Limited Liability Company With The Ability To Establish Series

Description

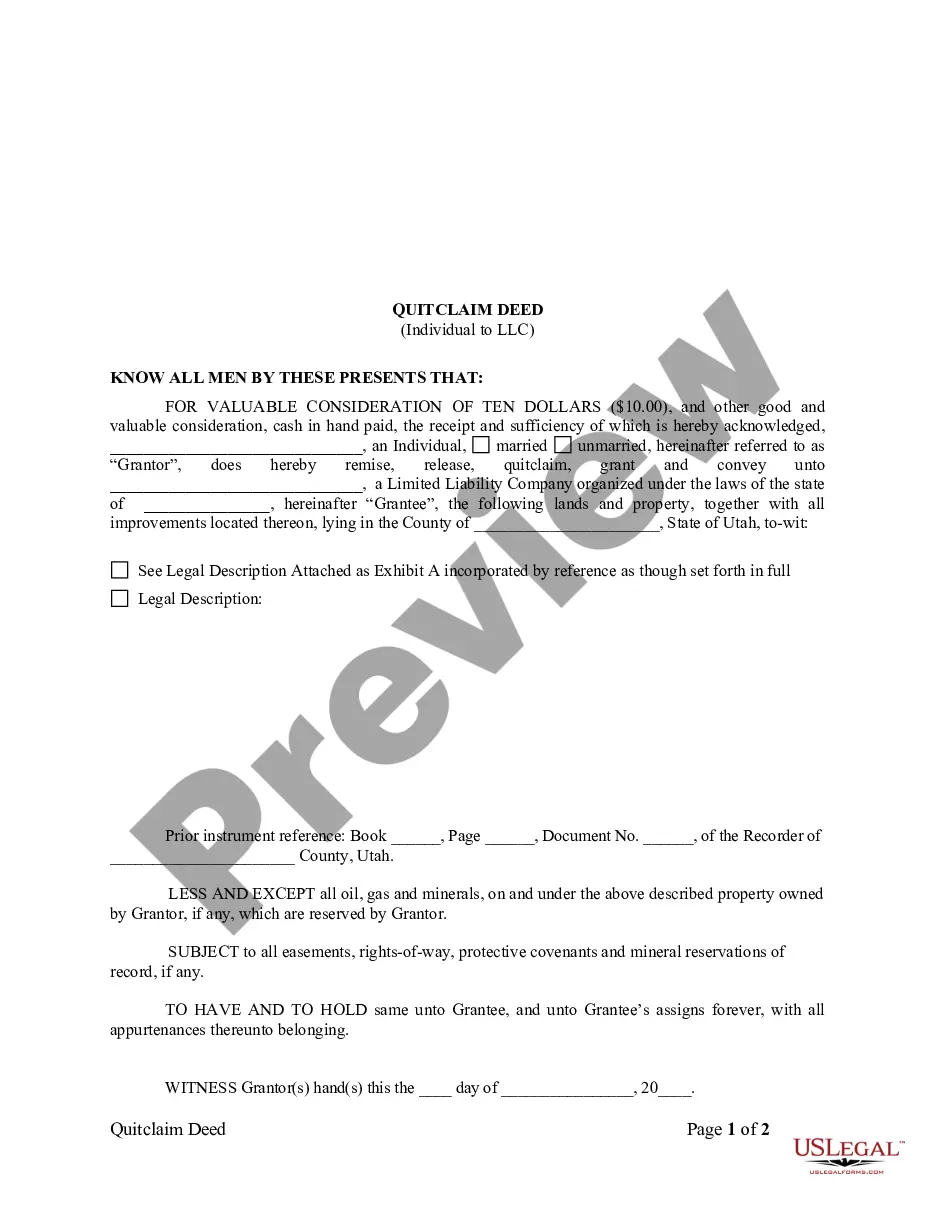

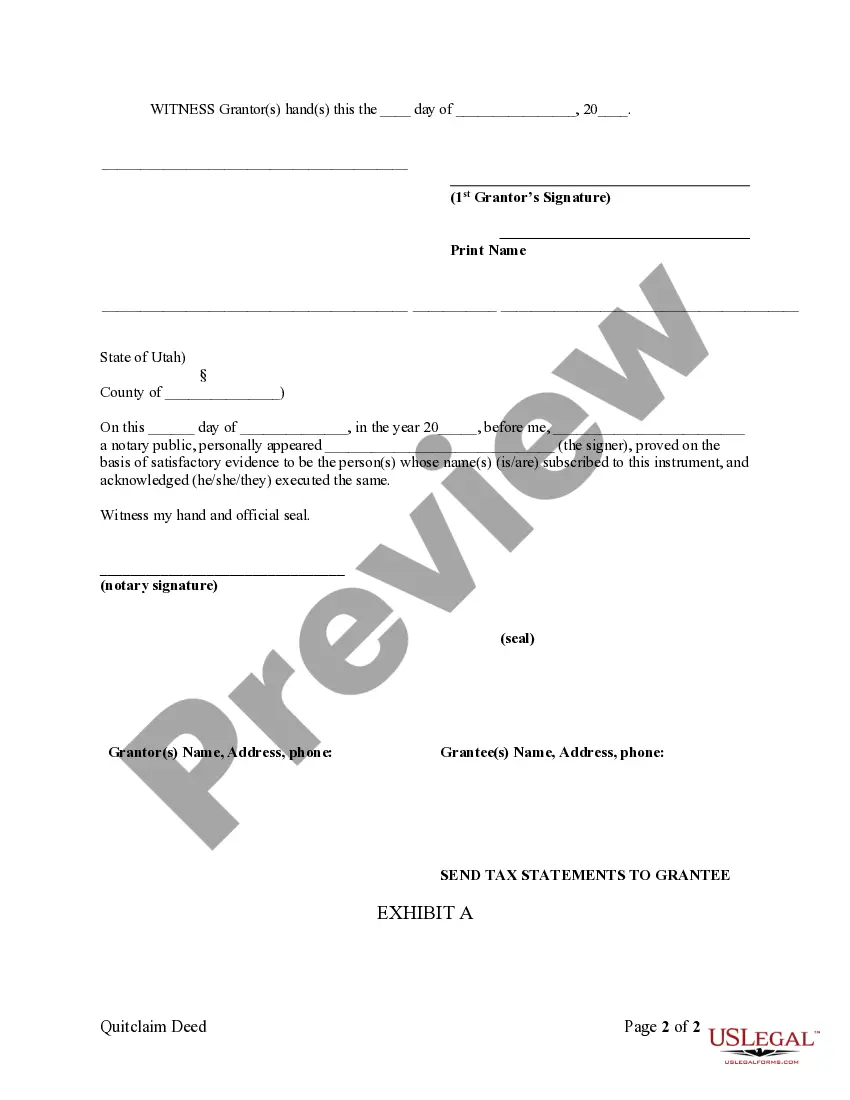

How to fill out Utah Quitclaim Deed From Individual To LLC?

- If you are a returning user, log into your account to download your desired form. Ensure your subscription is active; if not, renew it based on your plan.

- For first-time users, first review the Preview mode and read the form description to confirm it fits your needs and complies with your local jurisdiction requirements.

- If the selected template requires adjustments or doesn’t match, utilize the Search tab to locate the right document.

- Proceed to purchase the document by clicking the Buy Now button and select your preferred subscription plan. Creating an account is necessary to access the extensive library.

- Complete your purchase by providing your credit card details or opting for PayPal to finalize the subscription.

- Finally, download the form to your device and access it anytime through the My Forms section.

With access to over 85,000 editable legal forms, US Legal Forms empowers users to craft their legal documents efficiently.

Don’t hesitate to explore the extensive resources available, and take advantage of the expert assistance for precise document preparation!

Form popularity

FAQ

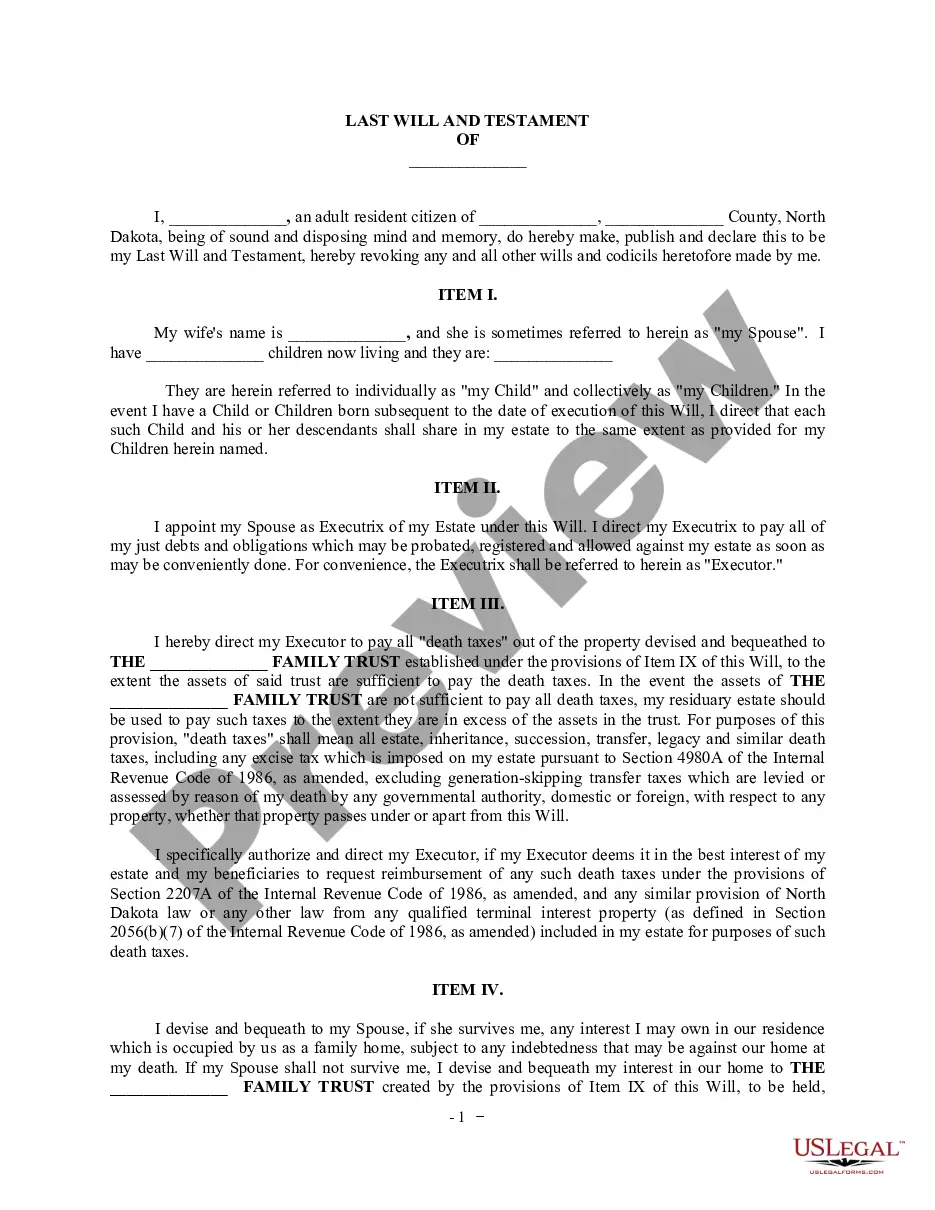

While a series LLC offers many benefits, there are potential downsides to consider. Some states may not recognize series LLCs, which can complicate interstate operations. Additionally, the complexity of managing multiple series may require more administrative resources and legal guidance. It's important to weigh these factors carefully when deciding if a limited liability company with the ability to establish series is the right choice for your business.

A series LLC allows you to create multiple business entities under one umbrella, providing liability protection for each series. This structure streamlines management, saves on registration costs, and simplifies tax filings. It is particularly beneficial for businesses with distinct assets or operations, allowing for tailored liability protection. If you're looking to streamline your business organization, consider the advantages of a limited liability company with the ability to establish series.

When you establish a limited liability company with the ability to establish series, each series is treated as a separate entity for tax purposes. You can choose how each series is taxed, either as a corporation or a pass-through entity. It’s advisable to work with a tax professional to navigate the specific requirements for each series. This will help ensure compliance and maximize your financial benefits.

Yes, you can convert your standard limited liability company into a series LLC. This process typically involves amending your formation documents and complying with state requirements. It's crucial to check the regulations in your state, as they may vary. Additionally, using a service like USLegalForms can simplify this transition and ensure you meet all legal requirements.

To transform your LLC into a Series LLC, you typically need to amend your operating agreement and comply with your state laws. This process involves outlining how your series will function and filing the necessary documents with the state. Utilizing resources like the USLegalForms platform can simplify the creation of your Series LLC and ensure all requirements are met.

Yes, a limited liability company can establish a series within its structure. This allows the LLC to create separate divisions that can hold assets and liabilities independently. Each series can operate under its own name and have its own members. This structure may offer enhanced operational flexibility and protection.

To obtain an Employer Identification Number (EIN) for your Series LLC, you need to apply through the IRS. Each series may require its own EIN if it operates independently. You can apply online, by mail, or by fax. Consider visiting the USLegalForms platform for a guided application process.

Yes, you can change the classification of your limited liability company, depending on your goals and state regulations. This might involve submitting certain forms or documents to the IRS or your state. Keep in mind that classification changes can have tax implications. Consulting with an expert can help clarify the best approach.

Yes, you can change your limited liability company to a Series LLC. However, you need to follow specific state laws and procedures to do this. Generally, it involves amending your LLC's operating agreement and filing relevant documents with your state. It’s advisable to consult with a legal expert to ensure compliance.

The primary difference between a series LLC and a normal LLC lies in their structural framework and liability protection. A normal LLC protects the owners’ personal assets from business liabilities but does not offer separate divisions. In contrast, a series LLC can have multiple series, each shielding its assets and liabilities from the others, making it an attractive option for businesses with diverse ventures.