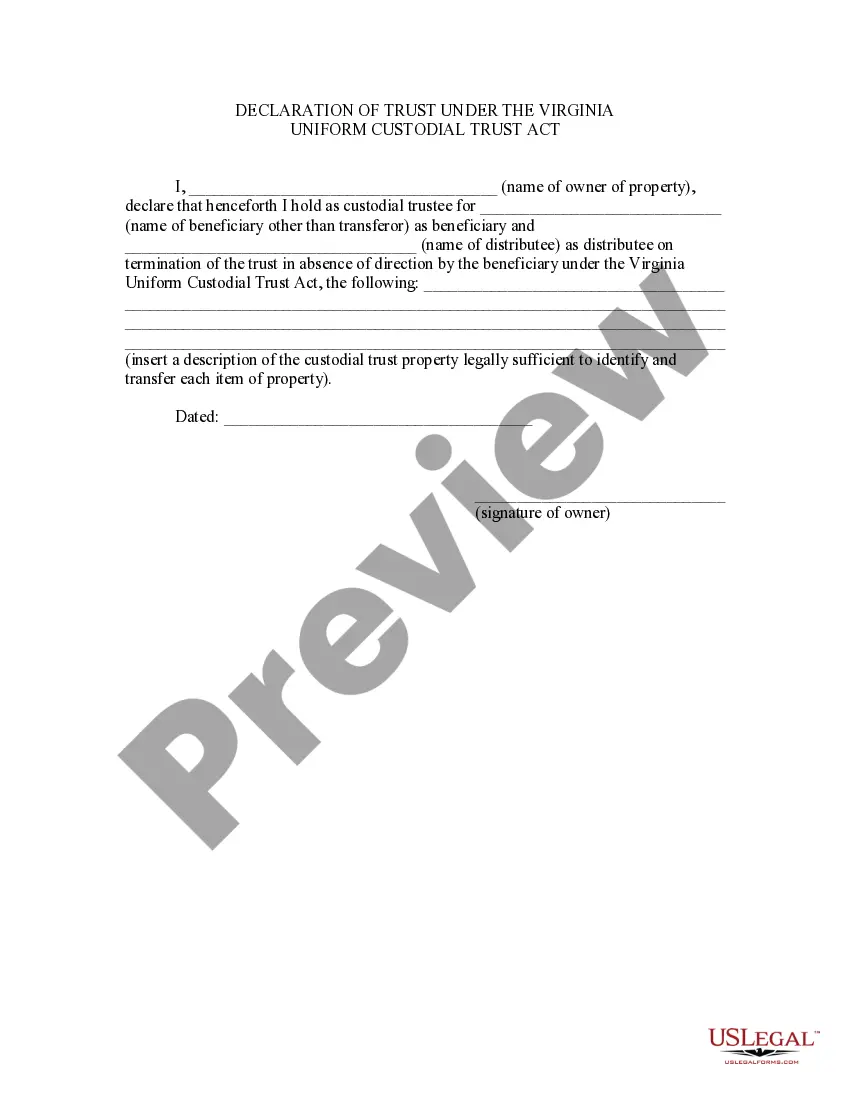

This is a sample form for use in Virginia matters involving trusts, a Declaration of Trust - Uniform Custodial Trust Act. Under § 55-34.2 of the Virginia Uniform Custodial Trust Act, a person may create a custodial trust of property by a written declaration, evidenced by registration of the property if the property is of a type subject to registration, or by other instrument of declaration executed in any lawful manner, describing the property and naming as beneficiary an individual other than the declarant, in which the declarant as titleholder is designated, in substance, as custodial trustee under this chapter. A registration or other declaration of trust for the sole benefit of the declarant is not a custodial trust under this chapter.

Uniform Custodial Trust Act Withdrawal

Description

Form popularity

FAQ

When a child turns 18, the Uniform Custodial Trust Act allows them to take control of their UTMA account. At this age, the custodianship ends, and the child can withdraw the funds as they see fit. It's essential for parents and guardians to educate their children about responsible financial management during this transition. For those seeking guidance on the withdrawal process, US Legal Forms offers resources and templates to facilitate a smooth transfer and understanding of the Uniform custodial trust act withdrawal.

An UCTA account, or Uniform Custodial Trust Act account, is a financial account created to hold and manage assets for a minor or an individual who cannot legally manage their own funds. This account allows for the custodian to make withdrawals as per the guidelines of the Uniform Custodial Trust Act. Such an account typically provides tax benefits and simplifies the process of transferring assets. By utilizing uslegalforms, you can easily set up and manage an UCTA account to ensure compliance and security.

A custodial trust operates by designating a custodian to manage assets on behalf of a minor or an individual who cannot manage their own finances. The custodian handles investments, distributions, and any necessary withdrawals while adhering to the Uniform Custodial Trust Act. By following this act, the custodian ensures that funds are used responsibly until the beneficiary reaches a certain age or condition. This structure promotes financial security and ease of management.

Section 603 of the Uniform Trust Code focuses on the rights and responsibilities of trustees regarding income and principal. This section is crucial for understanding how a trust can distribute assets, particularly during a Uniform custodial trust act withdrawal. Comprehending these provisions can lead to better decision-making and asset management.

A custodial account can indeed be placed within a trust framework. This approach often protects the assets more robustly while allowing for controlled access as per the trust's terms. Understanding the implications of the Uniform custodial trust act withdrawal can help you navigate this arrangement smoothly.

Once a child turns 21, the custodial account must transition to the child as they are legally entitled to the funds. You can guide them in managing their new financial responsibilities effectively. Keeping the Uniform custodial trust act withdrawal provisions in mind can assist during this transition to ensure compliance.

The Uniform Trust Code is a comprehensive legal framework governing the establishment and management of trusts. It offers essential guidelines for trustees and beneficiaries, ensuring their rights and responsibilities are clearly defined. Familiarizing yourself with the Uniform custodial trust act withdrawal guidelines within this code enhances trust administration.

The UTC code refers to the Uniform Trust Code, which standardizes trust laws. It aims to improve the administration and regulation of trusts, providing clarity and consistency across jurisdictions. This code is particularly relevant when navigating issues related to Uniform custodial trust act withdrawal.

Yes, an UTMA account can be transferred to a trust. This transition allows for more comprehensive management of the funds under trust provisions, safeguarding them until the child reaches adulthood. Proper guidance through the Uniform custodial trust act withdrawal is essential when executing this process.

Uniform Trust Code 411 outlines the requirements related to trust modification and termination. It provides clarity on how trusts can be adjusted based on changing circumstances or beneficiary needs. Engaging with this code may prove beneficial during a Uniform custodial trust act withdrawal.