Trust Deed Form With Protector

Description

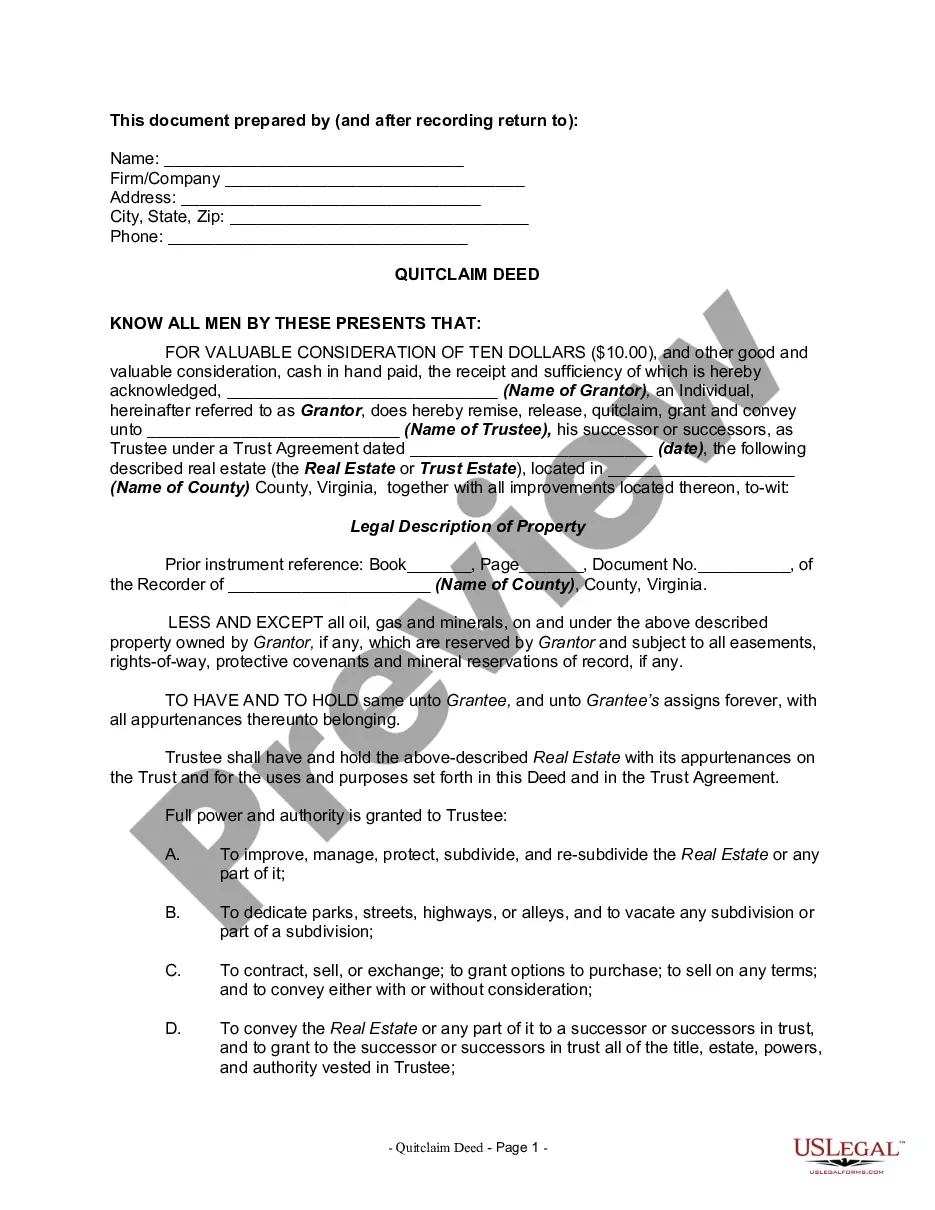

How to fill out Virginia Land Trust - Quitclaim Deed?

There's no longer a reason to squander hours searching for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in one location and simplified their availability.

Our website provides over 85,000 templates for any business and personal legal situations categorized by state and purpose.

Use the Search bar above to find another sample if the previous one did not suit you.

- All forms are expertly crafted and verified for accuracy, ensuring you receive an up-to-date Trust Deed Form With Protector.

- If you are acquainted with our service and already possess an account, make sure your subscription is active before accessing any templates.

- Click Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents whenever needed by navigating to the My documents tab in your profile.

- If you have never used our service before, the procedure will involve a few additional steps.

- Here’s how new users can find the Trust Deed Form With Protector in our collection.

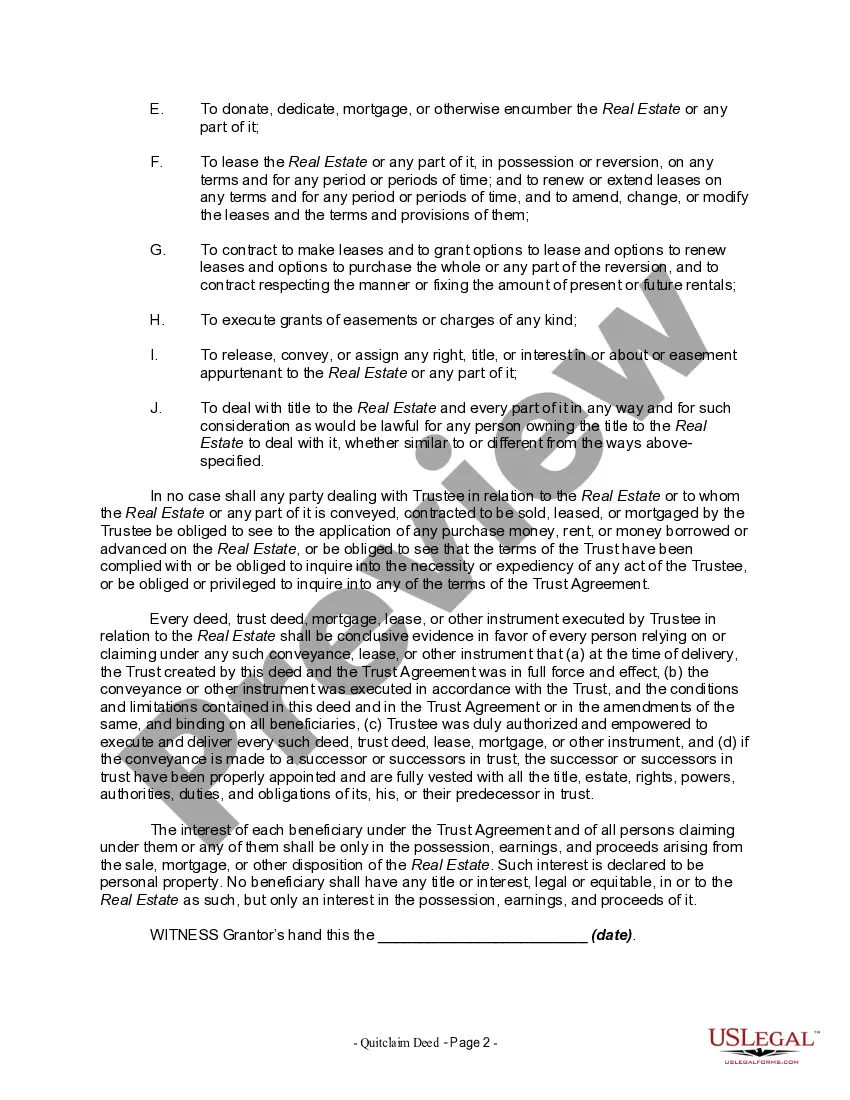

- Examine the page content closely to confirm it includes the sample you need.

- To assist with this, make use of the form description and preview options if available.

Form popularity

FAQ

If you stop paying your trust deed, it can lead to serious consequences, including potential loss of assets held in trust. The trustee may take action to enforce the terms of the trust, which could result in legal repercussions. By using a trust deed form with protector from US Legal Forms, you can gain insights into your obligations, making it easier to manage payments and avoid default.

A trust deed is a legal document that sets up a trust, while a protected trust deed offers additional security and benefits for the debtor. The protected version usually has more stringent regulations to safeguard the creditor’s rights. If you are using a trust deed form with protector, you can better navigate the differences, ensuring that you select the appropriate type of trust for your specific needs.

A trust deed typically lasts for the duration specified in the trust agreement, which can vary greatly. In general, it remains valid until the trust's purpose is fulfilled or terminated. When you create a trust deed form with protector, you can specify duration and conditions, providing clarity and security for beneficiaries.

Yes, obtaining a mortgage after establishing a trust deed is feasible, but it may come with complexities. Lenders often assess the trust’s terms and the borrower's financial status. Using a trust deed form with protector can help clarify the terms and ensure that all parties involved are informed, which may facilitate the mortgage process.

The protector and appointor serve different roles in a trust setup. A protector oversees the trust, ensuring it operates according to the grantor’s wishes and can make changes if necessary. On the other hand, the appointor has the authority to appoint or remove trustees. If you are considering a trust deed form with protector, it’s important to understand how these roles create a balance of power in managing a trust.

A protector in a trust serves as an additional safeguard, overseeing the actions of the trustee and ensuring adherence to the trust's objectives. Their role often includes approving significant decisions and providing guidance to manage the trust effectively. Including a protector in your trust deed form with protector can add an extra layer of security and peace of mind for all parties involved.

Requirements for a trust deed can vary by state, but generally, you need a clearly defined grantor, trustee, and beneficiaries. Additionally, the trust deed form with protector should be signed and dated by the grantor and may require witnesses or notarization. Be sure to understand your state's specific regulations to ensure legal compliance.

A trust deed typically includes essential elements like the names of the trustee and beneficiaries, details about the trust property, terms of administration, and a clause regarding the protector's role. To create a comprehensive trust deed form with protector, ensure all relevant details are precise. This clarity helps prevent disputes and misinterpretations in the future.

A trust is a legal arrangement where one party holds property for the benefit of another, while a trust deed is a formal document that outlines the terms of that trust. The trust deed form with protector is crucial because it establishes the roles, responsibilities, and protections for all parties involved. Understanding these differences can help you make informed decisions about estate planning.

To obtain a trust deed form with protector, start by identifying your specific requirements. You can access various online platforms that offer templates, such as US Legal Forms, which provides customizable options. Simply choose the right form, fill in the required information, and ensure you have the appropriate witnesses or notarization as needed.