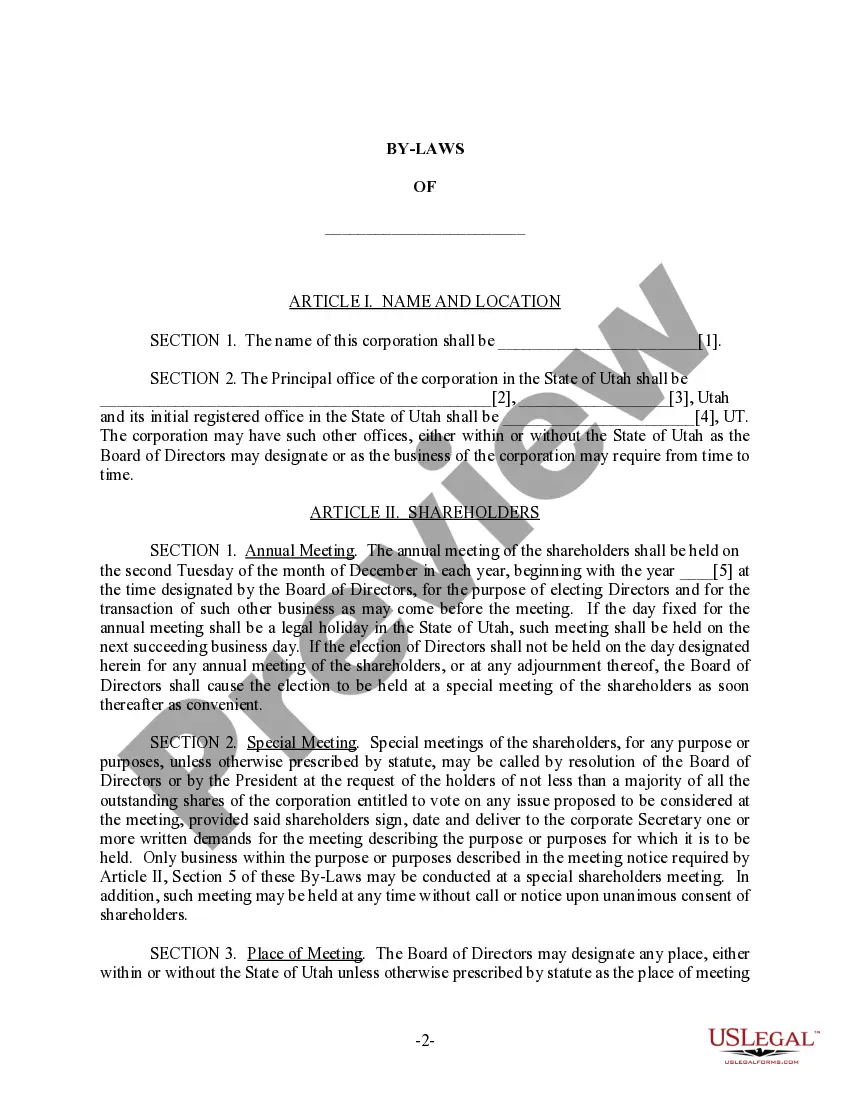

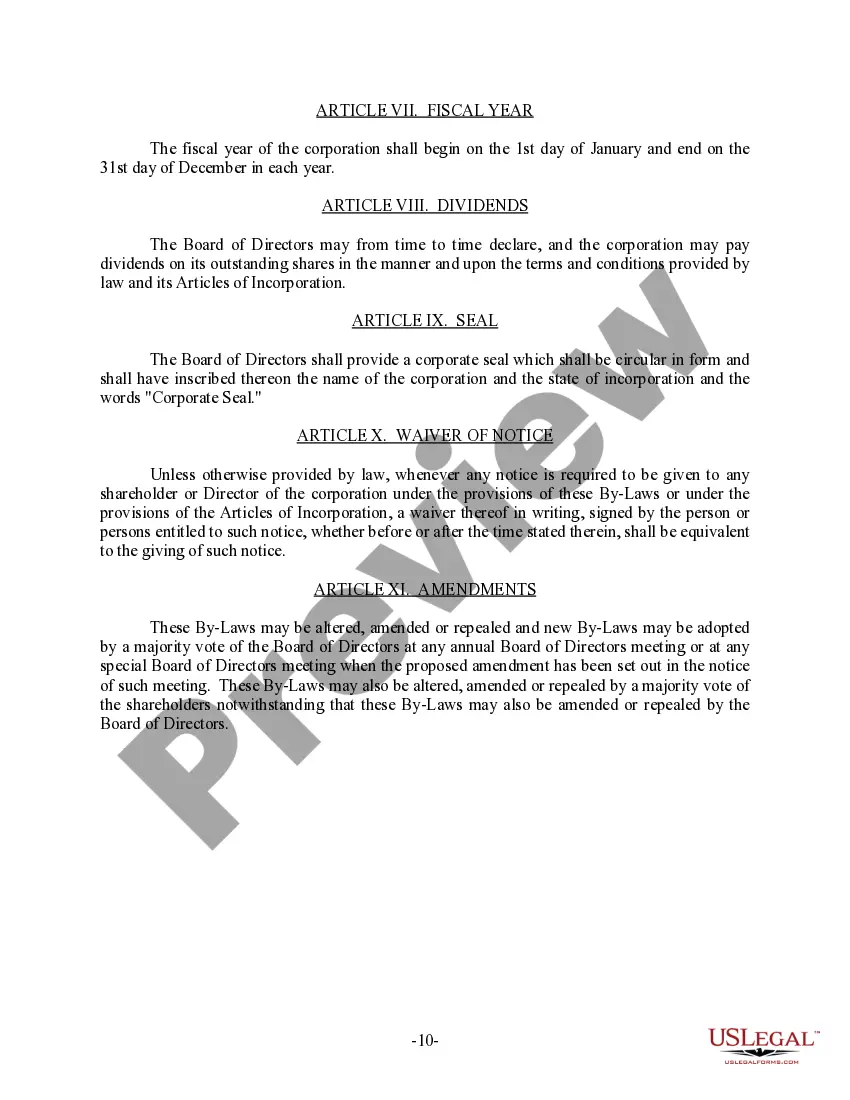

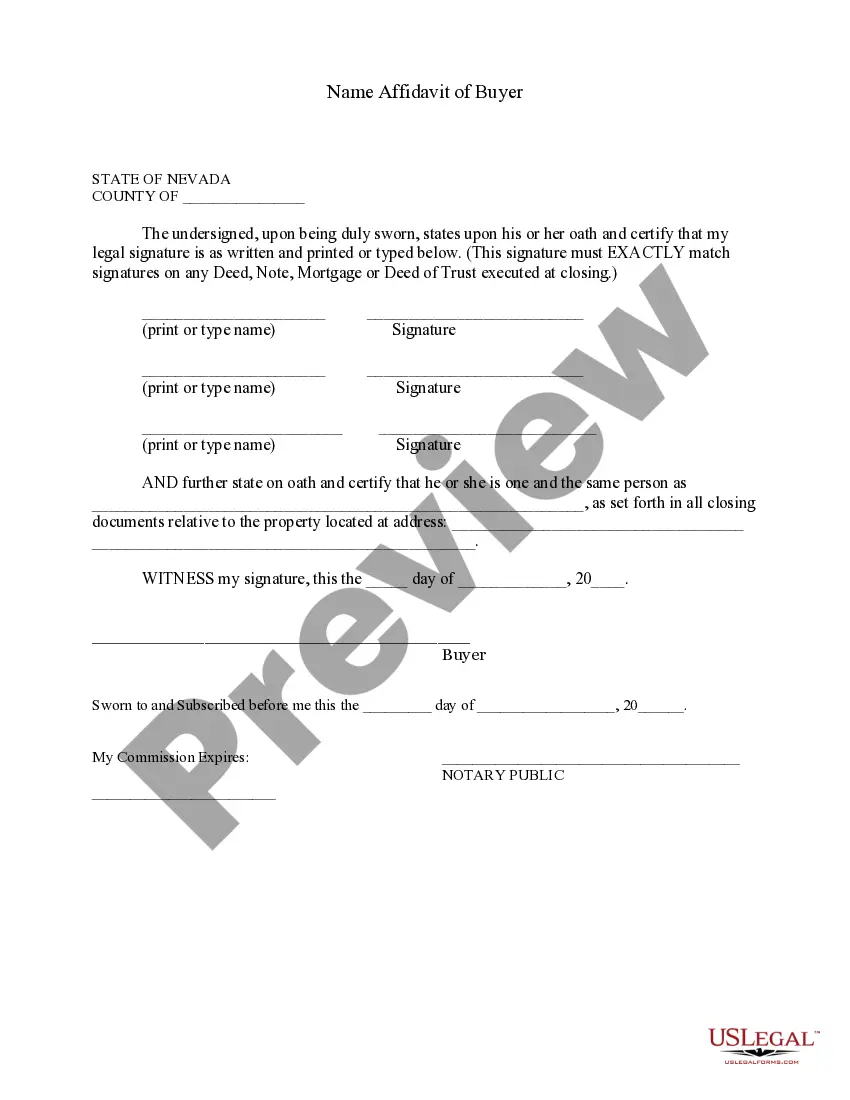

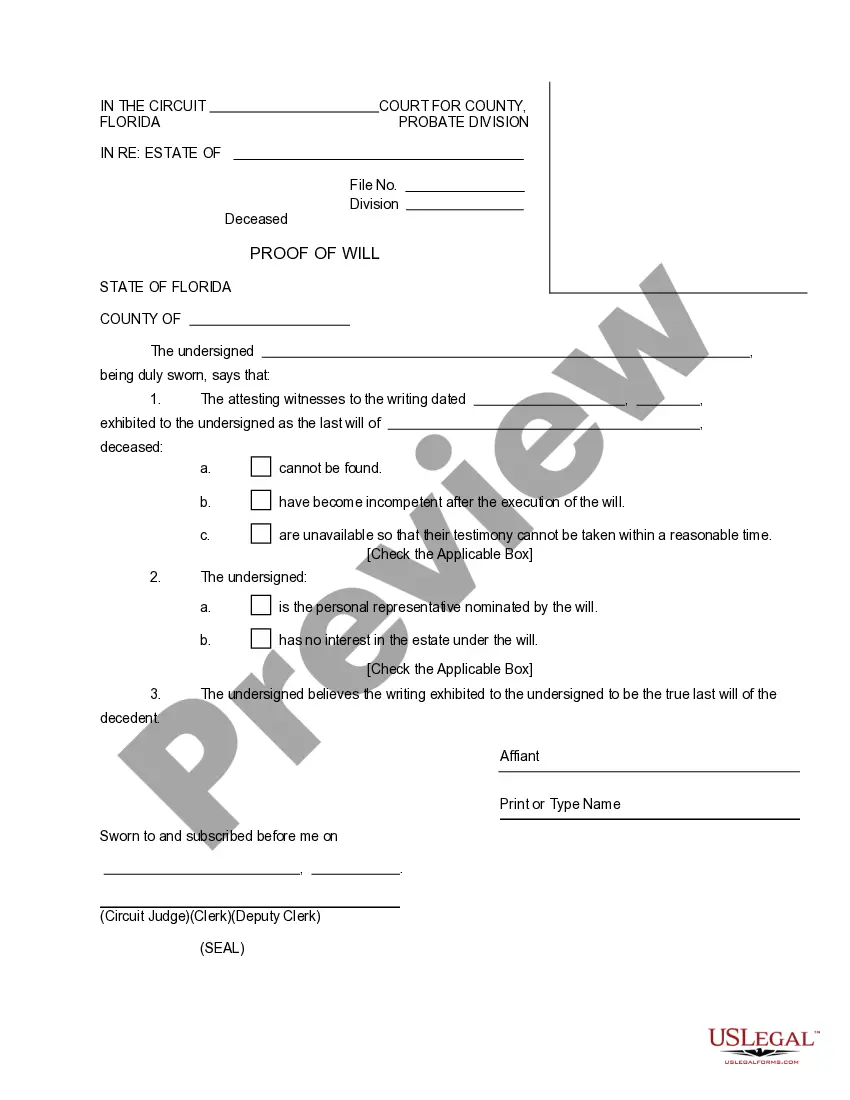

This form is By-Laws for a Business Corporation and contains provisons regarding how the corporation will be operated, as well as provisions governing shareholders meetings, officers, directors, voting of shares, stock records and more. Approximately 9 pages.

Utah Corporation Business For Sale

Description

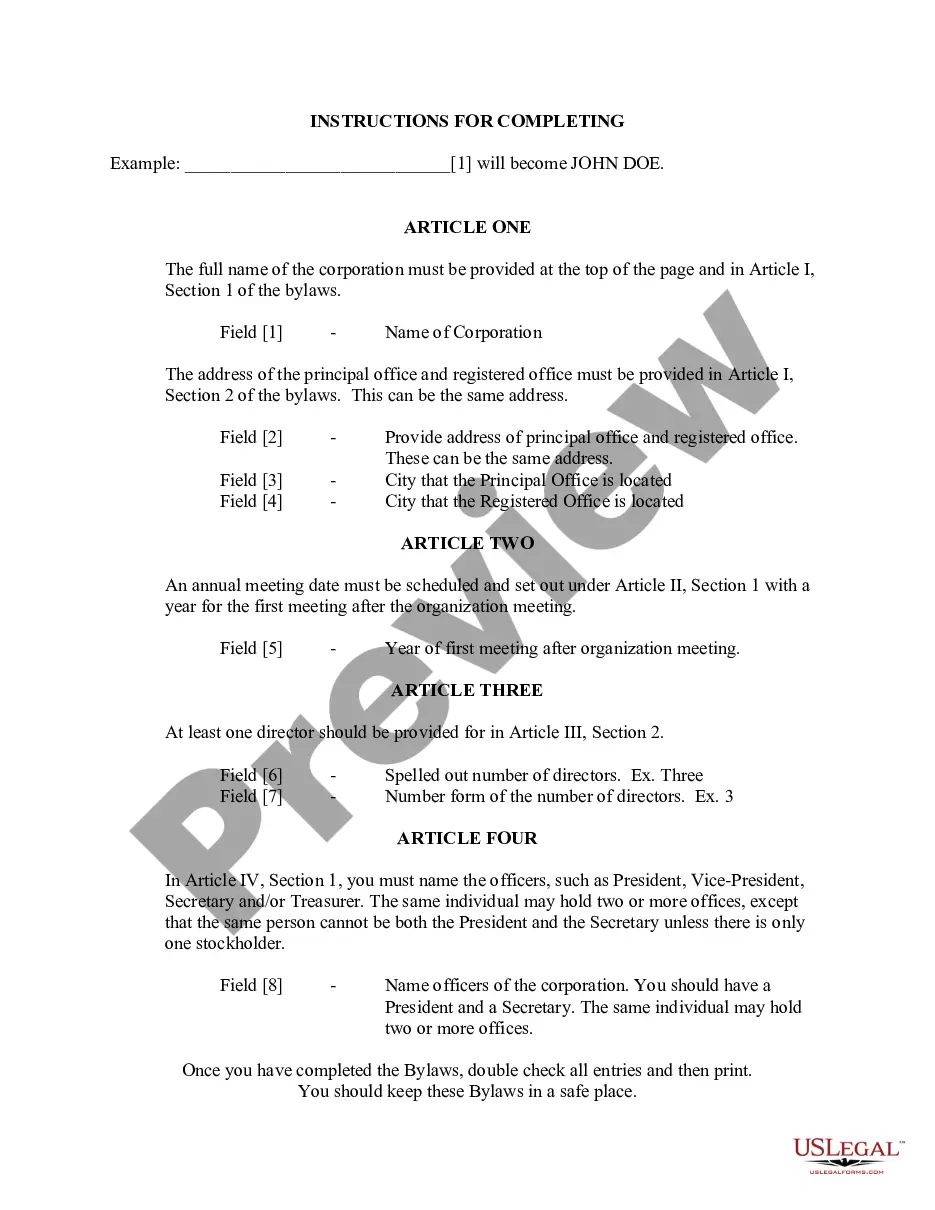

How to fill out Utah Bylaws For Corporation?

Managing legal documents and processes can be a lengthy addition to the day.

Utah Corporation Business For Sale and similar forms generally necessitate that you look for them and figure out how to fill them out correctly.

Therefore, if you are handling financial, legal, or personal affairs, having a comprehensive and accessible online collection of forms available when needed will significantly help.

US Legal Forms is the premier online resource for legal templates, boasting over 85,000 state-specific documents and an assortment of tools to help you complete your paperwork effortlessly.

Is this your first time using US Legal Forms? Register and create an account in a few minutes to gain access to the form collection and Utah Corporation Business For Sale. Then, follow the steps outlined below to fill out your form: Be sure to verify you have the correct form by utilizing the Preview function and examining the form description. Choose Buy Now when ready, and select the subscription plan that fits you best. Click Download, then fill out, eSign, and print the document. US Legal Forms has 25 years of expertise helping clients manage their legal paperwork. Find the form you need today and simplify any process without the hassle.

- Browse the available document catalog with a single click.

- US Legal Forms offers state- and county-specific documents available for download anytime.

- Protect your document management workflows by utilizing a reliable service that allows you to create any form in minutes without any extra or concealed fees.

- Simply sign in to your account, locate Utah Corporation Business For Sale, and obtain it instantly from the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

Yes, Utah typically requires a seller's permit if you sell tangible goods or certain services. This permit allows you to collect sales tax from customers legally. Acquiring the necessary permits supports your business operations and builds trust, especially vital when promoting your Utah corporation business for sale.

'Administratively dissolved' means that your corporation has lost its legal status due to failing to comply with state requirements, like not filing annual reports or paying fees. This status can be reversed by rectifying the issues and reinstating your corporation with the state. Understanding this term is crucial if you are exploring a Utah corporation business for sale, as it affects the sale process and valuation.

Generally, you should send a debt validation request if you're contacted by a collection agency and you don't recognize the debt. Send a validation request within 30 days of receiving contact from a collection agency, otherwise, they'll assume the debt is valid and can legally continue to contact you about it.

I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt. This is NOT a request for ?verification? or proof of my mailing address, but a request for VALIDATION made pursuant to 15 USC 1692g Sec.

If you've already paid the debt If you're sure that you're talking with a legitimate debt collector, you can send copies of documents that prove you made the payments, including cancelled checks or credit card statements. You may also include copies of any correspondence about settling the debt.

A debt collection form is used by employers to get the contact information from debtors (people who owe you money).

Provide verification and documentation about why this is a debt that I am required to pay. The amount and age of the debt, including: A copy of the last billing statement sent to me by the original creditor. State the amount of the debt when you obtained it, and when that was.

The key is to be thorough in your request for debt verification. In your letter, ask for details on: Why the collector thinks you owe the debt: Ask who the original creditor is and request documentation that verifies you owe the debt, such as a copy of the original contract.

The federal Fair Debt Collection Practices Act (FDCPA) requires that debt collectors treat you fairly and prohibits certain methods of debt collection. Under the FDCPA, a debt collector is someone who regularly collects debts owed to others.

How To Prove a Debt Isn't Yours (and Dispute It) Gather your credit reports and bank statements. Request that debt collectors contact you via mail. Send a debt validation letter within 30 days. Check the reporting limits in your state. File an official identity theft report with the FTC.