Memorandum Of Lien Virginia Withholding

Description

Form popularity

FAQ

For the tax year, Virginia offers a standard deduction that varies based on your filing status. As of now, the standard deduction is set at $4,500 for single filers and $9,000 for married couples filing jointly. Understanding these deductions is vital as they directly impact your Virginia withholding and overall tax owed.

Withholding taxes in Virginia can be determined by your earnings and exemptions. Typically, employees review their VA 4 form to finalize the amount for tax withholding. To ensure accuracy and compliance, consider consulting tax guides from USLegalForms to streamline your understanding.

The amount you should withhold for Virginia state taxes depends on your income and personal situation. It's essential to complete the VA 4 form accurately, as this will guide your withholding amount based on your allowances. For tailored advice, utilizing resources like USLegalForms can significantly simplify the process.

Virginia withholding tax rates vary based on your income level. Generally, the state follows a progressive tax system with rates ranging from 2% to 5.75%. To calculate how much to withhold accurately, you can refer to the Virginia Department of Taxation or use tools available on platforms like USLegalForms.

Filling out the Virginia VA 4 form requires a few important steps. First, provide your personal details such as your name and address. Next, indicate your marital status and number of allowances, as these will affect your Virginia withholding amount. For specific guidelines, consider checking resources like USLegalForms for a reliable outline.

Whether you are subject to Virginia withholding depends on your employment status and the type of income you receive. Generally, if you work in Virginia and earn a wage, you are subject to withholding. To clarify your specific situation, considering consulting a tax professional or utilizing resources like USLegalForms can help.

Yes, Virginia does have a withholding tax system in place. This tax is deducted from employee wages and applies to different types of income. Understanding Virginia withholding is crucial for both employers and employees to ensure compliance with state laws while managing their finances effectively.

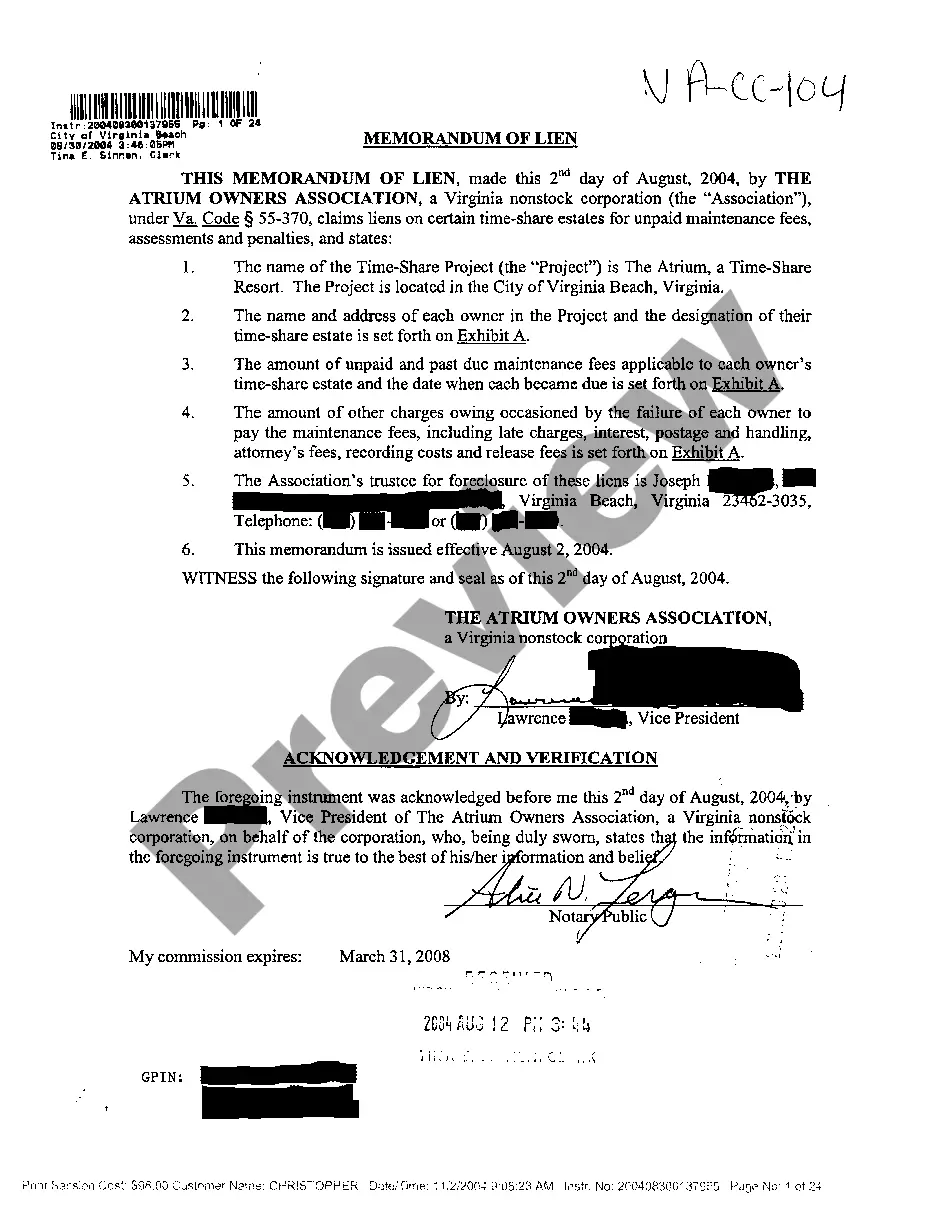

In Virginia, the priority of a lien is generally determined by the date it is officially recorded. A Memorandum of lien virginia withholding will establish the state's claim, usually taking precedence over other claims filed after it. This means that if multiple liens exist, the one recorded first typically has the highest priority in terms of repayment.

Virginia does indeed implement tax liens as a recovery method for unpaid taxes. If you owe back taxes, the state has the authority to file a lien, which can be documented through a Memorandum of lien virginia withholding. This lien will affect your credit and could hinder your ability to sell or refinance your property until the debt is cleared.

To determine if you owe state taxes in Virginia, you need to review your income and any potential deductions. If you have income sourced from Virginia, you are likely subject to state taxes. Keep in mind that a Memorandum of lien virginia withholding may also affect your tax liabilities if filed against your property. Consulting a tax professional can help clarify your specific situation.