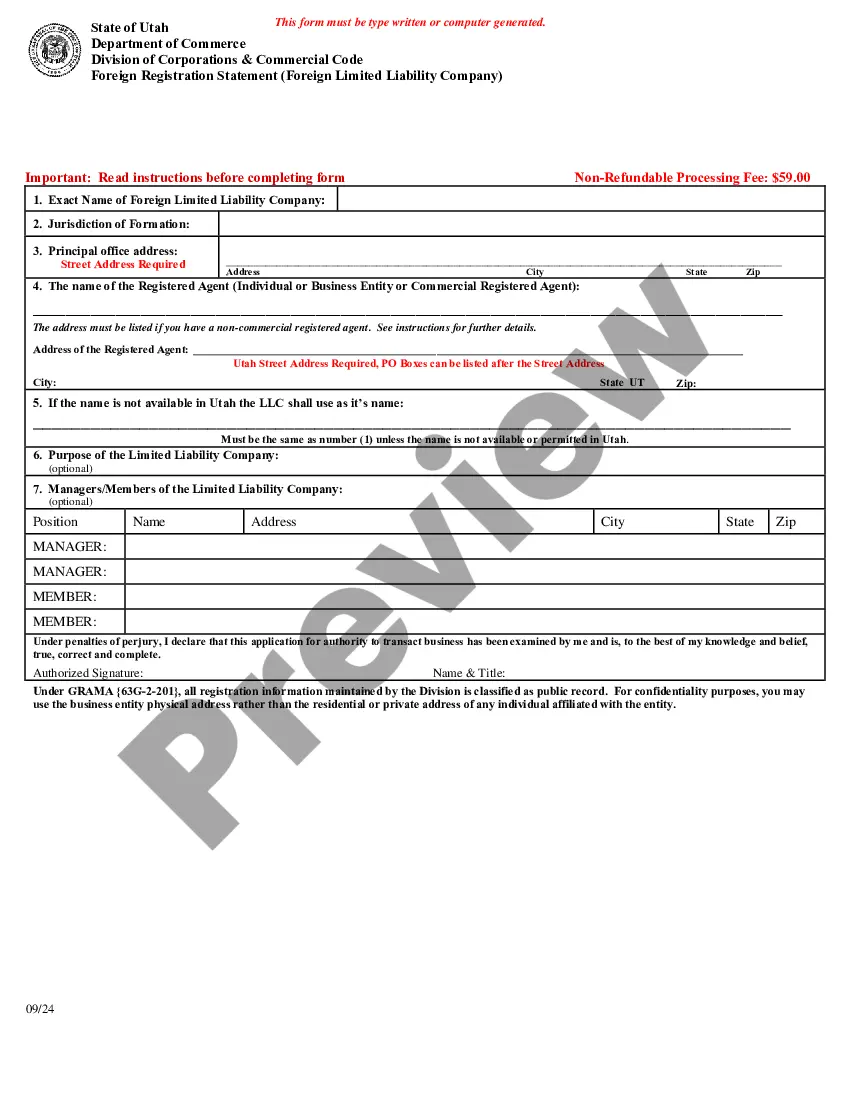

Register a foreign corporation in Utah.

Utah foreign corporation registration with ITIN number is a process that allows non-resident individuals or companies to establish a presence in Utah and conduct business activities within the state. An ITIN, or Individual Taxpayer Identification Number, is a unique identification number issued by the Internal Revenue Service (IRS) to individuals who are required to have a U.S. taxpayer identification number but do not qualify for a Social Security Number. By obtaining Utah foreign corporation registration with an ITIN, non-resident corporations can legally operate and engage in various business transactions in Utah. The registration process ensures compliance with state and federal laws, allowing these corporations to establish a legal entity and conduct business activities such as sales, purchasing, contracting, and more. There are different types of Utah foreign corporation registrations available depending on the nature of the business and its structure. Some notable types include: 1. Utah Foreign C Corporation Registration with ITIN Number: This type of registration is suitable for corporations intending to operate in Utah while maintaining a separate legal entity from its shareholders. C corporations are taxed separately from their owners and have limited liability protection. 2. Utah Foreign S Corporation Registration with ITIN Number: S corporations are suitable for small businesses and offer certain tax advantages. By obtaining this type of registration, non-resident corporations can take advantage of pass-through taxation, where the corporation's income and losses are passed through to its shareholders. 3. Utah Foreign LLC Registration with ITIN Number: Limited Liability Companies (LCS) are popular among entrepreneurs due to their flexibility and limited liability protection. By registering as a foreign LLC with an ITIN, non-resident corporations can establish a separate legal entity and enjoy greater personal asset protection. 4. Utah Foreign Partnership Registration with ITIN Number: Some businesses prefer operating as partnerships, where two or more individuals or entities share profits, losses, and management responsibilities. Registering a foreign partnership with an ITIN allows non-resident corporations to engage in partnership-based business activities in Utah. To initiate the Utah foreign corporation registration with an ITIN number, interested parties must gather the necessary legal documentation, such as a Certificate of Good Standing from their home state, Articles of Incorporation or Organization, and a completed application form. Additionally, they must comply with Utah's Secretary of State's registration requirements and pay the requisite fees. In conclusion, Utah foreign corporation registration with ITIN number is a crucial step for non-resident corporations looking to do business in Utah. By selecting the appropriate type of registration that suits their business structure, these corporations can set up a legal presence in Utah, comply with state and federal laws, and enjoy various benefits while operating within the state.