Va Law Codes For 401

Description

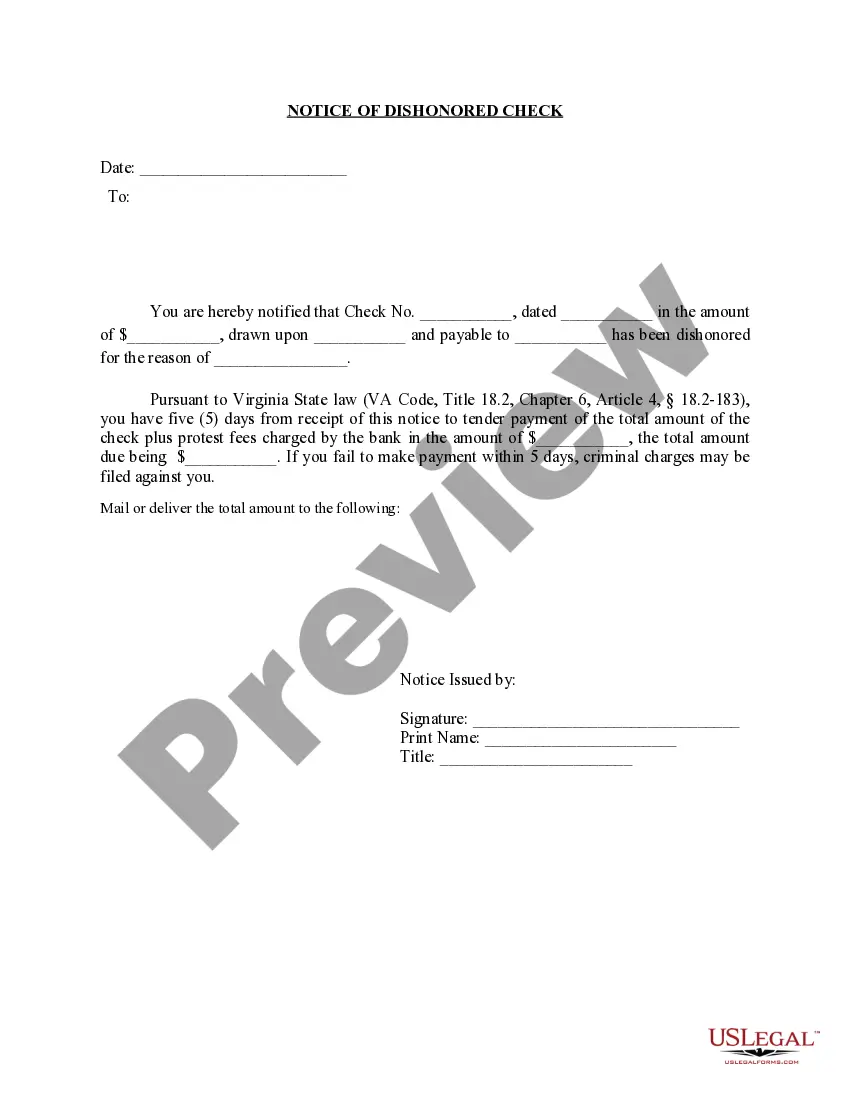

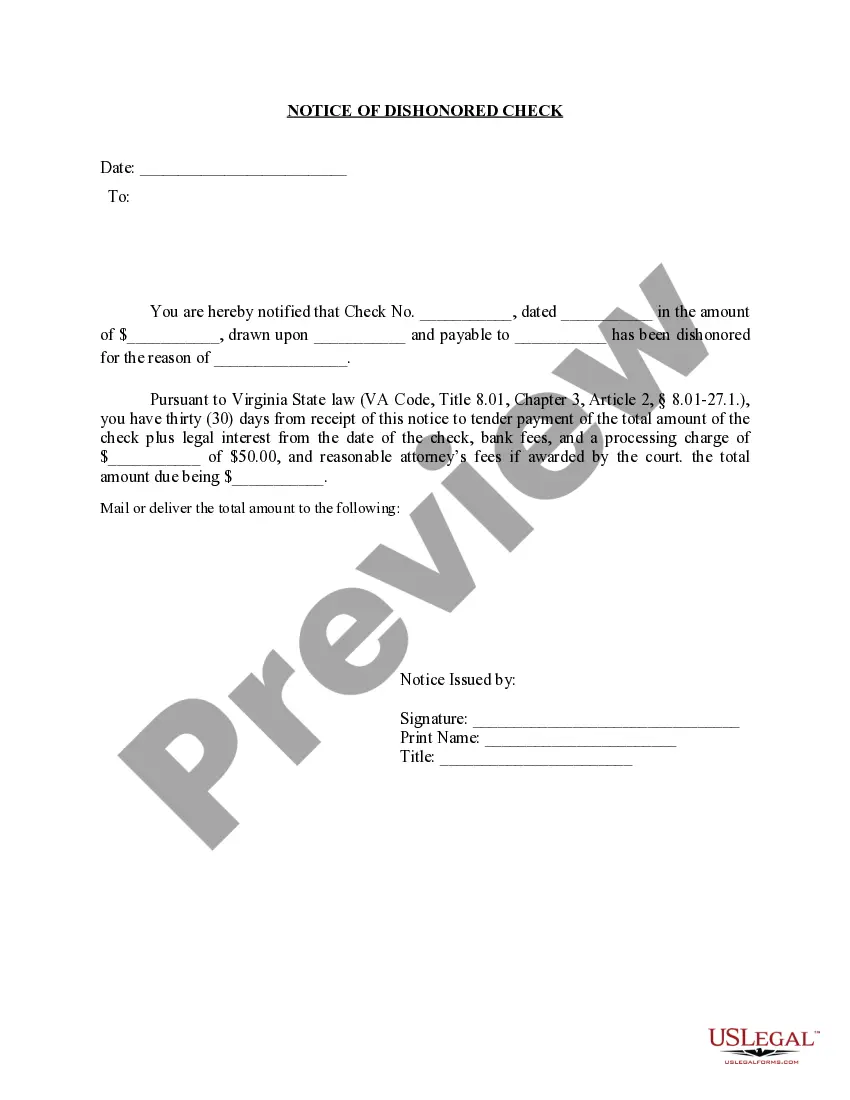

How to fill out Virginia Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Accessing legal documents that comply with federal and local regulations is crucial, and the internet presents numerous choices to select from.

However, what’s the point in squandering time looking for the suitable Va Law Codes For 401 example online if the US Legal Forms digital library already contains such documents collected in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable documents prepared by attorneys for any business and life scenario. They are simple to navigate with all forms organized by state and intended use. Our specialists keep up with regulatory updates, ensuring your documentation is always current and compliant when obtaining a Va Law Codes For 401 from our site.

All templates available through US Legal Forms are reusable. To re-download and complete previously acquired documents, access the My documents section in your account. Enjoy the most extensive and user-friendly legal documentation service!

- Examine the template using the Preview function or via the textual description to confirm it suits your requirements.

- Search for another example using the search bar at the top of the page if necessary.

- Click Buy Now when you’ve discovered the correct document and choose a subscription plan.

- Create an account or Log In and process a payment using PayPal or a credit card.

- Select the appropriate format for your Va Law Codes For 401 and download it.

Form popularity

FAQ

Similarly, both parents signing an Acknowledgment of Paternity (AOP) form under oath establishes paternity for that child. This is most often done in the hospital when the child is born. Among other benefits for the child, signing an AOP ensures that the child's original birth certificate includes the father's name.

In the Commonwealth of Virginia, if parents are not legally married at the time of birth, the biological father's name will not appear on his child's birth certificate unless they establish paternity.

Determining Paternity without a DNA Test? Date of Conception. There are ways to estimate date of conception, which can be found all over the web. ... Eye-Color Test. An eye-color paternity test shows how eye color and inherited-trait theory can be used to help estimate paternity. ... Blood-Type Test.

§ 20-49.1. How parent and child relationship established. A. The parent and child relationship between a child and a woman may be established prima facie by proof of her having given birth to the child, or as otherwise provided in this chapter.

A judgment establishing a father's paternity made by a court having jurisdiction to determine his paternity is sufficient evidence of paternity for the purposes of this section.

Acknowledgement of Paternity You likely can obtain the AOP form at the hospital where your child's birth occurs. If not, you can obtain one at your local health department. Both you and your child's mother will need to sign this form in front of a notary public.

§ 63.2-1913. Paternity may be established by a written statement of the father and mother made under oath acknowledging paternity or scientifically reliable genetic tests, including blood tests, which affirm at least a ninety-eight percent probability of paternity.

Can You Sue for False Paternity in California? Yes, a man can sue the child's mother if she lied about him being the father. ing to the statute of limitations in California, filing a petition to disestablish paternity is five years.