Utah Business Corporation Form 2553 Instructions

Description

How to fill out Utah Business Incorporation Package To Incorporate Corporation?

Locating a reliable source for obtaining the latest and pertinent legal templates is a significant part of managing bureaucracy.

Selecting the appropriate legal documents requires precision and meticulousness, which is why it is essential to obtain samples of Utah Business Corporation Form 2553 Instructions solely from trustworthy sources, such as US Legal Forms.

Remove the hassle that comes with your legal paperwork. Explore the extensive US Legal Forms library where you can discover legal templates, assess their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search box to locate your sample.

- Examine the form’s details to verify if it meets the stipulations of your state and area.

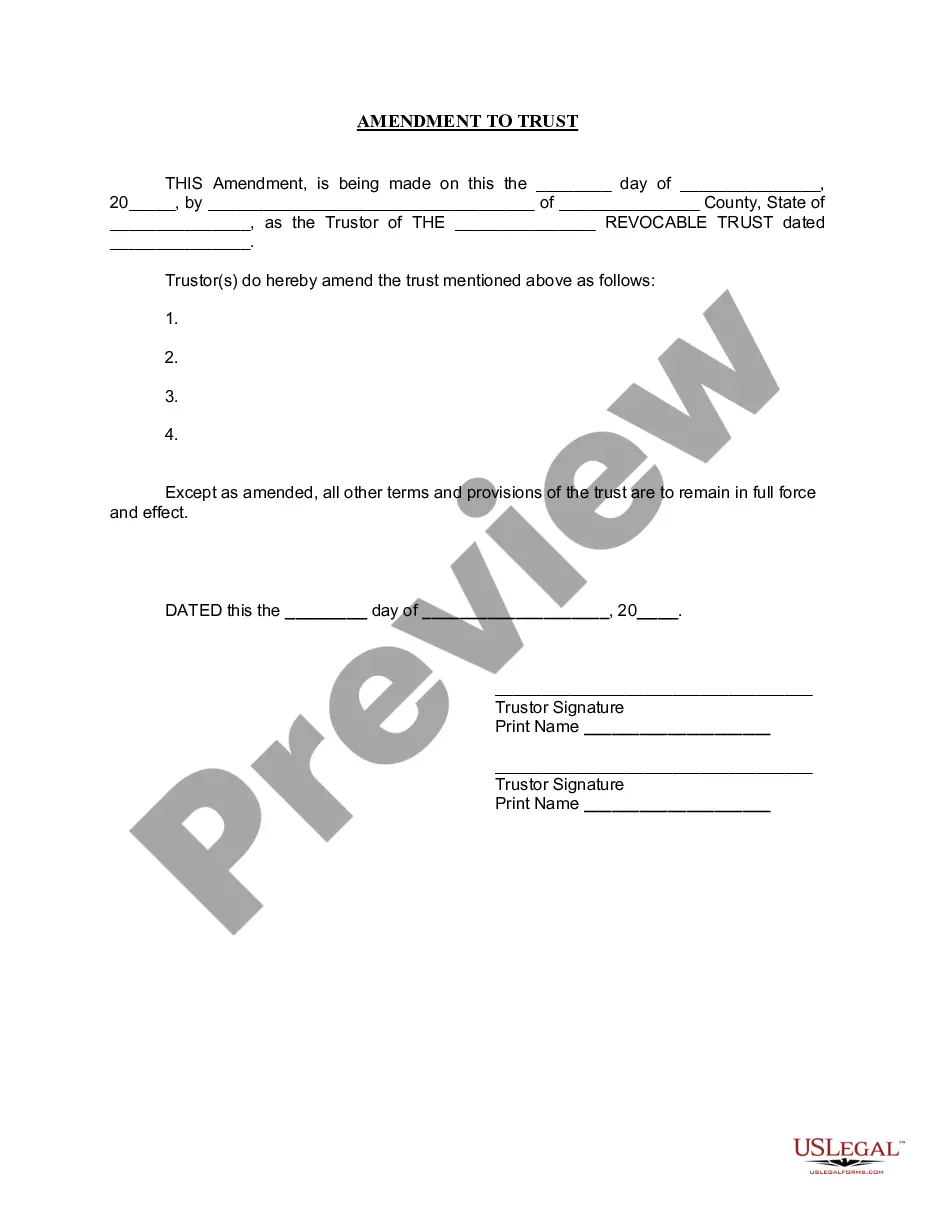

- Check the form preview, if accessible, to confirm that the template is the one you seek.

- Return to the search and seek the correct document if the Utah Business Corporation Form 2553 Instructions does not fulfill your needs.

- If you are confident about the form’s applicability, download it.

- If you are an authorized user, click Log in to verify your identity and access your chosen forms in My documents.

- If you do not yet have an account, click Buy now to acquire the form.

- Select the pricing option that meets your requirements.

- Proceed with the registration to complete your transaction.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Utah Business Corporation Form 2553 Instructions.

- After obtaining the form on your device, you can alter it with the editor or print it out and complete it manually.

Form popularity

FAQ

A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to be an S corporation.

If you file Form 2553 before the date on line E (the date the election will go into effect), you only need to list the current shareholders. If you file the form after the date on line E, list anyone who held stock between that date (the effective date) and the filing date (the election date).

As an SMLLC (single-member limited liability company), taxes can be burdensome if one is paying taxes on all the profits that they receive from their company. However, IRS form 2553 can be filed, which would allow the SMLLC to reap the tax benefits of an S-Corp.

Part IV: Late corporate classification election representations. Another section that most businesses can skip, Part IV only applies to you if you're an LLC and you're filing Form 2553 after the form deadline. Again, if that doesn't apply to you, skip this section.

Part III. Part III of Form 2553 is specifically for qualified subchapter S trusts (QSST). For those who are required to complete Part III, keep in mind that you must make the election in Part I, as Part III of Form 2553 cannot be submitted on its own.