Living Trust Forms For Florida

Description

How to fill out Virginia Notice Of Assignment To Living Trust?

Legal oversight can be overwhelming, even for the most knowledgeable professionals.

When you are looking for Living Trust Documents for Florida and lack the time to search for the correct and current version, the process can be challenging.

Tap into a database of articles, guides, manuals, and resources relevant to your situation and needs.

Save time and effort looking for the documents you require, and leverage US Legal Forms’ advanced search and Review feature to find Living Trust Documents for Florida and obtain it.

Ensure that the template is recognized in your state or county. Press Buy Now when ready. Select a subscription plan, choose the format you desire, and Download, fill out, eSign, print, and dispatch your document. Benefit from the US Legal Forms web repository, backed by 25 years of expertise and reliability. Streamline your daily document management into a straightforward and user-friendly process today.

- If you hold a subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents section to view the documents you previously stored and to manage your folders as you wish.

- If this is your initial experience with US Legal Forms, create an account to enjoy unrestricted access to all platform benefits.

- Here are the steps to follow after reaching the form you require.

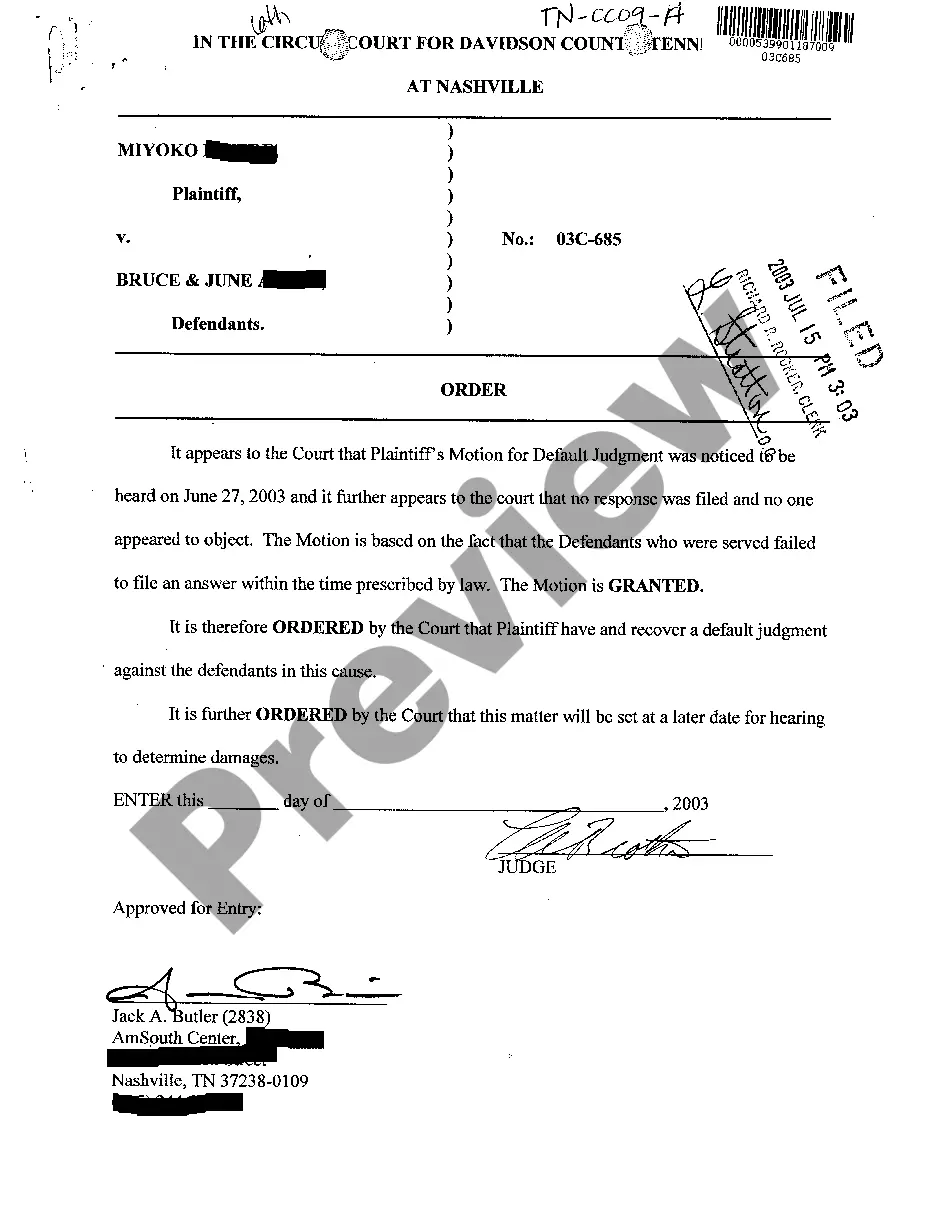

- Confirm that this is the correct document by previewing it and reviewing its details.

- Access state- or district-specific legal and business documents.

- US Legal Forms addresses all your needs, from personal to commercial records, all in one location.

- Utilize sophisticated tools to complete and manage your Living Trust Documents for Florida.

Form popularity

FAQ

You can absolutely do your own living trust in Florida with the proper tools at your disposal. Living trust forms for Florida are available online, enabling you to create a customized trust that fits your needs. With platforms such as USLegalForms, you gain access to user-friendly templates and clear instructions that make the process straightforward. This empowers you to take control of your estate planning without needing legal assistance.

Yes, you can create a trust without a lawyer in Florida using living trust forms for Florida. Many residents choose to handle this process independently, and with the right resources, it is manageable. Platforms like USLegalForms provide the necessary templates and guidance to help you complete the paperwork accurately. By utilizing these forms, you save time and potentially reduce costs.

No, you do not have to register a living trust in Florida. Instead, focus on properly completing your living trust forms for Florida and executing them correctly. While registration is not required, it is important to ensure your trust is funded and managed appropriately for your wishes to be honored. If you need help with the forms, consider using uslegalforms for guidance and easy access to the necessary documents.

A living trust does not need to be recorded or filed with a court in Florida. However, having your living trust forms for Florida accurately completed and executed is crucial. This ensures that your trust operates smoothly without any legal hindrances. Keep all original documents safe but accessible for future reference.

In Florida, you don't actually register a living trust with the state. Instead, fill out the necessary living trust forms for Florida and ensure they are properly executed. You should maintain these forms with your important documents, as they may be needed for your financial institutions or in case of legal issues. If you fund your trust by transferring assets into it, that is the most important step after creating the trust.

To file a living trust in Florida, you first need to complete the appropriate living trust forms for Florida. After filling out the forms, you must sign them in front of a notary public. It's also advisable to create a certification of trust to simplify the process for banks and institutions. Once completed, keep your documents in a safe location, but remember, you do not submit them to a court.

Creating a living trust in Florida involves several key steps. First, you need to gather necessary information and documents. Then, using our living trust forms for Florida, you can outline your wishes regarding the distribution of your assets. After completing the forms, you will need to fund the trust by transferring your assets into it, ensuring it functions effectively according to your intentions.

Putting your house in a trust in Florida can offer significant benefits. With living trust forms for Florida, you can help avoid probate, making the transfer of your property smoother for your heirs. Additionally, a trust can provide privacy, as it does not become public record like a will. Overall, placing your home in a trust can simplify management and distribution for your family.