Como Llenar Un Título De Carro En Virginia Without

Description

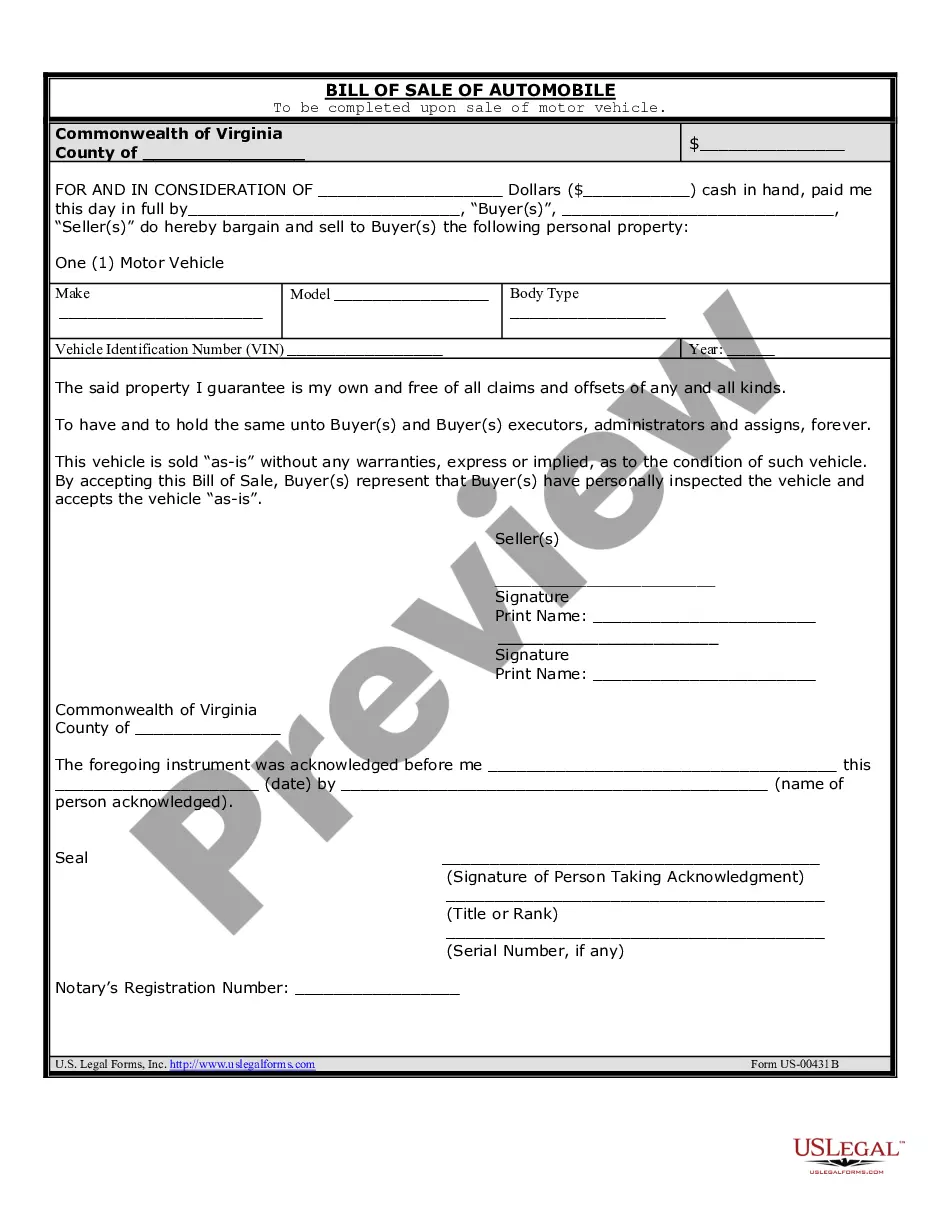

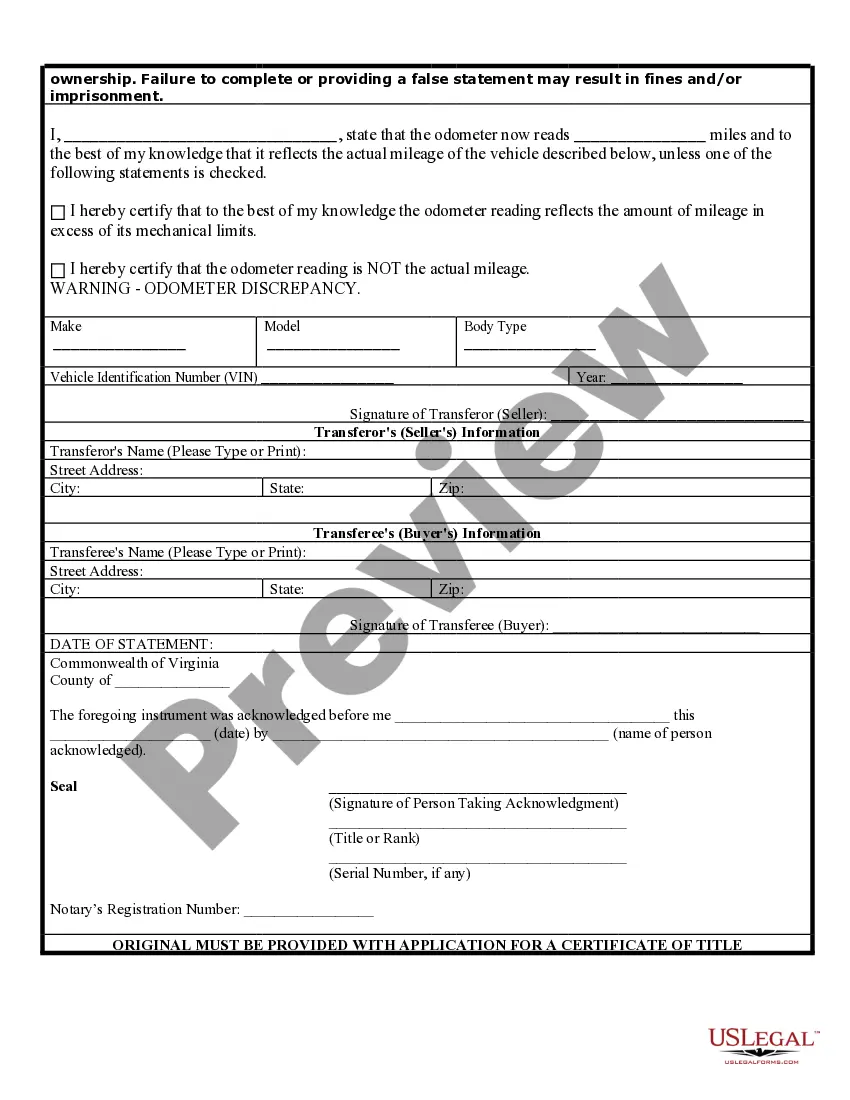

How to fill out Virginia Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

It’s widely known that you can’t become a legal authority in a short period, nor can you understand how to swiftly draft Como Llenar Un Título De Carro En Virginia Without without possessing a specific set of competencies.

Assembling legal documents is a lengthy process that necessitates specialized education and expertise. Therefore, why not entrust the creation of the Como Llenar Un Título De Carro En Virginia Without to the specialists.

With US Legal Forms, one of the largest collections of legal templates available, you can discover everything from court paperwork to templates suitable for in-office correspondence. We acknowledge the significance of compliance with federal and local regulations.

Create a free account and select a subscription option to buy the form.

Click Buy now. Once the payment is processed, you can access the Como Llenar Un Título De Carro En Virginia Without, complete it, print it, and send or mail it to the appropriate individuals or organizations. You can revisit your documents from the My documents section at any time. If you’re a returning user, simply Log In and locate and download the template from the same section. Regardless of your forms' intent—whether financial, legal, or personal—our site has everything you need. Try US Legal Forms today!

- That’s why, on our platform, all forms are tailored to specific locations and are current.

- Begin by visiting our website and obtaining the document you require in just a few minutes.

- Locate the document you need using the search bar located at the top of the page.

- Review it (if this option is available) and examine the supporting description to determine if Como Llenar Un Título De Carro En Virginia Without is what you want.

- If you need a different form, restart your search.

Form popularity

FAQ

North Dakota Wage Garnishment Rules Except for a child or spousal support order, bankruptcy order, or tax levy, the maximum that employers can withhold is the lesser of? 25% of disposable earnings or the amount by which weekly disposable earnings exceed 40 times the federal minimum wage.

North Dakota is more protective of low-income debtors than federal law. The state only allows the lesser of the following to be garnished: 25% of disposable income (same as federal law,)

Writ of Garnishment in North Dakota The creditor goes to a court to enforce the judgment. It will apply in writing for garnishment as remedy, in its application stating that it has a judgment for money which the debtor has not paid, and therefore that garnishment is necessary.

North Dakota follows federal law in terms of how much of your disposable income can be garnished by a creditor. Creditors can garnish whichever is less: 25% of your weekly disposable income, or. The amount by which your weekly income exceeds 40 times the federal minimum wage.

The judgment creditor must apply for a writ of execution in the same North Dakota county that ordered the judgment. For foreign judgments registered in North Dakota, the judgment creditor must apply for a writ of execution in the same North Dakota county where the foreign judgment is registered.

Title III allows up to 50% or 60% of disposable earnings to be garnished for this purpose. A garnishment order for the collection of a defaulted consumer debt is also served on the employer.

North Dakota wage garnishment laws Amount limitations: In North Dakota, the maximum amount that can be garnished from your earnings is less than 25% of disposable earnings or disposable income exceeding 40 times the federal minimum wage per week ($290).

The statute of limitations for actions on notes and contracts, including credit card debt, is six years.