Easement County Withholding

Description

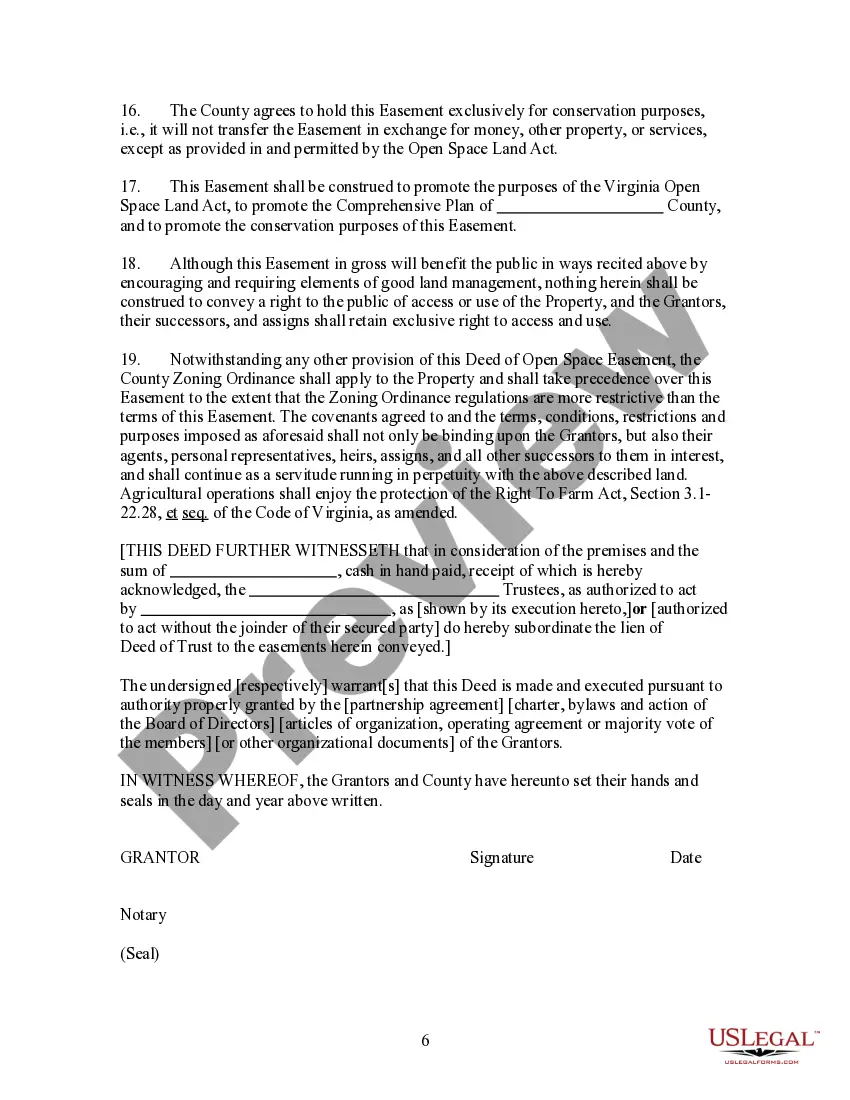

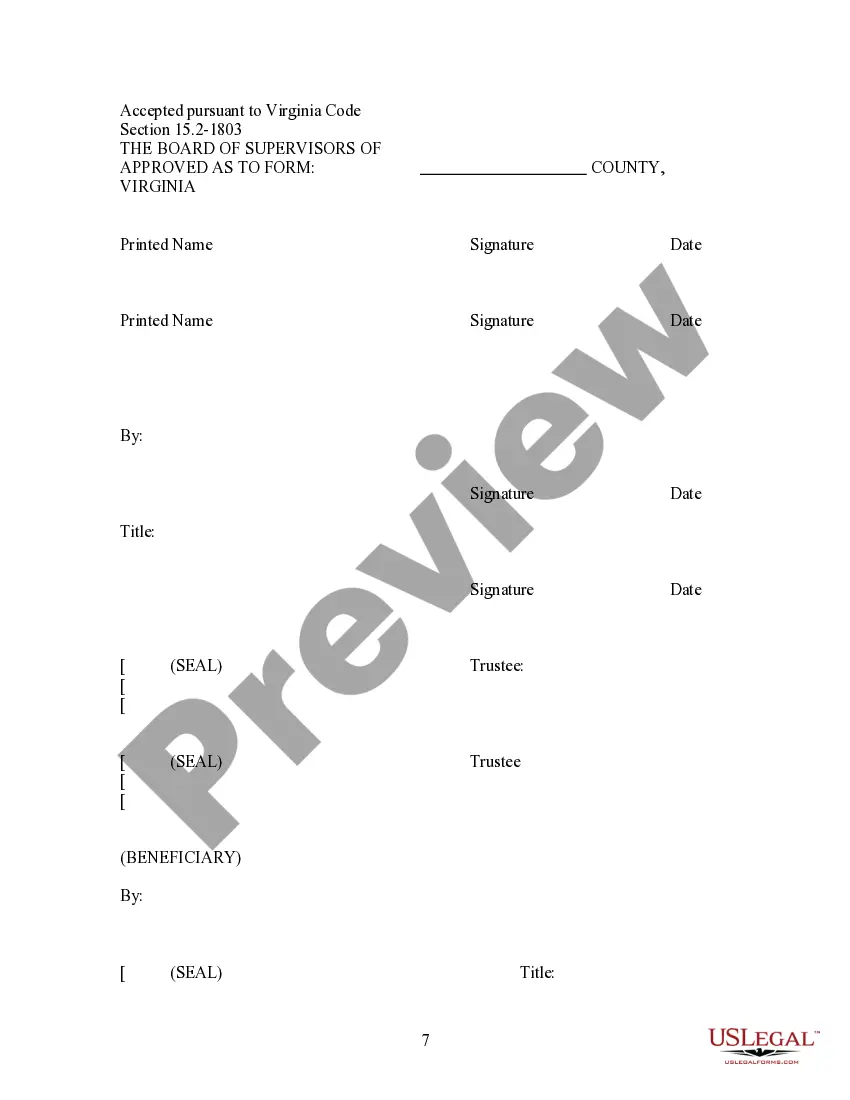

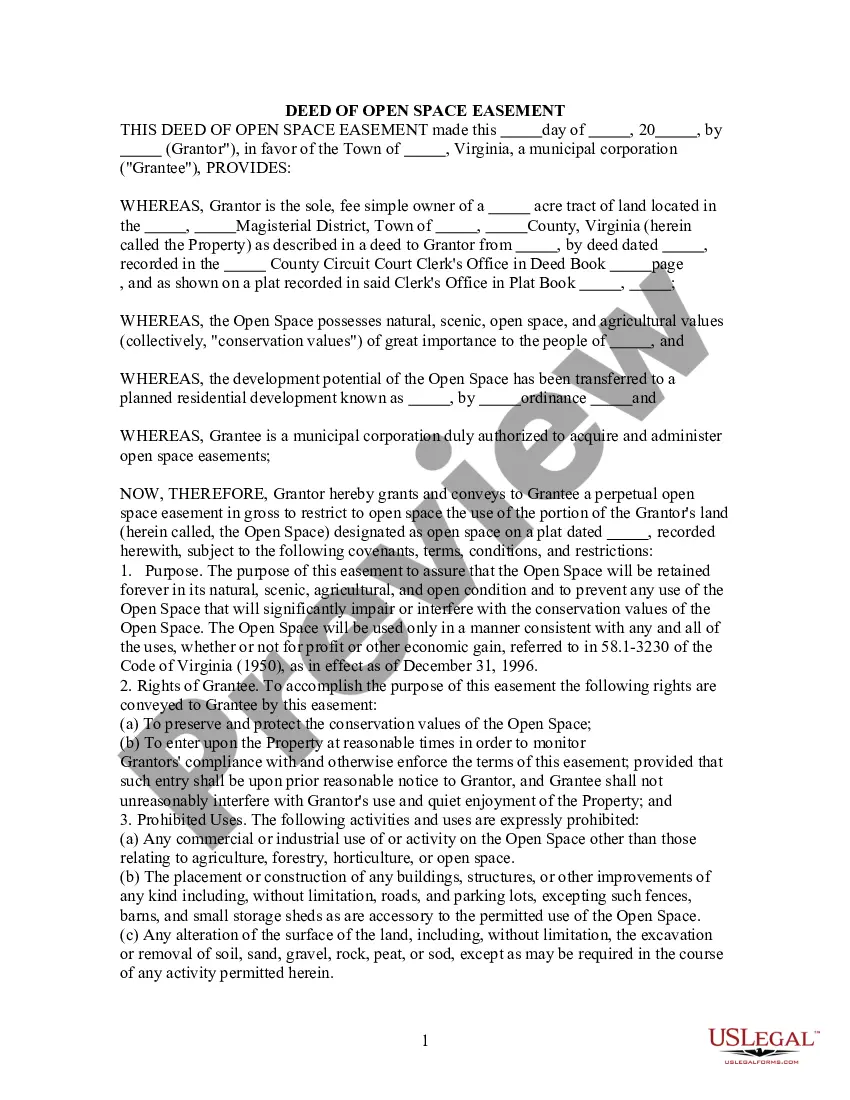

How to fill out Virginia Deed Of Open Space Easement To County?

Well-crafted official documentation is one of the essential safeguards for preventing problems and legal disputes, but obtaining it without the assistance of an attorney may require time.

Whether you need to swiftly locate an up-to-date Easement County Withholding or any other templates for employment, family, or business matters, US Legal Forms is always available to assist.

The process is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the chosen document. Furthermore, you can access the Easement County Withholding at any time later, as all documents ever retrieved on the platform are available within the My documents section of your profile. Save time and resources on preparing official paperwork. Try US Legal Forms today!

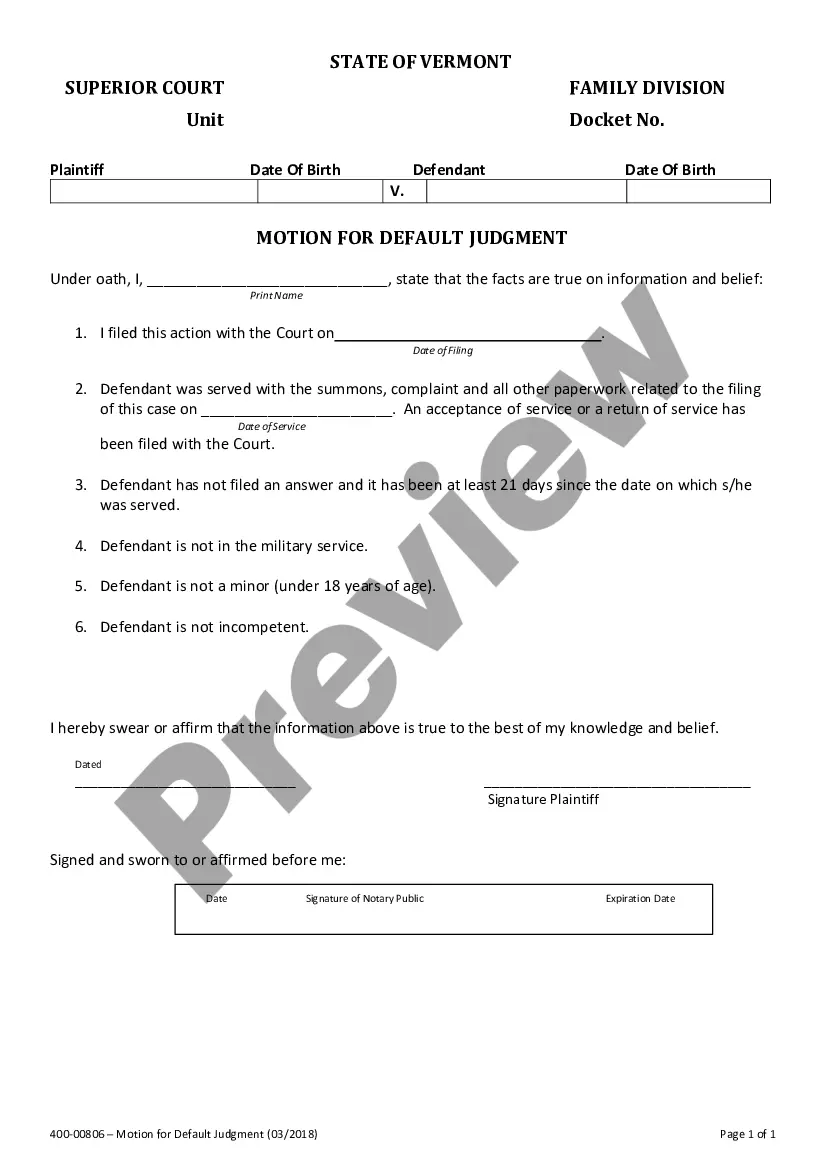

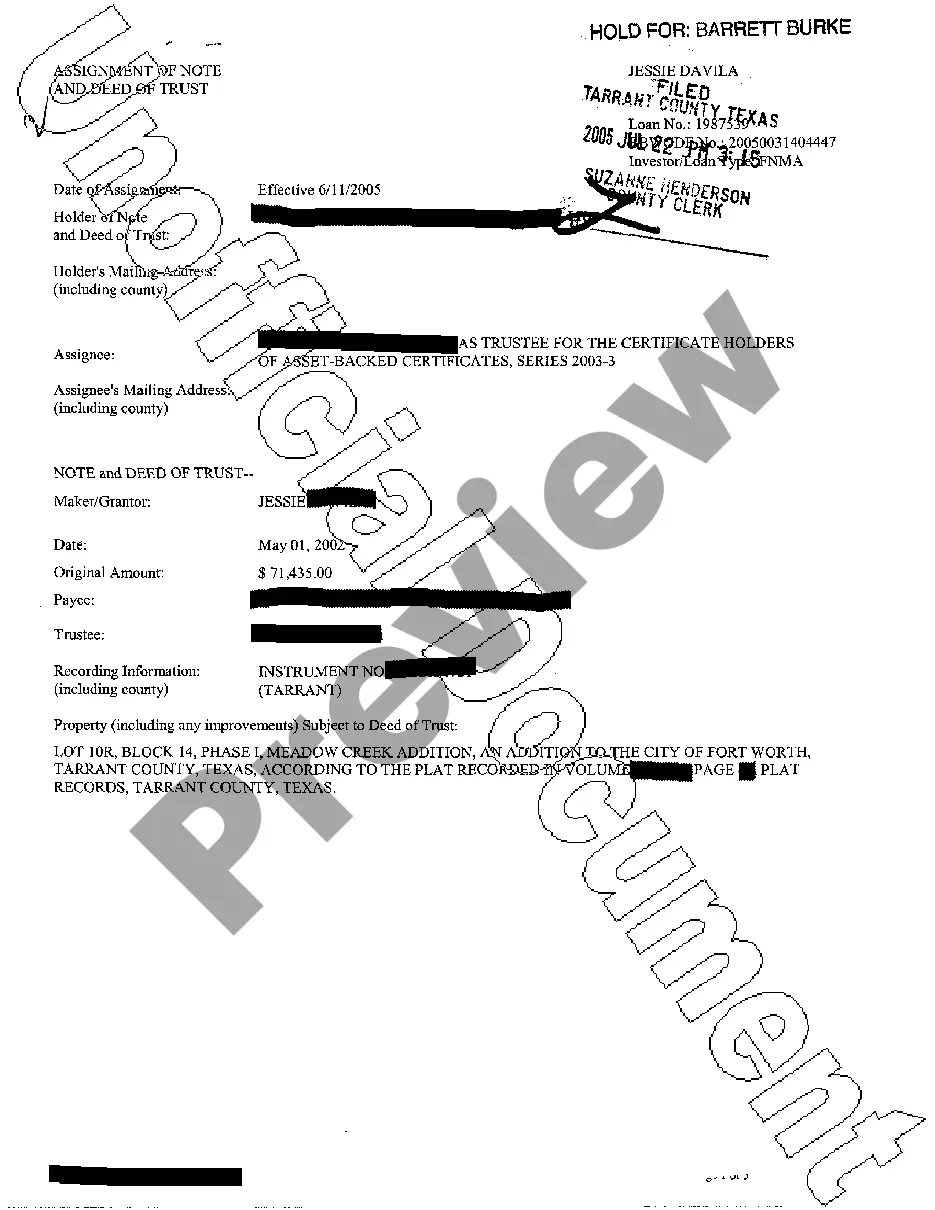

- Verify that the form is appropriate for your situation and locality by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar located in the page header.

- Click Buy Now once you discover the suitable template.

- Select the pricing plan, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Easement County Withholding.

- Press Download, then print the template to complete it or incorporate it into an online editor.

Form popularity

FAQ

Whoever is paying for the easement will send you a Form 1099 at the end of the year. If you get a 1099-MISC for rental payments, you report the income on Schedule E. For a permanent easement, you get a 1099-S and use Schedule D to report capital gains.

Easement: An intangible capital asset that reflects the purchased right to use land without ownership.

To complete a 1099 S, you need to provide:Filer's name, address, telephone number.Filer's tax identification number or social security number.Transferor's TIN/SSN.Transferor's name, address.Account number.Date of closing.Gross proceeds.Address or legal description of transferred property.More items...

For tax purposes, payments to secure a temporary or term easement are generally treated as rent payments. This means they are reported on Schedule E (Form 1040), Supplemental Income and Loss. They are treated as ordinary income, but not subject to self-employment tax.

All remitters are required to complete the applicable part(s) of Form 593 and submit Sides 1-3 to the Franchise Tax Board (FTB) regardless of real estate transaction.