Gift Deed Form For Texas

Description

How to fill out Virginia Deed Of Gift - Husband And Wife Or Two Individuals To Indvidual?

Managing legal papers and processes can be a lengthy addition to your day.

Gift Deed Form For Texas and similar documents often require you to locate them and figure out how to fill them out correctly.

Thus, whether you're handling financial, legal, or personal issues, having a comprehensive and accessible online collection of forms at your disposal will be immensely beneficial.

US Legal Forms is the leading online resource for legal templates, providing over 85,000 state-specific documents and a range of tools to help you finalize your papers swiftly.

Is it your first time using US Legal Forms? Sign up and create an account in a few minutes to gain access to the form library and Gift Deed Form For Texas. Then, follow the steps outlined below to complete your document: Ensure you have the correct form using the Preview feature and reviewing the form description. Choose Buy Now when ready, and select the monthly subscription plan that fits you. Click Download then fill out, sign, and print the form. US Legal Forms has twenty-five years of experience helping users manage their legal documents. Locate the form you need today and streamline any process effortlessly.

- Browse the collection of relevant documents available to you with a single click.

- US Legal Forms provides you with state- and county-specific forms available for download at any time.

- Protect your document management processes by utilizing a premium service that allows you to prepare any form within minutes without additional or concealed charges.

- Simply Log In to your account, search for Gift Deed Form For Texas and obtain it instantly from the My documents section.

- You can also access previously stored forms.

Form popularity

FAQ

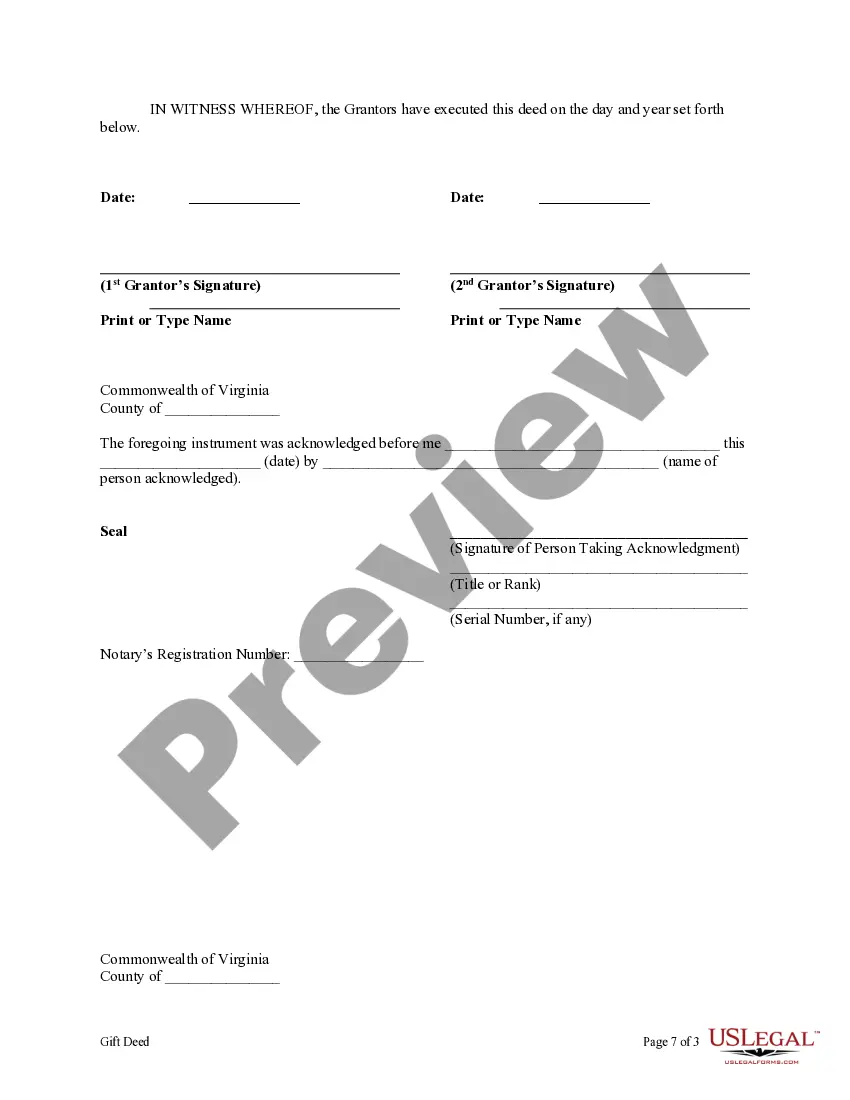

Filling out a gift deed in Texas requires specific information to ensure its validity. Begin by including the names of both the donor and the recipient, along with their addresses. Next, accurately describe the property being gifted, and ensure the gift deed form for Texas is signed and notarized. Utilizing US Legal Forms can simplify the process, guiding you through each step to create a legally sound document.

Common mistakes in gift deeds often involve incomplete information or incorrect details. For instance, failing to include the legal description of the property can lead to confusion. Additionally, not having the gift deed form for Texas properly notarized can invalidate the transfer. It is crucial to use a reliable platform like US Legal Forms to ensure your gift deed form is accurate and compliant with Texas laws.

To transfer ownership of a house to a family member in Texas, you should use a gift deed form for Texas. Begin by filling out the form with all necessary details, including the property description and the names of both parties. After completing the form, sign it in front of a notary, and then file it with the county clerk’s office. This process ensures the transfer is legally binding and protects everyone involved.

In Texas, a gift deed must meet certain requirements to be valid. First, it should clearly identify the property being gifted and the recipient. Additionally, both the giver and recipient must sign the gift deed form for Texas. It is advisable to have the deed notarized to avoid any disputes in the future.

Yes, you can gift a house to someone in Texas. To do so, you will need to complete a gift deed form for Texas. This legal document allows you to transfer ownership without expecting anything in return. It’s important to follow the proper procedures to ensure the transfer is valid and recognized by the state.

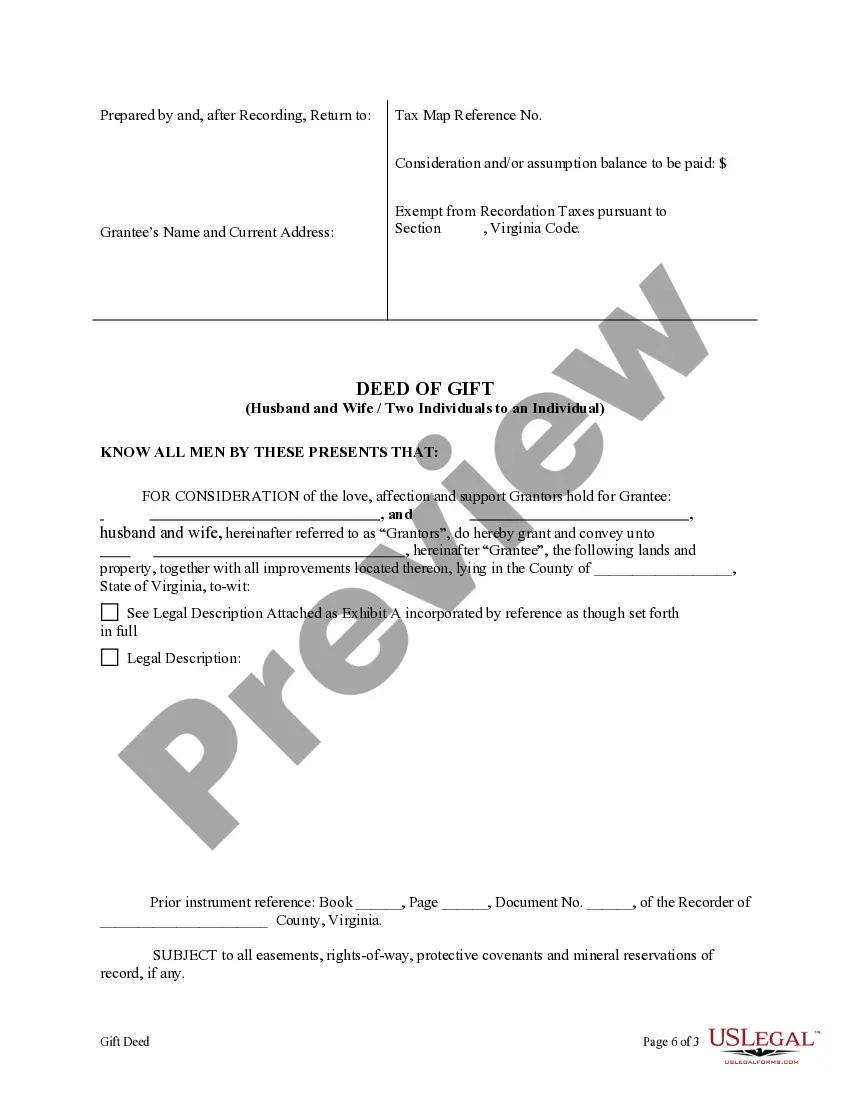

All transfers of real estate in Texas are either in exchange for something, such as money or services, or for no money or services, which is a Gift Deed. Using this deed to transfer real estate property is the same as any other deed, except there is no money or services given for the transfer. The property is free.

The Gift Deed needs to be in writing. It must include the full name of the current owner and the full name, mailing address and vesting of the new owner. The property needs to be properly described.

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

However, Texas does not impose a gift tax on transfers of real estate between family members nor is there a capital gains tax in Texas, so you may only be liable for federal taxes. When transferring a house after death through a will or trust, estate taxes may come into play.

The County Clerk only requires an Affidavit of Death to make the transfer effective. You do not need additional proof of death to take ownership. However, you must give the title company a death certificate, obituary, or other acceptable document if you want to sell the property or use it as collateral.