Trust Tributação

Description

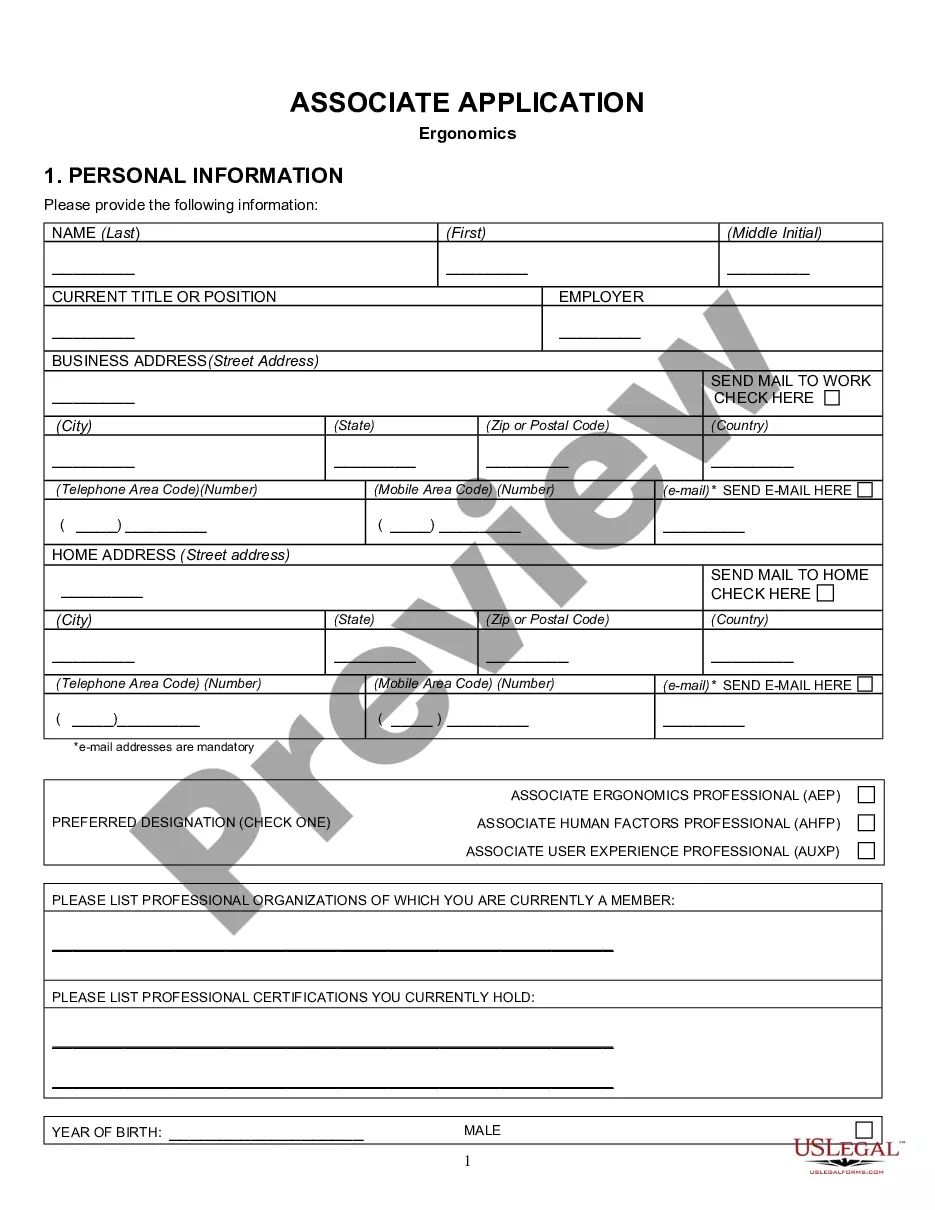

How to fill out Virginia Amendment To Living Trust?

- If you’re a returning user, log into your account on the US Legal Forms platform and click on the Download button for your preferred template. Verify that your subscription is active to proceed.

- For first-time users, begin by browsing the preview mode and descriptions of available forms. Confirm that you choose the one that satisfies your specific legal requirements and complies with local jurisdiction.

- Should you find discrepancies or need another document, utilize the Search tab to find alternatives. Make sure any new template meets your needs before continuing.

- Once you’ve selected the appropriate form, click on the Buy Now button and opt for the subscription plan that best fits your needs. You’ll need to create an account to access more resources.

- Provide your payment information, either through credit card or PayPal, to complete your purchase.

- After the payment is successful, download your chosen form onto your device. You can also revisit your saved documents anytime through the My Forms section in your account.

By utilizing US Legal Forms, you gain access to a diverse collection of over 85,000 customizable legal forms designed to empower individuals and attorneys alike. This extensive library not only ensures you find the right documents but also provides expert assistance to guarantee accuracy and compliance.

Start your journey today by signing up with US Legal Forms and simplify your legal documentation needs with confidence. Don’t wait—get your forms now!

Form popularity

FAQ

One of the biggest mistakes parents make when setting up a trust fund is not clearly defining the terms of the trust or the roles of the trustees. This oversight can lead to misunderstandings that may complicate trust tributação later on. Make sure to communicate your intentions clearly and seek guidance from legal services like uslegalforms to avoid these pitfalls.

To fill out a 1041 estate tax return, you need to gather all income details related to the estate, including any deductions you plan to claim. Understanding the rules of trust tributação will help you accurately report the estate's income or losses. Consider seeking assistance from tax professionals or resources from uslegalforms to ensure accuracy.

Filling out a trust fund involves several steps, including creating a written trust document and listing the assets to be included. It’s essential to specify the beneficiaries and their rights under trust tributação. Utilizing documents provided by platforms like uslegalforms can make this process straightforward and efficient.

Not all trusts need to file a tax return, but most do if they generate income. Under trust tributação, irrevocable trusts usually require a separate tax return, while revocable trusts often do not, assuming no income is generated. Always check with a tax advisor to clarify if your particular trust meets the criteria for tax filing.

The tax identification number for a grantor trust is typically the Social Security number of the grantor. This approach simplifies the tax reporting process under trust tributação. However, it’s crucial to consult with a tax professional to ensure that you are meeting all legal requirements associated with your specific trust situation.

Yes, you can set up a trust fund by yourself, but it's essential to understand the rules and implications of trust tributação. Doing so may involve paperwork, such as drafting a trust document and transferring assets. If you're unsure about the process, consider using legal platforms like uslegalforms, which provide templates and guidance to make the process easier.

Yes, an IL 1041, which is the Illinois Income Tax Return for Trusts, can be filed electronically. This electronic filing option makes it easier to comply with state tax requirements. It is advisable to check the state guidelines to ensure your trust tributação filing is accurate and timely.

Not all trusts are required to file IRS Form 1041. Generally, if a trust has taxable income or gross income of $600 or more, it must file. Understanding your specific trust's obligations regarding trust tributação will help ensure that you meet necessary filing requirements.

Failure to file a trust tax return can lead to penalties and interest on unpaid taxes, which may escalate over time. Additionally, the IRS may pursue further action if the trust does not comply with trust tributação rules. It is essential to file timely to avoid these complications.

To file a tax return for a trust, complete IRS Form 1041 with all necessary information, including income, deductions, and distributions. Make sure to provide accurate data to meet trust tributação requirements. If you’re unsure about the process, consider using platforms like Uslegalforms for helpful guidance.