Utah Promissory Note With Collateral Sample

Description

How to fill out Utah Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

What is the most reliable service to obtain the Utah Promissory Note With Collateral Sample and other updated versions of legal forms.

US Legal Forms is the answer! It's the finest collection of legal templates for any situation.

If you don't yet have an account, follow these steps to create one: Form compliance verification. Before acquiring any document, ensure it meets your specific requirements and complies with your state or county regulations. Review the form description and utilize the Preview if it's available. Alternative document search. If there are any discrepancies, use the search bar at the top of the page to find another form. Click Buy Now to select the appropriate one. Account registration and subscription payment. Choose the best pricing plan, Log In or register your account, and process your subscription payment through PayPal or credit card. Document download. Choose the format in which you want to save the Utah Promissory Note With Collateral Sample (PDF or DOCX) and click Download to retrieve it. US Legal Forms is an ideal resource for anyone needing to handle legal paperwork. Premium subscribers can enjoy additional benefits as they can complete and sign previously saved documents electronically at any time using the integrated PDF editing tool. Check it out now!

- Each document is professionally drafted and confirmed for adherence to federal and local laws.

- They are organized by field and jurisdiction, making it easy to find what you need.

- Experienced users of the platform simply need to Log In, verify their subscription status, and click the Download button next to the Utah Promissory Note With Collateral Sample to access it.

- Once saved, the document remains available for future reference in the My documents section of your account.

Form popularity

FAQ

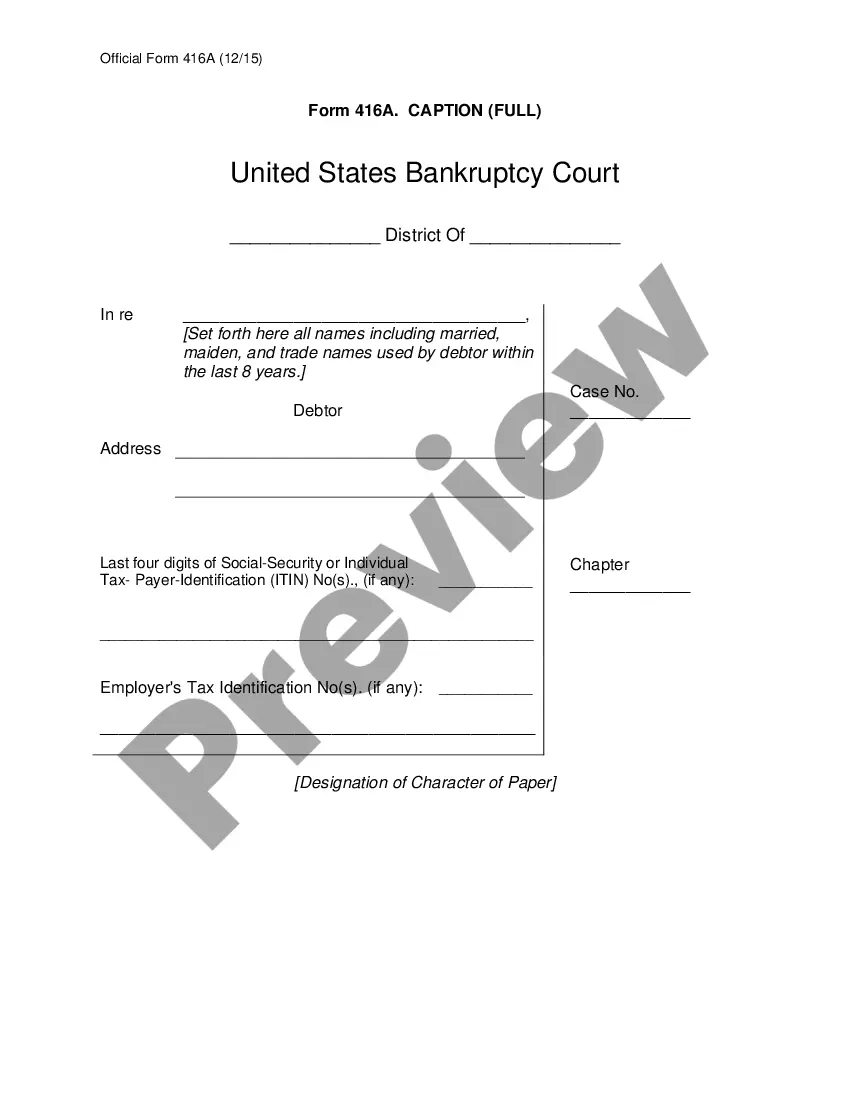

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

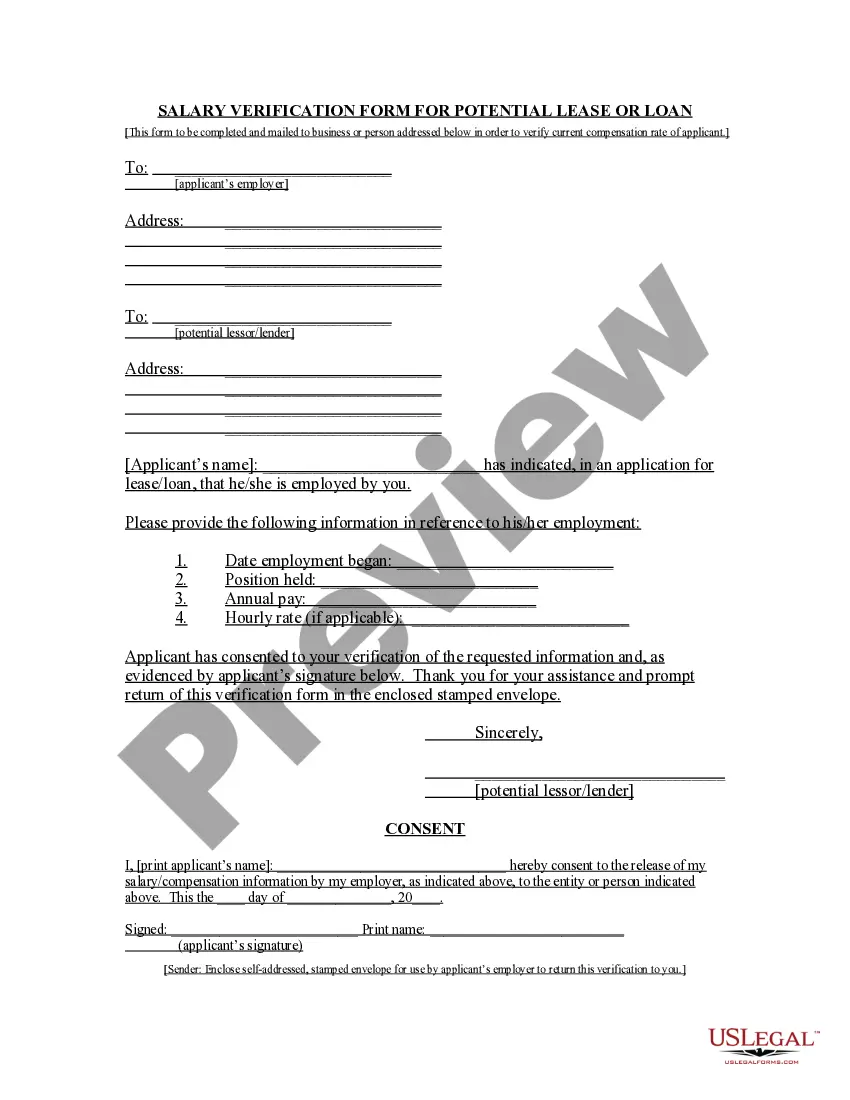

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Secured Promissory NotesThe property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.