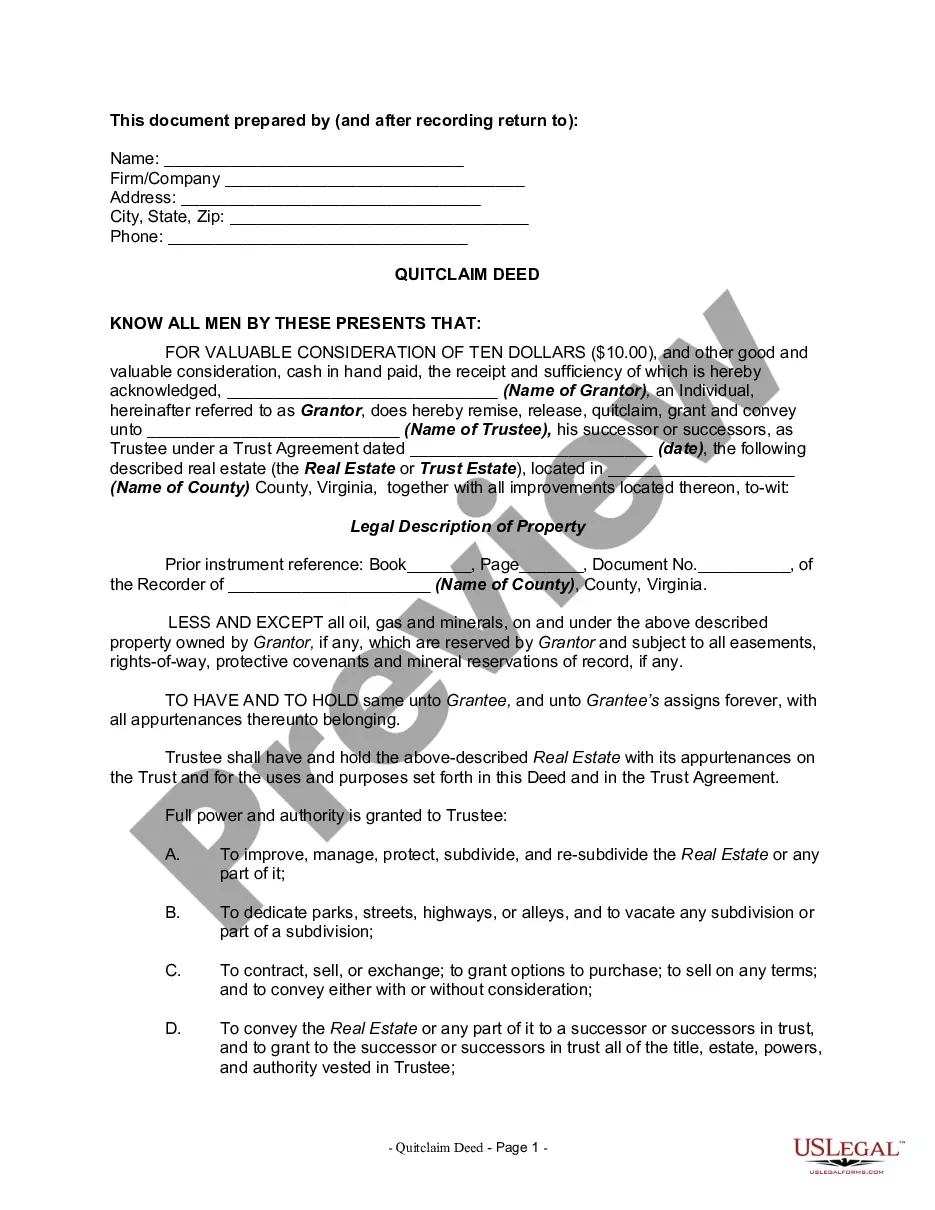

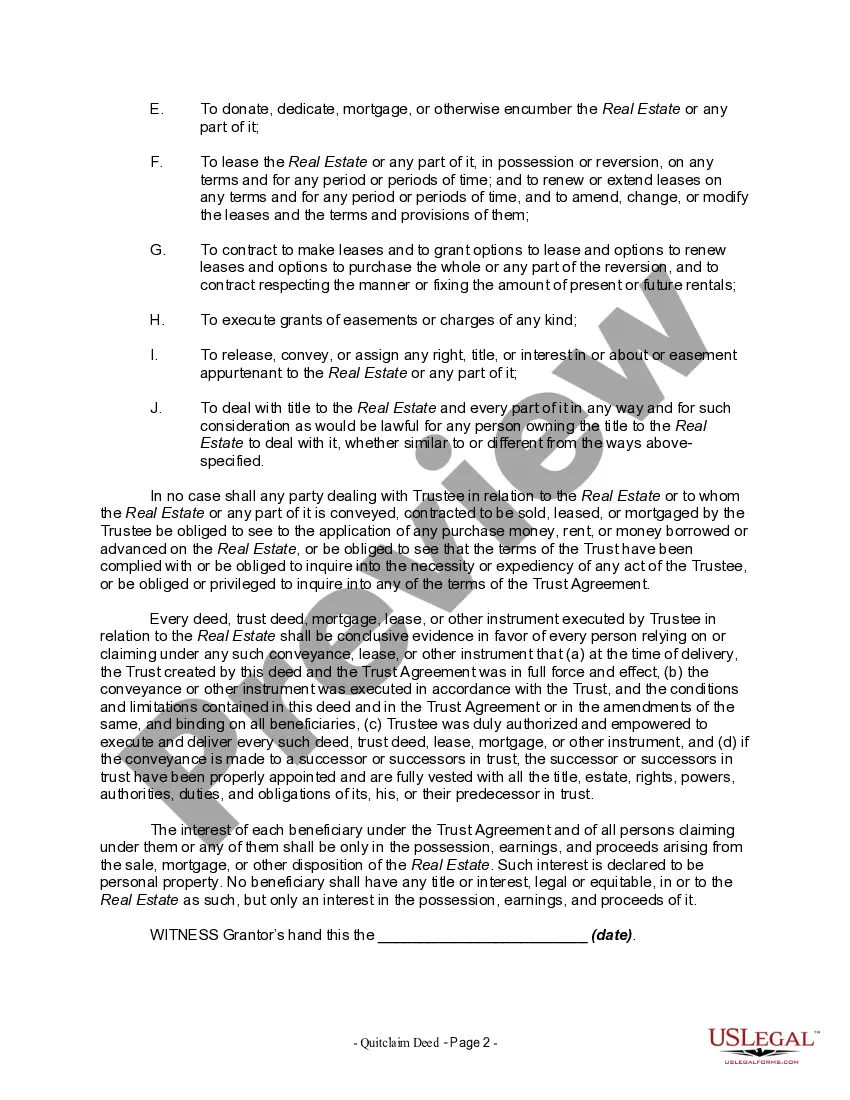

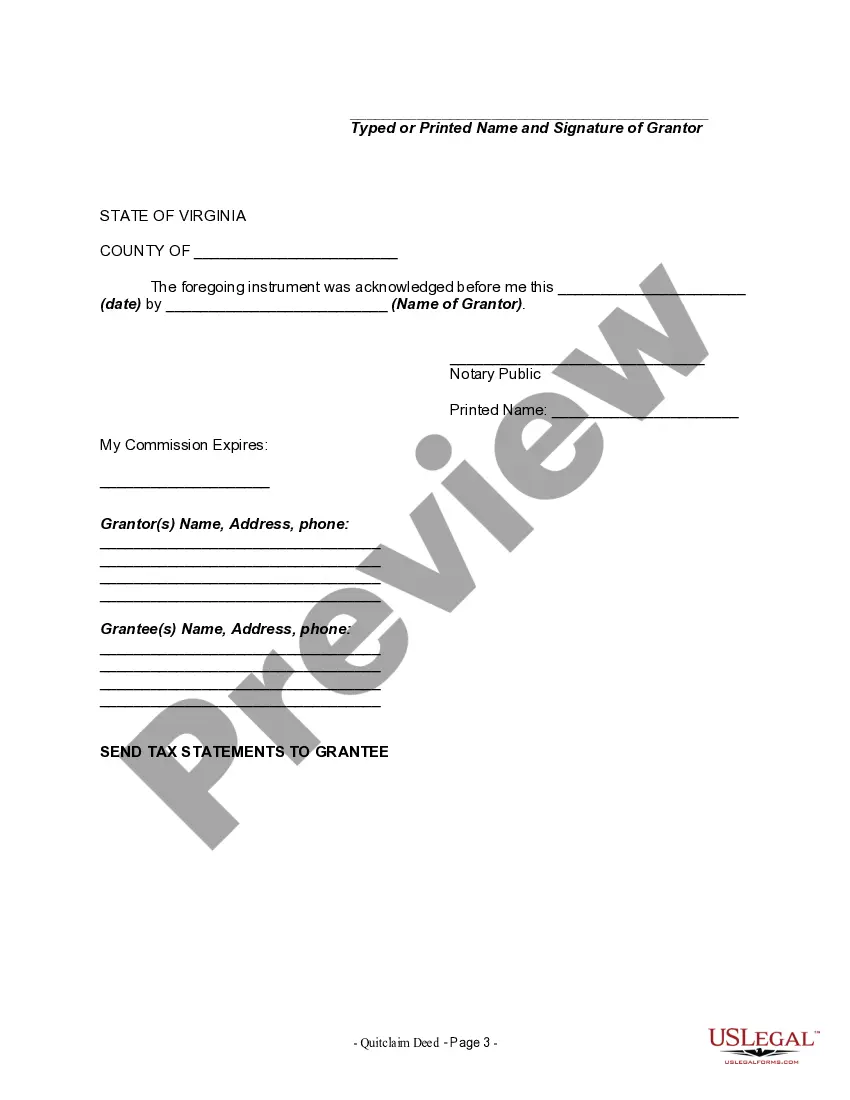

A land trust is a device by which land is conveyed to a trustee for the benefit of another. The Trust is formed when the document is created and executed. The Trust is then funded when the property is put into the Trust and the deed into Trust recorded in the public record. Only when the trust is funded is it a valid trust.

Virginia is one of a very few states that have a specific land trust statute laws. In other states, the land trust is a matter of "contract law". Unlike many trusts the beneficiary does not hold equitable title but controls the trustee with written direction to act. A land trust is normally a revocable trust which means that the beneficiary can direct the trustee to remove the property from trust.