Va Trust Guidelines

Description

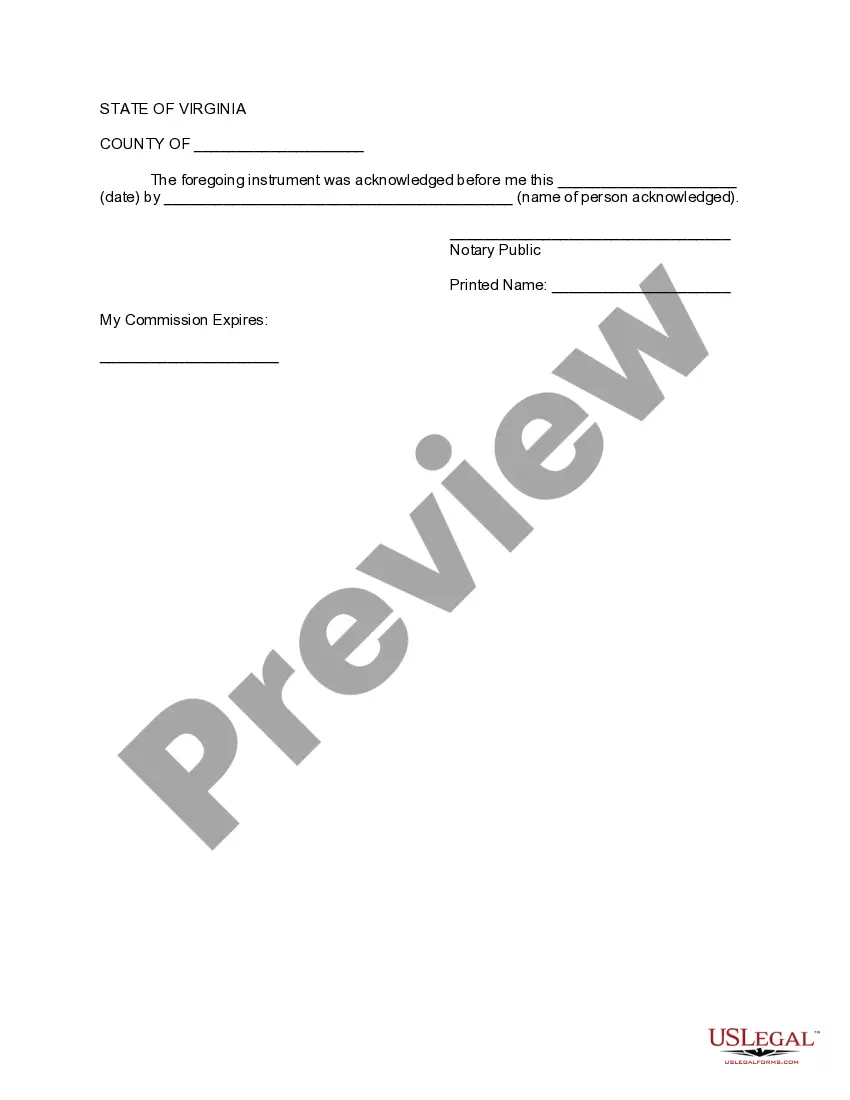

How to fill out Virginia Amendment To Living Trust?

It’s common knowledge that you cannot instantly become a legal authority, nor can you swiftly understand how to effectively formulate Va Trust Guidelines without a designated set of expertise. Assembling legal documents is a lengthy task that demands particular training and proficiency. So why not entrust the creation of the Va Trust Guidelines to the specialists.

With US Legal Forms, one of the most extensive legal template collections, you can access everything from courtroom paperwork to models for internal corporate communication. We recognize the significance of compliance and adherence to federal and state statutes and regulations. That’s why, on our platform, all templates are location-specific and up-to-date.

Here’s how you can initiate your journey with our platform and acquire the document you need in just minutes.

You can revisit your documents from the My documents section at any point. If you're an existing client, you can effortlessly Log In, and locate and download the template from the same area.

Regardless of the reason for your documentation—whether financial and legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Locate the document you require by utilizing the search bar at the summit of the page.

- Examine it (if this option is available) and review the accompanying description to determine if Va Trust Guidelines is what you seek.

- Re-initiate your search if you require another document.

- Sign up for a complimentary account and choose a subscription plan to purchase the template.

- Select Buy now. Once the transaction is completed, you can download the Va Trust Guidelines, complete it, print it, and send or mail it to the necessary individuals or organizations.

Form popularity

FAQ

The 5-year rule, related to an irrevocable trust, refers to how assets are treated for Medicaid eligibility and other benefits. If assets have been transferred to an irrevocable trust within five years of applying for benefits, they may be subject to penalties or delays in receiving care. Understanding this rule is essential for financial planning and aligns with the VA trust guidelines. It is wise to consult a legal professional for personalized advice regarding your situation.

In this case, the seller immediately becomes the lessee and the buyer the lessor. This lease agreement is more common among financial institutions and insurance companies. 3. Operating lease: This type of lease ensures the lessor retains all ownership rights over the asset.

Every equipment lease should include the following fundamental contract elements: Lessor: The equipment owner who will be renting out the equipment. Lessee: The renter who will be paying for the privilege to use the gear. Term: The length of time the lessee will lease the equipment.

An equipment lease agreement is a contractual agreement where the lessor, who is the owner of the equipment, allows the lessee to use the equipment for a specified period in exchange for periodic payments. The subject of the lease may be vehicles, factory machines, or any other equipment.

Equipment Lease Types Operating Leases. An operating lease is a contract that permits one company to use another company's equipment in exchange for fixed monthly payments over a specific period of time. ... Finance Leases (or Capital Leases) ... $1 Buyout Lease. ... Purchase Option Lease. ... Sale-Leaseback (or Leaseback) ... TRAC Lease.

For example, if a car dealership leases a vehicle to someone, the car is the asset. The person renting the car is the lessee and the dealership is the lessor. The lessee pays the dealership, or lessor, for the right to use the vehicle for an agreed-upon amount of time.

Equipment leasing means you're ?renting? the equipment, but the ownership of the equipment stays with the lender. Equipment financing means you're paying a portion of the purchase price of the equipment monthly (plus interest), but once all payments are made, you'll own the equipment.

A lessee is a person who rents land or property from a lessor. The lessee is also known as the ?tenant? and must uphold specific obligations as defined in the lease agreement and by law. The lease is a legally binding document, and if the lessee violates its terms they could be evicted.

Meaning of equipment leasing in English a system in which equipment is lent to a company for a particular period of time in return for regular payments: Equipment leasing can be successfully included in micro-finance.

For example, a manufacturer might lease a production machine under a capital lease because they'll use the equipment daily over a number of years. A company with a warehouse might lease forklifts for the same reason. Many capital leases allow the lessee to purchase the equipment at the end of the term.