Transfer On Death Deed Form Virginia With Iowa

Description

How to fill out Virginia Revocable Transfer On Death Deed From Individual To Individual?

Creating legal documents from the beginning can frequently be somewhat daunting.

Certain cases may require numerous hours of investigation and substantial financial expenditure.

If you’re looking for a simpler and more economical approach to produce Transfer On Death Deed Form Virginia With Iowa or any other documents without unnecessary complications, US Legal Forms is always accessible.

Our digital repository featuring over 85,000 contemporary legal documents addresses nearly every aspect of your financial, legal, and personal needs. With merely a few clicks, you can promptly access state- and county-compliant templates meticulously crafted for you by our legal professionals.

Examine the form preview and descriptions to confirm that you have the correct form, ensure that the template you select complies with your state's and county's laws, choose the appropriate subscription plan to acquire the Transfer On Death Deed Form Virginia With Iowa, and proceed to download the form. Afterward, fill it out, sign it, and print it. US Legal Forms enjoys a strong reputation and over 25 years of expertise. Join us now and make document preparation easy and efficient!

- Utilize our platform whenever you require trustworthy and dependable services for swiftly locating and downloading the Transfer On Death Deed Form Virginia With Iowa.

- If you’re already familiar with our services and have registered an account with us before, simply Log In to your account, select the form, and download it immediately or re-download it later in the My documents section.

- Not registered yet? No worries. Setting up an account takes very little time, allowing you to explore the library.

- However, before rushing to download the Transfer On Death Deed Form Virginia With Iowa, adhere to these suggestions.

Form popularity

FAQ

Transfer-on-death real estate, vehicles in Iowa In Iowa, transfer-on-death deeds or registration is not allowed for real estate or vehicles.

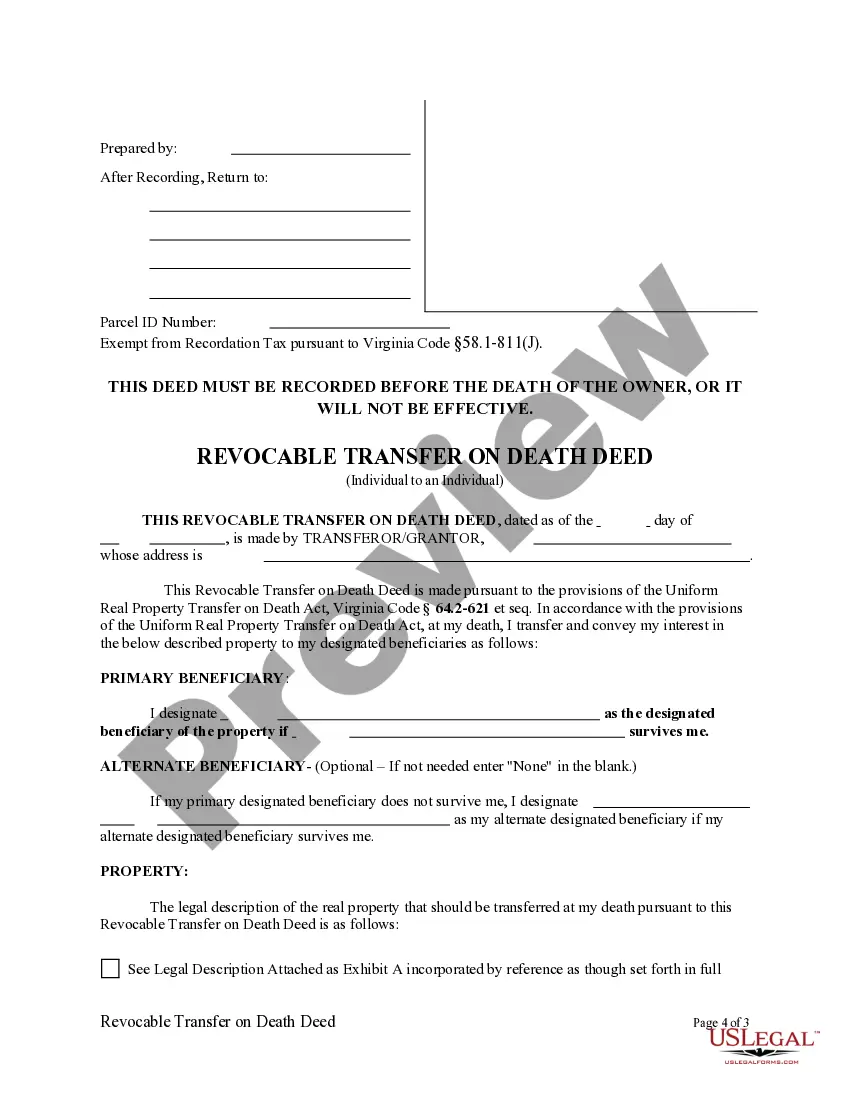

You must sign the deed and get your signature notarized, and then record (file) the deed with the circuit court clerk's office before your death. Otherwise, it won't be valid. You can make a Virginia transfer on death deed with WillMaker.

§ 64.2-624. An individual may transfer property to one or more beneficiaries effective at the transferor's death by a transfer on death deed.

Real Estate and TOD in Iowa In Iowa, real estate can be transferred via a TOD deed, also known as a beneficiary deed. This deed allows a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

Virginia residents who own real estate property can use a transfer on death deed (TODD) to automatically transfer property directly to beneficiaries upon the owner's death. This can be a good estate planning strategy , especially for those whose primary asset is their house and they do not have much other property.