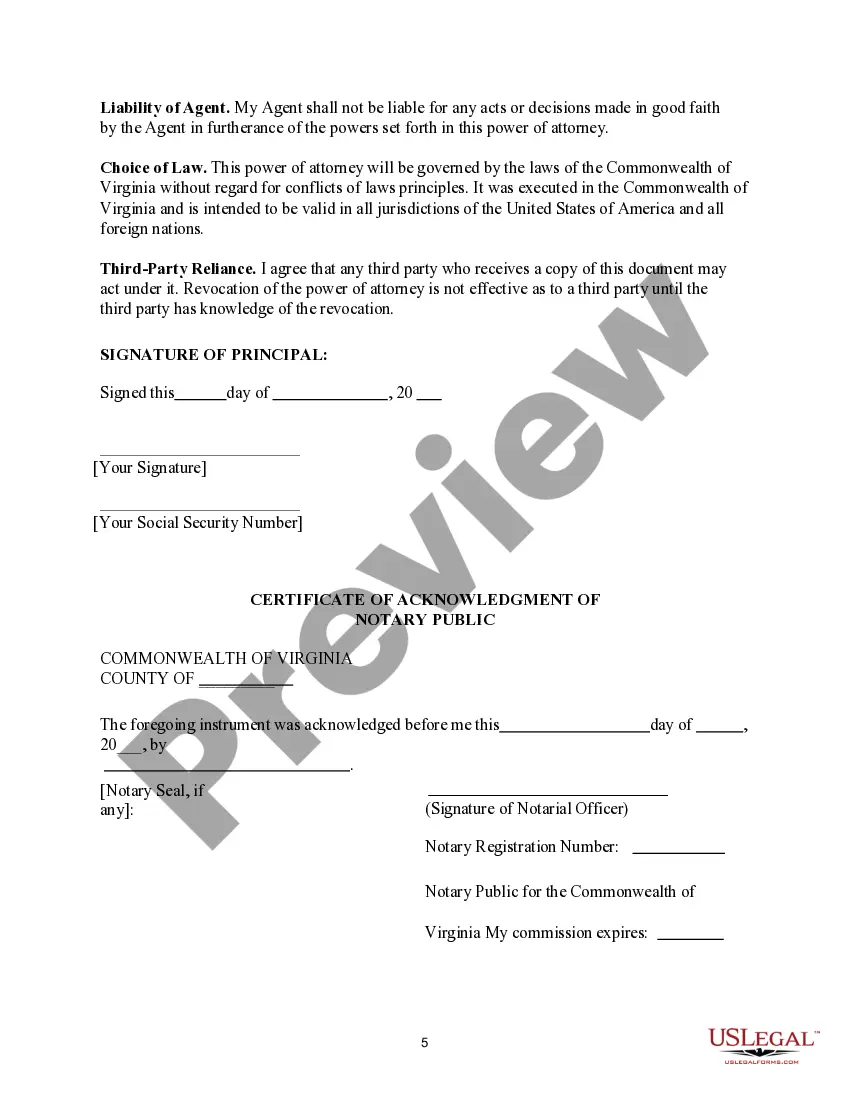

To obtain a power of attorney in Virginia, you need to draft the document and ensure it meets the state's legal requirements. You can create the document yourself or use a template from a reliable source like UsLegalForms for added assurance. Once completed, you should sign it in the presence of a notary. This process is critical if you plan to use the power of attorney for VA home loan dealings, as proper execution ensures your agent’s authority is recognized.

The easiest way to create a power of attorney is by utilizing online services that offer customizable templates. These services allow you to input your specific needs and generate a legal document ready for use. Using a power of attorney for a VA home loan can become less daunting with platforms like UsLegalForms, which provide guided step-by-step approaches. This ensures your document complies with state requirements while reducing the complexity of the process.

Yes, in Virginia, a power of attorney must be notarized to be valid. This requirement ensures that the document is officially recognized, which is particularly important when using a power of attorney for VA home loan transactions. Notarization helps prevent potential disputes regarding the authority granted to the agent. You may want to consider using platforms like UsLegalForms to streamline the process of creating a notarized power of attorney.

The VA does not provide power of attorney documents directly; however, you can easily create one through platforms like USLegalForms. A power of attorney for a VA home loan allows someone else to handle your loan-related tasks, ensuring you can manage your responsibilities efficiently. Having this legal document in place can help you navigate the complexities of VA home loans with greater ease.

Yes, the VA recognizes power of attorney for various transactions, including those related to home loans. This means you can appoint someone to act on your behalf for decisions involving your VA home loan. It's crucial to ensure that the power of attorney document meets VA's requirements. With the right documentation, you can simplify the process of managing your VA home loan.

To submit a power of attorney for a VA home loan, you should first ensure the document is properly completed and signed. Then, send your POA documentation to the VA regional loan center that processes your claim. You can also utilize platforms like US Legal Forms to create an accurate power of attorney document that meets VA requirements. This process ensures that your requests are handled efficiently and correctly.

VA loans can be assumable, which means that another qualified buyer can take over the loan under its existing terms. However, the original borrower may still be responsible for the loan if the new buyer defaults. This flexibility can benefit you, especially if you're using a power of attorney for a VA home loan. Always verify with your lender about the specific terms and conditions of your loan.