Small Estate Affidavit Form Indiana

Description

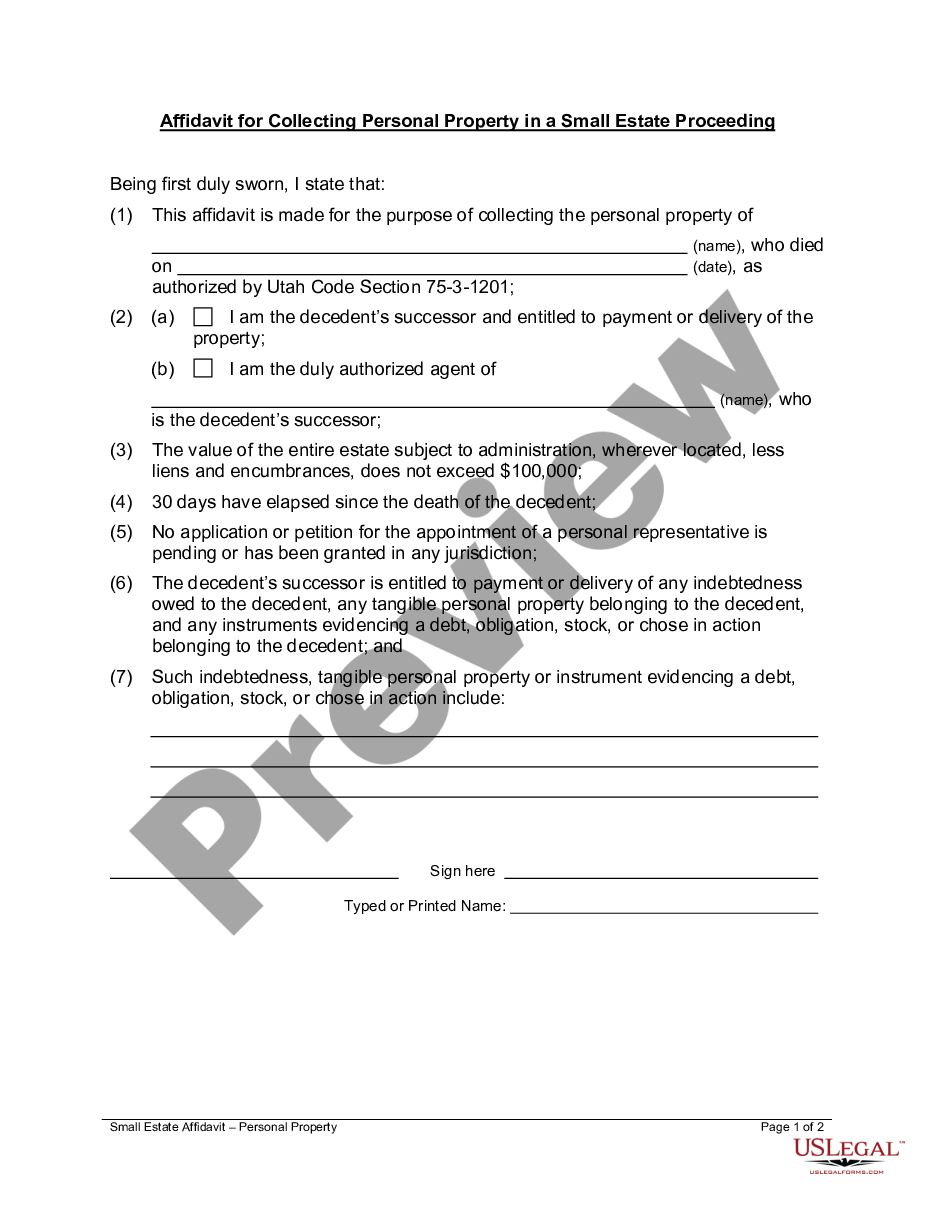

How to fill out Utah Small Estate Heirship Affidavit For Estates Under 100,000?

- If you're a returning user, log in to your account to access the document. Ensure your subscription is active; if not, renew it according to your plan.

- For new users, start by previewing the form descriptions and details. Confirm you choose the appropriate document that aligns with Indiana's legal standards.

- If needed, you can search for alternative templates using the Search tab to find the best match for your needs.

- Proceed by clicking the 'Buy Now' button and select your preferred subscription plan. Registration is required for full library access.

- Finalize your purchase by entering your payment details using credit or PayPal.

- Once purchased, download your small estate affidavit form and save it. You can access it anytime in the My Forms section of your profile.

Using US Legal Forms not only provides a wide selection of templates but also ensures you have access to expert assistance for completing your documents accurately.

Start your journey towards effective estate management today by visiting US Legal Forms and getting your small estate affidavit form now!

Form popularity

FAQ

To complete an affidavit of inheritance, ensure you have all pertinent information regarding the deceased’s estate and the beneficiaries. Detail any relevant relationships and provide a comprehensive account of the inherited assets. For assistance, consider using the small estate affidavit form Indiana, which can simplify the preparation of this important document.

Filling out an affidavit of inheritance requires clarity and precision. Begin with basic identification details about the deceased and the heirs involved, then detail the assets being inherited. The small estate affidavit form Indiana equips you with a structured template you can follow to ensure all vital information is included.

To fill out a beneficiary affidavit, start by collecting the names and necessary details of all beneficiaries. Clearly state the relationship to the deceased and include any supporting documents, such as a will or trust. Resources like the small estate affidavit form Indiana can aid in providing a valid and comprehensive format for your affidavit.

When filling out an affidavit example, begin with identifying key information, such as the affiant's name and the statements being made. Follow the structure provided, ensuring all sections are filled accurately and clearly. For Indiana, the small estate affidavit form Indiana offers a useful framework to follow, making it easier to prepare your own affidavit.

To fill out a small estate affidavit form in Indiana, start by gathering necessary documents, including proof of death and details about the deceased's assets. Following that, use a guided approach, either through legal counsel or a reliable template, to properly complete the affidavit. The Small estate affidavit form Indiana provides clear instructions, making this process much simpler.

In Indiana, an affidavit of heirship may be prepared by an interested party, such as a family member or heir. However, it is often beneficial to have a legal professional help ensure that the document meets state requirements. Utilizing tools like the Small estate affidavit form Indiana can streamline this process significantly. You want to ensure all necessary details are accurately reported.

To file a small estate affidavit in Indiana, begin by completing the small estate affidavit form Indiana, which details information about the deceased and the assets. You will need to gather essential documents, such as the death certificate and asset valuations. Once completed, you submit the affidavit to the appropriate court for your county. This straightforward process ensures that heirs can efficiently access their inheritance without the complications of probate.

Yes, you can open an estate bank account with a small estate affidavit in Indiana. This affidavit serves as a legal document that confirms your right to claim the deceased’s assets. After completing the small estate affidavit form Indiana, you can present it to the bank, allowing you to establish an account for managing the estate's finances. This simplifies the process for heirs, giving them immediate access to necessary funds.

In Indiana, estates valued at over $50,000 generally must go through the probate process. This value includes all assets, such as real estate, bank accounts, and personal property. If the estate falls below this limit, you may use a small estate affidavit form Indiana to simplify the transfer of assets. This form allows heirs to bypass the lengthy probate process and claim their rightful inheritance more quickly.

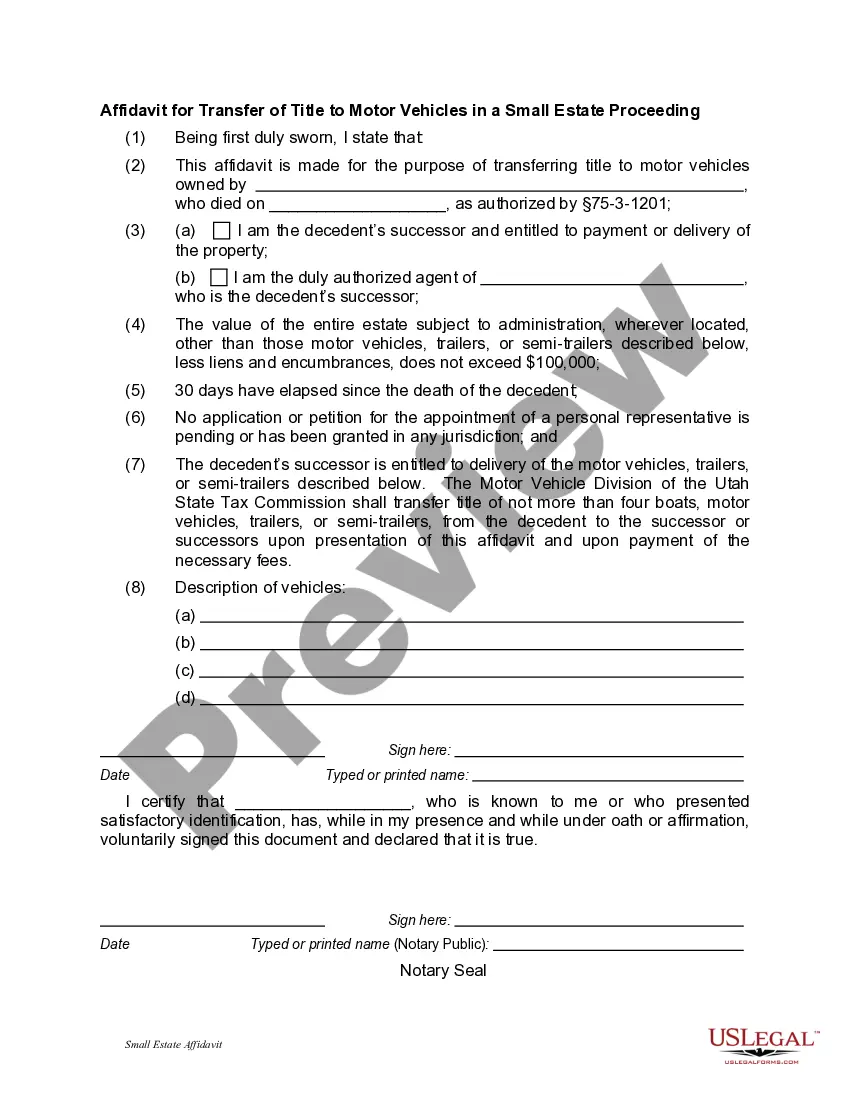

An affidavit for transfer without probate in Indiana is a document that allows heirs to transfer property without going through the probate process. It can be a vital tool for executing a small estate affidavit form Indiana efficiently. This affidavit captures necessary information about the deceased and details of the property being transferred. Taking advantage of this option can save time, reduce stress, and cut costs.