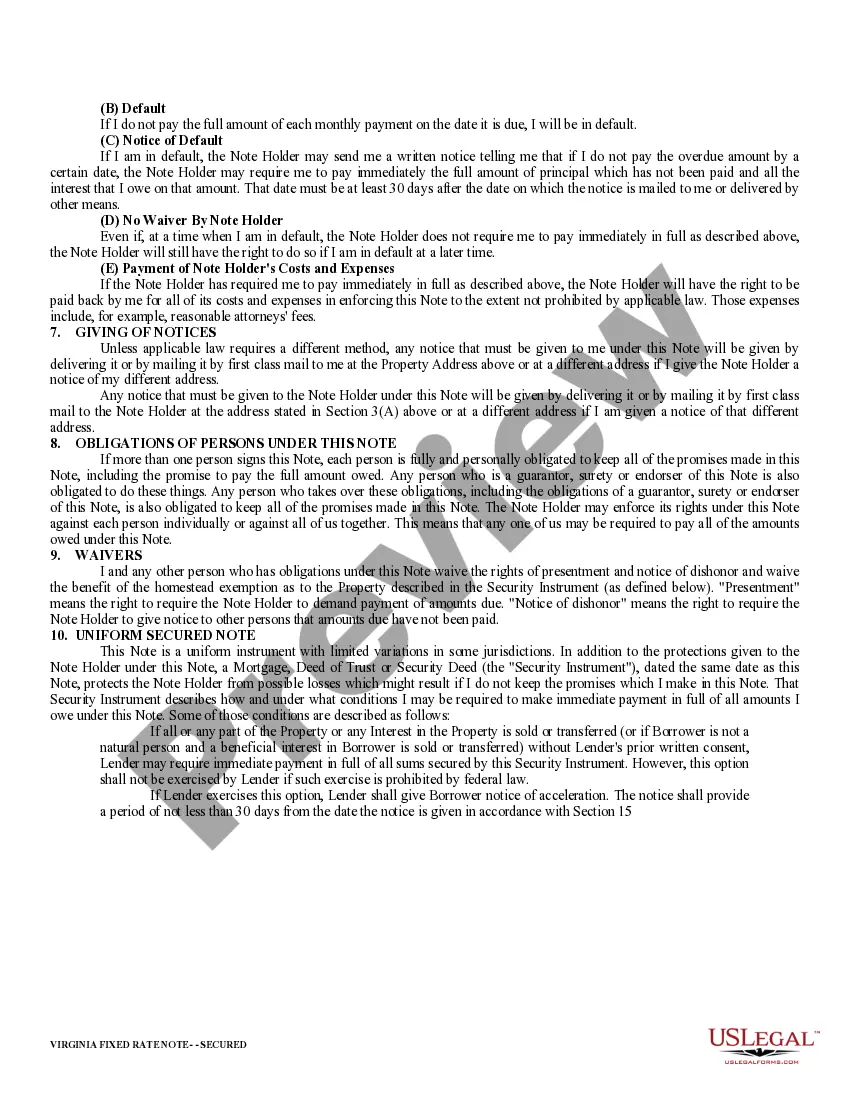

This is a Promissory Note for your state. The promissory note is secured, with a fixed interest rate, and contains a provision for installment payments.

Virginia Promissory Note Contract For Purchase

Description

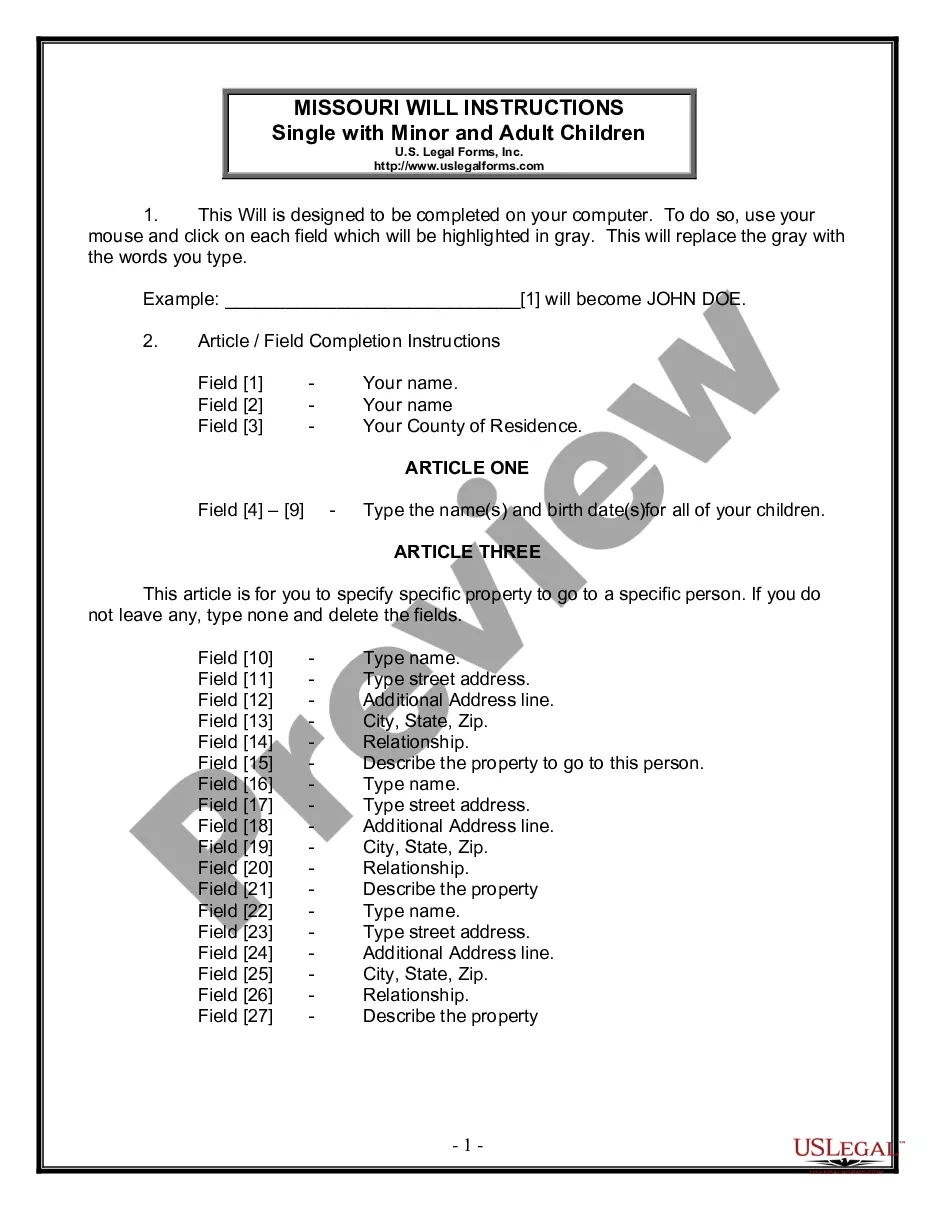

How to fill out Virginia Promissory Note Contract For Purchase?

What is the most trustworthy service to acquire the Virginia Promissory Note Agreement For Purchase and other recent versions of legal documents.

US Legal Forms is the answer! It boasts the largest collection of legal forms for any purpose. Each sample is expertly drafted and validated for adherence to federal and local laws and regulations.

US Legal Forms is an excellent solution for anyone needing to handle legal documents. Premium users can additionally benefit as they fill out and authorize previously saved files electronically at any time using the integrated PDF editing tool. Give it a try today!

- They are categorized by jurisdiction and state of utilization, making it easy to find the one you require.

- Experienced users of the platform only need to Log In to the system, verify if their subscription is active, and click the Download button next to the Virginia Promissory Note Agreement For Purchase to obtain it.

- Once saved, the document is accessible for further use within the My documents section of your profile.

- If you do not yet have an account with us, here are the steps you should follow to create one.

Form popularity

FAQ

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.04-Apr-2022

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Most Virginia promissory notes do not need to be notarized. If the promissory note involves real estate, it must be executed in front of a notary. The borrower must sign and date the promissory note to make it legally binding.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.