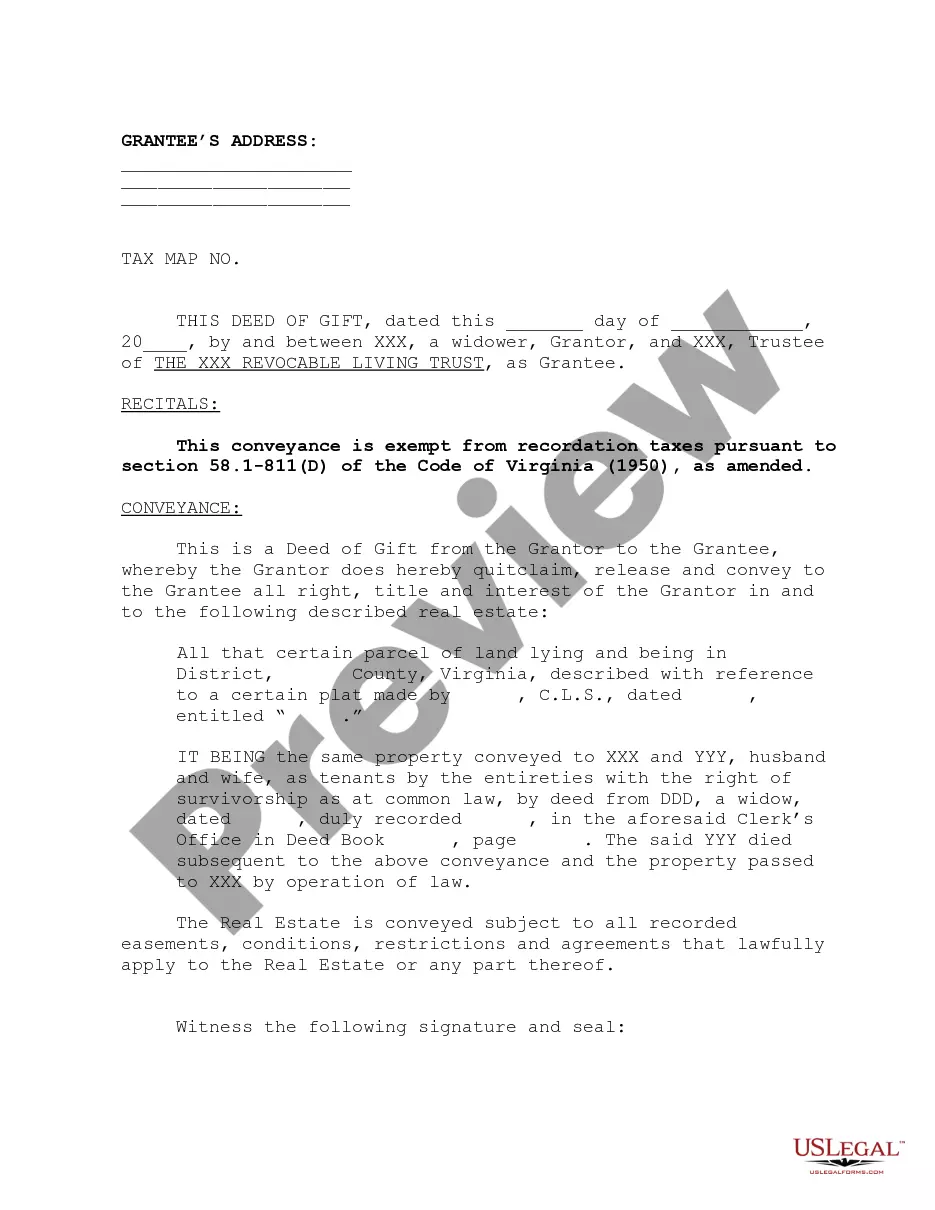

This is a form for a deed of gift of property from a single widower to the Trustee of Revocable Living Trust.

A Revocable Living Trust is designed to allow a Settlor (person establishing the Trust) to ensure that his/her estate does not require court-supervised probate.