Bill Of Sale Utah Example For Atv

Description

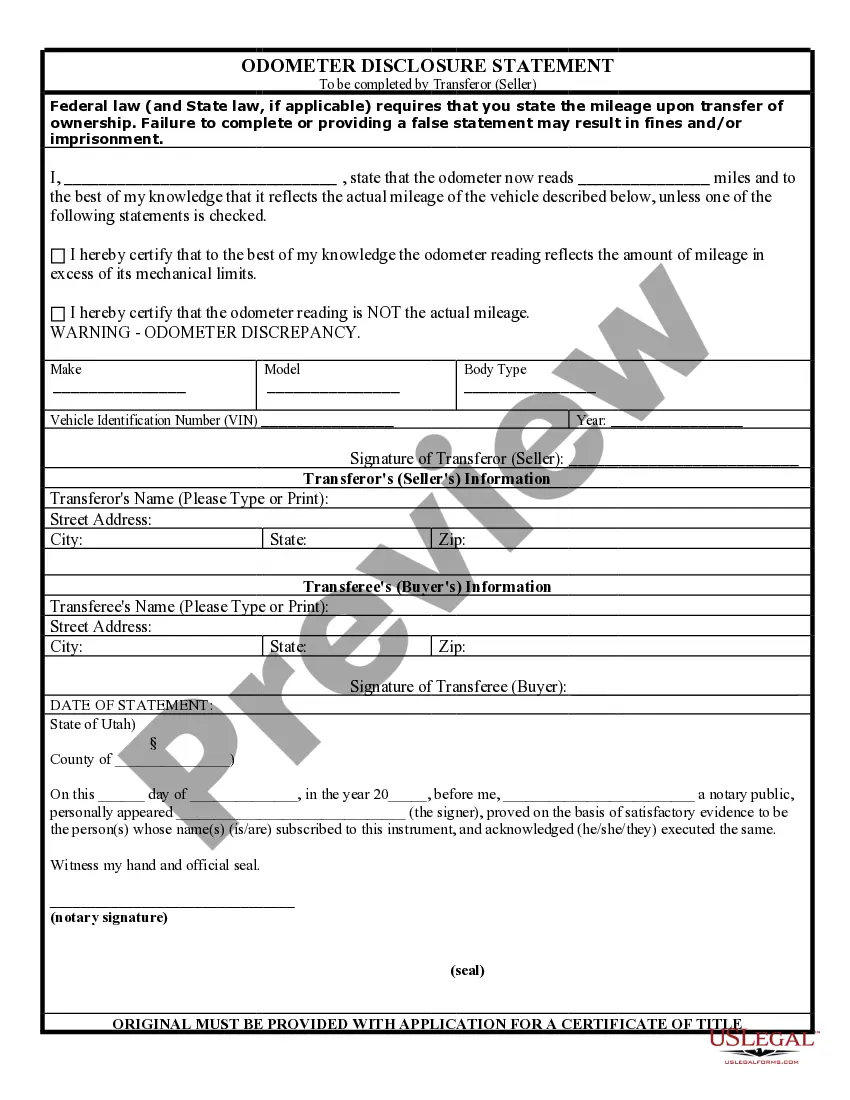

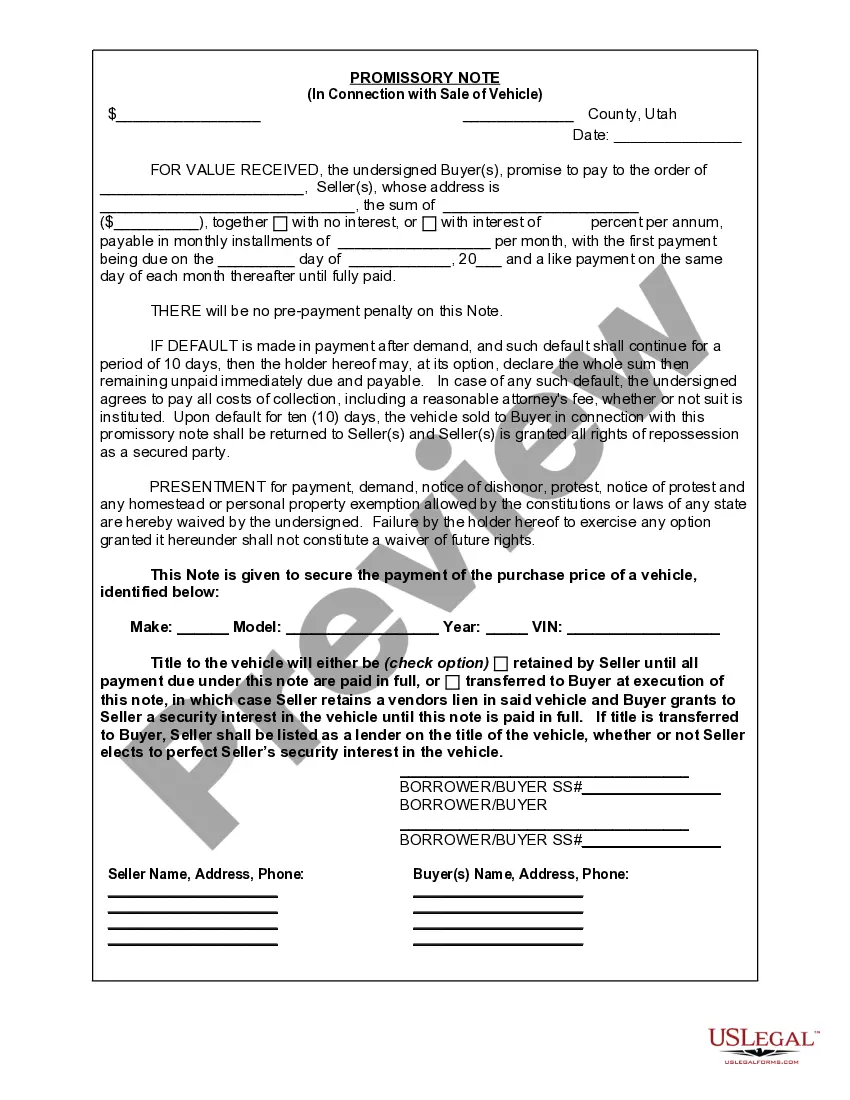

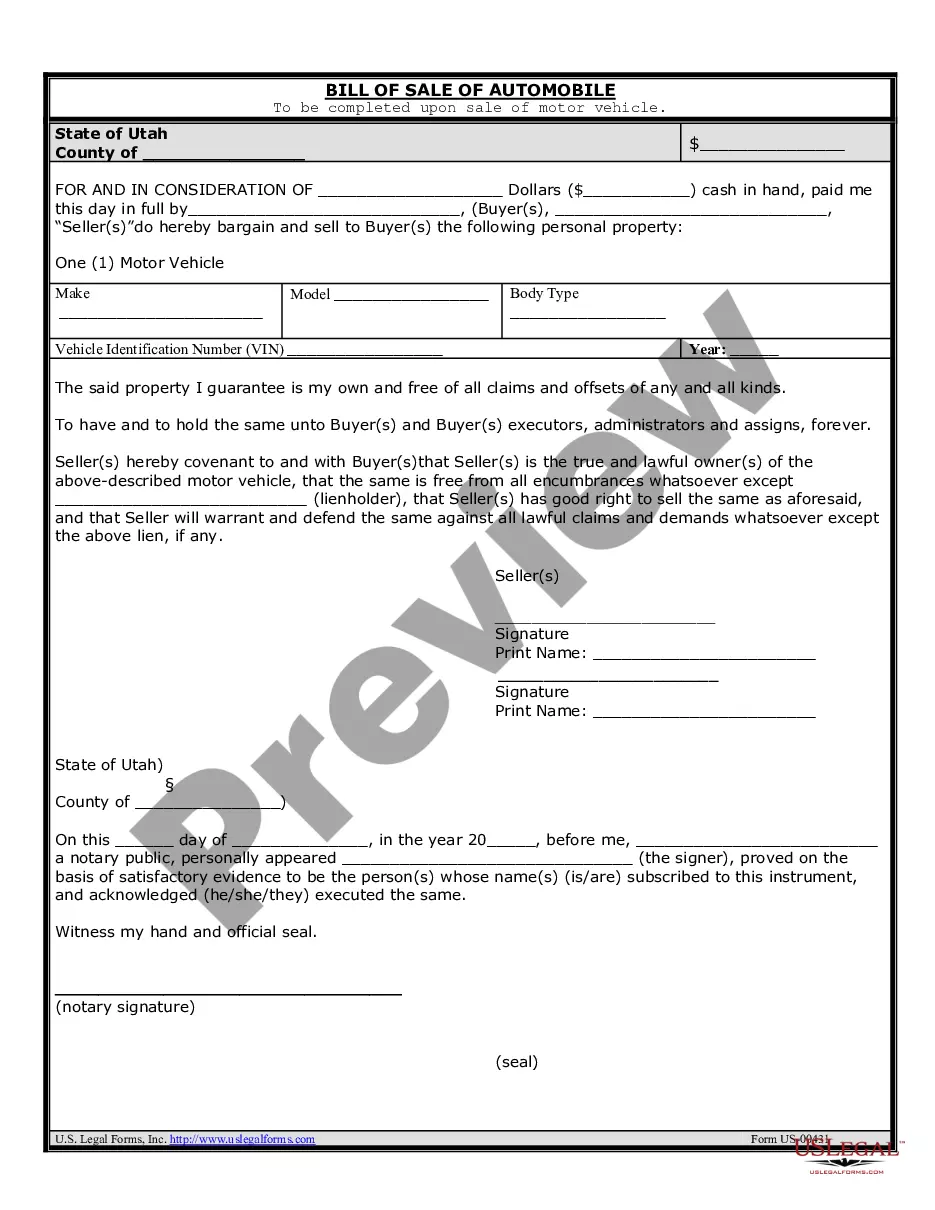

How to fill out Utah Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

Finding a reliable location to access the latest and pertinent legal templates is a significant part of navigating through bureaucracy. Identifying the appropriate legal documents requires precision and meticulousness, which is why it is essential to acquire samples of Bill Of Sale Utah Example For Atv solely from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and delay your current situation. With US Legal Forms, you have very little to worry about. You can review and examine all the specifics regarding the document’s application and relevance for your situation and within your state or county.

Follow these outlined steps to finalize your Bill Of Sale Utah Example For Atv.

Eliminate the complications associated with your legal paperwork. Browse the extensive US Legal Forms archive to discover legal templates, verify their relevance to your situation, and download them immediately.

- Utilize the catalog navigation or search box to find your template.

- Review the document’s details to ensure it meets the specifications of your state and county.

- Examine the document preview, if available, to confirm it is the correct form you need.

- Return to your search and find the suitable document if the Bill Of Sale Utah Example For Atv does not satisfy your needs.

- If you are confident about the document’s applicability, proceed to download it.

- If you are a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you have not created an account yet, click Buy now to acquire the document.

- Select the pricing option that aligns with your preferences.

- Proceed to registration to complete your order.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Select the file format for downloading Bill Of Sale Utah Example For Atv.

- After obtaining the template on your device, you may modify it using the editor or print it out and fill it manually.

Form popularity

FAQ

For those not subject to this electronic filing requirement: All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format. Most forms are provided in a format allowing you to fill in the form and save it. To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.

You must complete Form RI W-4 for your employer(s). Once you have completed Form RI W-4 for your employer, Form RI W-4 only needs to be completed if you are making changes to your withholding allowance or have a new employer.

Form W-3 is a tax form used by employers to report combined employee income to the Internal Revenue Service (IRS) and the Social Security Administration. Employers who send out more than one Form W-2 to employees must complete and send this form to summarize their total salary payment and withholding amounts.

Yes. You can make your own will in Rhode Island and do not need an attorney if you have a simple estate and know your wishes. Because a will is a legal document, it's important to create it correctly, conforming with state law.

What's the difference between Form W-2 and Form W-3? Employees use the information provided by their employer on the Form W-2 to complete and file their personal income tax returns. Employers use Form W-3 to report employee income to the IRS and Social Security Administration.

Form RI-W3 - Transmittal of Wage and Tax Statements. INFORMATION FOR EMPLOYERS FILING TRANSMITTAL OF WAGE AND TAX STATEMENTS. 1. The employer's name and address should be pre-printed on the form. If incorrect, any necessary changes may be made directly on the form.

If the power of attorney is granted to a person other than an attorney, certified public accountant, or licensed public accountant, or enrolled agent, it must be witnessed or notarized below.

To order official IRS information returns such as Forms W-2 and W-3, which include a scannable Copy A for filing, go to IRS' Online Ordering for Information Returns and Employer Returns page, or visit .irs.gov/orderforms and click on Employer and Information returns.